- Introduction to Accounting Principles

- Importance in Financial Reporting

- GAAP Overview

- Key Principles Explained

- Accrual vs Cash Basis

- Consistency Principle

- Prudence Concept

- Going Concern Principle

- Matching Concept

- Limitations

- Regulatory Bodies

- Summary

Introduction to Accounting Principles

Basic Accounting Concepts are the standardized rules and guidelines that govern how financial transactions and statements are recorded, interpreted, and reported. These principles are the backbone of financial accounting and are essential for maintaining transparency, consistency, and comparability in the financial world. Every organization, regardless of its size or nature, relies on these principles to ensure that its financial records are accurate and that stakeholders can trust the reported information. By following a uniform set of accounting principles, businesses can communicate their financial health effectively to investors, regulators, and other external parties. Basic Accounting principles serve as a common language for business and finance. They ensure that different entities report their financial information in a similar way, which helps in analyzing, comparing, and making informed economic decisions. Without standardized principles, it would be challenging to gauge the performance or financial position of a business. Basic Accounting Concepts are not static; they evolve with time to accommodate changes in the business environment, economic practices, and regulatory frameworks.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

Importance in Financial Reporting

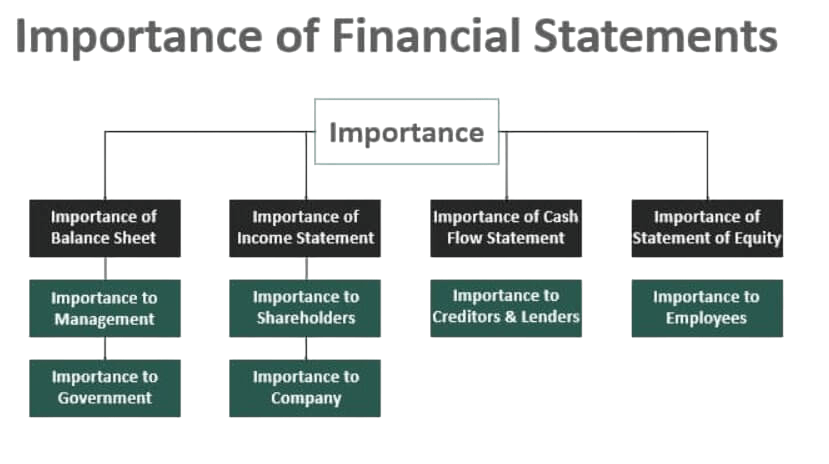

Financial reporting is the process of disclosing financial data and performance metrics of a business over a specific period. It is a key component in the decision-making process of stakeholders such as investors, creditors, regulators, and management. Basic Accounting principles ensure that financial reports are both accurate and understandable. They provide a framework for recording transactions, preparing financial statements, and maintaining internal controls. The significance of accounting principles in financial reporting is immense.

Firstly, they ensure consistency in reporting across time periods and between different companies. This allows for meaningful comparisons, trend analysis, and benchmarking. Secondly, adherence to principles enhances the credibility of financial reports. Investors and stakeholders are more likely to trust and act upon information that has been prepared according to recognized standards. Thirdly, accounting principles help organizations stay compliant with legal and regulatory requirements, thus avoiding penalties and reputational damage.

GAAP Overview

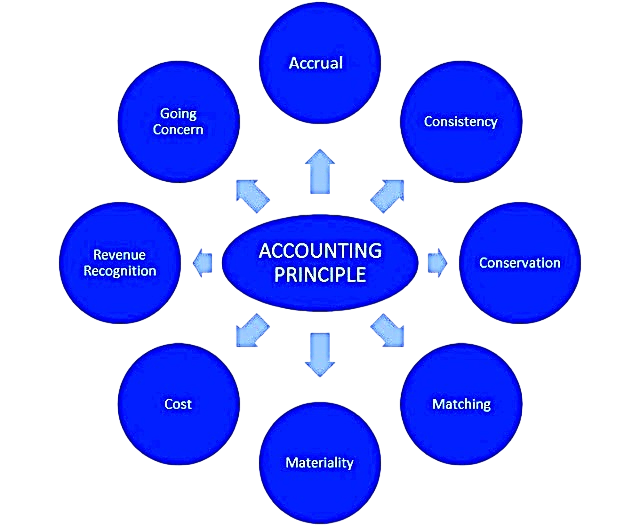

- GAAP, or Generally Accepted Accounting Principles, is a widely accepted set of accounting standards used in the United States. GAAP encompasses a broad set of rules and guidelines that cover various aspects of accounting, such as revenue recognition, expense matching, asset valuation, and financial statement presentation. Accounting Principles and Concepts are developed and maintained by regulatory bodies such as the Financial Accounting Standards Board (FASB) and the American Institute of Certified Public Accountants (AICPA).

- GAAP ensures that companies follow a consistent and transparent method of accounting, thereby making financial statements more reliable and comparable. The use of GAAP is mandatory for publicly traded companies in the U.S., and many private firms also follow GAAP to maintain standard accounting practices.

- GAAP is grounded in several Basic Accounting Concepts that guide accountants in preparing accurate and honest financial statements. These principles include the Revenue Recognition Principle, Matching Principle, Full Disclosure Principle, and Historical Cost Principle, among others.

- Revenue Recognition Principle: This principle dictates that revenue should be recognized when it is earned, not when cash is received. This aligns with the accrual basis of accounting.

- Matching Principle: Expenses should be recognized in the same period as the revenues they help to generate, ensuring that income statements reflect true profitability.

- Historical Cost Principle: Assets should be recorded at their original cost, not their current market value.

- Full Disclosure Principle: All relevant financial information should be disclosed in financial statements or notes to ensure transparency.

- Objectivity Principle: Accounting data should be verifiable and based on objective evidence.

- Consistency Principle: The same accounting methods should be used from one period to another, enabling comparability.

- Materiality Principle: All significant financial information must be reported, and trivial details can be omitted.

- Accrual Basis Accounting records revenues and expenses when they are earned or incurred, regardless of when the cash is actually received or paid. This method provides a more accurate picture of a company’s financial position and performance, as it reflects economic events more realistically.

- Cash Basis Accounting, on the other hand, records revenues and expenses only when cash changes hands. While simpler to use and easier for small businesses, the cash basis may not give an accurate representation of financial health, especially when there are significant receivables or payables.

- The accrual basis is widely used by larger businesses and is a requirement under GAAP for publicly traded companies. It aligns with principles like the matching and revenue recognition principles.

- The going concern Basic Accounting Concepts assumes that a business will continue to operate for the foreseeable future and has no intention or need to liquidate. This assumption affects the valuation of assets and liabilities and the way financial statements are prepared.

- If a company is not a going concern, assets may need to be valued at liquidation prices rather than their book values. Auditors are required to assess the going concern status of an entity and disclose any doubts in their audit reports.

- The going concern principle is fundamental because it supports long-term planning, investment decisions, and strategic business operations. It also affects the classification of liabilities as current or non-current.

- The matching concept is closely related to the accrual basis of accounting. It states that expenses should be recorded in the same accounting period as the revenues they help to generate. This principle ensures that income statements reflect the true profitability of a company during a given period.

- For instance, if a company incurs costs to produce goods in one month but sells them in the next month, those costs should be matched to the month of sale. This avoids misleading profits or losses in the interim period.

- The matching concept is crucial for accurate financial reporting and plays a significant role in cost accounting, budgeting, and performance evaluation. It ensures that the net income reported is not distorted by timing differences between revenues and expenses.

- Financial Accounting Standards Board (FASB) – Sets GAAP in the United States.

- Securities and Exchange Commission (SEC) – Regulates financial reporting for publicly traded companies in the U.S.

- American Institute of Certified Public Accountants (AICPA) – Provides guidance and sets ethical standards for accountants.

- International Accounting Standards Board (IASB) – Develops IFRS used in many countries around the world.

- Governmental Accounting Standards Board (GASB) – Establishes accounting standards for U.S. state and local governments.

Key Principles Explained

Basic Accounting Concepts make up the foundation of GAAP and accounting in general. Each of these principles plays a unique role in guiding the recording and reporting of financial transactions.

Accrual vs Cash Basis

Accounting can be performed using two main methods: the accrual basis and the cash basis. Understanding the difference between these two is essential in grasping the fundamentals of financial accounting.

The accrual basis is widely used by larger businesses and is a requirement under GAAP for publicly traded companies. It aligns with principles like the matching and revenue recognition principles.

Consistency Principle

The consistency principle states that a business must apply the same accounting methods and procedures from one period to another. This principle is important because it enables stakeholders to make valid comparisons between different accounting periods. For instance, if a company switches its depreciation method from straight-line to declining balance without justification, it may mislead stakeholders about its financial performance. However, if a change in accounting method is necessary, it must be disclosed clearly along with the rationale and its impact on financial statements. Consistency not only improves the reliability of financial reports but also instills confidence among investors and regulators. It ensures that reported financial data is comparable over time, enabling better analysis of trends and decision-making.

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Prudence Concept

The prudence concept, also known as conservatism, suggests that accountants should exercise caution when making judgments under conditions of uncertainty. In practice, this means recognizing expenses and liabilities as soon as they are anticipated, but only recognizing revenues and assets when they are assured. For example, if a business expects a potential lawsuit loss, it should record the liability even before the actual amount is known. Conversely, potential profits should not be recorded until they are realized. The prudence concept ensures that financial statements are not overly optimistic, thereby protecting stakeholders from unexpected financial shocks. It promotes a conservative approach to accounting that emphasizes reliability and minimizes risk.

Going Concern Principle

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

Matching Concept

Limitations

Despite their usefulness, accounting principles have several limitations. One major limitation is that they often rely on historical cost rather than current market values, which can result in outdated asset valuations. Additionally, accounting principles sometimes allow for subjective judgment, such as in estimating bad debts or asset depreciation. Another limitation is that accounting principles may not fully capture non-financial factors such as employee satisfaction, environmental impact, or brand value. These qualitative elements can significantly affect a company’s long-term success but are not reflected in financial statements. Furthermore, Basic accounting principles are not globally uniform. While the U.S. uses GAAP, many other countries use International Financial Reporting Standards (IFRS). This lack of standardization can hinder international comparisons and investment decisions.

Regulatory Bodies

Several regulatory bodies are responsible for establishing, maintaining, and enforcing accounting principles:

These organizations ensure that accounting standards are robust, relevant, and evolve with changing business practices. They also play a role in enforcement, education, and international harmonization of accounting practices.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Summary

Accounting Principles and Concepts are the cornerstone of financial reporting. They ensure that financial data is recorded, reported, and interpreted in a consistent, reliable, and transparent manner. From the foundational concepts of accrual accounting and matching principles to the regulatory oversight provided by organizations like FASB and IASB, these principles underpin every aspect of modern accounting. Understanding these principles is essential for anyone involved in financial decision-making, whether you’re a business owner, investor, student, or accountant. While these principles have limitations, they provide a necessary structure that allows stakeholders to trust and understand financial information. As global markets continue to evolve, Accounting Principles and Concepts will also adapt to meet the demands of increased complexity and globalization. By mastering the core Accounting Principles and Concepts, individuals and organizations alike can enhance financial literacy, ensure compliance, and drive informed decision-making in an increasingly complex financial landscape.