- Beginner & Advanced level Classes.

- Hands-On Learning in SAP Tax and Revenue Management.

- Best Practice for interview Preparation Techniques in SAP Tax and Revenue Management.

- Lifetime Access for Student’s Portal, Study Materials, Videos & Top MNC Interview Question.

- Affordable Fees with Best curriculum Designed by Industrial SAP Tax and Revenue Management Expert.

- Delivered by 9+ years of SAP Tax and Revenue Management Certified Expert | 12402+ Students Trained & 350+ Recruiting Clients.

- Next SAP Tax and Revenue Management Batch to Begin this week – Enroll Your Name Now!

Our Hiring Partners

Receive Our Inventive SAP Tax and Revenue Management Training in Bangalore

- Our training at Sap Tax and Revenue Management is designed to give high-quality training, including a practical approach that offers a sound basic understanding of important ideas.

- Sap Tax and Revenue Management training presents you an expert in application building through the leveraging of efficiency enhancement options, integration with cloud practices, capacity increase, financing, and price increases.

- This certification proves you are trained enough to perform jobs in real-time and also distinguishes you from the crowd.

- Sap Tax and Revenue Management provides adjustable and scalable value-enhancing services withSap Tax and Revenue Management Strategic Procuring Supply Management solutions, customized for client needs and corporate objectives.

- The course provides Sap Tax and Revenue Management the greatest and industrially targeted training to develop abilities to improve your career.

- Our professional trainers deliver teachers to obtain genuine experience more realistically.

- Concepts: Overview Tax Processing, Form-Based Processes, Registering Taxpayers, Managing Taxpayer Inquiries, Processing Tax Submissions, Amending Tax Submissions, Processing Refunds, Managing Correspondence, Managing Tax Work Items.

What You'll Learn From SAP Tax and Revenue Management Training

Gain a deep understanding of risk management principles and frameworks aligned with SAP Tax and Revenue standards.

Learn to identify, assess, and mitigate project risks effectively to ensure successful project outcomes.

Master advanced risk analysis tools and techniques to enhance your decision-making and strategic planning skills.

Develop hands-on experience in real-world risk management scenarios guided by certified SAP Tax and Revenue professionals.

Your IT Career Starts Here

550+ Students Placed Every Month!

Get inspired by their progress in the Career Growth Report.

- Non-IT to IT (Career Transition) 2371+

- Diploma Candidates3001+

- Non-Engineering Students (Arts & Science)3419+

- Engineering Students3571+

- CTC Greater than 5 LPA4542+

- Academic Percentage Less than 60%5583+

- Career Break / Gap Students2588+

Upcoming Batches For Classroom and Online

Who Should Take a SAP Tax and Revenue Management Training

IT Professionals

Non-IT Career Switchers

Fresh Graduates

Working Professionals

Diploma Holders

Professionals from Other Fields

Salary Hike

Graduates with Less Than 60%

Job Roles For SAP Tax and Revenue Management Training

SAP Tax Consultant

Tax Management Specialist

Data Governance Engineer

SAP Tax Manager

Systems Performance Engineer

Tax Specialist

Business Process Consultant

SAP Revenue Architect

What’s included ?

📊 Free Aptitude and Technical Skills Training

- Learn basic maths and logical thinking to solve problems easily.

- Understand simple coding and technical concepts step by step.

- Get ready for exams and interviews with regular practice.

🛠️ Hands-On Projects

- Work on real-time projects to apply what you learn.

- Build mini apps and tools daily to enhance your coding skills.

- Gain practical experience just like in real jobs.

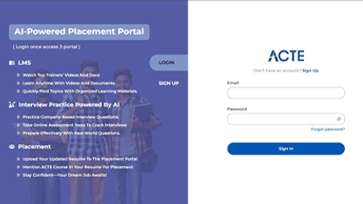

🧠 AI Powered Self Interview Practice Portal

- Practice interview questions with instant AI feedback.

- Improve your answers by speaking and reviewing them.

- Build confidence with real-time mock interview sessions.

🎯 Interview Preparation For Freshers

- Practice company-based interview questions.

- Take online assessment tests to crack interviews

- Practice confidently with real-world interview and project-based questions.

🧪 LMS Online Learning Platform

- Explore expert trainer videos and documents to boost your learning.

- Study anytime with on-demand videos and detailed documents.

- Quickly find topics with organized learning materials.

Curriculum

Syllabus of Sap Tax and Revenue Management Training in Bangalore

Module 1: Introduction- Overview Tax Processing

- Form-Based Processes

- Registering Taxpayers

- Managing Taxpayer Inquiries

- Processing Tax Submissions

- Amending Tax Submissions

- Processing Refunds

- Managing Correspondence

- Managing Tax Work Items

- Processing Tax Objects

- Processing Property Tax

- Invoicing Taxes and Revenues

- Providing Taxpayer Online Services

- Business Intelligence

Course Objectives

What are the main techniques used in Sap Tax and Revenue Management Training in Bangalore?

- Perishable products.

- High mounted prices and low variable prices.

- The result will be priced otherwise.

- Search evolves.

- The stock will be sold earlier.

- The business will be segmental.

What tools are used in the Sap Tax and Revenue Management Course?

- Quality management system (PMS).

- Booking engine.

- Business intelligence tools.

- Business knowledge.

How are the advantages of SAP revenue management and tax training in Bangalore?

- A consummate read.

- Expanded voluntary payer agreement.

- Reduced outstanding assets.

- One logical master-data framework.

- More precise inquiry response time.

- Fixed center contact rates.

- Increased energy.

- More immediate exposure.

- And efficient use of sources.

Is there anything special about Sap Tax and Revenue Management Certification Training?

- Taxpayer administration.

- Enterprise rule framework tool.

- Data recovery and restoration process.

- Tax accounting and distribution.

- Communication management.

- Solicit delinquent assets provide insight.

How does the Sap Tax and Revenue Management Course aim to achieve?

-

The basic goal of revenue management is mercantilism: getting the right items to the right customer at the right time for the right price and in the right package.

Are there any suggestions for Sap Tax and Revenue Management Training in Bangalore?

- Consumer segmentation.

- Interest statement.

- Yield management.

- Effective evaluation.

What types of employment will I be able to pursue after completing the Sap Tax and Revenue Management Certification Training?

- Accounting Supervisor.

- Accounting Director.

- Cost Accounting Administrator.

- Revenue Examiner.

- Project Accounting Manager.

- Revenue bourgeois.

What is a Sap Tax and Revenue Management's compensation?

-

The ideal Business Analyst's sample includes from $350,000 to $500,000, depending on years of experience. The more reasonable end is the pay at entry-level only has a year of job experience, and the more expensive end is the remuneration for those with 1-4 years of experience.

Why skills do you need to take the Sap Tax and Revenue Management Certification Course?

-

Revenue management is the equivalent of market analysis in the alternative industry. As a result, solid analytical skills are an essential necessity. One must be able to evaluate and compare specific dates, sight trends, and variations, and also grasp and understand exceptional information models.

What else does SAP have to say about tax and revenue management?

-

SAP Tax & Revenue Management is employed comprehensively to increase collections and maximize payer agreement. The answer supports leaders deliver handling and revenue management resolutions, with one payer learned that supports increased revenue sorts

Is Sap Tax and Revenue Management a trustworthy company to work for?

-

Income accounting can be a challenging and difficult job for those with the right abilities. Revenue analysts, like all calculators, should be practical when it comes to strategy. Advanced science skills, such as high-level calculus, need not appear to be required in many areas of the company.

So what was the salary of a SAP Tax and Revenue Management Consultant?

-

The national normal wage for an SAP Tax and Revenue Management is $104054 per year in the USA.

Overview of SAP Tax and Revenue Management Training in Bangalore

ACTE Provides Best SAP Tax and Revenue Management Training in Bangalore. The SAP Tax and Revenue Management bundle for the general public area will make it less difficult for organization sales managers to offer powerful sales series and control services. The software program machine will make it less difficult for public area groups to grow expenses and maximize compliance at the same time as enhancing provider and payroll satisfaction.

The Training publications provide a stop-to-stop technique guide for the victimization of the middle methods of SAP Tax and Revenue Management in addition to the middle methods of the Group Stock Manager, the Market Risk Instrument, and the Credit Risk Instrument Luxury bendy time table classes are supplied through the routing module SAP Tax and Revenue Management from ACTE Training anybody or all individuals splendid freedom in Bangalore.

Get Hands-on Knowledge about SAP Tax and Revenue Management Projects

Project 1

SAP Tax and Revenue Management for Public Sector

Revenue management includes all the systems required to assure that the income of government departments is well designed and fully accounted for.

Project 2

Enabling the implementation of behavioral approaches

The primary goal of the behavioral approach is to describe how managers connect these two sets of behaviors to influence followers in their attempts to give a goal.

Project 3

Disclosures on Tax and Payments to Government

The main purpose of taxation is to boost revenue to fund government expenditure. SAP-based software Tax and Revenue Management System.

Project 4

Status-based taxation Project

This project examines whether concerns for social status can be used as a “carrot” to promote tax compliance and increase tax.

Our Top Hiring Partner for Placements

ACTE Bangalore offers placement opportunities as add-on to every student / professional who completed our classroom or online training. Some of our students are working in these companies listed below.

- We are associated with top organizations like HCL, Wipro, Dell, Accenture, Google, CTS, TCS, IBM etc. It make us capable to place our students in top MNCs across the globe

- We have separate student’s portals for placement, here you will get all the interview schedules and we notify you through Emails.

- After completion of 70% SAP Tax and Revenue Management training course content, we will arrange the interview calls to students & prepare them to F2F interaction

- SAP Tax and Revenue Management Trainers assist students in developing their resume matching the current industry needs

- We have a dedicated Placement support team wing that assist students in securing placement according to their requirements

- We will schedule Mock Exams and Mock Interviews to find out the GAP in Candidate Knowledge

Get Certified By Oracle & Industry Recognized ACTE Certificate

Acte Certification is Accredited by all major Global Companies around the world. We provide after completion of the theoretical and practical sessions to fresher's as well as corporate trainees.

Our certification at Acte is accredited worldwide. It increases the value of your resume and you can attain leading job posts with the help of this certification in leading MNC's of the world. The certification is only provided after successful completion of our training and practical based projects.

Complete Your Course

a downloadable Certificate in PDF format, immediately available to you when you complete your Course

Get Certified

a physical version of your officially branded and security-marked Certificate.

About Experienced SAP Tax and Revenue Management Trainer

- Our SAP Tax and Revenue Management Training in Bangalore. Trainers are certified professionals with 7+ years of experience in their respective domain as well as they are currently working with Top MNCs.

- As all Trainers are SAP Tax and Revenue Management domain working professionals so they are having many live projects, trainers will use these projects during training sessions.

- All our Trainers are working with companies such as Cognizant, Dell, Infosys, IBM, L&T InfoTech, TCS, HCL Technologies, etc.

- Trainers are also help candidates to get placed in their respective company by Employee Referral / Internal Hiring process.

- Our trainers are industry-experts and subject specialists who have mastered on running applications providing Best SAP Tax and Revenue Management training to the students.

- We have received various prestigious awards for SAP Tax and Revenue Management Training in Bangalore from recognized IT organizations.

Authorized Partners

ACTE TRAINING INSTITUTE PVT LTD is the unique Authorised Oracle Partner, Authorised Microsoft Partner, Authorised Pearson Vue Exam Center, Authorised PSI Exam Center, Authorised Partner Of AWS .

Career Support

Placement Assistance

Exclusive access to ACTE Job portal

Mock Interview Preparation

1 on 1 Career Mentoring Sessions

Career Oriented Sessions

Resume & LinkedIn Profile Building

We Offer High-Quality Training at The Lowest Prices.

Affordable, Quality Training for Freshers to Launch IT Careers & Land Top Placements.

What Makes ACTE Training Different?

Feature

ACTE Technologies

Other Institutes

Affordable Fees

Competitive Pricing With Flexible Payment Options.

Higher Fees With Limited Payment Options.

Industry Experts

Well Experienced Trainer From a Relevant Field With Practical Training

Theoretical Class With Limited Practical

Updated Syllabus

Updated and Industry-relevant Course Curriculum With Hands-on Learning.

Outdated Curriculum With Limited Practical Training.

Hands-on projects

Real-world Projects With Live Case Studies and Collaboration With Companies.

Basic Projects With Limited Real-world Application.

Certification

Industry-recognized Certifications With Global Validity.

Basic Certifications With Limited Recognition.

Placement Support

Strong Placement Support With Tie-ups With Top Companies and Mock Interviews.

Basic Placement Support

Industry Partnerships

Strong Ties With Top Tech Companies for Internships and Placements

No Partnerships, Limited Opportunities

Batch Size

Small Batch Sizes for Personalized Attention.

Large Batch Sizes With Limited Individual Focus.

LMS Features

Lifetime Access Course video Materials in LMS, Online Interview Practice, upload resumes in Placement Portal.

No LMS Features or Perks.

Training Support

Dedicated Mentors, 24/7 Doubt Resolution, and Personalized Guidance.

Limited Mentor Support and No After-hours Assistance.

SAP Tax and Revenue Management Course FAQs

Looking for better Discount Price?

Does ACTE provide placement?

- ACTE is the Legend in offering placement to the students. Please visit our Placed Students List on our website

- We have strong relationship with over 700+ Top MNCs like SAP, Oracle, Amazon, HCL, Wipro, Dell, Accenture, Google, CTS, TCS, IBM etc.

- More than 3500+ students placed in last year in India & Globally

- ACTE conducts development sessions including mock interviews, presentation skills to prepare students to face a challenging interview situation with ease.

- 85% percent placement record

- Our Placement Cell support you till you get placed in better MNC

- Please Visit Your Student Portal | Here FREE lifetime Online Student Portal help you to access the Job Openings, Study Materials, Videos, Recorded Section & Top MNC interview Questions

Is ACTE certification good?

-

ACTE Gives Certificate For Completing A Course

- Certification is Accredited by all major Global Companies

- ACTE is the unique Authorized Oracle Partner, Authorized Microsoft Partner, Authorized Pearson Vue Exam Center, Authorized PSI Exam Center, Authorized Partner Of AWS

Work On Live Projects?

- The entire SAP Tax and Revenue Management training has been built around Real Time Implementation

- You Get Hands-on Experience with Industry Projects, Hackathons & lab sessions which will help you to Build your Project Portfolio

- GitHub repository and Showcase to Recruiters in Interviews & Get Placed

Who are the Trainers?

What if I miss one (or) more class?

What are the modes of training offered for this SAP Tax and Revenue Management Course?

Why Should I Learn SAP Tax and Revenue Management Course At ACTE?

- SAP Tax and Revenue Management Course in ACTE is designed & conducted by SAP Tax and Revenue Management experts with 10+ years of experience in the SAP Tax and Revenue Management domain

- Only institution in India with the right blend of theory & practical sessions

- In-depth Course coverage for 60+ Hours

- More than 50,000+ students trust ACTE

- Affordable fees keeping students and IT working professionals in mind

- Course timings designed to suit working professionals and students

- Interview tips and training

- Resume building support

- Real-time projects and case studies

Can I Access the Course Material in Online?

What certification will I receive after course completion?

How Old Is ACTE?

What Will Be The Size Of A SAP Tax and Revenue Management Batch At ACTE?

Will I Be Given Sufficient Practical Training In SAP Tax and Revenue Management?

How Do I Enroll For The SAP Tax and Revenue Management Course At ACTE?

Job Opportunities in SAP

More Than 35% of Professionals Prefer SAP. SAP is One of the Most Popular and in-demand Technologies in the Tech World.

Salary in SAP

- SAP Consultant ₹2.5 LPA to ₹4 LPA

- SAP Basis Administrator ₹3 LPA to ₹4.5 LPA

- SAP Developer ₹4 LPA to ₹5.5 LPA

- SAP Functional Analyst ₹4.5 LPA to ₹6 LPA

- SAP FICO Consultant ₹5.5 LPA to ₹7 LPA

- SAP Project Manager ₹6.5 LPA to ₹8 LPA

- SAP HANA Consultant ₹7.5 LPA to ₹9 LPA