- Introduction to Capital Structure

- Importance of Capital Structure

- Leverage

- Cost of Capital

- Risk Factors

- Cash Flow Position

- Control Considerations

- Market Conditions

Introduction to Capital Structure

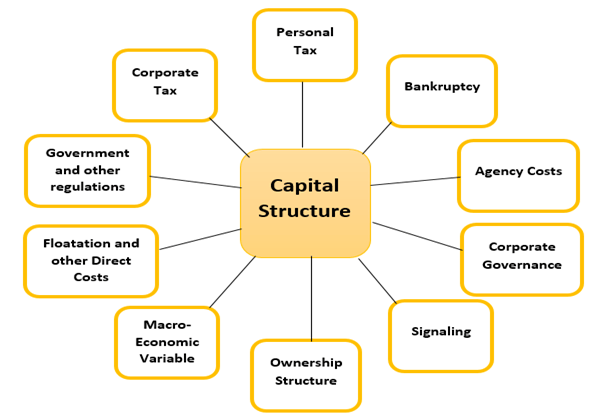

Capital structure refers to the way a company finances its overall operations and growth by using different sources of funds, primarily debt and equity. It represents the proportion of debt, equity, and sometimes hybrid securities that a firm uses to fund its assets, operations, and future investments. A well-balanced capital structure is crucial as it influences a company’s risk profile, cost of capital, financial flexibility, and overall value. Equity financing involves issuing shares to raise money, while debt financing involves borrowing funds through instruments like loans or bonds, which require regular interest payments. The optimal capital structure strikes a balance between the benefits and costs of debt and equity to maximize shareholder value. Too much debt increases financial risk and interest obligations, whereas excessive reliance on equity may dilute ownership and reduce earnings per share. Companies often consider factors such as market conditions, interest rates, tax implications, and business risk when deciding their capital mix. An effective capital structure aligns with the company’s strategic goals, risk tolerance, and industry standards. Understanding capital structure is essential for financial managers, investors, and stakeholders, as it directly affects financial performance, investment decisions, and long-term sustainability.

Importance of Capital Structure

- Optimizes Cost of Capital: A balanced capital structure helps minimize the overall cost of capital by leveraging the right mix of debt and equity.

- Enhances Financial Flexibility: Proper capital structuring allows companies to respond effectively to changes in market conditions, funding needs, and investment opportunities.

- Improves Risk Management: By managing the proportion of debt and equity, businesses can better control financial risk and avoid over-leveraging.

Capital structure plays a critical role in determining a company’s financial health, risk level, and long-term profitability. It directly influences how a business funds its operations, manages risks, and maximizes shareholder value. In financial management, choosing the right capital structure is essential for achieving the organization’s strategic goals and ensuring financial stability. Below are six key reasons why capital structure is important:

- Maximizes Shareholder Value: An efficient capital structure contributes to higher earnings per share and improved return on equity, benefiting shareholders.

- Influences on Company Valuation: Investors and analysts often assess a company’s capital structure to determine its financial strength and market value.

- Supports Strategic Decision-Making: In financial management, capital structure is a key tool for planning expansions, mergers, or investments, aligning financial decisions with long-term objectives.

Leverage

Leverage refers to the use of borrowed funds to increase the potential return on investment, allowing businesses to amplify their gains or losses by using debt to finance operations, acquisitions, or expansions. It plays a significant role in corporate finance by enabling companies to undertake projects without having to raise large amounts of equity. Leverage is commonly measured using financial ratios such as the debt-to-equity ratio or debt ratio, which help assess a firm’s financial risk and borrowing capacity. The concept of leveraged finance is particularly relevant in scenarios like buyouts, restructurings, and high-growth ventures, where companies use significant debt to achieve strategic objectives. While leverage can enhance profitability when returns on investments exceed the cost of debt, it also increases the financial risk if revenues fall short or market conditions deteriorate. Effective leveraged finance requires careful planning, risk assessment, and interest coverage management to avoid default or bankruptcy. In modern leveraged finance, institutions often provide structured loans or high-yield bonds tailored to the risk-return profile of the borrower, supporting both corporate expansion and investor gains. Ultimately, leverage can be a powerful financial tool when used wisely, aligning capital structure with growth ambitions and shareholder value creation.

Cost of Capital

- Guides Investment Decisions: The Cost of Capital acts as a benchmark for evaluating investment opportunities, helping companies accept projects that generate returns above this threshold.

- Supports Capital Budgeting: It is used to discount future cash flows of potential projects, playing a vital role in determining their feasibility and profitability.

- Aids in Firm Valuation: By using the Cost of Capital in valuation models, businesses and investors can estimate the present value of expected cash flows and the overall worth of the firm.

- Improves Financial Planning: Understanding the cost of various funding sources enables better financial planning and resource allocation.

- Helps in Optimizing Capital Structure: Companies strive to minimize their Cost of Capital by balancing debt and equity to enhance value.

- Indicates Risk Level: A higher Cost of Capital usually signals greater risk, impacting investor confidence and financing decisions.

The Cost of Capital is the required return a company must earn on its investments to satisfy its investors and maintain its market value. It reflects the cost of securing funds through debt, equity, or a combination of both. A proper understanding of the Cost of Capital is essential in financial management, as it influences critical decisions such as project selection, capital budgeting, and strategic planning. Here are six key points highlighting its importance:

Risk Factors

Risk factors refer to various elements or conditions that can negatively impact a business’s financial performance, operations, or overall success. These risks can arise from both internal and external sources and are critical for businesses to identify, assess, and manage effectively. Common risk factors include market risk, which involves changes in economic conditions, interest rates, or currency fluctuations; credit risk, which arises from a borrower’s failure to repay loans; operational risk, stemming from internal failures like system breakdowns or human error; and legal or regulatory risk, which can result from non-compliance with laws or changes in government policies. Strategic risks also emerge when business plans fail to achieve expected results due to competitive pressures or poor decision-making. Natural disasters, geopolitical tensions, and cyber threats are additional external risks that can disrupt operations. Effective risk management involves identifying these factors early, evaluating their potential impact, and implementing strategies to mitigate them. Investors, lenders, and other stakeholders closely examine risk factors before making financial decisions, as they directly affect a company’s stability and future returns. Understanding and managing risk factors is essential for long-term sustainability, helping businesses prepare for uncertainty and remain competitive in a dynamic environment.

Cash Flow Position

Cash flow position refers to the net amount of cash and cash equivalents moving into and out of a business over a specific period. It reflects the company’s ability to generate sufficient cash to meet its short-term obligations, fund operations, and support growth. A strong cash flow position indicates that a business is financially healthy, capable of paying bills, investing in new opportunities, and withstanding economic downturns. On the other hand, a weak or negative cash flow position can signal financial trouble, even if the company appears profitable on paper. This is because profits do not always equate to available cash, especially if revenue is tied up in accounts receivable or inventory. Cash flow is typically categorized into three types: operating cash flow, which comes from core business activities; investing cash flow, related to asset purchases or sales; and financing cash flow, involving debt and equity transactions. Monitoring the cash flow position helps management make informed decisions, maintain liquidity, and avoid insolvency. Investors and lenders also rely heavily on a company’s cash flow statements to assess its financial strength and creditworthiness. Overall, maintaining a positive cash flow position is essential for the long-term sustainability and success of any business.

Control Considerations

Control considerations refer to the various factors and mechanisms that organizations implement to ensure effective oversight, accountability, and alignment with strategic goals. These considerations are vital for maintaining operational efficiency, minimizing risks, and safeguarding assets. In financial management, control considerations involve setting internal policies, establishing approval hierarchies, monitoring financial transactions, and enforcing compliance with regulatory requirements. They help prevent fraud, errors, and mismanagement by ensuring that duties are clearly separated, financial reports are accurate, and all activities are properly authorized. Effective control systems also support performance evaluation by providing timely and reliable data for decision-making. From a governance perspective, control considerations extend to board oversight, audit practices, and internal reviews that promote transparency and ethical conduct. For businesses with multiple stakeholders, including investors and creditors, strong control measures enhance trust and credibility. Furthermore, control considerations play a crucial role in strategic planning, helping ensure that objectives are met within defined risk parameters and that resources are used efficiently. Whether it’s through automated systems, policy enforcement, or regular audits, maintaining strong control processes is essential for sustainable growth and operational resilience. Ultimately, robust control considerations contribute to a well-managed, compliant, and trustworthy organization capable of achieving long-term success.

Market Conditions

Market conditions refer to the current state of the economy and financial markets that influence business operations, investment decisions, and consumer behavior. These conditions encompass a wide range of factors, including interest rates, inflation, employment levels, consumer confidence, exchange rates, and the performance of stock and bond markets. Favorable market conditions such as low interest rates, strong economic growth, and high consumer spending create opportunities for businesses to expand, invest, and increase profitability. In contrast, unfavorable conditions like economic downturns, rising inflation, or financial instability can limit access to capital, reduce consumer demand, and increase operational risks. Market conditions also affect investor sentiment and the availability of funding, making them a critical factor in financial planning and capital structure decisions. Businesses closely monitor market trends to adapt their strategies, manage risks, and seize opportunities at the right time. For example, companies might delay large investments during volatile periods or accelerate growth initiatives when markets are stable. Global events, political developments, and technological changes can also rapidly shift market conditions, requiring agility and informed decision-making. Understanding and responding to current market conditions is essential for maintaining competitiveness, optimizing financial performance, and ensuring long-term business sustainability in an ever-changing economic environment.