50+ Best Hyperion Financial Management Interview Questions and Answers

Last updated on 12th Nov 2021, Blog, Interview Questions

Hyperion Financial Management Interview Questions refer to a set of inquiries designed to assess a candidate’s knowledge and expertise in using Hyperion Financial Management (HFM), a financial consolidation and reporting application. These questions cover various aspects, including architecture, functionalities, deployment options, integration capabilities, user training, and best practices related to HFM. Interviewers use these questions to evaluate a candidate’s proficiency in implementing, managing, and optimizing financial processes using Hyperion Financial Management.

1. What are the critical features of Hyperion Financial Management?

Ans:

Hyperion Financial Management (HFM) is a financial consolidation and reporting application developed by Oracle. Here are some key features of Hyperion Financial Management:

- Consolidation and Reporting

- Data Entry and Validation

- Workflow and Process Management

- Intercompany Transactions

- Data Translation and Currency Conversion

2. How does HFM support financial reporting?

Ans:

HFM enables the creation of customizable financial reports and statements. Users can generate consolidated financial statements, variance analyses, and other financial reports to meet regulatory and internal reporting requirements. They are designed to support comprehensive and sophisticated financial reporting processes.

3. What is the role of HFM in the financial close process?

Ans:

Hyperion Financial Management streamlines the financial close process by automating tasks, providing a centralized platform for collaboration, and ensuring data accuracy through validation rules. It helps organizations achieve a faster and more efficient financial close.

4. Can HFM handle multi-currency consolidations?

Ans:

Yes, HFM supports multi-currency consolidations. It allows organizations to manage financial data in multiple currencies, perform currency translations, and report results in the desired reporting currency.

5. How does HFM integrate with other Oracle EPM applications?

Ans:

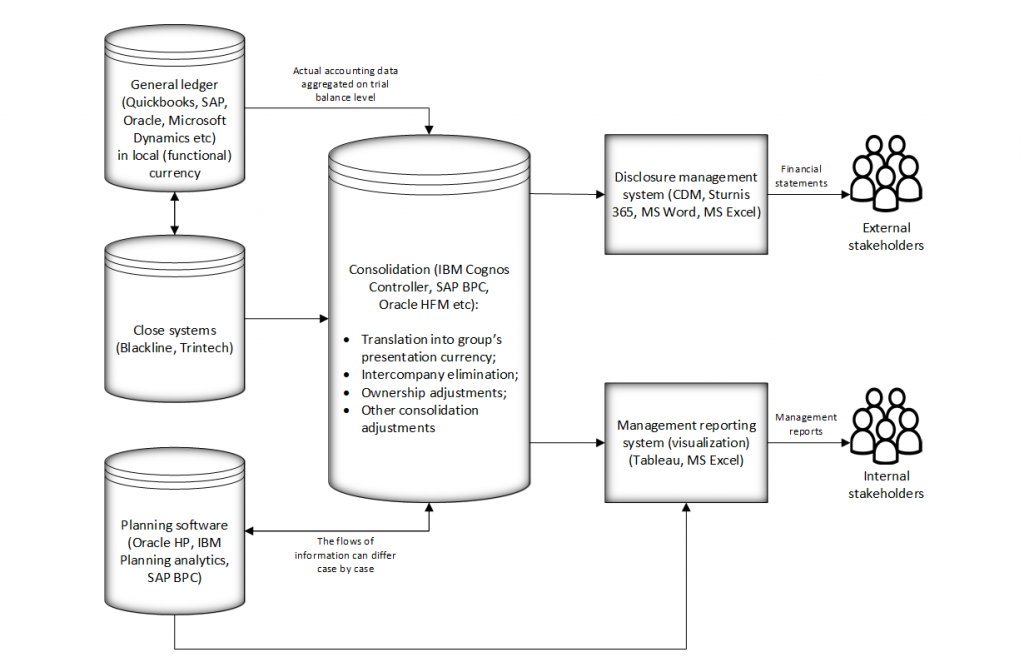

Hyperion Financial Management integrates with other Oracle EPM applications and tools, such as Hyperion Planning and Oracle Essbase. This integration allows for a comprehensive approach to financial planning, consolidation, and reporting within the organization.

6. What are the HFM services you need to start?

Ans:

To start Oracle Hyperion Financial Management (HFM), you must ensure the necessary services are up and running. In a typical Hyperion Financial Management deployment, you would typically start the following services:

- Hyperion Financial Management (HFM) Service

- Oracle Process Manager and Notification Server (OPMN)

- World Wide Web Publishing Service (WWPUB)

- Hyperion Calculation Manager Service

- Database Services

7. How many Account types are in HFM?

Ans:

Hyperion Financial Management (HFM) has three primary types of accounts.

- Balance Sheet Accounts

- Income Statement Accounts

- Statistical Accounts

8. What kind of reporting capabilities does Hyperion Financial Management offer?

Ans:

Hyperion Financial Management provides robust reporting capabilities, allowing organizations to generate various financial reports, including income statements, balance sheets, and cash flow statements. It supports the creation of custom reports and offers features for report formatting and distribution.

9. Is Hyperion Financial Management suitable for large enterprises?

Ans:

Yes, Hyperion Financial Management is designed to meet the needs of large enterprises with complex financial consolidation and reporting requirements. It can handle high volumes of financial data and support organizations with diverse structures and business units.

10. Can Hyperion Financial Management handle intercompany eliminations?

Ans:

Yes, Hyperion Financial Management includes functionality for intercompany eliminations. This feature ensures that intercompany transactions are eliminated adequately during consolidation, helping to produce accurate consolidated financial statements.

11. How does Hyperion Financial Management handle currency translation?

Ans:

Hyperion Financial Management supports multi-currency consolidation. It allows organizations to manage and consolidate financial data in different currencies, performing currency translation as part of the consolidation process to ensure accurate and consistent reporting.

12. What is the typical implementation process for Hyperion Financial Management?

Ans:

The implementation process for Hyperion Financial Management involves several stages, including planning, installation, configuration, data migration, and user training. Organizations usually work closely with consultants or experts to ensure a successful deployment tailored to their needs.

13. How does Hyperion Financial Management address security and access control?

Ans:

Hyperion Financial Management provides robust security features, allowing organizations to define user roles, access permissions, and data-level security. It ensures that sensitive financial information is accessible only to authorized individuals, maintaining data integrity and confidentiality.

14. Is Hyperion Financial Management suitable for global organizations with multiple subsidiaries?

Ans:

Hyperion Financial Management is well-suited for global organizations with complex structures and multiple subsidiaries. Its multi-currency support, intercompany eliminations, and global consolidation capabilities make it a preferred choice for enterprises in diverse regions.

15. What is the level of automation in the financial consolidation process with Hyperion Financial Management?

Ans:

Hyperion Financial Management offers a high degree of automation in financial consolidation. Tasks such as data validation, intercompany eliminations, currency translation, and consolidation adjustments can be automated, reducing the time and effort required for the financial close.

16. Can Hyperion Financial Management handle regulatory reporting requirements?

Ans:

Yes, Hyperion Financial Management is designed to support regulatory reporting requirements. It provides flexibility in custom financial reports, ensuring organizations comply with local accounting standards and regulations.

17. What kind of support and maintenance does Hyperion Financial Management require?

Ans:

Hyperion Financial Management typically requires ongoing support and maintenance to ensure optimal performance. This may include applying software updates, addressing issues, and providing user training. Many organizations choose to have a dedicated support team or engage with Oracle’s support services.

18. How does Hyperion Financial Management assist with financial planning and forecasting?

Ans:

While Hyperion Financial Management primarily focuses on consolidation and reporting, Oracle offers other products within the Hyperion suite, such as Hyperion Planning, which is specifically designed for financial planning, budgeting, and forecasting. These tools can be integrated to provide a comprehensive financial management solution.

19. What is the role of Hyperion Financial Management in financial consolidation?

Ans:

Hyperion Financial Management plays a crucial role in financial consolidation by combining financial data from different sources and business units. It facilitates the consolidation process, ensuring accuracy and compliance with accounting standards.

20. How does Hyperion Financial Management handle data integrity?

Ans:

Hyperion Financial Management incorporates data integrity checks to validate and ensure the accuracy of financial data. These checks help identify and resolve inconsistencies or errors in the data, maintaining the integrity of the consolidated financial information.

21. Can Hyperion Financial Management handle complex ownership structures?

Ans:

Yes, Hyperion Financial Management is designed to handle complex ownership structures commonly found in large enterprises. It supports consolidating financial data for organizations with multiple subsidiaries, joint ventures, and other intricate ownership relationships.

22. What are the benefits of using Hyperion Financial Management for financial reporting?

Ans:

Hyperion Financial Management offers several benefits for financial reporting, including automation of the reporting process, increased accuracy in financial statements, enhanced visibility into financial performance, and the ability to generate various reports to meet regulatory and internal requirements.

23. How does Hyperion Financial Management contribute to the financial close process?

Ans:

Hyperion Financial Management streamlines the financial close process by automating tasks such as journal entries, intercompany eliminations, and currency translations. This results in a faster and more efficient close, allowing organizations to meet reporting deadlines confidently. The financial close process, also known as the relative or close cycle, involves activities to finalize the financial results for a specific accounting period.

24. What sets apart the strategies and resources for effective training and onboarding in Hyperion Financial Management?

Ans:

| Aspect | Hyperion Financial Management | General Financial Management Systems | |

| Training Strategies |

Allows customization of training content based on the specific roles and responsibilities of users. |

Generic training plans, may not be as targeted to individual roles. | |

| User Role Customization | Allows customization of training content based on the specific roles and responsibilities of users. | Training content may be more standardized and less role-specific. | |

| Interactive Training Simulations |

Utilizes interactive simulations for hands-on learning experiences. |

May or may not incorporate interactive simulations for practical training. | |

| User Engagement Techniques | Incorporates engaging and interactive techniques to keep users actively involved during training sessions. | Training sessions may rely more on traditional teaching methods. | |

| Continuous Learning Resources |

Provides ongoing resources, such as documentation and knowledge base, for continuous learning. |

May offer limited post-training resources for continuous learning. | |

| Feedback Mechanisms |

Establishes feedback mechanisms to gather user input and improve training programs continuously. |

May not have robust feedback mechanisms for continuous improvement. |

25. Does Hyperion Financial Management support scenario modeling and forecasting?

Ans:

Yes, Hyperion Financial Management supports scenario modeling and forecasting. Organizations can use the software to analyze different financial scenarios, make informed predictions, and assess the potential impact of various business decisions on their financial performance. Scenario modeling is a crucial aspect of financial planning and analysis, allowing organizations to determine the possible effects of multiple factors on their financial performance.

26. How does Hyperion Financial Management assist with compliance and regulatory requirements?

Ans:

Hyperion Financial Management helps organizations comply with various regulatory and accounting standards by providing a structured and auditable process for financial consolidation. Hyperion Financial Management (HFM) assists organizations with compliance and regulatory requirements through features supporting accurate financial reporting, adherence to accounting standards, and a transparent and auditable financial consolidation process.

27. Are there any industry-specific considerations when implementing Hyperion Financial Management?

Ans:

The implementation of Hyperion Financial Management may have industry-specific considerations based on different sectors’ unique financial and reporting requirements. Customizing the solution to align with industry standards and compliance regulations is essential. While HFM is a versatile financial consolidation and reporting solution, different industries may have unique requirements, regulatory standards, and business practices.

28. How does Hyperion Financial Management handle data integration from different source systems?

Ans:

Hyperion Financial Management supports data integration through various methods, including data imports, data forms, and integrations with other Oracle EPM tools. Users can import data from diverse sources to ensure accurate and up-to-date financial information for consolidation. The goal is to consolidate financial data from various sources into a centralized platform for accurate reporting and analysis.

29. How is security managed in Hyperion Financial Management?

Ans:

Hyperion Financial Management offers robust security features, allowing administrators to define user roles and permissions. Access controls can be configured at different levels, ensuring that users only have access to the specific data and functionality required for their roles. The primary goal is to ensure that only authorized users have appropriate access to sensitive financial data and functionality within the application.

30. Can Hyperion Financial Management help meet regulatory compliance and audit requirements?

Ans:

Yes, Hyperion Financial Management provides audit trails and logs that track user activities and changes to financial data. This helps organizations comply with regulatory requirements and facilitates auditing by providing a clear history of financial data modifications.

31. How does Hyperion Financial Management streamline the financial consolidation process?

Ans:

Hyperion Financial Management includes workflow and process management capabilities to guide users through the financial consolidation process. It supports

the automation of routine tasks, accelerates the close process, and ensures that all necessary steps are followed. The financial consolidation process through automation, advanced functionalities, and a robust set of features that facilitate efficient and accurate consolidation of financial data.

32. Is Hyperion Financial Management scalable for growing organizations?

Ans:

Yes, Hyperion Financial Management is designed to scale with the growth of an organization. It can handle increasing volumes of financial data and users. Performance optimization features, such as data compression and caching, contribute to efficient processing even as the scale increases. Scalability refers to a system’s ability to handle increasing data, users, and complexity as an organization expands.

33. What resources are available for user training and support for Hyperion Financial Management?

Ans:

Oracle provides documentation, training materials, and online resources to support users in learning and mastering Hyperion Financial Management. Additionally, organizations often invest in training programs or consulting services to ensure their teams are proficient in using the software. These resources are designed to help users, administrators, and developers effectively use and manage HFM for financial consolidation and reporting.

34. What is the primary purpose of Hyperion Financial Management?

Ans:

Hyperion Financial Management is designed to facilitate financial consolidation, reporting, and analysis for organizations. It helps ensure accuracy, transparency, and efficiency in the financial close process. It is an enterprise performance management (EPM) software application developed by Oracle, and it serves as a comprehensive solution for managing the complex processes associated with financial consolidation, reporting, and analysis.

35. What role does currency translation play in HFM?

Ans:

Currency translation in Hyperion Financial Management (HFM) is a crucial aspect of financial consolidation, especially for organizations operating in multiple countries and dealing with transactions in various currencies. The role of currency translation in HFM includes the following key aspects:

- Multi-Currency Environment

- Consistent Exchange Rates

- Translation of Financial Statements

- Automatic Exchange Rate Application

- Historical and Average Rates

- Impact on Consolidated Financial Statements

36. How does HFM address intercompany transactions?

Ans:

HFM includes features for intercompany eliminations, ensuring that transactions between different entities within the organization are appropriately eliminated during the consolidation process to prevent double counting. Managing intercompany transactions is critical for accurate financial consolidation and reporting.

37. What advanced analysis capabilities does HFM offer?

Ans:

HFM provides tools for advanced financial analysis and scenario modeling. This allows organizations to perform in-depth analysis of financial data, conduct what-if scenarios, and gain insights into various financial metrics. These capabilities go beyond standard financial reporting and consolidation, allowing users to perform sophisticated analyses for strategic decision-making.

38. Is Hyperion Financial Management suitable for organizations of different sizes?

Ans:

While HFM is often used by large enterprises with complex financial structures, it can be scaled to meet the needs of organizations of varying sizes. It is designed to cater to the needs of medium to large enterprises, making it particularly suitable for organizations with complex financial structures and significant data volumes. HFM is often chosen by organizations facing the challenges of managing financial data across multiple entities, dealing with intercompany transactions, and ensuring compliance with accounting standards.

39. What types of financial reports can be generated using HFM?

Ans:

HFM allows the generation of various financial reports, including income statements, balance sheets, and cash flow statements. Organizations can create custom reports to meet specific reporting requirements. Users can leverage HFM’s reporting capabilities to create standard financial statements, management reports, and specialized analyses.

40. How does HFM enhance the financial reporting process?

Ans:

HFM streamlines the financial reporting process by automating data collection, ensuring data integrity, and providing a centralized platform for financial information. This results in faster and more accurate financial reporting. It enhances

financial reporting by providing a comprehensive financial consolidation, reporting, and analysis platform. It streamlines and automates various aspects of financial reporting, ensuring accuracy, consistency, and compliance with accounting standards.

41. How does Hyperion Financial Management facilitate the financial consolidation process?

Ans:

Hyperion Financial Management automates financial consolidation by consolidating data from various sources, handling intercompany transactions, performing currency translations, and applying consolidation rules. This streamlines the process of producing accurate and timely consolidated financial statements. The software simplifies and automates various aspects of financial consolidation, ensuring accuracy, efficiency, and compliance with accounting standards.

42. What is the role of data integrity checks in Hyperion Financial Management?

Ans:

Data integrity checks in Hyperion Financial Management help ensure the accuracy and reliability of financial data. The software performs validation checks, audit trails, and consistency checks to identify and rectify data errors, contributing to the overall reliability of financial information. These checks are designed to identify and prevent errors, discrepancies, and inconsistencies that could impact the quality of financial reporting.

43. Does Hyperion Financial Management support workflow and collaboration during the financial close process?

Ans:

Hyperion Financial Management includes workflow and collaboration features to facilitate the financial close process. It allows users to define and manage tasks, track progress, and collaborate on economic close activities, enhancing communication and coordination among team members.

44. How does Hyperion Financial Management address compliance and regulatory reporting requirements?

Ans:

Hyperion Financial Management (HFM) is designed to assist organizations in meeting compliance and regulatory reporting requirements. As a financial consolidation and reporting application, HFM provides features and capabilities that support adherence to accounting standards, regulatory guidelines, and reporting obligations.

45. Can Hyperion Financial Management integrate with other enterprise systems and data sources?

Ans:

Yes, Hyperion Financial Management offers integration capabilities, allowing it to connect with other enterprise systems, databases, and data sources. This facilitates the seamless flow of financial data into the system, ensuring that the most up-to-date information is used for consolidation and reporting.

46. How does Hyperion Financial Management support financial analysis and modeling?

Ans:

Hyperion Financial Management (HFM) supports financial analysis and modeling by providing a robust platform for consolidating and reporting financial data. While HFM is primarily known for its financial consolidation capabilities, organizations often leverage its features to conduct various types of financial analysis and modeling

47. What are the deployment options for Hyperion Financial Management?

Ans:

Hyperion Financial Management can be deployed on-premises or in the cloud, allowing organizations to choose the deployment model that best suits their needs. The cloud deployment option offers the advantages of scalability, accessibility, and reduced infrastructure maintenance. These options include on-premises deployment, cloud-based deployment, and hybrid deployment models.

48. How does Hyperion Financial Management improve financial consolidation processes?

Ans:

Hyperion Financial Management streamlines financial consolidation by automating the process. It facilitates collecting, validating, and consolidating financial data from various sources, ensuring accuracy and reducing the time required for the financial close. It provides a comprehensive suite of features and capabilities that enhance the financial consolidation process’s efficiency, accuracy, and transparency.

49. What role does data integrity play in Hyperion Financial Management?

Ans:

Data integrity is crucial in Hyperion Financial Management. The system performs data validation checks to ensure the accuracy and consistency of financial data. This helps organizations maintain reliable and trustworthy information for financial reporting. Data integrity is critical in ensuring the accuracy, consistency, and reliability of financial data within the application.

50. How does Hyperion Financial Management support compliance with financial regulations?

Ans:

Hyperion Financial Management helps organizations comply with financial regulations by providing a secure and auditable platform for financial processes. It helps maintain an accurate audit trail, ensure transparency, and meet regulatory reporting requirements.

51. Is Hyperion Financial Management cloud-based or on-premises?

Ans:

Oracle offers both on-premises and cloud-based versions of Hyperion Financial Management. Organizations can choose the deployment option that best fits their needs and preferences, whether it’s an on-premises installation or leveraging Oracle’s cloud infrastructure. Organizations can select the deployment model that best aligns with their preferences, IT infrastructure, and strategic considerations.

52. Can Hyperion Financial Management integrate with other enterprise systems?

Ans:

Hyperion Financial Management can integrate with other enterprise systems, including ERP (Enterprise Resource Planning). Integration allows for the seamless flow of financial data between systems, reducing manual data entry and improving overall efficiency.

53. What types of financial analysis does Hyperion Financial Management support?

Ans:

Hyperion Financial Management (HFM) supports various financial analysis capabilities, enabling organizations to analyze and interpret their financial data in multiple dimensions. The application provides tools and features that facilitate standard and ad-hoc financial analysis.

54. How user-friendly is the Hyperion Financial Management interface?

Ans:

The interface of Hyperion Financial Management is designed to be user-friendly, with features like dashboards and customizable reports. However, like any enterprise software, training and familiarity with the system are essential for users to maximize its capabilities. The user-friendliness of the Hyperion Financial Management (HFM) interface can vary depending on user experience, familiarity with financial consolidation tools, and the specific tasks being performed.

55. How does Hyperion Financial Management ensure data accuracy and integrity?

Ans:

HFM includes robust data integrity checks to validate and ensure the accuracy of financial data. It enforces validation rules, consistency checks, and validation of intercompany transactions to maintain data integrity throughout the consolidation process. It employs several mechanisms to ensure data accuracy and integrity in financial consolidations. The application is designed to support financial information’s reliability and maintain consolidated results consistency.

56. Can Hyperion Financial Management handle complex ownership structures?

Ans:

Yes, Hyperion Financial Management is capable of handling complex ownership structures. It accommodates organizations with multiple subsidiaries, joint ventures, and intricate ownership relationships, making it suitable for enterprises with diverse structures.

57. What role does Hyperion Financial Management play in financial close processes?

Ans:

Hyperion Financial Management plays a crucial role in the financial close process by automating and accelerating the consolidation of financial data. It helps organizations close their books faster, reducing the time and effort required for the economic compact cycle.

58. How does Hyperion Financial Management support regulatory compliance?

Ans:

HFM provides features to support compliance with financial reporting standards and regulations. It facilitates the generation of accurate and compliant financial statements, ensuring that organizations adhere to regulatory requirements and reporting standards.

59. Is training available for Hyperion Financial Management users?

Ans:

Yes, Oracle provides training and documentation for users of Hyperion Financial Management. Training programs cover various aspects of the software, including configuration, administration, and usage, to help users maximize the benefits of the application.

60. What are common challenges organizations may face when implementing Hyperion Financial Management?

Ans:

Challenges during implementation may include:

- Data integration complexities

- Configuring the system to meet specific organizational requirements

- User training

- Ensuring a smooth transition from existing financial systems

61. What is the purpose of financial consolidation in Hyperion Financial Management?

Ans:

Financial consolidation in Hyperion Financial Management refers to combining the financial data from different entities or business units within an organization to create a unified set of financial statements. It helps produce accurate and consolidated reports for a comprehensive view of the company’s economic performance.

62. Can Hyperion Financial Management automate the consolidation process?

Ans:

Yes, Hyperion Financial Management is designed to automate the financial consolidation process. It includes consolidation rules, automated eliminations, and currency translation, allowing organizations to streamline the close process and reduce manual effort.

63. What is the significance of currency translation in Hyperion Financial Management?

Ans:

Currency translation in Hyperion Financial Management is crucial for organizations operating in multiple currencies. It ensures that financial data from different entities or subsidiaries, recorded in their respective local currencies, is converted into a common reporting currency during consolidation. This ensures consistency in financial reporting.

64. How does Hyperion Financial Management handle intercompany transactions?

Ans:

Hyperion Financial Management facilitates intercompany transactions by providing functionality for intercompany eliminations. It identifies and eliminates transactions between entities within the organization, preventing double counting and ensuring accurate consolidated financial statements.

65. What types of financial reports can be generated using Hyperion Financial Management?

Ans:

Hyperion Financial Management supports the generation of various financial reports, including income statements, balance sheets, cash flow statements, and custom reports. Users can create reports tailored to their specific needs and requirements, and the system offers flexibility in report formatting.

66. How does Hyperion Financial Management address complex ownership structures?

Ans:

Hyperion Financial Management is designed to handle complex ownership structures commonly found in large enterprises. It supports multi-tiered ownership hierarchies and can accommodate intricate consolidation structures, accurately representing the organization’s financial position.

67. What is the primary purpose of Hyperion Financial Management (HFM)?

Ans:

Hyperion Financial Management is designed to streamline and automate financial consolidation, reporting, and analysis processes for organizations. It is a centralized platform for managing financial data, ensuring accuracy, and providing insights into financial performance.

68. How does Hyperion Financial Management facilitate financial consolidation?

Ans:

HFM enables organizations to consolidate financial data from various sources, business units, and subsidiaries. It automates intercompany eliminations, currency translations, and other consolidation tasks, ensuring accurate and compliant financial reporting.

69. What role does currency translation play in Hyperion Financial Management?

Ans:

Currency translation is a crucial aspect of HFM. It allows organizations to consolidate financial data from entities operating in different currencies. HFM automates the translation process to ensure that all financial information is presented in a consistent currency for reporting purposes.

70. How does Hyperion Financial Management address intercompany transactions?

Ans:

HFM provides features for handling intercompany transactions. It automates intercompany eliminations to remove double-counting of transactions between affiliated entities during the consolidation process, ensuring accurate and consolidated financial statements.

71. Is Hyperion Financial Management scalable for large enterprises?

Ans:

Yes, Hyperion Financial Management is scalable and designed to meet the needs of large enterprises. It can handle high volumes of financial data, support complex organizational structures, and provide the performance required for large-scale financial consolidations.

72. How does Hyperion Financial Management contribute to financial analysis?

Ans:

HFM facilitates financial analysis by providing a consolidated and accurate view of financial data. It supports scenario modeling, variance, and trend analysis, empowering organizations to gain insights into their financial performance and make informed strategic decisions.

73. Can Hyperion Financial Management be integrated with other Oracle EPM products?

Ans:

Hyperion Financial Management can be integrated with other Oracle EPM (Enterprise Performance Management) products, such as Hyperion Planning and Essbase. This integration enhances EPM capabilities, allowing organizations to align financial planning, consolidation, and reporting processes.

74. What common challenges organizations may face when implementing Hyperion Financial Management?

Ans:

Common challenges during HFM implementation may include:

- Data quality issues

- Complex data mapping requirements

- User training

- Ensuring alignment with regulatory compliance standards

Proper planning, training, and collaboration with experienced consultants can help mitigate these challenges.

75. How does HFM contribute to financial consolidation?

Ans:

Hyperion Financial Management (HFM) plays a crucial role in the financial consolidation process for organizations. Financial consolidation involves combining the financial data of multiple entities or business units within a corporate group to produce consolidated financial statements. It ensures accurate and consistent financial reporting.

76. How does HFM address intercompany transactions?

Ans:

HFM includes features for intercompany eliminations, ensuring that transactions between affiliated entities are appropriately accounted for and eliminated during the consolidation process.

- Intercompany Elimination Rules

- Intercompany Matching

- Elimination Entities

- Currency Translation

- Ownership Management

- Intercompany Matching Reports

77. What is involved in implementing Hyperion Financial Management?

Ans:

Implementing Hyperion Financial Management (HFM) involves a series of steps to configure, customize, and deploy the application according to the organization’s financial consolidation and reporting requirements. The implementation process typically includes the following key phases.

- Project Planning

- Requirements Gathering

- System Design

- Installation and Configuration

- Data Integration

78. How user-friendly is the interface of Hyperion Financial Management?

Ans:

The user interface is designed to be intuitive for finance professionals. It provides dashboards, data input forms, and reporting tools to simplify financial consolidation and analysis tasks. The user interface of Hyperion Financial Management (HFM) has evolved, and its user-friendliness can be subjective, depending on user preferences and familiarity with financial consolidation tools.

79. Is there support for customizations and extensions in Hyperion Financial Management?

Ans:

Hyperion Financial Management allows organizations to customize and extend functionalities based on their unique business requirements. This includes creating custom reports, data input forms, and calculations. However, it’s important to note that the extent of customization capabilities can be influenced by factors such as the version of HFM, the deployment model (on-premises or cloud), and the specific features or components being considered for customization.

80. How is support and maintenance handled for Hyperion Financial Management?

Ans:

Oracle provides support services for Hyperion Financial Management, including updates, patches, and technical assistance. Organizations may also have the option for cloud-based deployment and managed services. Support and maintenance for Hyperion Financial Management (HFM) typically involve a combination of resources provided by the software vendor (Oracle, in the case of HFM) and internal processes within the organization.

81. How does Hyperion Financial Management facilitate financial consolidation?

Ans:

Hyperion Financial Management automates the consolidation process by collecting financial data from various sources, applying consolidation rules, performing eliminations for intercompany transactions, and generating consolidated financial statements. This helps organizations produce accurate and timely financial results.

82. How does Hyperion Financial Management support financial analysis?

Ans:

Hyperion Financial Management provides advanced features for financial analysis, including the ability to create what-if scenarios, conduct variance analysis, and perform trend analysis. This supports decision-making processes by offering insights into financial performance and helping organizations plan for the future. The software facilitates financial consolidation and provides capabilities contributing to meaningful financial analysis.

83. Is Hyperion Financial Management available as an on-premises solution or in the cloud?

Ans:

Yes, Hyperion Financial Management (HFM) is available both as an on-premises solution and in the cloud. Organizations can choose the deployment option that best aligns with their IT strategy, infrastructure preferences, and business requirements. Here are the two deployment options for Hyperion Financial Management.

- Cloud Deployment

- On-Premises Deployment

84. What training and support options are available for Hyperion Financial Management users?

Ans:

Hyperion Financial Management (HFM) users can access various training and support options to enhance their skills, troubleshoot issues, and maximize the software’s benefits. These options include.

- Third-Party Training Providers

- Official Documentation

- Oracle Support

- Oracle University Training

- Certification Programs

- Oracle Community

- Webinars and Events

85. How does Hyperion Financial Management assist in the financial consolidation process?

Ans:

HFM automates the consolidation of financial data from various sources, such as different business units or subsidiaries. It handles tasks like intercompany eliminations, currency translations, and data validations to produce accurate consolidated financial statements. Financial consolidation involves combining financial data from various entities, subsidiaries, or business units to create consolidated financial statements.

86. What benefits does Hyperion Financial Management offer for financial reporting?

Ans:

Hyperion Financial Management provides robust financial reporting capabilities. It allows organizations to generate standardized financial statements and reports, ensuring consistency and accuracy. Users can create custom reports and dashboards to meet specific business needs.

87. How does Hyperion Financial Management address data integrity and accuracy?

Ans:

The software includes data integrity checks and validations to ensure the accuracy of financial data. It provides a secure and controlled environment for managing financial information, reducing the risk of errors and discrepancies in the reporting process. It addresses data integrity and accuracy through a combination of features, validation mechanisms, and controls designed to ensure the reliability of financial data.

88. Is Hyperion Financial Management suitable for global organizations with multiple currencies?

Ans:

Hyperion Financial Management is well-suited for global organizations dealing with multiple currencies. It supports currency translation, enabling companies to consolidate financial data in their reporting currency while handling the complexities of currency exchange rates.

89. What support and training are available for Hyperion Financial Management users?

Ans:

Hyperion Financial Management (HFM) users can access various support and training resources to enhance their understanding of the software and address any issues they may encounter. The support and training options for HFM users typically include.

- Official Documentation

- Oracle Support

- Community Forums

- Training Courses

- Certification Programs Consulting Services

90. How frequently can financial consolidations be performed using Hyperion Financial Management?

Ans:

The frequency of financial consolidations can be tailored to the organization’s needs. Some companies perform consolidations every month, while others may choose a quarterly or annual frequency. Hyperion Financial Management is flexible and can accommodate various consolidation schedules. The consolidation frequency is typically determined by the organization’s reporting requirements, business processes, and the nature of its financial operations.

91. What are the benefits of using Hyperion Financial Management for financial reporting?

Ans:

Hyperion Financial Management provides standardized and consistent financial reporting. It offers features for generating various financial statements, facilitating compliance with regulatory requirements, and helping organizations make informed business decisions based on accurate financial data.

92. How does Hyperion Financial Management address data integrity and security concerns?

Ans:

HFM includes robust data integrity checks and security features. It ensures that financial data is accurate and trustworthy by validating and verifying data during consolidation. Additionally, it allows organizations to define access controls and permissions to protect sensitive financial information. It addresses data

integrity and security concerns through features and best practices.

93. Is Hyperion Financial Management scalable for growing organizations?

Ans:

Yes, Hyperion Financial Management is scalable and can accommodate the growth of an organization. It suits large enterprises with complex financial structures and smaller organizations that may expand. The scalability ensures that the system remains effective as the business evolves.

94. What integration capabilities does Hyperion Financial Management offer with other enterprise systems?

Ans:

Hyperion Financial Management can integrate with other Oracle EPM and ERP (Enterprise Resource Planning) solutions. This integration allows seamless data flow between financial management, planning, and other enterprise systems, providing a holistic view of an organization’s performance. Integrating HFM with other systems is crucial for streamlining financial processes and ensuring consistency in data.

95. Can Hyperion Financial Management support regulatory compliance requirements?

Ans:

Yes, Hyperion Financial Management (HFM) can support regulatory compliance requirements for financial reporting. Compliance with various regulatory standards and reporting frameworks is crucial for organizations, especially those operating in multiple jurisdictions. HFM offers features and capabilities that help organizations adhere to regulatory requirements.

96. What types of checks does HFM perform for data integrity?

Ans:

HFM includes robust data integrity checks to ensure the accuracy and reliability of financial information. It performs validation checks, intercompany matching, and audit trails to identify and rectify discrepancies in financial data, contributing to the integrity of the consolidated results.

- Data Validation Rules

- Consolidation and Elimination Rules

- Cross-Validation Rules

- Intercompany Matching

- Security Controls

- Audit Trail

- Data Submissions and Locking

- Calculation and Aggregation Controls

- Data Integrity Reports

97. How does HFM support multi-currency consolidation?

Ans:

HFM supports multi-currency consolidation by allowing organizations to manage and consolidate financial data in different currencies. It includes features for currency translation, ensuring that financial statements reflect accurate values in the reporting currency, thus accommodating global businesses.

98. Is HFM suitable for large enterprises with high data volumes?

Ans:

Yes, HFM is well-suited for large enterprises with significant data volumes. It is designed to handle the complexities associated with organizations of considerable size, offering scalability and performance to meet the demands of extensive financial consolidation processes.HFM is part of Oracle’s Enterprise Performance Management suite, and it provides robust features for managing complex financial consolidation processes, handling comprehensive data, and producing accurate financial reports.

99. Can HFM be integrated with other enterprise systems?

Ans:

HFM can be integrated with other enterprise systems, including ERP (Enterprise Resource Planning) systems, data warehouses, and business intelligence tools. This integration ensures a seamless flow of financial data and enhances the overall efficiency of economic processes. Integration is crucial for organizations to streamline financial processes, improve data accuracy, and enhance efficiency.

100. How does Hyperion Financial Management handle data integrity and validation?

Ans:

Hyperion Financial Management includes built-in data integrity checks to ensure the accuracy and consistency of financial data. It validates data during the consolidation process, flagging any inconsistencies or errors that may arise, and provides tools for data validation and reconciliation. It is designed to help organizations with financial consolidation, reporting, and analysis. Regarding data integrity and validation, HFM incorporates several features and processes to ensure the accuracy and reliability of financial data.