- Introduction

- Definition and Purpose

- Types of Variances

- Material Variance

- Labor Variance

- Overhead Variance

- Sales and Profit Variance

- Favorable vs Unfavorable Variance

- Calculating Variances

- Reasons for Variances

- Importance in Decision-Making

- Conclusion

Introduction

Management Accounting Variances analysis is a critical tool used in business and financial management to assess performance by comparing actual results against planned or budgeted outcomes. To support entrepreneurial vision with strategic analysis and data-driven planning, explore Business Analyst Training a program designed to equip professionals with market research tools, business modeling frameworks, and decision-making skills essential for launching and scaling successful ventures. By identifying variances, businesses can gain insights into their operations and financial efficiency and identify areas that require corrective actions or improvements. Understanding the various types of variances, such as material, labor, overhead, sales, and profit variances, is vital for managers to make informed decisions and ensure better financial control in Management Accounting Variances.

Definition and Purpose

Variance refers to the difference between the budgeted or planned figures and the actual figures realized. The primary purpose of variance analysis is to pinpoint deviations and help managers understand the reasons behind these differences. It serves as a performance measurement tool and enables businesses to track whether they are adhering to their financial goals and operating efficiently. In essence, variance analysis can provide valuable insights into different aspects of a business, enabling better resource allocation, cost control, and enhanced operational efficiency. By identifying unfavorable variances early, managers can take corrective actions promptly.

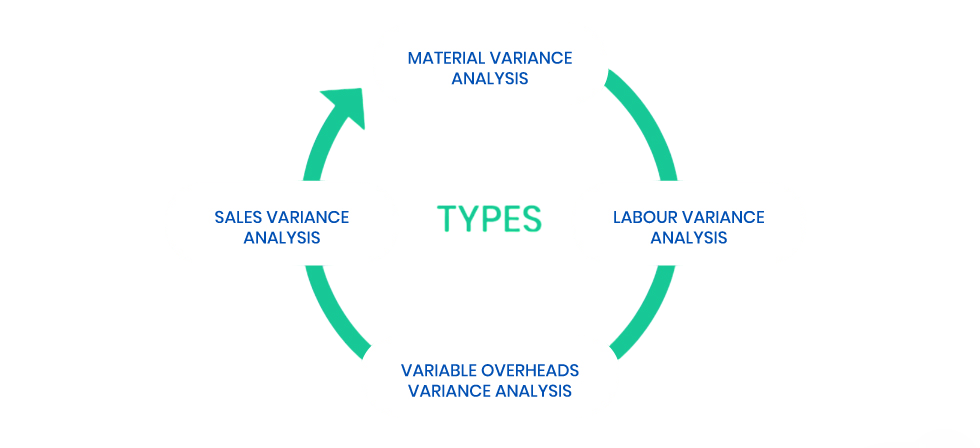

Types of Variances

There are several types of variances used to analyze different cost elements and revenue aspects. The most common types include

- Material Variance

- Labor Variance

- Overhead Variance

- Sales and Profit Variance

Each type is designed to monitor a specific aspect of business operations, helping companies to stay on track with their budgeting and forecasting objectives.

To Earn Your Business Analyst Certification, Gain Insights From Leading Data Science Experts And Advance Your Career With ACTE’s Business Analyst Training Today!

Material Variance

Material variance occurs when there is a difference between the actual cost of materials used in production and the budgeted cost. It can further be broken down into

- Material Price Variance: The difference between the expected cost per unit of material and the actual cost per unit.

- Material Usage Variance: The difference between the expected quantity of materials used and the actual quantity used.

A favorable material variance means that the actual costs were less than the budgeted costs, while an unfavorable variance indicates that the costs exceeded expectations. Example: If a company planned to spend $5 per unit on raw materials but spent $4.80 per unit, a favorable material price variance would be recorded. Similarly, if the company used fewer units than planned, it would show a favorable material usage variance.

Labor Variance

The variance in labor measures the difference between the budgeted labor costs and the actual labor costs for a specific output level. The two main parts of this variance are. Labor Rate Variance. This shows the difference between the actual wage rate paid and the expected wage rate. The variance is favorable if employees are paid less than expected; it is unfavorable if they are paid more. Labor Efficiency Variance. This reflects the difference between the actual hours worked and the standard hours expected for the level of production. The variance is unfavorable if workers spend more hours than expected to produce the same output; if they spend fewer hours, the variance is favorable. For example, the labor rate variance would be $2 favorable per hour if the expected labor rate were $20 per hour, but the company paid $18 per hour. However, an unfavorable labor efficiency variance would occur if employees worked longer hours than planned to achieve the same amount of work. By examining labor variances, businesses can keep track of wage expenses and labor productivity, leading to better cost management and operational planning.

Overhead Variance

The difference between budgeted or applied overhead expenses and actual overhead costs is called overhead variation. It provides helpful insights into how well a firm manages its indirect costs. This variance is typically split into fixed and variable overhead variances. To strengthen these components with analytical precision and strategic insight, explore Business Analyst Training a program designed to equip professionals with data interpretation skills, market research frameworks, and business modeling tools essential for crafting investor-ready plans and scalable ventures. On the other hand, fixed overhead variance, often affected by long-term contracts or changes in capacity usage, highlights the differences between budgeted and actual fixed costs like rent, depreciation, or administrative salaries. For example, a project would show a $200 negative variance if its budgeted variable overhead was $1,000 but the actual cost was $1,200. Understanding these gaps helps firms improve cost control, identify inefficiencies, and monitor indirect costs.

Want to Pursue a Business Analyst Master’s Degree? Enroll For Business Analyst Master Program Training Course Today!

Sales and Profit Variance

Sales and profit variances are essential for understanding whether a company’s actual sales and profitability align with expectations. These variances reflect the differences between the planned or budgeted revenue and the actual revenue.

- Sales Volume Variance: The difference between the expected sales volume and the actual sales volume, measured in terms of both quantity and price.

- Sales Price Variance: The difference between the expected price per unit of the product sold and the actual price achieved.

- Profit Variance: The difference between actual profit and the expected or budgeted profit.

Sales and profit variances help organizations track if they are achieving their sales targets and if their pricing strategy is effective in delivering the desired profit levels.Example: If the company expected to sell 10,000 units at $50 each, resulting in $500,000 in sales, but only sold 9,000 units at $52, the sales volume variance would be unfavorable, while the sales price variance would be favorable.

Go Through These Business Analyst Interview Questions and Answers to Excel in Your Upcoming Interview.

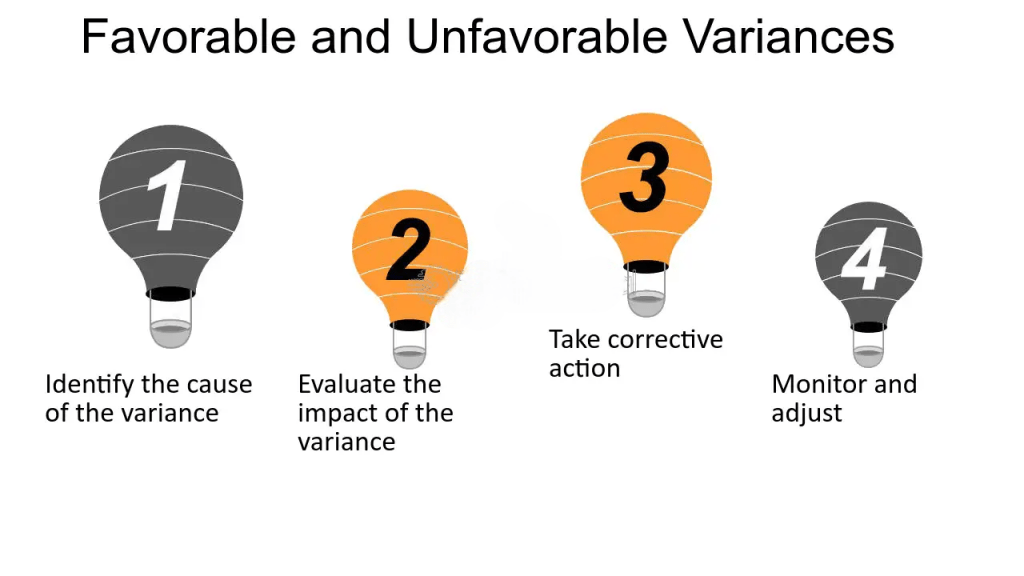

Favorable vs. Unfavorable Variance

Several factors influence the cost of capital, including:

- In accounting and financial analysis, a variance is the difference between planned or budgeted outcomes and actual results. This variance can be categorized as either favorable or unfavorable based on its effect on the company’s financial performance.

- A favorable variance happens when the actual outcome results in higher profits or lower costs than expected. For instance, if the cost of raw materials is less than what was budgeted, it creates a positive financial effect, leading to a favorable variance.

- On the other hand, an unfavorable variance occurs when the actual result leads to lower profits or higher costs than anticipated. A common example is when actual labor costs go over the budgeted amount, which harms profitability and results in an unfavorable variance.

- Understanding these variances helps businesses spot areas of strong or weak performance. This insight supports better cost control and decision-making.

Both types of variances provide useful insights, but unfavorable variances often require more immediate attention to rectify potential operational inefficiencies or cost overruns.

Calculating Variances

Variance analysis is a key technique in management accounting. It compares actual revenues or expenses with planned figures to assess performance. This comparison reveals whether operations are going as intended or if changes are needed. You can calculate any variance using this simple equation: Variance = Budgeted Amount – Actual Amount. A positive result shows that the actual cost is lower than the budgeted cost, indicating a favorable variance. An unfavorable variance occurs when the actual amount exceeds the budgeted one, particularly in costs. For example, suppose the budgeted material cost for a product is $5 per unit, but the actual cost is $4.50 per unit. The variance in material prices would be: $5 – $4.50 = $0.50, which is favorable. This suggests that the company used fewer materials than expected, which is positive. You can determine variances in areas like labor costs, overhead costs, and sales revenue using similar methods. This helps management identify inefficiencies or issues and take the right actions when needed.

Reasons for Variances

Several factors can contribute to variances, and understanding these causes helps businesses address performance gaps. Some common reasons for variances include

- Market Conditions: Changes in market prices, such as raw material costs or wages, can lead to price and cost variances.

- Operational Efficiency: Inefficiencies in the production process, such as machine breakdowns, low worker productivity, or inefficient use of materials, can result in unfavorable variances.

- Changes in Production Volume: Variations in production levels can lead to unexpected changes in material usage, labor hours, or overhead costs.

- External Factors: Factors like government regulations, changes in tax rates, or unforeseen events such as supply chain disruptions can contribute to variances.

- Accounting or Estimation Errors: Sometimes, variances arise due to errors in budgeting or forecasting. Estimation discrepancies between actual performance and planned outcomes can contribute to unexpected variances.

Importance in Decision-Making

Variance analysis is crucial in the decision-making process because it provides valuable insights into a company’s performance. By regularly analyzing variances, managers can:

- Identify Problem Areas: If unfavorable variances are detected, managers can investigate the root causes and make necessary adjustments.

- Improve Budgeting and Forecasting: Accurate variance analysis helps refine future budgeting and forecasting processes by highlighting patterns and trends.

- Cost Control: Identifying variances allows companies to control costs better, ensuring they remain within budget and make informed spending decisions.

- Operational Improvements: Regular variance analysis helps identify inefficiencies in the production process or supply chain, allowing for better optimization and cost savings.

By leveraging variance analysis, managers are better equipped to make data-driven decisions that align with organizational goals and improve overall profitability.

Conclusion

Management Accounting Variances analysis is an essential tool in financial management that provides deep insights into a company’s performance. To reinforce these qualities with data-driven insight and structured analysis, explore Business Analyst Training a program designed to equip professionals with market research techniques, business modeling frameworks, and strategic planning tools essential for building resilient ventures. Analyzing favorable and unfavorable variances allows managers to take proactive steps to address issues, ultimately enhancing the company’s ability to achieve its financial and strategic objectives. Management Accounting Variances analysis is not just a retrospective tool; it’s a forward-looking instrument that helps in refining future business strategies and ensuring sustainable growth.