- Introduction to Capital Structure

- Importance of Business Stability

- Components of Capital Structure

- Equity vs Debt Financing

- Factors Influencing Capital Structure

- Capital Structure Theories

- Optimal Capital Structure Concept

- Financial Leverage and Risk

Introduction to Capital Structure

Capital structure refers to the way a company finances its overall operations and growth by using different sources of funds, primarily a mix of debt and equity. It plays a crucial role in determining a firm’s financial health, risk profile, and long-term sustainability. A well-planned capital structure balances the cost of capital with the benefits of financial leverage, aiming to maximize shareholder value while minimizing the cost of capital. Equity typically includes common and preferred stock, representing ownership in the company, while debt encompasses loans, bonds, and other forms of borrowings that must be repaid over time. The proportion of debt to equity is often analyzed using financial ratios such as the debt-to-equity ratio, which helps assess the risk level and financial stability of a business. Companies with high debt levels may benefit from tax shields on interest payments but also face higher financial risk, especially in times of economic uncertainty. Conversely, relying more on equity can reduce financial risk but might dilute ownership and earnings per share. Ultimately, the optimal capital structure varies across industries and individual firms, depending on factors like business risk, market conditions, growth prospects, and management philosophy. Strategic capital structure decisions are essential for achieving financial efficiency and competitive advantage.

Importance of Business Stability

- Investor Confidence: Stable businesses attract and retain investors by offering lower risk and consistent returns.

- Employee Retention: A stable work environment enhances job security and satisfaction, leading to greater employee loyalty and lower turnover.

- Customer Trust: Consistency in product or service quality strengthens customer relationships and brand loyalty.

Business stability is essential for ensuring long-term success, resilience, and sustainable growth. A stable company can better navigate economic challenges, gain trust from stakeholders, and make strategic decisions with confidence. It builds a solid foundation that supports consistent performance and future expansion.

- Financial Health: Business stability supports effective cash flow management, timely debt repayment, and smarter investment decisions.

- Growth Opportunities: Stable companies are better positioned to explore new markets, invest in innovation, and pursue strategic partnerships.

- Risk Management: A stable business is more prepared to handle unexpected challenges, economic fluctuations, or operational disruptions effectively.

Components of Capital Structure

Capital structure refers to the combination of different sources of capital used by a company to finance its operations and growth. The main components of capital structure include equity capital, debt capital, and hybrid instruments. Equity capital consists of common and preferred shares, representing ownership in the company and carrying voting rights and dividends. Debt capital includes short-term and long-term borrowings such as loans, bonds, and debentures, which involve fixed interest payments and must be repaid over time. Hybrid instruments, like convertible debentures or preference shares, combine features of both equity and debt, offering flexibility in financing. An emerging and increasingly important component is funding through venture capital, particularly relevant for startups and high-growth companies. The venture capital fund structure provides equity financing in exchange for ownership stakes, often accompanied by strategic support and governance involvement. In this context, understanding the venture capital fund structure becomes essential for entrepreneurs seeking scalable funding while balancing control. Additionally, a company’s capital structure can be influenced by factors such as cost of capital, risk tolerance, market conditions, and growth objectives. For early-stage firms, aligning with a suitable venture capital fund structure can be a critical factor in building a strong financial foundation and achieving long-term success.

Equity vs Debt Financing

- Ownership and Control: Equity financing involves giving up a portion of ownership, which can dilute control, especially under a venture capital structure. Debt financing allows founders to retain full ownership, as lenders do not gain equity.

- Repayment Obligations: Debt must be repaid with interest within a specific time frame. Equity does not require repayment, as investors earn returns through dividends or capital gains.

- Cost of Capital: While debt may offer tax-deductible interest, it can strain cash flow. Equity, especially under a venture capital structure, may seem costlier in the long term due to ownership dilution.

- Risk Level: Debt increases financial risk, especially during downturns. Equity spreads risk among shareholders, which is why the venture capital structure is preferred for high-risk ventures.

- Investor Involvement: Equity investors, particularly in a venture capital structure, often seek decision-making influence. Debt lenders typically have no say in operations unless there’s a default.

- Use Case: Debt is often ideal for short-term needs or asset purchases. Equity, including venture capital structure, is better suited for funding innovation, expansion, and long-term growth.

- Net Income Theory: Suggests that increasing debt in the capital structure can lower the overall cost of capital and increase the value of the firm due to the tax advantages of debt.

- Net Operating Income Theory: Opposes the NI theory and argues that capital structure does not affect a firm’s value or cost of capital; it is irrelevant in determining the market value of the company.

- Traditional Theory: Proposes an optimal capital structure where the weighted average cost of capital (WACC) is minimized and firm value is maximized through a balanced mix of debt and equity.

- Modigliani and Miller Theory (No Taxes): Claims that under perfect market conditions with no taxes, capital structure is irrelevant to firm value.

- Modigliani and Miller Theory (With Taxes): Revises the original theory, acknowledging the tax benefits of debt, thus favoring a capital structure with more debt to enhance value.

- Pecking Order Theory: States that firms prefer internal financing first, then debt, and issue equity as a last resort, based on the cost and signaling effects of each option within capital structure theories in financial management.

Equity and debt financing are two primary methods businesses use to raise capital, each with its advantages, risks, and implications. Choosing between the two depends on a company’s financial goals, risk tolerance, and long-term strategy. Understanding how these financing types align with models like the venture capital structure is especially important for startups and growing businesses seeking external funding.

Factors Influencing Capital Structure

Capital structure is a critical aspect of a company’s financial strategy, and several factors influence how a business decides on the right mix of debt and equity. One key factor is the cost of capital; companies aim to minimize this cost while maximizing returns. Business risk also plays a major role; firms with stable cash flows may take on more debt, while those with unpredictable earnings prefer equity to avoid the burden of fixed payments. Tax considerations impact decisions as well, since interest on debt is tax-deductible, making debt a more attractive option for some companies. In the context of Capital Structure in Financial Management, a firm’s flexibility and ability to adapt to future financial needs are crucial. Market conditions, such as interest rates and investor sentiment, can affect access to and pricing of both equity and debt. Additionally, the company’s stage of growth, asset structure, and industry practices can shape its capital decisions. For instance, startups may lean toward equity or venture capital, while established firms can sustain higher debt. Capital Structure in Financial Management must also account for control concerns, as issuing new equity can dilute ownership. Overall, a well-balanced Capital Structure in Financial Management ensures financial stability, strategic agility, and long-term value creation.

Capital Structure Theories

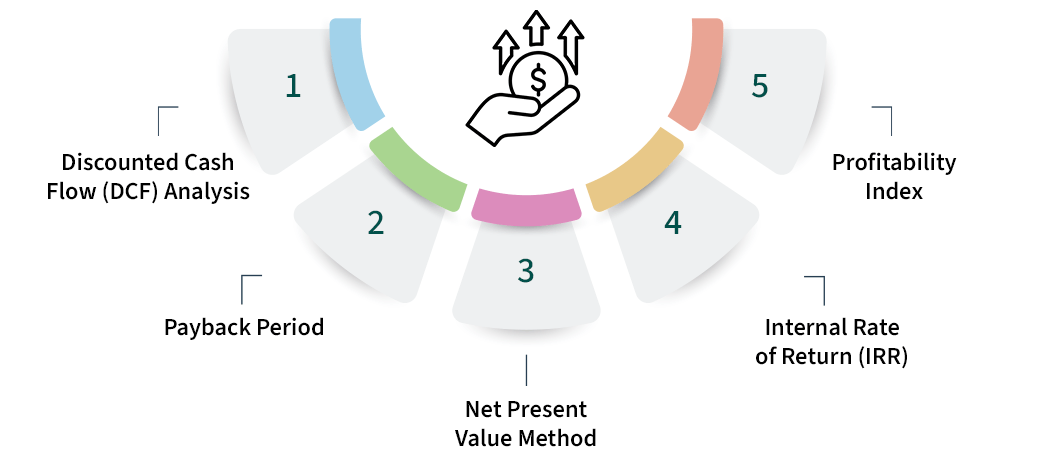

Capital structure theories provide a framework to understand how companies decide on the optimal mix of debt and equity financing. These theories help explain the impact of capital structure decisions on a firm’s value, cost of capital, and risk. Understanding capital structure theories in financial management is essential for making informed financing decisions that align with a company’s strategic goals and market environment.

Here are six major theories under capital structure theories in financial management:

These capital structure theories in financial management help businesses analyze and adopt the most beneficial financing approach under various economic and operational scenarios.

Optimal Capital Structure Concept

The concept of optimal capital structure refers to the ideal mix of debt and equity financing that minimizes a company’s overall cost of capital while maximizing its market value. Achieving this balance is crucial, as too much debt can increase financial risk, while too much equity may dilute ownership and reduce returns. Companies must consider factors such as tax benefits, financial flexibility, risk tolerance, and market conditions when determining their optimal capital structure. For startups and high-growth businesses, the role of VC fund structure becomes especially relevant, as it typically involves equity financing in exchange for ownership and strategic involvement. The VC fund structure is designed to provide capital while allowing room for future fundraising rounds, often influencing how much debt a company can or should take on later. In some cases, firms may deliberately maintain lower debt levels to stay attractive to venture capitalists and align with the typical VC fund structure, which favors scalability and agility over heavy financial obligations. Ultimately, the optimal capital structure is not static it evolves with the company’s lifecycle, market dynamics, and strategic objectives. A well-managed capital structure enhances shareholder value, ensures long-term stability, and positions the business for sustainable growth.

Financial Leverage and Risk

Financial leverage refers to the use of debt to amplify potential returns on investment. By borrowing funds, a company can increase its capacity to invest in new projects, expand operations, or acquire assets without needing to raise equity. While financial leverage can enhance profitability during periods of growth, it also introduces risk. The primary risk of financial leverage is that it magnifies both potential gains and losses. If a company’s investments do not generate sufficient returns to cover its debt obligations, it may face financial distress or even bankruptcy. The use of leverage increases the firm’s fixed costs, such as interest payments, making it more vulnerable to economic downturns or fluctuations in cash flow. High leverage also raises the company’s risk profile, which can affect its credit rating and increase borrowing costs. Investors often assess the level of financial leverage through ratios like the debt-to-equity ratio, which helps determine how much of a company’s capital is financed by debt versus equity. While financial leverage can be a powerful tool for growth, it requires careful management to ensure that the potential benefits outweigh the associated risks, especially in volatile markets or during periods of economic uncertainty.