- Introduction to Managerial Economics

- Scope and Importance of Managerial Economics

- Demand Analysis

- Production and Cost

- Market Structures

- Pricing Strategies

- Profit Management

- Capital Budgeting

Introduction to Managerial Economics

Managerial Economics is a crucial field that integrates economic theory with business practice to facilitate effective decision-making and strategic planning. It involves the application of microeconomic principles and quantitative tools to analyze business situations and solve managerial problems. This discipline equips managers with the ability to make rational choices by assessing the economic environment, evaluating alternatives, and anticipating the outcomes of various business decisions. Key areas of focus in managerial economics including demand and supply analysis, production and cost functions, pricing strategies, market structures, and risk management are also highly relevant for professionals undergoing PMP training as they provide essential insights for effective project planning and decision-making. By studying consumer behavior, market trends, and government policies, managers can make informed decisions that align with organizational objectives and adapt to dynamic market conditions. Managerial economics also emphasizes the use of optimization and marginal analysis to ensure efficient resource allocation and maximize profits. It serves as a foundation for planning, budgeting, and forecasting in both short-term operations and long-term strategy. As businesses face increasing complexity and competition, managerial economics provides the analytical framework and practical tools needed to maintain a competitive edge and achieve sustainable growth. Thus, it stands as a fundamental component of business education and a valuable resource for managers across all industries.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

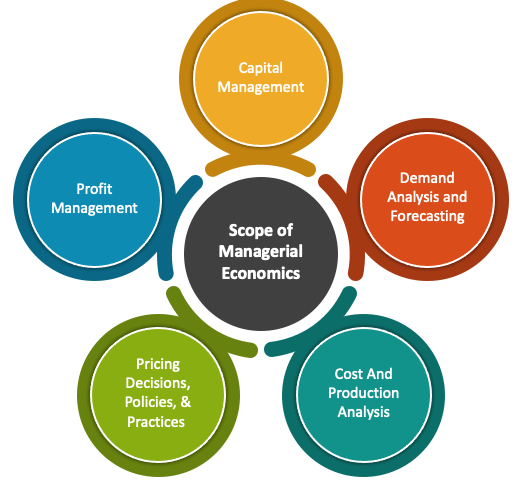

Scope and Importance of Managerial Economics

- Decision-Making and Planning: Managerial economics helps in making logical and data-driven decisions related to production, pricing, and investment, enhancing overall strategic planning, an essential skill in MBA Managerial Economics courses.

- Demand Analysis and Forecasting: It provides insights into consumer behavior and helps forecast demand, enabling businesses to plan output and marketing strategies efficiently key aspects that fall under Operations Manager Responsibilities.

- Cost and Production Analysis: Understanding cost structures and production techniques allows managers to minimize costs and maximize productivity, a core focus in MBA Managerial Economics studies.

- Pricing Strategies: Managerial economics assists in developing optimal pricing strategies based on market conditions, competition, and consumer demand.

Managerial Economics plays a critical role in modern business decision-making by combining economic theory with managerial practices. It provides a structured approach to analyzing business problems, formulating strategies, and optimizing performance. The scope of managerial economics is vast, encompassing various aspects of both micro- and macroeconomics tailored to managerial needs. Especially in the context of MBA Managerial Economics, understanding its importance equips future managers with analytical tools to tackle complex business scenarios effectively.

- Profit Management: It aids in setting profit targets and analyzing factors that influence profitability, helping managers align actions with financial goals.

- Policy Formulation and Risk Analysis: It supports evaluating government policies, taxation, and risk factors, allowing firms to adapt strategies accordingly.

- Production Efficiency: Analyzing production processes helps identify ways to increase output with fewer resources, leading to higher efficiency and lower costs.

- Cost Structures: Understanding fixed and variable costs allows businesses to develop strategies for minimizing expenses and maximizing profit margins, especially in the context of fluctuating demand—an essential part of building strong Financial Management Skills for growth.

- Economies of Scale: As production increases, businesses can benefit from economies of scale, reducing per-unit costs and improving competitiveness in the market.

- Cost Control: Effective cost control strategies enable businesses to monitor and manage expenses, ensuring they stay within budget and avoid overspending.

- Break-even Analysis: This tool helps determine the point at which total revenues equal total costs, providing insights into pricing and production decisions.

- Marginal Costing: Analyzing the additional cost incurred for producing one more unit helps businesses make informed decisions about pricing and production levels, optimizing profit.

- Cost-Plus Pricing: This strategy involves adding a fixed markup to the cost of production. It ensures that all costs are covered while generating a desired profit margin.

- Penetration Pricing: Businesses use this strategy to enter a competitive market by offering low prices initially, attracting customers, and gaining market share before gradually increasing prices.

- Price Skimming: This approach sets high initial prices for new or innovative products, targeting early adopters willing to pay a premium before gradually lowering prices to attract more price-sensitive customers, while also requiring a clear Understanding Difference Between Cost Accounting and Management Accounting to effectively analyze costs and guide strategic pricing decisions.

- Competitive Pricing: In this strategy, businesses set their prices based on competitors’ prices. It helps maintain a competitive position in the market without overpricing or underpricing products.

- Psychological Pricing: Prices are set to create an illusion of value, such as pricing products at $9.99 instead of $10, making them appear more affordable to consumers.

- Dynamic Pricing: This strategy involves adjusting prices based on market demand, time of day, or customer profile. It’s commonly used in industries like airlines and hospitality.

In summary, MBA Managerial Economics not only enhances theoretical knowledge but also develops practical skills crucial for business success.

Demand Analysis

Demand analysis is a critical component of managerial economics that focuses on understanding how various factors influence consumer demand for goods and services. It involves examining the relationship between price, quantity demanded, and other determinants such as income, tastes, and preferences. A thorough market demand analysis helps businesses forecast future demand, adjust pricing strategies, and optimize production levels to meet consumer needs effectively. By studying patterns in consumer behavior, managers can identify trends, anticipate shifts in demand, and develop strategies that enhance market share and profitability. Market demand analysis also plays a key role in pricing decisions, as it helps businesses assess how price changes may affect consumer purchasing decisions an important consideration emphasized in PMP training. Furthermore, this analysis allows firms to segment their target markets and tailor products or services to specific consumer groups. A robust demand analysis not only focuses on short-term fluctuations but also considers long-term changes influenced by factors such as technological advancements, economic cycles, and regulatory changes. Ultimately, market demand analysis equips managers with the insights needed to make informed decisions, minimize risks, and capitalize on market opportunities, ensuring the business remains competitive and responsive to consumer needs.

Production and Cost

- Understanding production and cost is fundamental for managers to efficiently allocate resources, optimize operations, and maximize profitability. By analyzing production functions and cost structures, businesses can identify areas for improvement, reduce waste, and ensure sustainable growth. Effective cost control is a key component in achieving financial success, as it enables firms to keep expenses in check while maintaining high levels of productivity.

By focusing on production and cost management, companies can improve cost control, streamline operations, and achieve financial sustainability.

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

Market Structures

Market structures refer to the organizational characteristics of a market that influence competition, pricing, and the behavior of firms within that market. These structures range from perfect competition to monopolies, each with distinct features. In a perfect competitive market, many firms are selling identical products, and no single firm has the power to influence market prices. In such a market, where prices are determined purely by supply and demand, Key Functions of Financial Management such as investment decisions, financing decisions, and dividend decisions play a crucial role in ensuring efficient resource allocation. A perfect competition environment encourages innovation and price sensitivity, as firms must operate at the lowest cost to stay competitive. However, in reality, very few markets achieve perfect competition. Most markets fall somewhere between the extremes of perfect competition and monopolistic structures, with firms possessing varying degrees of market power. Understanding market structures, including perfect competition, is crucial for managers to make informed decisions about pricing, production, and market entry strategies. In such a competitive environment, businesses must focus on reducing costs, enhancing product quality, and differentiating themselves to maintain profitability. Ultimately, knowledge of market structures allows firms to navigate different competitive landscapes and adjust their strategies to thrive in diverse market conditions.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Pricing Strategies

Pricing strategies are essential for businesses to maximize revenue, stay competitive, and achieve profitability. By selecting the right pricing approach, companies can influence customer perception, market demand, and their financial performance. Effective pricing strategies take into account factors such as production costs, competition, consumer behavior, and market conditions. Here are six key pricing strategies that businesses commonly use:

Profit Management

Profit management is a crucial aspect of business strategy, focused on maximizing a company’s profitability while efficiently managing costs and resources. It involves analyzing revenue streams, controlling costs, and making strategic decisions that directly impact the bottom line. To manage profits effectively, businesses must balance their pricing strategies, production levels, and marketing efforts to ensure that revenues consistently exceed costs, while gaining insights from Top Product Management Courses in India to enhance decision-making and strategy formulation. This includes identifying areas where cost reductions are possible without sacrificing product quality or customer satisfaction. Profit management also involves setting clear profit targets, using financial data to forecast future profits, and implementing policies that optimize operational efficiency. Companies often employ techniques such as break-even analysis, contribution margin analysis, and financial forecasting to better understand their profit potential. In addition, businesses need to monitor external factors like market demand, economic trends, and competition that can influence profitability. A well-structured profit management approach helps businesses make informed decisions regarding pricing, investments, and cost control. It ensures long-term financial sustainability by improving cash flow, reducing unnecessary expenditures, and optimizing revenue generation. Ultimately, effective profit management empowers businesses to navigate challenges, invest in growth opportunities, and maintain a competitive edge in their respective industries.

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Capital Budgeting

Capital budgeting is the process of evaluating and selecting long-term investment projects that align with a company’s strategic goals and financial objectives. It involves analyzing potential investments, such as purchasing new equipment, expanding facilities, or launching new products, to determine their viability and profitability. The goal of capital budgeting is to ensure that the company’s resources are allocated efficiently, prioritizing investments that generate the highest returns. This process typically uses techniques like Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index to assess the potential financial outcomes of each project, all of which are essential concepts covered in PMP training. By considering factors such as the cost of capital, expected cash flows, and the time value of money, capital budgeting helps businesses make informed decisions about which projects to pursue and how to minimize risks. It also allows companies to allocate resources to the most promising ventures, ensuring they contribute to long-term growth and profitability. Capital budgeting is essential for managing large investments and mitigating financial risk, especially in industries with high capital expenditure requirements. Through effective capital budgeting, businesses can optimize their investment portfolios, achieve strategic objectives, and improve their overall financial health. Ultimately, it is a key tool for sustainable growth and value creation in the competitive business landscape.