- Introduction to NPV

- Importance of NPV in Investment Decisions

- NPV Formula and Explanation

- Cash Flow Estimation

- Discount Rate and Time Value of Money

- Positive vs Negative NPV

- NPV vs IRR Comparison

- Applications of NPV

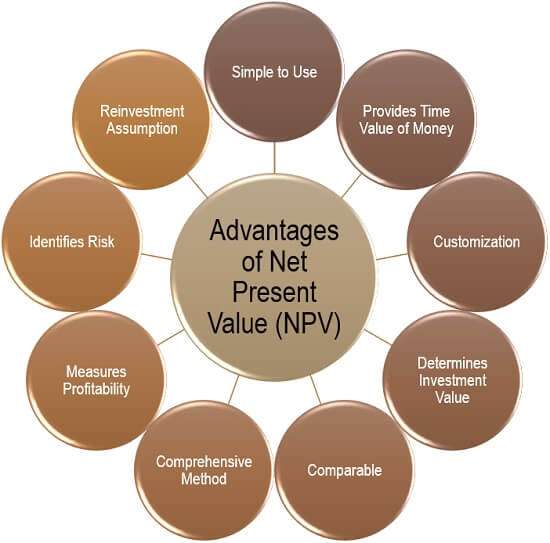

Introduction to NPV

Net Present Value (NPV) is a fundamental financial metric used to evaluate the profitability of an investment or project by comparing the present value of cash inflows with the present value of cash outflows. By discounting future cash flows to their present value using a specific discount rate, often the cost of capital NPV helps businesses determine whether an investment will add value over time. A positive NPV indicates that projected earnings exceed anticipated costs, making the investment potentially worthwhile, while a negative NPV suggests the opposite. Understanding NPV is crucial for making informed financial decisions, particularly in capital budgeting, mergers, and acquisitions. For those unfamiliar with complex financial formulas, using an NPV calculator simplifies the process, allowing users to input expected cash flows, discount rates, and time periods to instantly receive an accurate NPV result. This tool is especially helpful for entrepreneurs, investors, and financial analysts looking to assess risk and return efficiently. Whether you’re planning a new venture or analyzing the value of long-term projects, an NPV calculator offers clarity and precision, making it an indispensable resource in strategic financial planning.

Importance of NPV in Investment Decisions

- Measures True Profitability: NPV accounts for the time value of money, showing the actual value an investment will add after considering all costs and future earnings.

- Helps Compare Multiple Projects: It allows investors to evaluate and rank different investment options objectively, making it easier to choose the most beneficial project.

- Supports Long-Term Planning: NPV provides a long-term view of an investment’s impact, which is crucial for strategic decision-making and sustainable growth.

Net Present Value (NPV) plays a critical role in guiding investors and businesses toward sound financial decisions. By providing a clear picture of the expected profitability of an investment over time, NPV helps determine whether a project is financially viable. Understanding the importance of NPV in investment decisions ensures that capital is allocated efficiently and risk is minimized.

Here are six key reasons highlighting the importance of NPV in investment decisions:

- Identifies Value Creation: A positive NPV clearly indicates that an investment will generate value, helping businesses focus on opportunities that increase shareholder wealth.

- Incorporates Risk Through Discount Rate: By adjusting the discount rate, NPV can reflect the risk level of a project, providing a more realistic financial outlook.

- Enhances Financial Discipline: Using NPV in investment decisions encourages a data-driven, disciplined approach to spending and resource allocation.

NPV Formula and Explanation

The Net Present Value (NPV) formula is a key concept in capital budgeting and is widely used to evaluate the profitability of investments. It is expressed as: NPV = ∑ (Ct / (1 + r)^t) – C0, where Ct is the cash inflow at time t, r is the discount rate, and C0 is the initial investment. This formula calculates the present value of all expected future cash flows and subtracts the initial investment to determine the net gain or loss. The application of Net Present Value in Financial Management is essential because it provides a clear, quantifiable measure of an investment’s value over time. By discounting future cash flows, NPV accounts for the time value of money, ensuring that businesses do not overestimate future returns. A positive NPV indicates that the investment will generate more value than its cost, making it a financially sound decision. A negative NPV suggests that the investment would result in a net loss. Using Net Present Value in Financial Management allows decision-makers to compare multiple investment opportunities on an equal footing, assess risk through the discount rate, and make informed strategic choices that align with the company’s financial goals and long-term value creation.

Cash Flow Estimation

- Predicts Future Financial Health: Estimating cash flow helps predict whether a business will have enough cash to meet its short-term and long-term obligations, such as paying suppliers, employees, and debts.

- Helps Identify Funding Needs: By forecasting cash inflows and outflows, businesses can identify periods when they may need additional financing or credit to bridge gaps in cash availability.

- Supports Investment Decisions: Accurate cash flow estimation is essential when making investment decisions, as it provides insight into the potential return on investment and future financial stability.

- Improves Budgeting: Cash flow estimation is vital for effective budgeting, allowing businesses to plan for both expected and unexpected expenses and avoid cash shortages.

- Ensures Liquidity Management: It helps businesses manage their liquidity by highlighting when cash may be tight and when they need to take action to preserve cash reserves.

- Mitigates Risk: By estimating cash flows, businesses can anticipate potential financial challenges and implement strategies to mitigate risks, ensuring smoother operations and better financial outcomes.

Cash flow estimation is a critical aspect of financial planning and decision-making, as it provides a forecast of the money coming into and going out of a business. Accurate cash flow estimates help businesses assess liquidity, plan for future expenses, and make informed investment choices. By projecting future cash flows, companies can ensure they have enough resources to cover their obligations and achieve growth. Here are six key points about cash flow estimation:

Discount Rate and Time Value of Money

The discount rate and the time value of money are fundamental concepts in financial analysis, particularly when using the calculate NPV formula. The time value of money refers to the principle that a dollar today is worth more than a dollar in the future due to its potential earning capacity. This concept is crucial for assessing investments, as it acknowledges that cash inflows received in the future are less valuable than those received today. The discount rate, typically the required rate of return or cost of capital, is used to adjust future cash flows to their present value. In the calculate NPV formula, the discount rate plays a key role in determining how much future cash flows are worth today. A higher discount rate reflects greater risk or opportunity cost, reducing the present value of future cash flows, while a lower rate results in a higher present value. By using the discount rate, the NPV formula allows businesses to evaluate whether an investment will provide a return that exceeds the cost of capital, helping to make more informed and financially sound decisions. Understanding the discount rate and the time value of money ensures more accurate financial forecasting and risk management in investment projects.

Positive vs Negative NPV

Understanding the difference between positive and negative NPV is crucial for making sound investment decisions. A positive NPV indicates that the present value of expected cash inflows exceeds the initial investment and associated costs, signaling that the project will likely generate a net gain and create value for stakeholders. When an investment has a positive NPV, it suggests that the project is financially viable and is expected to yield returns above the required rate of return, making it an attractive option. On the other hand, a negative NPV means the present value of the expected future cash flows is less than the initial investment, indicating that the project will result in a net loss. A negative NPV suggests that the investment will not meet the required return and may reduce shareholder value, making it an undesirable option. In capital budgeting, a positive NPV is often used as a benchmark for project selection, while a negative NPV typically leads to rejecting the investment. Ultimately, the distinction between positive and negative NPV helps businesses prioritize projects that align with long-term financial goals and avoid investments that could harm their financial stability.

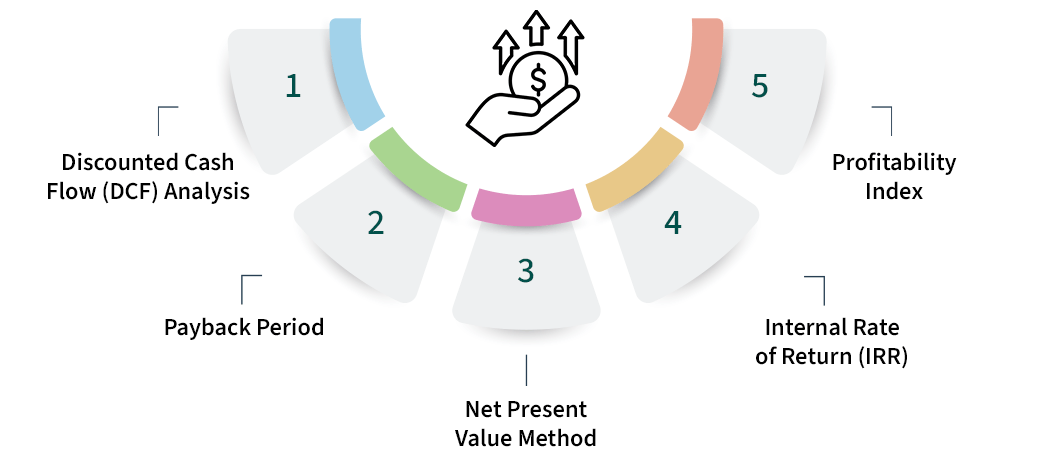

NPV vs IRR Comparison

When evaluating investment opportunities, both Net Present Value (NPV) and Internal Rate of Return (IRR) are commonly used financial metrics, but they offer different insights and have distinct advantages. NPV calculates the absolute value added by an investment by discounting future cash flows to their present value and subtracting the initial investment. It provides a clear dollar amount that represents how much value the project is expected to create, making it a reliable tool for decision-making. On the other hand, IRR is the discount rate at which the NPV of a project becomes zero, representing the project’s expected annualized rate of return. While IRR is useful for comparing the profitability of different projects, it can sometimes give misleading results, particularly in cases of non-conventional cash flows or multiple IRRs. NPV, however, offers a more straightforward and consistent approach, as it directly accounts for the scale of the investment and the required rate of return. In general, if the NPV is positive, the project is viable, whereas with IRR, a project is considered acceptable if the IRR exceeds the cost of capital. Both metrics complement each other, but NPV is often preferred for its precision in quantifying the actual value created.

Applications of NPV

Net Present Value (NPV) has a wide range of applications across various industries and financial decision-making processes. It is primarily used in capital budgeting to evaluate the profitability of long-term investments, such as purchasing equipment, launching new projects, or expanding operations. By calculating the present value of expected cash flows and subtracting the initial investment, NPV helps businesses determine whether a project will generate enough returns to justify its costs. In capital budgeting, NPV provides a clear financial picture that allows businesses to prioritize projects based on their expected value. Additionally, NPV is essential in mergers and acquisitions as it allows companies to assess the value of potential acquisitions or investments and compare them against their cost. It is also used in real estate development, where developers evaluate whether a property project will provide sufficient returns after considering development costs, financing, and operational expenses. Another key application of NPV is in project financing, where it helps in assessing the viability of funding large-scale projects such as infrastructure development or energy production. NPV also plays a significant role in investment portfolio management, where investors use it to assess the potential returns of different investment options. Ultimately, NPV provides a reliable method for making informed decisions that align with both short-term financial goals and long-term strategic objectives.