- Introduction

- Who is a Credit Manager?

- Salary Overview (India)

- Salary Overview (USA)

- Factors Affecting Salary

- Industry-wise Breakdown

- Experience-level Comparison

- Salary Trends Over Time

- Certifications That Help

- Benefits and Bonuses

- Comparison with Similar Roles

- Conclusion

Introduction

A credit manager plays a vital role in the financial health of an organization by overseeing credit-granting processes, managing credit policies, assessing the creditworthiness of customers, and ensuring the timely collection of payments. To support entrepreneurial vision with strategic analysis and data-driven planning, explore Business Analyst Training a program designed to equip professionals with market research tools, business modeling frameworks, and decision-making skills essential for launching and scaling successful ventures. Their decisions directly impact an organization’s cash flow, risk management strategies, and overall profitability. As businesses increasingly rely on accurate financial analysis and risk assessment, the demand for skilled credit managers is on the rise both in India and internationally.

Who is a Credit Manager?

A credit manager is a financial professional responsible for evaluating the creditworthiness of potential clients, establishing credit limits, monitoring outstanding debts, and initiating collection efforts, often collaborating with an Agile Business Analyst to align financial practices with business goals. They work closely with sales teams, finance departments, and external clients to ensure that credit policies are adhered to and that the company maintains a healthy cash flow. In larger organizations, a credit manager may lead a team of credit analysts and collectors. Their role is critical in minimizing bad debts and optimizing the credit terms extended to clients.

To Earn Your Business Analyst Certification, Gain Insights From Leading Business Analyst Experts And Advance Your Career With ACTE’s Business Analyst Training Today!

Salary Overview (India)

In India, the salary of a credit manager can vary based on experience, education, industry, and location. On average, professionals who Start A Career Become A Business Analyst may also explore similar financial career paths with competitive compensation.

- Entry-Level (0-2 years): INR 3.5 – 5 LPA

- Mid-Level (3-7 years): INR 6 – 10 LPA

- Senior-Level (8+ years): INR 12 – 25+ LPA

The figures are influenced by whether the individual works for a multinational corporation, a large domestic firm, or a smaller enterprise. Cities like Mumbai, Bangalore, and Delhi tend to offer higher salaries due to the concentration of financial institutions and corporate headquarters.

Salary Overview (USA)

In the United States, credit managers earn significantly higher salaries due to the cost of living and the complexity of financial regulations. Average salary ranges are as follows, and professionals who understand Business Analyst Job Requirements can draw useful parallels when evaluating financial career paths.

- Entry-Level: USD 55,000 – 75,000 per year

- Mid-Level: USD 80,000 – 110,000 per year

- Senior-Level: USD 120,000 – 160,000+ per year

Credit managers working in finance, manufacturing, and IT industries in cities like New York, San Francisco, and Chicago often command premium salaries, sometimes exceeding USD 180,000 annually with bonuses.

Want to Pursue a Business Analyst Master’s Degree? Enroll For Business Analyst Master Program Training Course Today!

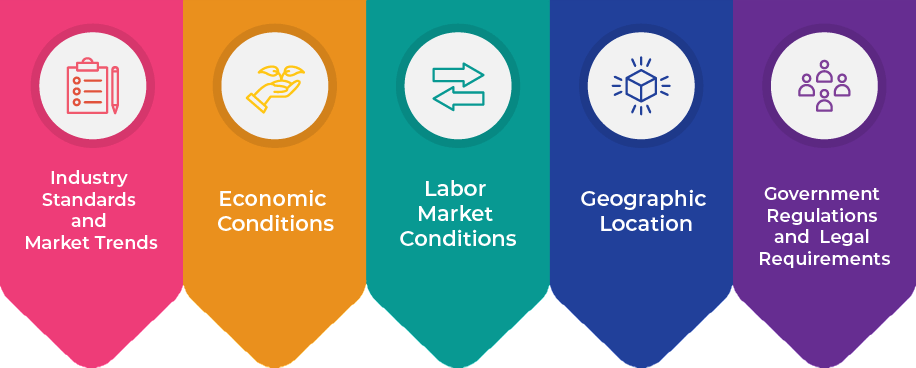

Factors Affecting Salary

Several factors influence a credit manager’s salary:

- Experience: More years in the industry typically result in higher pay.

- Education: A degree in finance, accounting, or economics boosts credibility; an MBA or certifications can add a premium.

- Industry: Finance and technology sectors generally offer higher pay than retail or construction.

- Company Size: MNCs and large corporations tend to pay more than SMEs.

- Location: Urban centers with high business activity offer better compensation.

- Performance and KPIs: Meeting or exceeding targets in collection efficiency or bad debt reduction can lead to bonuses.

Industry-wise Breakdown

Strengthen these components with analytical precision and strategic insight, explore Business Analyst Training a program designed to equip professionals with data interpretation skills, market research frameworks, and business modeling tools essential for crafting investor-ready plans and scalable ventures. Credit managers are employed across a wide range of industries, each offering different salary scales:

- Banking and Financial Services: INR 10 – 25 LPA (India) / USD 100,000 – 160,000 (USA)

- Manufacturing: INR 8 – 18 LPA / USD 90,000 – 140,000

- IT and Software Services: INR 10 – 20 LPA / USD 100,000 – 150,000

- Retail and FMCG: INR 6 – 12 LPA / USD 80,000 – 120,000

- Construction and Real Estate: INR 7 – 15 LPA / USD 85,000 – 130,000

Go Through These Business Analyst Interview Questions and Answers to Excel in Your Upcoming Interview.

Experience-level Comparison

Compensation for credit managers can vary significantly based on their experience and job responsibilities, and knowledge of Accounting and Management Accounting often plays a crucial role in determining career growth and salary potential. A Junior Credit Manager typically has less than three years of experience and focuses on credit analysis and reporting. In India, the salary for this role usually ranges from INR 3.5 to 6 LPA. In the USA, it falls between USD 55,000 and 75,000 annually. As credit managers gain experience, they move into Mid-Level Credit Manager roles, which typically require three to seven years of experience. These managers take on more responsibilities, including supervising teams, negotiating with clients, and creating credit policies. Salaries at this level generally range from INR 6 to 12 LPA in India and from USD 80,000 to 110,000 in the USA. At the top level, Senior Credit Managers with over eight years of experience often manage entire credit departments and are involved in strategic business planning. Their salaries reflect their seniority, typically ranging from INR 12 to 25+ LPA in India and from USD 120,000 to 160,000 or higher in the USA.

Salary Trends Over Time

Over the past decade, the role of credit managers has evolved, leading to upward salary trends. Digitization, data analytics, and risk modeling have added complexity and importance to the role, justifying higher compensation, especially for professionals who Master Hyperion Financial Management. Post-COVID, as companies prioritize liquidity and cash flow management, the demand and remuneration for credit managers have grown. In India, average salaries have seen a 20–30% increase over the last five years. In the U.S., salaries have climbed steadily with inflation and the increased need for regulatory compliance.

Certifications That Help

Professional certifications can significantly enhance a credit manager’s earning potential and career prospects. Notable certifications include:

- Certified Credit Executive (CCE) – NACM (USA)

- Certified Risk Analyst (CRA) – American Academy of Financial Management

- Chartered Financial Analyst (CFA) – CFA Institute

- Certified Credit Professional (CCP) – Credit Institute of Canada

- SAP Certification in Financial Supply Chain Management

- MBA in Finance or Accounting

These certifications validate a professional’s expertise and commitment to continuous learning, often leading to higher-paying roles.

Benefits and Bonuses

Along with their standard salaries, credit managers usually receive various benefits and incentives that increase their total pay. Performance bonuses are often given based on recovery rates and collection efficiency. These rewards recognize effective risk management and financial discipline. In larger companies, credit managers may also receive stock options or profit-sharing opportunities.This helps align their financial goals with the company’s long-term plans, especially when they Create Conditional Formatting in Cognos Report to ensure accurate and strategic reporting. Health insurance and retirement plans are typically part of the benefits package, offering good coverage in both India and the USA. After the pandemic, many organizations have introduced flexible work arrangements that allow for remote or hybrid work. Additionally, paid time off (PTO) policies are often quite generous, especially for experienced professionals. These bonuses and benefits can make up 20 to 30% of the total compensation, greatly increasing the role’s value beyond the base salary.

Comparison with Similar Roles

When compared with other financial roles, credit managers tend to earn competitive salaries.

- Financial Analyst: Typically earns slightly less than a credit manager

- Risk Manager: Usually earns more due to broader responsibilities

- Accounts Receivable Manager: Comparable salary but with less strategic involvement

- Treasury Manager: Higher pay due to involvement in liquidity and investment management

- Finance Manager: Comparable or slightly higher, depending on responsibilities

Conclusion

Credit managers are essential to the financial stability of any organization. Their role in assessing risk, managing receivables, and ensuring credit discipline directly impacts an organization’s bottom line. To reinforce these qualities with data-driven insight and structured analysis, explore Business Analyst Training a program designed to equip professionals with market research techniques, business modeling frameworks, and strategic planning tools essential for building resilient ventures. With evolving financial technologies, increased regulatory demands, and a global push for better risk management, the credit manager’s profile is more valuable than ever. Whether in India or the USA, professionals in this domain can expect lucrative salaries, strong career growth, and a wide array of opportunities across industries.