- Introduction

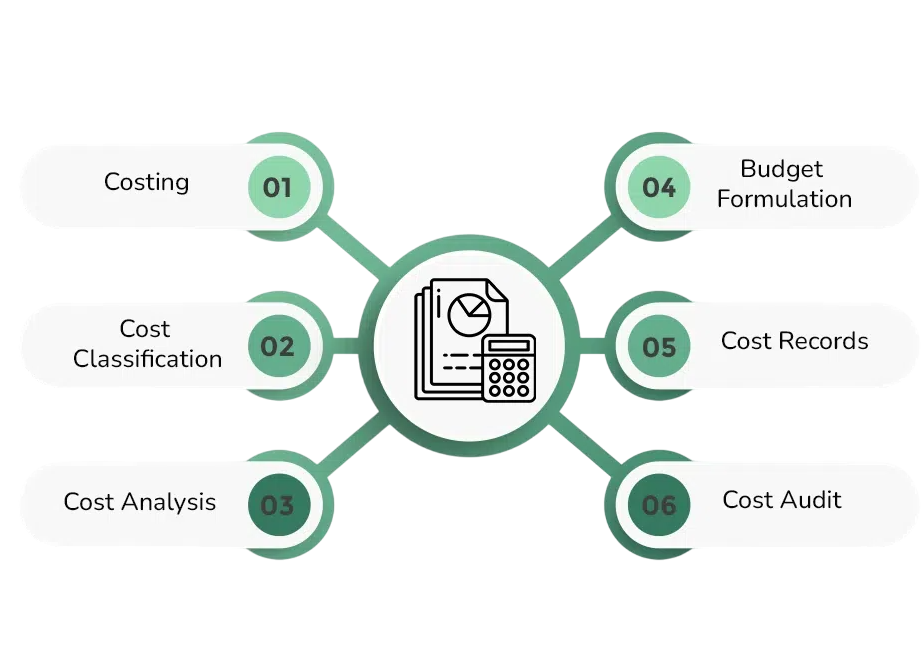

- Overview of Cost Accounting

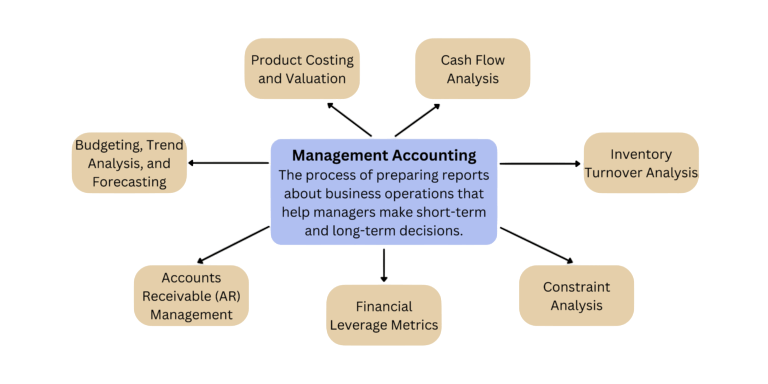

- Overview of Management Accounting

- Key Differences

- Scope of Both Fields

- Objectives Comparison

- Tools and Techniques

- Users of Information

- Time Orientation

- Compliance Requirements

- Integration Possibilities

- Conclusion

Introduction

Cost and Management Accounting is a discipline that provides crucial information for decision-making, planning, and control in any business. Special accounting branches like Management and Cost Accounting play distinct yet interrelated roles. While both focus on internal processes and support managerial decisions, their scope, purpose, tools, and users differ significantly, and professionals can enhance their expertise through Business Analyst Training. Understanding Management and Cost Accounting differences is essential for students, professionals, and business leaders who rely on accurate, timely, and relevant financial insights. Cost Accounting helps understand and manage the costs of operations, products, and services. Management Accounting, on the other hand, provides broader insights that aid strategic and operational decisions. This document comprehensively compares the two, highlighting their objectives, methods, users, and contributions to organizational success.

Overview of Cost Accounting

Cost Accounting is a branch of accounting that records, classifies, analyzes, summarizes, and allocates costs associated with a process, product, or service. Its primary objective is to determine the cost of goods or services produced and control those costs through standard costing, variance analysis, and budgeting, all of which are guided by Basic Accounting Principles. Cost accounting is fundamental in setting product prices, determining profitability, and evaluating cost efficiency. It uses methods like job costing, process costing, activity-based costing, and marginal costing. By tracing costs to specific units of output, businesses can identify areas of inefficiency and waste, thereby improving their operations and resource allocation.

Though traditionally focused on manufacturing, cost accounting is also applied in service sectors, construction, and healthcare to manage expenditures and maintain competitiveness. It primarily supports internal decision-making rather than external financial reporting.

Interested in Obtaining Your Business Analyst Certificate? View The Business Analyst Training Offered By ACTE Right Now!

Overview of Management Accounting

Management Accounting, also called managerial accounting, provides financial and non-financial information to internal stakeholders, primarily managers, to aid in planning, controlling, and decision-making.It encompasses a broader scope than cost accounting, integrating finance, economics, and statistics elements to present a holistic view of business performance, which directly connects to the Role of Compensation Management in aligning organizational efficiency with employee motivation. Unlike financial accounting, which focuses on historical performance and external reporting, management accounting emphasizes future-oriented planning and decision support. It includes techniques like budgeting, forecasting, economic analysis, break-even analysis, balanced scorecards, and key performance indicators (KPIs).

Management accountants work closely with senior executives to evaluate new investments, develop long-term strategies, optimize resource allocation, and assess risk. The ultimate aim is to support the organization in achieving its strategic goals efficiently and effectively.

To Earn Your Business Analyst Certification, Gain Insights From Leading Data Science Experts And Advance Your Career With ACTE’s Business Analyst Training Today!

Key Differences

While both cost accounting and management accounting focus on internal operations, they have several fundamental differences, which also highlight the importance of understanding What is a Business Model in aligning financial practices with overall organizational strategy.

- Purpose: Cost accounting is primarily concerned with cost control and reduction. Management accounting is focused on strategic planning, performance evaluation, and decision-making.

- Scope: Cost accounting is narrower and limited to cost-related data, while management accounting covers broader financial and operational metrics.

- Timeframe: Cost accounting often focuses on past and present data. Management accounting emphasizes future projections.

- Reporting Style: Cost accounting follows standardized formats. Management accounting is flexible and customized to management’s needs.

- Regulation: Cost accounting may follow specific industry standards. Management accounting is generally unregulated.

Understanding these differences helps organizations decide how to allocate accounting resources and interpret data for strategic advantage.

Want to Pursue a Business Analyst Master’s Degree? Enroll For Business Analyst Master Program Training Course Today!

Scope of Both Fields

The scope of cost accounting is relatively narrower than management accounting, but professionals can broaden their expertise through Business Analyst Training to gain a wider perspective on organizational processes.

Cost Accounting Scope:

- Cost ascertainment and analysis.

- Product pricing and inventory valuation.

- Cost control and reduction strategies.

- Efficiency assessment of production processes.

Management Accounting Scope:

- Planning and control functions.

- Decision-making support across departments.

- Investment and capital budgeting analysis.

- Strategic management and corporate governance.

- erformance measurement using non-financial metrics.

Management accounting includes cost accounting techniques as part of its broader analytical framework but also delves into forecasting, long-term planning, and risk analysis.

Go Through These Business Analyst Interview Questions and Answers to Excel in Your Upcoming Interview.

Objectives Comparison

The goals of cost accounting and management accounting differ in their focus, importance, and use within a company. Cost accounting centers on tracking, recording, and reviewing the actual costs related to production or service delivery. Its main aims are to calculate the actual cost per unit, set standard costs for budgeting, analyze the differences between actual and standard costs, spot areas of inefficiency, and support pricing strategies based on accurate cost data, all of which are integral to effective Financial Management in Business. In contrast, management accounting takes a broader and more strategic view. Its goal is to provide relevant financial and non-financial information to support decision-making, planning, and performance evaluation. Management accounting also plays a key role in monitoring business metrics, forecasting future trends, and ensuring coordination among departments to keep activities in line with the overall business goals. While cost accounting emphasizes operational efficiency and financial management, management accounting seeks to encourage long-term growth and strategic success for the organization.

Tools and Techniques

Both accounting fields use specific tools to achieve their objectives. Below are the most common ones:

Cost Accounting Tools:

- Standard Costing: Estimating expected costs to evaluate performance.

- Job Costing: Tracking costs per job or project.

- Process Costing: Suitable for industries with continuous production.

- Marginal Costing: Analyzing variable costs for decision-making.

- Variance Analysis: Comparing actual and standard costs.

Management Accounting Tools:

- Budgeting and Forecasting: Predicting future financial trends.

- Balanced Scorecard: Integrating financial and non-financial metrics.

- Break-even Analysis: Assessing profit-volume relationships.

- Ratio Analysis: Evaluating liquidity, profitability, and efficiency.

- Cash Flow Projections: Anticipating future inflows and outflows.

Management accounting tools are more holistic and future-oriented, whereas those in cost accounting are primarily used for cost determination and control.

Users of Information

The information generated by both fields serves different sets of internal users:

Cost Accounting Users:

- Cost Accountants: Use data for product pricing and inventory valuation.

- Production Managers: Monitor efficiency and cost control.

- Procurement Teams: Evaluate supplier cost-effectiveness.

Management Accounting Users:

- Senior Executives: Use reports for strategic decision-making.

- Financial Controllers: Monitor performance and cash flows.

- Marketing and Sales: Evaluate campaign profitability and pricing models.

- Operations Managers: Improve resource allocation and process optimization.

While both fields serve internal users, management accounting caters to a broader audience involved in strategy and operations.

Time Orientation

A key difference between cost accounting and management accounting is their focus on timeframes. Cost accounting mainly looks at historical data. It monitors and evaluates past and present costs, providing regular insights into production expenses. This backward-looking approach is important for efficiency audits, assessing past performance, and understanding resource use, all of which contribute to the broader Scope of Marketing Management. In contrast, management accounting is more focused on the future. It emphasizes forecasting, planning, and decision-making by using historical information to predict future outcomes. This forward-looking view helps with both short-term operational planning and long-term strategic goals. This difference in focus shows how crucial management accounting is for guiding a company’s future, while cost accounting mainly deals with analyzing past events.

Compliance Requirements

Cost accounting and management accounting differ significantly in terms of regulatory compliance, and mastering Financial Management Skills helps professionals navigate these differences effectively.

Cost Accounting:

- Law may regulate it in specific industries (e.g., defense, public utilities).

- Some companies are required to submit cost audit reports.

- Follows particular standards issued by institutes like the ICWA (Institute of Cost and Works Accountants of India).

Management Accounting:

- Not governed by statutory regulations or standards.

- Reports are internal and flexible in format.

- Designed to meet the specific informational needs of the management.

Because management accounting is intended for internal use, it allows greater flexibility and customization, while cost accounting may occasionally adhere to regulatory frameworks.

Integration Possibilities

Though distinct, cost accounting and management accounting can be effectively integrated:

- Cost data generated by cost accounting forms the basis for many managerial decisions.

- Management accounting relies on cost structures to assess profitability, pricing, and budgeting.

- Cost and management accounting modules work together in integrated systems like ERP (Enterprise Resource Planning).

- Joint analysis enhances cost control, operational planning, and strategic forecasting.

Integrating both approaches results in a comprehensive management information system (MIS) that boosts efficiency, cost-effectiveness, and decision-making precision.

Conclusion

In the evolving business and finance landscape, cost accounting and management accounting play indispensable roles. Though their objectives, tools, and methodologies differ, they are complementary in achieving organizational effectiveness. Cost accounting offers critical insights into the internal cost structure and production efficiency, while management accounting provides broader strategic guidance for future planning and control, both of which can be strengthened through Business Analyst Training. Understanding the synergy between the two can significantly enhance an organization’s capacity to respond to internal and external challenges. Cost accounting ensures accurate cost measurement, while management accounting transforms that data into actionable business intelligence. They empower managers and executives to make informed, timely, and strategic decisions in a competitive environment.