- Introduction

- Financial Accounting Integration

- Cost Accounting Inclusion

- Budgeting and Forecasting

- Performance Measurement

- Decision-Making Support

- Tax Planning

- Internal Controls

- Investment Appraisal

- Risk Management

- Strategic Planning

- Conclusion

Introduction

Management Accounting plays a crucial role in today’s dynamic business environment. It is a specialized branch of accounting that focuses on providing relevant financial and non-financial information to internal stakeholders, particularly management, to support decision-making, planning, and control. Unlike financial accounting, which focuses on external reporting and historical data, management accounting is proactive, future-focused, and customized to internal needs, a skillset that can be sharpened through PMP Training. Businesses rely on management accounting to gain insights into their financial health, operational efficiency, and strategic direction. It integrates data from various sources, analyzes business trends, evaluates performance, and supports managerial decisions. By aligning financial insights with business objectives, management accounting ensures that organizations remain agile, competitive, and sustainable.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

Financial Accounting Integration

Management accounting is deeply interconnected with financial accounting, even though their purposes differ. Management accountants often extract data from financial accounting systems to prepare budgets, cost analyses, and performance evaluations. Profit and loss statements, balance sheets, and cash flow statements, for example, provide the foundation for more detailed analysis in management accounting, which also connects to understanding What is Service Marketing in aligning financial insights with customer-focused strategies. The integration enables consistent data flow across departments, ensures data integrity, and bridges short-term financial health with long-term strategic objectives. When used together, financial and management accounting offers a 360-degree view of business performance.

Cost Accounting Inclusion

- Cost accounting is considered a foundational element of management accounting. While it explicitly deals with recording, analyzing, and controlling costs, its findings are critical for managerial decisions. Cost data helps organizations understand how much it takes to produce goods or deliver services, which supports pricing, budgeting, and efficiency improvements.

- Management accountants use cost accounting techniques such as activity-based costing, job costing, and variance analysis to identify inefficiencies and propose corrective actions. These insights are relevant for production departments and inform broader strategic decisions such as outsourcing, product discontinuation, or process automation.

- Thus, cost accounting is not a standalone process but an integral component that empowers management accounting to support profit optimization and resource management.

- Budgeting and forecasting are core responsibilities of management accountants. Budgeting involves creating detailed financial plans for a specific period, setting revenue targets, cost limits, and capital allocation, all of which are closely tied to understanding What is a Business Model. Conversely, forecasting predicts future financial outcomes based on historical data, market trends, and internal performance metrics.

- Management accounting uses both to provide a financial roadmap for the business. Budgets help enforce discipline and accountability across departments, while forecasts allow managers to adjust plans proactively based on changing conditions. Tools such as rolling forecasts and zero-based budgeting enhance flexibility and responsiveness.

- These processes help ensure that businesses remain aligned with their financial goals and are well-prepared for uncertainties, enabling more confident and calculated decision-making.

- Although tax accounting is distinct, management accounting contributes significantly to tax planning by ensuring tax efficiency in business operations. Management accountants analyze the tax implications of investment decisions, business structures, and financial transactions to minimize tax liabilities legally.

- They work closely with tax professionals to align business strategies with the most favorable tax treatments. For example, choosing between leasing and buying assets or timing income recognition and expense deductions can have significant tax consequences.

- Effective tax planning supports compliance while preserving cash flow and enhancing after-tax profitability. It is a key area where financial prudence meets strategic foresight, and management accounting plays a guiding role.

- Internal controls are systems and procedures designed to safeguard assets, ensure accuracy in financial reporting, and promote operational efficiency. Management accountants help design, implement, and monitor these controls.

- Internal control monitors identify areas of risk such as unauthorized transactions, fraud, or errors and establish control measures such as segregation of duties, approval hierarchies, and automated checks. Regular audits, variance analyses, and reconciliations also fall under the purview of internal control monitoring.

- Strong internal controls reduce financial risk and build stakeholder confidence. Management accounting is a guardian of organizational integrity and compliance in this context.

- Risk is an inherent part of business, and management accounting plays a crucial role in identifying, evaluating, and mitigating it, aligning directly with the Objectives of Management Accounting. Risks may arise from market volatility, supply chain disruptions, credit defaults, legal compliance, or operational failures.

- Management accountants use sensitivity analysis, scenario planning, and risk mapping techniques to assess the likelihood and impact of various risks. They also help develop contingency plans and risk controls to protect the business from adverse events.

- Proactive risk management enhances business resilience, ensures regulatory compliance, and protects the company’s reputation. By integrating risk awareness into business planning, management accounting enables smarter, more sustainable decisions.

- Strategic planning is about setting long-term objectives and determining the best way to achieve them. Management accounting provides the data-driven foundation for this process. By analyzing internal capabilities and external environments, management accountants help define achievable goals and align resources accordingly.

- They support strategic initiatives such as market expansion, digital transformation, product development, and operational restructuring. Financial modeling, SWOT analysis, and benchmarking are commonly used tools.

- Moreover, strategic planning requires ongoing evaluation, and management accountants ensure plans remain relevant through continuous monitoring and adjustment. They act as advisors to top management, translating strategy into actionable financial plans.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Budgeting and Forecasting

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

Performance Measurement

One of the most critical roles of management accounting is evaluating performance across various dimensions. It measures how well departments, teams, or processes contribute to organizational goals. Financial accounting focuses on preparing standardized reports for external users such as investors, creditors, and regulatory agencies, while management accounting utilizes financial data internally for strategic decisions, a capability that can be further developed through PMP Training. Financial metrics like return on investment (ROI), gross margin, and net profit are supplemented by operational indicators such as production efficiency, employee productivity, and customer satisfaction. Performance measurement frameworks such as the Balanced Scorecard allow management accountants to assess financial and non-financial metrics. This holistic approach encourages alignment between daily operations and long-term strategy. Regular performance reviews help identify trends, highlight areas of concern, and reward high-performing units. Performance measurement supports continuous improvement and value creation by ensuring transparency and accountability.

Decision-Making Support

At its core, management accounting supports business decisions. Whether deciding between two investment opportunities, entering a new market, or launching a product, management accountants provide the quantitative and qualitative analysis needed to make informed choices, ensuring alignment with Financial Management in Business. They employ decision-making tools such as marginal costing, contribution, break-even, and sensitivity analysis. These techniques help managers understand the financial implications of different choices, evaluate trade-offs, and select the most profitable or least risky options. Moreover, management accounting adds value by providing scenario-based planning and what-if analyses, equipping decision-makers with the confidence to act decisively and strategically in uncertain conditions.

Tax Planning

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Internal Controls

Investment Appraisal

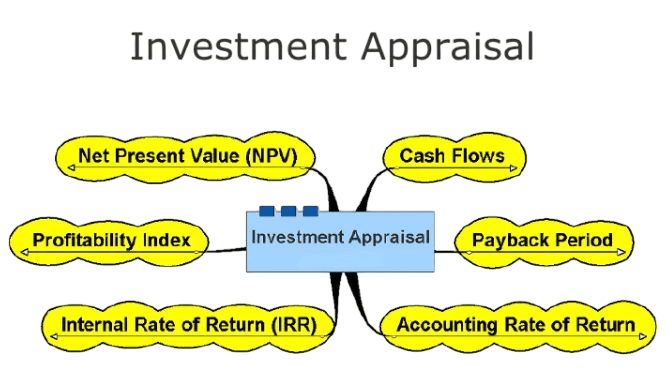

Management accounting is essential in evaluating investment opportunities and capital budgeting decisions. Using techniques such as Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, and Profitability Index, management accountants assess the financial viability of proposed projects, all of which are closely tied to Profit Maximization in Financial Management. These analyses consider the time value of money and the strategic fit of investments. For instance, launching a new product line, acquiring a company, or expanding into a new region requires rigorous financial justification.

Investment appraisal ensures that capital is allocated to initiatives that generate the best returns, thus aligning financial resources with business growth objectives. Management accountants also evaluate risk-adjusted returns and recommend mitigation strategies.

Risk Management

Strategic Planning

Conclusion

Management Accounting has evolved from a purely financial function into a strategic partner in business management. It extends beyond cost control to encompass budgeting, forecasting, performance measurement, decision-making, tax planning, internal control, and strategic development. Providing timely, relevant, and actionable information empowers managers to make informed decisions that drive organizational success, a capability that can be strengthened through PMP Training. Its integration with financial accounting, cost accounting, and other disciplines ensures a comprehensive view of the business landscape. Whether enhancing efficiency, ensuring compliance, or navigating uncertainty, management accounting is indispensable in the modern business world. Organizations that leverage management accounting effectively are better positioned to adapt, grow, and succeed in today’s competitive environment.