- Introduction

- Criteria for Good Topics

- Project on Working Capital

- Financial Statement Analysis

- Portfolio Management

- Risk Analysis

- Investment Decision Projects

- Budgeting Techniques

Introduction

The introduction of MBA Finance project topics serves as a crucial foundation for students aiming to apply theoretical knowledge to real-world financial challenges and gain practical insights into the dynamic world of finance. These projects not only help in understanding complex financial concepts but also enhance analytical, decision-making, and strategic thinking skills. MBA Finance students, especially those who have undertaken PMP Training can leverage project management principles alongside financial analysis to deliver more structured and impactful outcomes. Students are often required to explore diverse areas such as investment analysis, portfolio management, financial statement analysis, risk management, corporate finance, banking, mergers and acquisitions, and fintech innovations. Selecting the right project topic is essential, as it aligns with the student’s career aspirations and interests while also reflecting current industry trends. Through comprehensive research, data interpretation, practical application, and effective project management strategies learned in PMP Training, students can uncover valuable solutions to existing financial problems or explore emerging opportunities. A well-chosen finance project enables students to demonstrate their grasp of financial tools, techniques, and models while preparing them for roles in investment banking, corporate finance, financial consulting, and more. In essence, MBA Finance project topics, complemented by PMP Training play a vital role in bridging the gap between academic learning and practical financial applications, offering students a competitive edge in the job market and preparing them for leadership roles in the finance sector.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

Criteria for Good Topics

- Relevance to Current Trends: The topic should address contemporary financial issues, such as fintech, ESG investing, or changing regulatory environments, to ensure it is timely and insightful.

- Availability of Data: A good topic should have sufficient and accessible data sources, allowing for accurate research, analysis, and meaningful conclusions.

- Scope for Research and Analysis: The topic should offer depth for exploration and allow the use of financial models, tools, or frameworks for comprehensive analysis.

Choosing the right topic is a critical step in ensuring the success of an MBA Finance project. A good topic should not only align with the student’s interests and career goals but also offer scope for research, analysis, and practical application. The right topic helps maintain motivation throughout the project and increases its relevance to real-world financial issues. Moreover, being aware of Top MBA Subjects to Study can guide students in selecting topics that are not only academically enriching but also aligned with industry trends and emerging financial practices. Below are some key criteria for selecting a good finance project topic:

- Alignment with Career Goals: Choosing a topic related to one’s desired career path enhances learning and adds value during interviews and job placements.

- Originality and Uniqueness: A fresh perspective or an under-explored area can make the project stand out and demonstrate creativity.

- Feasibility and Practicality: The topic should be manageable within the available time, resources, and academic guidelines, ensuring successful completion.

Project on Working Capital

A project on working capital is a significant component of MBA Finance studies, as it focuses on the efficient management of a company’s short-term assets and liabilities. Working capital management is crucial for maintaining liquidity, ensuring operational efficiency, and supporting the overall financial health of a business. This project typically involves analyzing components such as inventory, accounts receivable, accounts payable, and cash management to evaluate how effectively a company utilizes its current assets and liabilities to sustain daily operations. By studying working capital, students gain insights into how companies balance profitability and liquidity, manage cash flows, and make strategic decisions to optimize resources. Additionally, incorporating concepts from Understanding Capital Markets can help students assess how market conditions, interest rates, and external financing options impact working capital decisions. The project may also include ratio analysis, trend analysis, and comparative studies across different periods or with industry benchmarks. It helps in understanding the challenges businesses face in managing working capital, especially in sectors with high inventory cycles or seasonal demand. Real-life data from companies can be used to assess the working capital position and recommend improvements or alternative strategies. Ultimately, a project on working capital, combined with insights from Understanding Capital Markets, not only sharpens analytical and financial modeling skills but also prepares students for finance roles where managing short-term finances and sustaining business operations are critical to long-term success.

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

Financial Statement Analysis

- Profitability Analysis: Evaluates how effectively a company generates profit using resources, often using ratios like net profit margin, return on assets (ROA), and return on equity (ROE).

- Liquidity Analysis: Assesses the company’s ability to meet short-term obligations through ratios such as the current ratio and quick ratio.

- Solvency Analysis: Measures long-term financial stability and debt management using ratios like debt-to-equity and interest coverage ratio.

- Trend Analysis: Involves comparing financial data over multiple periods to identify growth patterns, performance improvements, or potential issues.

- Comparative and Common Size Analysis: Compares financial data across companies or standardizes it as percentages for better benchmarking and understanding.

- Cash Flow Analysis: Examines cash inflows and outflows from operating, investing, and financing activities to evaluate liquidity and cash management efficiency.

- Identification of Risks: The first step involves recognizing various types of risks, such as market risk, credit risk, operational risk, and liquidity risk, that could affect financial outcomes.

- Risk Measurement: Quantifying risk using statistical tools and financial models such as standard deviation, Value at Risk (VaR), and beta helps determine the extent of exposure.

- Risk Assessment: This involves evaluating the probability and impact of different risks, helping prioritize which risks need immediate attention.

- Scenario and Sensitivity Analysis: These techniques test how changes in key variables affect outcomes, helping assess risk under different market conditions.

- Mitigation Strategies: Developing risk-reduction methods like diversification, insurance, hedging, and internal controls to minimize adverse effects.

- Monitoring and Review: Continuously tracking risk factors and adjusting strategies as needed to stay aligned with business objectives and changing environments.

Financial statement analysis is a fundamental aspect of MBA Finance projects, helping students understand a company’s financial health, performance, and decision-making processes. By examining financial statements such as the balance sheet, income statement, and cash flow statement, students can assess profitability, liquidity, solvency, and operational efficiency. Additionally, incorporating insights from Understanding Capital Structure in Financial Management allows students to evaluate how a company finances its operations through debt and equity, and how these decisions impact overall financial stability and cost of capital. This analysis is essential for investors, creditors, and management to make informed decisions. Below are six key components of financial statement analysis:

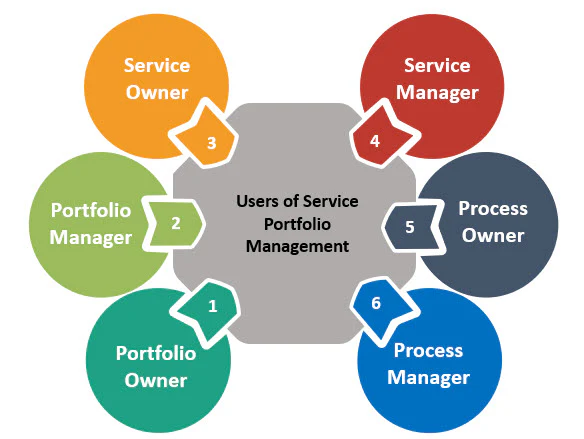

Portfolio Management

Portfolio management is a vital concept in MBA Finance that focuses on the strategic allocation and management of financial assets to achieve specific investment goals while minimizing risk. It involves selecting a mix of investment instruments such as stocks, bonds, mutual funds, and other securities based on an investor’s risk tolerance, time horizon, and return expectations. The primary objective of portfolio management is to optimize the balance between risk and return through diversification and asset allocation strategies. Students, particularly those who have completed PMP training can apply project management principles to portfolio management projects, ensuring structured analysis, disciplined monitoring, and timely decision-making. Students working on a project in this area analyze market trends, assess individual asset performance, and apply models like the Capital Asset Pricing Model (CAPM), Modern Portfolio Theory (MPT), and the Sharpe Ratio to evaluate the risk-adjusted returns. The process also includes regular monitoring and rebalancing of the portfolio to respond to market changes or shifts in investment objectives. Portfolio management projects offer practical exposure to investment decision-making and help develop critical skills such as financial analysis, market research, strategic planning, and project management. This area is especially relevant for those aiming for careers in investment banking, wealth management, or financial advisory. Overall, portfolio management, complemented by PMP Training, combines analytical tools with strategic judgment, making it a comprehensive and dynamic field of study in finance.

Risk Analysis

Risk analysis is a crucial aspect of financial decision-making and a key topic in MBA Finance projects. It involves identifying, assessing, and managing potential risks that could negatively impact an organization’s financial performance. Understanding risk helps businesses prepare for uncertainties and make more informed, strategic decisions. Risk analysis is especially important in areas like investments, lending, project evaluation, and business operations.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Investment Decision Projects

Investment decision projects are a key component of MBA Finance programs, allowing students to explore how businesses and individuals evaluate and choose among various investment options. These projects focus on analyzing the financial viability and expected returns of different investment opportunities, such as capital budgeting decisions, stock or bond investments, real estate ventures, or startup funding. Students learn to apply financial tools and techniques like Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index to assess the potential success and risks of investments. A strong emphasis is placed on Understanding the Investment Decision Strategies, which enables students to evaluate risk-return trade-offs, market conditions, cost of capital, and the impact of external factors such as inflation or regulatory changes. These projects often include real-life case studies, data analysis, and forecasting to support decision-making. Through this practical application, students develop critical skills in financial analysis, strategic planning, and value assessment. Investment decision projects not only enhance technical knowledge but also prepare students for roles in corporate finance, investment banking, portfolio management, and financial consulting. Overall, they provide a solid foundation for understanding how to make sound financial decisions that align with organizational goals and investor expectations.

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Budgeting Techniques

Budgeting techniques are essential tools in financial planning and control, and they form an important part of MBA Finance projects. These techniques help organizations allocate resources efficiently, forecast revenues and expenses, and set financial goals. Budgeting is not only about planning future finances but also about monitoring performance and ensuring that spending aligns with strategic objectives. Common budgeting techniques include incremental budgeting, which adjusts previous budgets to account for changes; zero-based budgeting, where every expense must be justified from scratch; and activity-based budgeting, which focuses on costs associated with specific activities or operations. Other advanced methods, like flexible budgeting, allow for adjustments based on actual performance levels, while rolling budgets are continuously updated to reflect changing business conditions. MBA students, particularly those who have undergone PMP training can apply project management principles to budgeting projects, ensuring a structured approach to resource allocation, scheduling, and cost control. These projects enable students to analyze financial data, identify cost-saving opportunities, and create realistic budget plans that support decision-making. They may also involve evaluating budgeting performance using variance analysis, which compares actual outcomes with budgeted figures. Understanding and applying various budgeting techniques, combined with PMP Training skills, equips students with practical expertise relevant for roles in corporate finance, planning and analysis, and managerial accounting. Overall, mastering budgeting techniques is vital for ensuring financial discipline, strategic alignment, and long-term sustainability in any organization.