Project Portfolio Management | A Defined Tutorial for Beginners

Last updated on 08th Feb 2022, Blog, Tutorials

- Introduction to Project Portfolio Management

- Face Informed Challenges

- Appreciate the situation from start to finish

- Apparatuses for Project Portfolio Management

- Why Project Portfolio the board is significant

- The Major Challenges of Enterprise Project Portfolio Management

- The Business Problem of PPM

- The Solution of PPM

- Portfolio Management Connects Strategy with Execution

- Conclusion

- Facing challenges is an intrinsic piece of business. Nonetheless, while facing a challenge, it is critical to recollect that greater dangers don’t continuously rise to greater prizes. Hazard versus reward reduces to savvy direction.

- Use Project Portfolio the board dashboards to proactively oversee progress, dangers, and issues to increment on-time conveyance.

- Use Project Portfolio the executives dashboards to proactively oversee progress, dangers, and issues to increment on-time conveyance.

- Adjusting each proposed task to in general hierarchical objectives

- Giving quantifiable information used to gauge hazards against remunerations

- Deciding possible bottlenecks and configuration imperfections at more than one level

- Accommodating group data transmission with how much work to be finished

- At the most fundamental level, PPM and Project the board contrast by number of tasks. Project the board centers around a singular venture’s street to the end, though Project Portfolio the executives thinks about each task or likely undertaking and its suitability to meeting generally business objectives.

- Yet, what is a Portfolio the executives framework? One methodology sees Project Portfolio the board as the cycle which establishes the framework for more effective task the executives.

- The Portfolio the board interaction upholds the essentials of task the executives by offering a make way to prioritization that permits Project chiefs to make adaptable schedules.

- Influence information and experiences in your undertaking Portfolio the executives framework for vital decision making to zero in on conveying what makes the biggest difference.

- Influence information and experiences in your task Portfolio the executives framework for vital decision making to zero in on conveying what makes the biggest difference.

- Project Portfolio the executives gives organizations a 10,000 foot perspective of impending, current and past undertakings. By appreciating the situation in its entirely of how a proposed undertaking will squeeze into the objectives and targets of the association, organizations can settle on better choices on what tasks to pick and what drives will make the most return.

- Interface and direction with all colleagues and give continuous announcements

- Track, offer and store information, records and criticism

- Answer questions and tackle issues quicker

- Rapidly and effectively mine information that can be imparted to partners

- Give chiefs straightforward, vigorous, and adaptable detailing and investigation to further develop Project Portfolio the executives efficiencies. Give chiefs straightforward, powerful, and adaptable revealing and investigation to further develop Project Portfolio the executives efficiencies. A decent venture Portfolio the board apparatus should offer hearty detailing choices.

- Report information gives chiefs and administrators viewpoint that permits them to foresee what undertakings might require over the top assets by featuring dynamic ventures or conditions that might go about as obstructions to hierarchical objectives.

- PPM detailing apparatuses additionally permit organizations to effectively screen each feature of the association’s current and likely undertakings, including planning, guaging and hazard/reward examination.

- Whenever individual undertaking spending plans are surpassed, powerful utilization of PPM instruments might assist an organization with seeing the possible effects on different activities and decide if going ahead with a task that is as of now over spending plan will represent an issue as far as duplicated monetary overages in different regions.

- Advance into a Multi-Faceted Strategic Partner.

- Master the 4 skills of a Savvy PMO

- View the eBook

- Evolve into a Multi-Faceted Strategic Partner

- What amount will it cost?

- What amount of time will it require?

- What is the profit from this venture? (What advantage will it give?)

- Are the assets accessible?

- What are the dangers related with this undertaking?

- Successful task associations center their restricted assets around the best undertakings, declining to do Projects that are great yet not adequate. PPfM empowers them to make and carry out these intense undertaking determination choices.

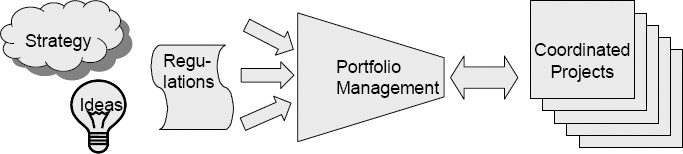

- PPfM is a pipe that associates vital wanting to the execution of ventures, making the essential destinations executable. Display 1 shows the PPfM pipe.

- Catch and exploration solicitations and thoughts

- Select the best tasks utilizing characterized differentiators that adjust, boost, and equilibrium

- Approve Portfolio practicality and start Projects

- Oversee and screen the Portfolio

- To begin with, Aim the in the Right Direction

- Prior to choosing the right undertakings, you should know where you need to go! As Alice of Alice in Wonderland talked about with the Cheshire Cat,

- Could you tell me, please, what direction I should stroll from here?

- That relies a decent arrangement upon where you need to get to, said the Cat.

- I don’t a lot of care where – , said Alice.

- Then, at that point, it doesn’t make any difference what direction you walk, said the Cat. (Carroll, 1920, p. 89)

- Extraordinary, separated item that offers better worth than clients

- Item is focused on at an appealing business sector

- Item and venture use inward organization qualities

Introduction to Project Portfolio Management

Project Portfolio the executives (PPM) alludes to an interaction utilized by Project chiefs and venture the board associations (PMOs) to dissect the likely profit from undertaking a task. By getting sorted out and solidifying each piece of information with respect to proposed and current activities, Project Portfolio administrators give anticipating and business investigation to organizations hoping to put resources into new tasks.

Project Portfolio the board enables associations to appreciate the situation in its entirely:

Leaders – realize what Project administrators to reach

Project Managers – simple admittance to colleagues

Colleagues – further developed correspondence with authority and different partners

Partners – kept insider savvy with dependable and predictable criticism

Face Informed Challenges

Get hazards; receive greater benefits

The undertaking Portfolio the executives cycle assists organizations with foreseeing results and plan for Projects that will offer the best outcomes. It features questions, for example,

1. Do I have the assets/spending plans accessible to take on this new Project?

2. Is there a comparative task in my Portfolio I can use to display after this one?

3. What current undertakings may go about as a hindrance to finishing this venture?

4. Are the partner’s assumptions practical? Where would we be able to think twice about?

5. Does this Project assist with arriving at our general goals as an association?

Alleviating hazards

Utilizing PPM, Project supervisors and PMOs have a worldwide perspective on each venture. At the point when each component of a task is introduced, issues can be anticipated before they at any point happen. The Portfolio the executives interaction gives associations the premonition to distinguish likely dangers and set up the vital measures. This helps an organization proactively oversee chances, permitting groups to reasonably appraise expected postponements and set up measures to forestall or relieve those hazards, would it be advisable for them they end up being unavoidable. Hazard relief can involve:

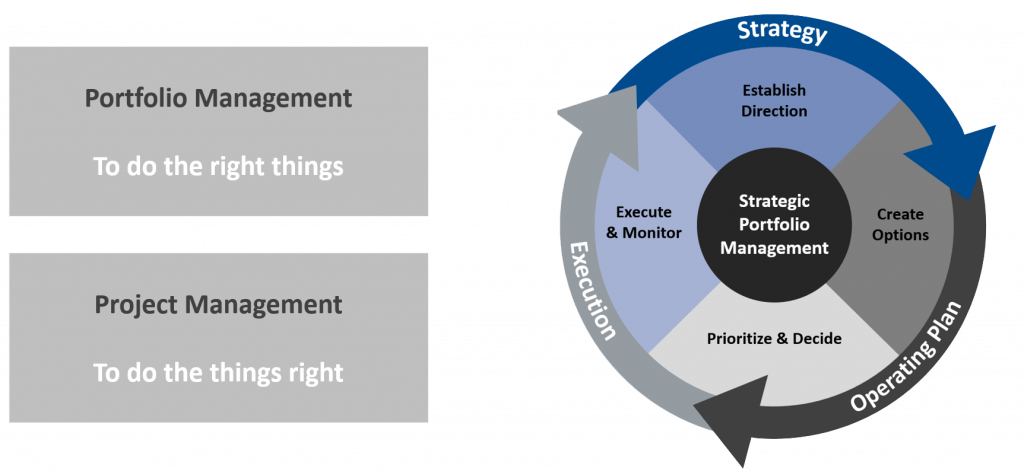

Project Portfolio Management versus Project Management

The following are a couple of manners by which the Portfolio the executives interaction helps support the basics of task the board:

a) Stays away from Project the board calamities by calling attention to great undertakings versus terrible tasks, the ROI and the Projected worth the venture may have to the association

b) Offers a make way to prioritization that permits Project supervisors to make adaptable schedules

c) Records what colleagues and task supervisors are accessible

d) Allots financial worth to an undertaking, making Project spending plans firm

e) Successful PPM assists Project the board with turning into a more straightforward street to travel. Whenever utilized couple, they are important to an association.

f) Project Portfolio the board sets out an approach used to anticipate likely issues, survey progress towards functional objectives, oversee spending plans, and address partner concerns, permitting Project directors to then development with accuracy execution.

Appreciate the situation from start to finish

Apparatuses for Project Portfolio Management

However there are many sorts of venture Portfolio the executives instruments, the best ones:

1. Oblige Project Portfolio the executives at the venture level

2. Offer easy to understand points of interaction and usefulness

3. Convey improved web-based elements for distant joint effort and correspondence

4. Give strong detailing and examination

5. Simple to-utilize undertaking Project Portfolio the board programming

Venture PPM instruments permit you to utilize one asset with different functionalities across the whole business. Venture Portfolio instruments decline the dependence on different applications that can build upward and befuddle work processes. Since Project Portfolio the executives is intrinsically complicated because of how much is being overseen on the double, it’s vital to choose an endeavor Project the board instrument that is straightforward and simple to use for everybody in the association – in addition to the early adopters.

This may be actually quite difficult: Be certain to search for instruments that limit upward, manual exertion, and extreme documentation, selecting rather for an apparatus that highlights natural plan, basic usefulness, and a versatile application that permits everybody in your association to get to the device, any place they are.

Brought together correspondence center

Frequently organizations and associations who take on different ventures have representatives and colleagues working from a distance. At the point when you have different colleagues working from numerous areas, powerful correspondence can be troublesome. The best venture Portfolio the board devices are available internet, killing correspondence hindrances. At the point when correspondence is smoothed out through one focal center, you can:

A stride ahead with better announcing

At the point when ventures fall behind, administration can smother the potential gradually expanding influence utilizing Project Portfolio the executives procedures. Detailing makes for authentic and informed venture Portfolio the board that thusly helps set assumptions inside the organization with respect to what undertakings ought to, and ought not, go ahead.

Project Portfolio the board (PPM) is the incorporated administration of an association’s ventures. While these undertakings could possibly be connected with each other, they are managed under one umbrella, called a Portfolio, to direct and deal with any contending assets. Portfolio the board in Project the executives additionally includes the admission cycle of undertakings. This incorporates recognizing likely ventures, approving them, allocating Project chiefs to them, and remembering them for the general Portfolio. It additionally incorporates undeniable level controls and checking to guarantee continuous ventures are straightforwardly connected with the business’ general objectives and techniques.

Why Project Portfolio the board is significant?

As per the Project Management Institute, “Portfolio the board is a method for overcoming any issues among procedure and execution.” It is the Portfolio supervisor’s responsibility to guarantee the ideal undertakings are being done at the ideal chance to boost the organization’s venture. This is especially significant in an association with a ton of inner ventures. Thoughts for activities can emerge out of anyplace, whenever, and it’s normal for a business to have an extensive rundown of expected undertakings to finish. Be that as it may, there typically isn’t sufficient opportunity, cash, or assets to do them OK away. Portfolio the board is important to comprehend which activities will helpfully affect the organization and focus on them appropriately.

The fundamental advantages of task Portfolio the board are:

1. It gives arrangement between organization targets and tasks

2. It removes the individual inclination from Project arranging, so there are no “pet” Projects

3. It settles on decision-production simpler around Project clashes

4. It assists the venture the executives office or Portfolio administrator with turning down Projects that are not lined up with business needs

5. It underscores the significance of zeroing in on the long haul, higher perspective view

6. It incorporates administration and oversight into the administration of activities

7. The five stages of undertaking Portfolio the board

8. There are five primary strides to Portfolio the board in Project the executives.

1. Distinguish the directing destinations of the business

In the event that you work for a supermarket, is their objective to give the freshest food, the biggest determination, or the most minimal costs? In the event that the most minimal costs are the need, activities to advance expense reserve funds are significantly more significant than tasks to further develop the food’s quality.

2. Catch and exploration solicitations and thoughts

Project thoughts could emerge out of anyplace whenever. It’s vital to have a formalized admission interaction to catch these thoughts so they can be followed and assessed. This might be pretty much as basic as an accounting page kept up with by the Portfolio chief, or it very well may be an internet based information base where anybody in the organization can enter thoughts as they think about them.

3. Select the best ventures

Whenever thoughts are caught, Portfolio chiefs should go through a standard cycle to assess and choose the tasks that will push ahead. This requires something beyond guaranteeing they are lined up with the organization goals, for example,

Since choices are being made on various ventures immediately, this can turn out to be much more perplexing. A typical method for improving on the cycle, and eliminate any predisposition, is to make a straightforward rundown of models that each task is estimated and scored against, like profit from venture (ROI), which is a typical positioning variable.

4. Approve Portfolio attainability and start Projects

When an assurance has been made on which ventures to push ahead, it’s vital to approve the Portfolio overall. This can incorporate ensuring the blend of ventures picked isn’t excessively huge, excessively dangerous, excessively costly, or excessively associated. The Portfolio ought to be appropriately offset and lined up with business objectives. For instance, assuming that three of your activities generally estimate testing in January, and you just have one test lab, this is an issue. Likewise, assuming two tasks are interrelated and a deferral in one will push out the other too, then, at that point, you might need to rethink beginning them both simultaneously. When the Portfolio is approved, Project administrators can be doled out and the activities started.

5. Oversee and screen the Portfolio

Projects change and advance over the long haul, and groundbreaking thoughts might be added to the rundown of expected ventures. Therefore it’s vital to persistently oversee both the continuous Portfolio execution and the admission cycle. Overseeing and observing the Portfolio might incorporate the accompanying:

The Major Challenges of Enterprise Project Portfolio Management

Project Portfolio the board (PPfM) is in a general sense not quite the same as task and program the executives. Task and program the board are about execution and conveyance -doing Projects right. Interestingly, PPfM centers around doing the perfect activities at the ideal time by choosing and overseeing Projects as an arrangement of ventures. It requires totally various procedures and points of view.

Great Portfolio the board expands business esteem by adjusting undertakings to an association’s essential bearing, utilizing restricted assets, and building cooperative energies between Projects. Sadly, associations regularly do Portfolio the executives ineffectively. Subsequently, they neglect to convey key outcomes since they endeavor some unacceptable undertakings or can’t say “no” to such a large number of ventures. This paper sums up current strategies for choosing, focusing on, and planning Projects as a Portfolio to expand worth to an association.

The Business Problem of PPM

a) Virtually all associations have more undertaking work to do than individuals and cash to accomplish the work. Frequently the supervisory crew experiences issues saying “no.” Instead, they attempt to do everything by packing more work onto the schedules of currently exhausted venture groups or by compromising during the task.

b) Notwithstanding a weighty speculation of individuals and cash in Projects, the association actually gets helpless outcomes since individuals are working on some unacceptable undertakings or on an excessive number of tasks. Attempting to do an excess of makes all undertakings experience the ill effects of postponements, cost overwhelms, or low quality.

The Solution of PPM

Portfolio Management Connects Strategy with Execution

Step 1: Portfolio Management Connects Strategy with Execution

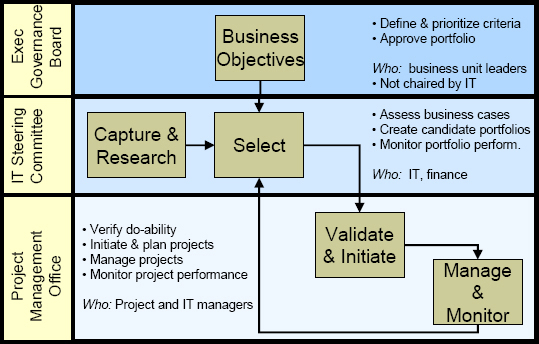

a) The mouth of the channel takes in each of the thoughts for Projects that the association may do. These thoughts might come from technique, client demands, administrative prerequisites, or thoughts from individual patrons. The reason for the pipe is to choose just those Projects that meet specific measures and to say “no” to the others. The subsequent assortment of undertakings is an engaged, composed, and executable arrangement of tasks that will accomplish the objectives of the association.

b) PPfM supplements task and program the board. It points the association in the correct bearing by choosing the best ventures to do. The chose Projects are gone over to program and Project the executives, which is the motor that starts and finishes them effectively. Doing Projects right, doing Projects together, and doing the right tasks: Project associations should dominate at every one of the three to have long haul achievement (Exhibit 2).

Step 2 : The Portfolio Management Process

The five essential strides of the Portfolio the board interaction. (Figure 3-2 in The Standard for Portfolio Management shows a more itemized breakdown of these means (Project Management Institute, 2006, p. 25):

Step 3: Explain business targets

Step 4: Portfolio Management Process Follows Five Steps

This interaction recognizes the main differentiators between Projects, like Return On Investment, hazard, effectiveness, or key arrangement. Then, at that point, it utilizes these differentiators to choose the high effect Projects, get out the messiness, and put forth boundaries. Compromises are made in a trained manner, rather than by permitting the most intense voice to win.

Step 5: The PPfM cycle gets three things done (Oltmann, 2006, p. 2):

Adjusts execution to technique. Each chose Project should assume a part in completing the system of the association. Not any more pet tasks! Amplifies the worth of the whole arrangement of undertakings to get the “most value for the money.” Taken together, the ventures should have an exceptional yield on the association’s speculation. This might be as far as dollars or different measures that are vital to the association. Balances the Portfolio. Ensures that it isn’t disproportionate – – for instance, by being too hazardous or too centered around transient outcomes.

Step 6: The accompanying areas depict each progression in more detail.

Additionally, you should have the option to obviously express your association’s essential targets prior to beginning Portfolio the board. This is frequently the primary snag individuals run into while attempting to execute PPfM. In the event that you can’t decide the essential destinations, quit chipping away at Portfolio the board and fix that issue first.

For instance, an extremely famous structure for vital arranging is the procedure map, in view of the essential viewpoints created by Kaplan and Norton (Kaplan and Norton, 1996). A methodology map infers and connections drives in a circumstances and logical results pecking order with the goal that they support each other Kaplan and Norton, 1996, p. 149). The high level of the ordered progression is monetary targets, on the grounds that making monetary returns for investors and proprietors is really important at revenue driven organizations. The supporting levels of the progressive system are:

Client esteem: what worth would the organization be able to make for the client that will convert into monetary outcomes?

Processes: what inward cycles will create that client esteem?

Learning and development: what abilities and inside realizing must the organization need to make the cycles work successfully?

Step 7: Choose What Value Means

Portfolio the board requires an orderly technique for separating between up-and-comer ventures to figure out which ones are “ideal.” What does “best” mean? The definition is exceptional to each association. For instance, one organization may esteem ecological stewardship most exceptionally, while one more puts first concern on ROI. Select a basic few standards that will quantify each venture’s actual worth to your special association. Thoroughly limit the quantity of standards to four to ten to keep how much information sensible.

Step 8: shows instances of the two kinds of measures.

Valuation Criteria Divide into Two Approaches. The right standards are basic, since helpless rules will make you select some unacceptable tasks. There are two essential ways to deal with characterizing valuation models: monetary and scoring.

Step 9: Valuation Criteria Divide into Two Approaches

The monetary way to deal with valuation utilizes quantitative money related measures, like net present worth, to characterize the distinctions between Projects. Sadly, a monetary methodology might delude Portfolio directors to confuse accuracy with precision. Robert Cooper says, Despite the way that monetary techniques are hypothetically right, the most thorough of all strategies, and the most well known of all apparatuses, of the multitude of techniques we contemplated in a huge example overview of practices versus results, they yielded the least fortunate outcomes on pretty much every Portfolio execution metric. The complexity of these strategies far surpasses the nature of the information! (Cooper, Edgett, and Kleinschmidt, 2001, p. 46).

Valuation by scoring adopts an alternate strategy. In many fields, specialists comprehend which attributes of ventures correspond with progress. Scoring utilizes these anticipating factors as the models for separating between up-and-comer Projects. For instance, Cooper ( Cooper, Greenberg, and Zuk, 2002, p. 47) records three elements in new item advancement that relate well with possible item achievement:

Despite hypothetical predominance, utilize a valuation strategy that fits with the leader dynamic style in your association. A few organizations are more OK with monetary examination, while others favor the structure for casting a ballot and conversation that scoring brings. However others consolidate monetary and scoring measures into a solitary framework. The greater part of my clients like at minimum some scoring measures in their assessment interaction. Utilizing either approach is superior to having no organized assessment models by any means!

Step 10: Capture and Research

Stage 1: The PPfM interaction constructs an establishment for making a Portfolio. It requires all of the chiefs to settle on essential targets and the fundamental few valuation models, so at first it very well may be troublesome and tedious. Luckily, just intermittent survey and update is required after that.

Stage 2: Expands on this establishment by beginning to construct a particular Portfolio. Display 5 shows the means for developing a speculative Portfolio (Oltmann, 2007, p. 36). The initial two stages are research:

Make a stock of up-and-comer Projects for the Portfolio. Remember for progress Projects as well as thoughts for new ventures. Sources can incorporate client demands, drives from vital preparation, administrative prerequisites, and smart thoughts from representatives and venture chiefs. Accumulate information for every up-and-comer Project on the stock. These incorporate information that will permit you to rate the tasks against

Conclusion

Project Portfolio the board is pointed toward diminishing shortcomings that happen while undertaking a venture and dispensing with possible dangers, which can happen because of the absence of data or frameworks accessible. Portfolios can upgrade how understudies might interpret the effect of extracurricular exercises, assist them with recognizing what they need to realize, distinguish their assets and shortcomings, and assist them with seeing how to change their way to deal with learning.