- Introduction to Financial Management Skills

- Analytical Thinking

- Budgeting and Forecasting

- Financial Reporting

- Strategic Planning

- Communication Skills

- Risk Management

- Cost Control

Introduction to Financial Management Skills

In today’s fast-paced economic environment, developing strong financial management skills is crucial for both individuals and organizations. These skills encompass the ability to plan, organize, control, and monitor financial resources to achieve business or personal financial goals effectively. Financial management supports better budgeting, risk reduction, and sustainable growth. PMP Training enhances these skills for smarter decision-making. By mastering key aspects such as budgeting, investing, cost control, and financial analysis, one can make informed choices that enhance overall financial well-being. Moreover, in a business context, financial management ensures that resources are allocated efficiently, operations remain cost-effective, and long-term profitability is maintained. As financial landscapes evolve with technological advancements and changing market conditions, acquiring and refining financial management skills becomes increasingly vital. These skills empower professionals to adapt to financial challenges, seize opportunities, and contribute meaningfully to organizational success. Whether you are managing your household finances or leading a corporate finance team, a solid foundation in financial management equips you with the tools to make sound financial decisions and secure a stable future.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

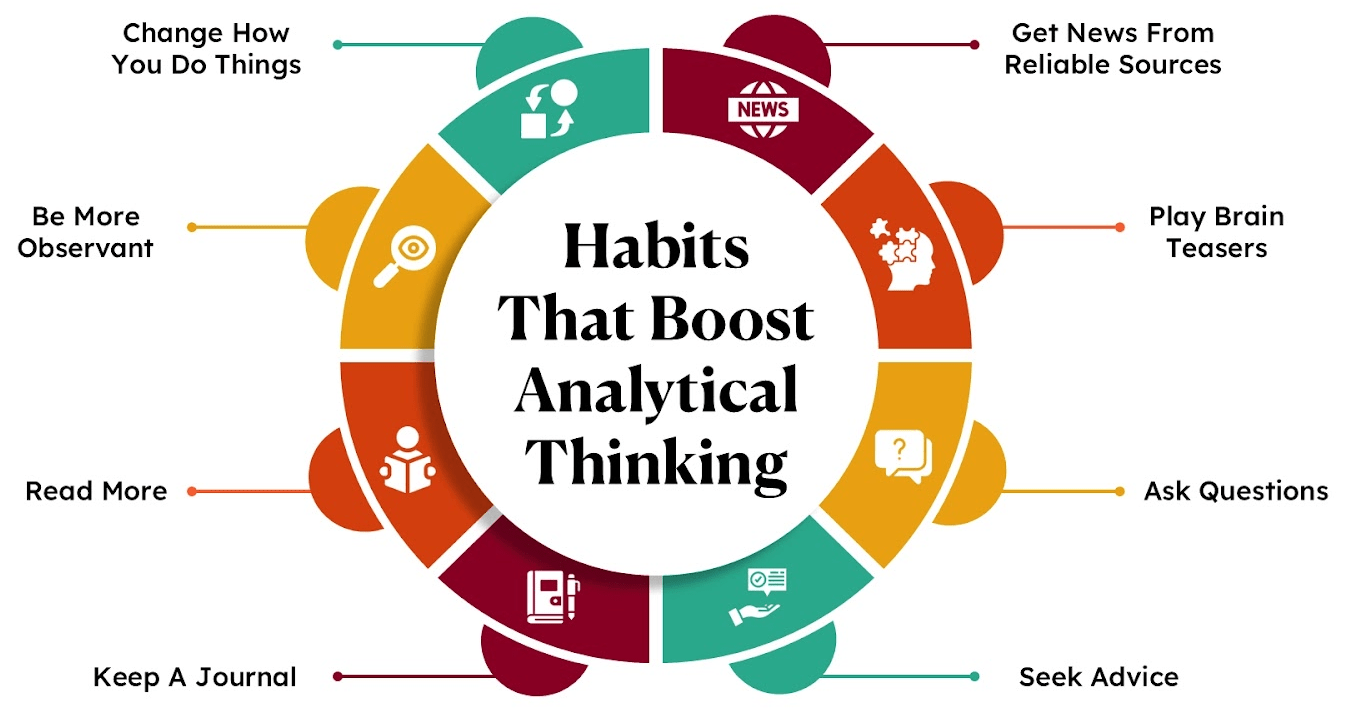

Analytical Thinking

- Improved Problem-Solving: Analytical thinking enables individuals to dissect complex issues, identify root causes, and find effective solutions through systematic evaluation.

- Better Decision-Making: By considering all available information and weighing different options, those with analytical thinking skills can make decisions based on facts and logical reasoning rather than assumptions an approach closely aligned with the Key Functions of Financial Management

- Enhanced Creativity: Analytical thinking encourages looking at problems from various angles, which often leads to innovative and creative solutions.

Analytical thinking is the ability to break down complex problems into smaller, manageable parts to gain a deeper understanding and solve them effectively. It involves evaluating information, identifying patterns, and using logical reasoning to make decisions. Developing strong analytical thinking skills enhances problem-solving capabilities, helps in making informed decisions, and supports strategic planning in various aspects of life and business.

- Increased Efficiency: Breaking down tasks into smaller components and understanding each part allows for more efficient execution and reduces the likelihood of errors.

- Effective Communication: Analytical thinkers can present complex ideas clearly, making it easier to convey information and persuade others with solid arguments.

- Career Advancement: Having strong analytical thinking skills is highly valued in many fields, as it shows the ability to approach challenges strategically and deliver results.

- Transparency: Financial reporting ensures transparency by offering a clear view of a company’s financial health, enabling stakeholders to understand its operations and performance.

- Key Financial Statements: Key documents in financial reporting include the balance sheet, cash flow statement, and profit and loss statement, each providing different insights into the financial status of the company. Understanding these reports is essential in frameworks like What is ITIL, which emphasizes aligning IT services with business needs and performance metrics.

- Informed Decision-Making: Accurate financial reporting, particularly the profit and loss statement, helps business leaders make informed decisions regarding budgeting, investing, and financial strategy.

- Regulatory Compliance: Financial reporting ensures that companies adhere to accounting standards and legal requirements, helping maintain compliance with regulatory bodies.

- Performance Monitoring: Financial reports allow businesses to monitor their progress over time, identifying trends and areas where they can improve profitability.

- Investor Confidence: Regular and accurate financial reporting, including the profit and loss statement, boosts investor confidence by providing a clear and honest picture of a company’s performance.

- Clear Expression: Good communication allows individuals to express thoughts, ideas, and emotions clearly, preventing misunderstandings and promoting effective collaboration.

- Active Listening: Communication is not just about talking; it involves actively listening to others, understanding their perspectives, and responding appropriately.

- Non-Verbal Communication: Body language, facial expressions, and tone of voice are all integral aspects of communication, and mastering these soft skills enhances overall interaction.

- Conflict Resolution: Effective communication skills enable individuals to handle disagreements constructively, finding solutions that satisfy all parties involved. These skills can be further enhanced to Achieve Goals with AI Powered Learning Tools, fostering better collaboration and problem-solving.

- Building Relationships: Strong communicators build rapport, trust, and empathy, which are essential for fostering strong personal and professional relationships.

- Leadership and Influence: Leaders with excellent communication skills are better equipped to inspire, motivate, and influence their teams, making communication an essential part of their soft skills toolkit.

Budgeting and Forecasting

Budgeting and forecasting are crucial financial tools for both individuals and organizations, allowing them to plan and manage their financial resources effectively. Budgeting involves creating a detailed plan for income and expenses over a specific period, helping ensure that funds are allocated appropriately to meet financial goals. Forecasting, on the other hand, focuses on predicting future financial outcomes based on current trends and historical data. Budget forecasting combines these two processes by estimating future revenues and expenditures, allowing businesses to anticipate cash flow, plan for contingencies, and make informed decisions. A well-documented Case Study on Marketing Management often highlights how effective budget forecasting supports successful marketing strategies. By regularly reviewing and updating budget forecasting, companies can adapt to market changes, control costs, and maximize profitability. For individuals, personal budgeting and forecasting can provide clarity on spending patterns, saving goals, and investment strategies. Both practices help in maintaining financial discipline and identifying potential financial issues before they become critical. Moreover, effective budget forecasting supports strategic planning, helping organizations allocate resources more efficiently and align their financial strategies with long-term objectives. Whether for personal or business finance, mastering budgeting and forecasting is key to maintaining financial stability and achieving future financial success.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Financial Reporting

Financial reporting is the process of creating and presenting financial statements that provide valuable insights into a company’s financial performance and position. It allows stakeholders, such as investors, creditors, and management, to make informed decisions based on accurate and timely data. One key component of financial reporting is the profit and loss statement, which summarizes the revenues, costs, and expenses incurred during a specific period.

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

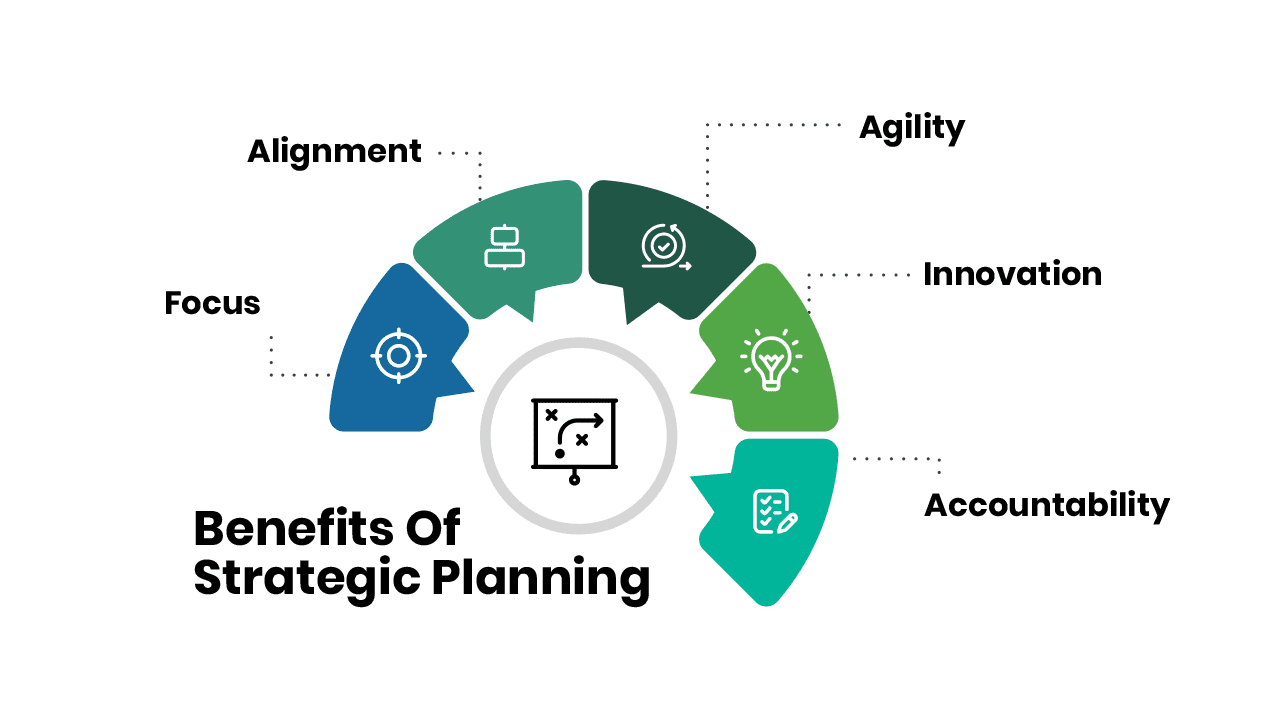

Strategic Planning

Strategic planning is the process of defining a company’s direction and making decisions on allocating resources to pursue this strategy. It provides a roadmap for organizations to follow, ensuring long-term goals are met while navigating potential challenges and opportunities. The strategic planning process involves several key steps, starting with identifying the organization’s mission, vision, and core values. From there, it moves to setting specific, measurable, achievable, relevant, and time-bound objectives that align with the overall vision. A critical part of the strategic planning process is analyzing the external environment, assessing market trends, and understanding competitors, which allows for better decision-making and positioning in the marketplace. PMP Training helps professionals develop these analytical skills for more effective strategic planning. Equally important is evaluating the internal environment to determine strengths, weaknesses, and resources available to execute the plan. The strategic planning process also involves continuous monitoring and adjustments to ensure the plan stays relevant in a dynamic business environment. By engaging in thorough and thoughtful strategic planning, companies can focus their efforts on high-priority initiatives, drive growth, and sustain competitive advantage. In today’s rapidly changing business landscape, strategic planning is essential for organizations to adapt, innovate, and succeed in their long-term objectives.

Communication Skills

Effective communication skills are essential for building relationships, conveying ideas clearly, and collaborating with others in any environment. Whether in personal interactions or professional settings, good communication enhances understanding, resolves conflicts, and fosters a positive atmosphere. In addition to technical expertise, strong soft skills like communication are increasingly valued by employers. Below are six key points that highlight the importance of communication skills:

Risk Management

Risk management is a critical process for identifying, assessing, and mitigating potential risks that could impact an organization’s objectives and operations. It involves proactively evaluating the uncertainties in a business environment, including financial, operational, strategic, and compliance risks. By understanding these risks, organizations can develop strategies to reduce their likelihood or minimize their impact. Effective risk management ensures that businesses are prepared to handle unforeseen events, whether they are economic downturns, technological disruptions, or regulatory changes. One key aspect of risk management is risk assessment, which involves analyzing both the probability and the potential impact of risks on the organization. Once risks are identified, appropriate mitigation strategies are developed, such as diversifying investments, implementing controls, or purchasing insurance. Another important element is continuous monitoring, as risks evolve and require ongoing evaluation. Furthermore, a strong risk management framework can enhance decision-making by providing leaders with the necessary insights to make informed choices. Incorporating methodologies like Improve Project Outcomes Using PRINCE2 ensures risks are managed systematically for better results. Overall, adopting a comprehensive risk management approach helps organizations safeguard their assets, improve operational resilience, and create a culture of awareness and accountability. It is essential for businesses to regularly review and update their risk management plans to stay agile and responsive in an ever-changing environment.

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Cost Control

Cost control is a critical aspect of financial management that ensures a project or business operates within its allocated budget, optimizing resource use and minimizing waste. Effective cost control involves monitoring expenses, identifying inefficiencies, and implementing strategies to reduce costs without compromising quality or performance. One key component of this process is project cost management, which includes the planning, estimating, and controlling of costs to ensure that a project is completed within its financial constraints. Project cost management helps businesses forecast expenses, track expenditures, and make adjustments as needed throughout the project lifecycle. PMP Training equips professionals with the tools to manage these costs effectively. By incorporating detailed budgeting and cost-tracking techniques, organizations can maintain financial discipline and achieve their goals without overspending. The project cost management process also emphasizes risk management, allowing for the identification of potential cost overruns early on and ensuring that corrective actions are taken to mitigate these risks. Whether managing a large construction project or a small business operation, implementing strong cost control practices is essential for financial stability and profitability. It allows businesses to make informed decisions, allocate resources efficiently, and ultimately achieve successful project outcomes within the expected budget.