- Introduction to Dividend Policy

- Importance for Companies and Shareholders

- Types of Dividend Policies

- Stable Dividend Policy

- Constant Dividend Payout Ratio

- Residual Dividend Policy

- Factors Influencing Dividend Policy

- Relevance Theories (Walter’s, Gordon’s Model)

Introduction to Dividend Policy

Dividend Policy in Financial Management refers to the strategy a company adopts to decide how much of its earnings will be distributed to shareholders in the form of dividends versus how much will be retained for reinvestment into the business. It plays a crucial role in shaping investor expectations and company valuation. Companies must balance the desire to reward shareholders with the need to fund future growth, whether through new projects, debt repayment, or other operational investments. A consistent and predictable Dividend Policy in Financial Management can enhance investor confidence, while an unpredictable or overly conservative policy may raise concerns about a company’s financial health or long-term strategy. Several factors influence dividend decisions, including profitability, cash flow, growth opportunities, tax considerations, and the overall economic environment. There are various dividend policies, such as a stable dividend policy, where dividends remain constant or grow over time, or a residual dividend policy, where dividends are based on earnings after all profitable investment opportunities are funded. The right Dividend Policy in Financial Management helps companies maintain a balance between rewarding shareholders and sustaining growth, contributing to financial stability and long-term corporate success.

Importance for Companies and Shareholders

- Investor Attraction and Retention: A stable and predictable dividend policy can attract income-focused investors, providing them with regular returns, thus increasing shareholder loyalty and long-term investment retention.

- Signaling Financial Health: Consistent dividends often signal a company’s strong financial position, profitability, and ability to generate stable cash flow, boosting investor confidence.

- Capital Allocation: Dividend policy helps companies decide how to allocate earnings between paying dividends and reinvesting in the business. This decision is critical for supporting sustainable growth while managing financial obligations.

Dividend policy is essential for both companies and shareholders, as it directly impacts financial strategy, market perception, and the wealth of investors. A carefully crafted dividend policy helps maintain a balance between rewarding shareholders and supporting the company’s growth objectives. Here’s why it holds importance:

- Tax Efficiency: For shareholders, dividends can be an efficient way of receiving returns on investment, depending on tax regulations. Companies need to consider the tax implications for their shareholders when setting dividend policies.

- Corporate Stability and Reputation: A well-defined dividend policy enhances a company’s credibility and financial stability, fostering a positive reputation in the market and among potential investors.

- Mitigating Agency Costs: Clear dividend policies can reduce agency costs, aligning the interests of management and shareholders, as they ensure profits are returned to investors rather than being wasted on inefficient projects or excessive management compensation.

Types of Dividend Policies

There are several types of dividend policies that companies may adopt, each reflecting different priorities in balancing shareholder returns with business growth. The stable dividend policy is one of the most common, where companies aim to pay a fixed or gradually increasing dividend over time, providing shareholders with predictable returns regardless of short-term fluctuations in earnings. This policy is popular among well-established companies with steady cash flows. Another type is the residual dividend policy, where dividends are paid out from the remaining earnings after all profitable investment opportunities have been funded. This policy ensures that the company prioritizes reinvestment in growth opportunities but may result in fluctuating dividends. The constant dividend payout ratio policy involves paying a fixed percentage of earnings as dividends, which means the dividend amount changes in proportion to earnings. This policy aligns dividend payments with a company’s profitability. Some companies also follow a low or no dividend policy, particularly growth-oriented firms that prefer to reinvest all their earnings into business expansion rather than distributing them to shareholders. Lastly, the hybrid dividend policy combines elements of stable and residual policies, where a base dividend is paid, with additional payouts made depending on excess earnings. Each policy serves different corporate strategies and shareholder preferences.

Stable Dividend Policy

- Predictability for Shareholders: A stable dividend policy offers investors a reliable income stream, making it particularly attractive to income-focused investors, such as retirees.

- Signal of Financial Strength: Consistently paying dividends suggests that the company is financially healthy, generating enough cash flow to distribute earnings without compromising its operations or growth potential.

- Minimizes Market Volatility: Stable dividends can reduce market volatility by giving investors a sense of security, which can result in less fluctuation in the company’s stock price.

- Boosts Investor Confidence: The commitment to a steady dividend payment strategy enhances the company’s reputation, improving investor trust in management and long-term performance.

- Long-Term Growth Alignment: For established companies, a stable dividend policy aligns with their focus on steady, sustainable growth, as they balance reinvestment needs with the desire to reward shareholders.

- Reduces Uncertainty: A predictable dividend policy mitigates uncertainty for shareholders, as they can rely on regular returns, regardless of short-term earnings fluctuations. This stability encourages a longer-term investment outlook.

- Focus on Growth: The primary objective of the residual dividend policy is to fund profitable investment opportunities first. Dividends are paid only after all necessary reinvestments are made, supporting the company’s growth.

- Earnings-Dependent Dividends: Dividends are not fixed and fluctuate based on the company’s earnings and the availability of excess cash after financing investments. This can lead to highly variable dividend payouts.

- Flexibility in Dividend Payments: The policy gives companies flexibility, as it ensures that dividends are paid only when there are sufficient funds left after meeting capital expenditure requirements.

- Minimizes Financial Strain: By prioritizing reinvestment, companies avoid overextending themselves with dividend payouts that could potentially hinder their financial health or growth potential.

- Market Volatility Impact: Due to the fluctuating nature of dividends, shareholders may experience uncertainty and dissatisfaction, especially during periods of lower earnings or high investment spending.

- Appeals to Growth-Oriented Investors: This policy is favored by companies focused on growth and expansion, as it demonstrates the company’s commitment to using funds for reinvestment rather than providing consistent dividends.

A stable dividend policy is a strategy where companies aim to provide shareholders with consistent and predictable dividend payouts, often in the form of fixed or gradually increasing dividends over time. This policy is favored by companies with steady earnings and cash flows, as it helps build investor confidence and fosters long-term shareholder loyalty. Here’s why it’s significant:

Constant Dividend Payout Ratio

The constant dividend payout ratio policy involves paying out a fixed percentage of a company’s earnings as dividends to shareholders. Under this policy, the dividend amount fluctuates in direct proportion to the company’s earnings, meaning that when profits rise, dividends increase, and when profits decline, dividends decrease. This approach aligns dividend payments with the company’s financial performance, making it more flexible than a stable dividend policy. It ensures that dividends remain tied to the company’s profitability, which can be advantageous during periods of high earnings, as shareholders receive a larger payout. However, during times of lower earnings, the dividends may decrease, which could lead to investor dissatisfaction. This policy is typically adopted by companies that want to maintain a close relationship between earnings and dividends, particularly those in industries where profitability is highly variable. While it allows companies to retain more earnings during downturns, it may also signal to the market that the company is less financially stable compared to firms with more predictable dividend policies. As a result, the constant dividend payout ratio policy is often seen as more volatile and less attractive to investors seeking steady income, but it offers a transparent method of linking dividends to a company’s financial performance.

Residual Dividend Policy

The residual dividend policy is a strategy where dividends are paid to shareholders from the remaining earnings after all profitable investment opportunities have been funded. Under this policy, the company prioritizes reinvestment in growth and expansion and only pays dividends with the leftover funds. This approach aligns dividend payments with the company’s investment needs, making it more flexible than other policies.

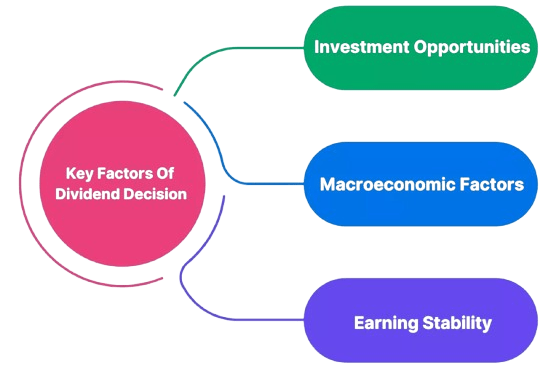

Factors Influencing Dividend Policy

Several factors influence a company’s dividend policy, as it must balance shareholder expectations with its financial health and growth objectives. Profitability is one of the primary factors; a company needs consistent earnings to maintain regular dividend payouts. Without sufficient profits, the company might struggle to sustain dividend payments. Cash flow is equally important, as having enough liquidity is essential for making dividend payments, especially if the company is investing heavily in its operations. Growth opportunities also play a critical role; companies with attractive investment opportunities may prefer to retain earnings to fund expansion, reducing the dividend payout. Debt obligations influence dividend policy too, as companies with high levels of debt might prioritize paying off loans rather than distributing profits to shareholders. Tax considerations are another factor, as dividend taxation can affect investor preferences and influence the company’s decision to pay out dividends. Additionally, shareholder preferences matter; some investors seek regular dividends for income, while others may favor reinvestment in the company for capital gains. The economic environment, including industry trends and macroeconomic conditions, also impacts dividend policy, as companies may adjust payouts during periods of economic uncertainty. Together, these factors shape a company’s approach to distributing profits while maintaining long-term financial stability.

Relevance Theories (Walter’s, Gordon’s Model)

The relevant theories of dividends, specifically Walter’s Model and Gordon’s Model, offer insights into how dividend policies can affect a company’s valuation and investor wealth. Walter’s Model suggests that the value of a company is directly influenced by its dividend policy. According to Walter, if a company has high internal returns (i.e., the return on investment is higher than the cost of capital), it should reinvest earnings rather than paying them out as dividends, as reinvestment will lead to higher growth and, therefore, higher shareholder wealth. On the other hand, if the return on investment is lower than the cost of capital, the company should pay out dividends, as reinvestment would reduce the company’s value. Walter’s model implies that dividend policy is crucial for determining a company’s market value. Gordon’s Model, or the Dividend Capitalization Model, similarly emphasizes the importance of dividends, but it views the dividend payout as a crucial determinant of the stock price. Gordon asserts that the value of a company is the present value of expected future dividends, with a higher dividend payout leading to a higher stock price, assuming the company’s growth rate and required rate of return remain constant. Both models highlight the critical relationship between dividend policy and company valuation, though they offer different perspectives on how dividends influence shareholder wealth.