- Introduction to Management Accounting

- Budgeting in Management Accounting

- Standard Costing

- Marginal Costing

- Break-Even Analysis

- Variance Analysis

- Ratio Analysis

- Cash Flow Analysis

Introduction to Management Accounting

Management Accounting is a crucial aspect of business that focuses on providing financial and non-financial information to managers for decision-making purposes. Unlike financial accounting, which deals with external reporting, management accounting is centered on internal processes. It aids in planning, controlling, and evaluating the performance of an organization by offering insights into cost management, budgeting, forecasting, and financial analysis. Management accounting involves techniques such as variance analysis, cost allocation, break-even analysis, and profitability analysis to ensure that a company can make informed decisions and align its resources effectively. PMP Training supports strategic decision-making by providing relevant data about the operational efficiency and financial health of a business. By examining trends, potential risks, and opportunities, management accounting helps managers make informed decisions that can lead to long-term success. Additionally, it assists in performance evaluation by measuring actual results against budgeted figures, ensuring resources are utilized efficiently. Overall, management accounting plays a vital role in helping businesses optimize their operations and stay competitive in an ever-changing market environment. Through its comprehensive tools and techniques, it serves as a backbone for managerial decision-making, driving growth and profitability.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

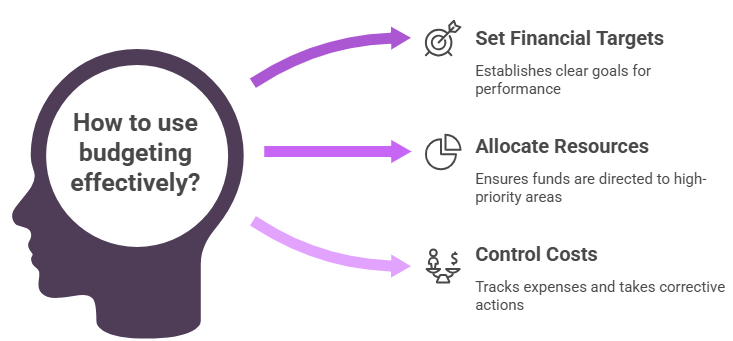

Budgeting in Management Accounting

- Setting Financial Targets: Budgets act as financial goals, setting clear revenue and expense targets for departments or projects to guide performance.

- Resource Allocation: Case Study on Marketing Management budgeting helps managers allocate resources efficiently, ensuring that funds are directed to areas with the highest priority and potential for growth.

- Cost Control: By comparing actual expenses to budgeted figures, managers can track variances and take corrective actions to control costs.

Budgeting in management accounting is an essential process that helps organizations plan and control their financial resources effectively. It involves forecasting future financial performance and setting targets for various departments, ensuring that the company operates within its financial means while achieving its goals. By using budgeting tools and techniques, managers can make informed decisions and assess the company’s financial health. A Certified Management Accountant (CMA) plays a key role in this process, providing expert insights to develop realistic budgets that align with the organization’s strategic objectives.

- Forecasting and Planning: Budgeting provides a structured approach for forecasting future financial outcomes, enabling proactive planning and risk management.

- Performance Evaluation: Budgets serve as a benchmark to evaluate the financial performance of departments, projects, or the entire organization, helping managers identify areas for improvement.

- Strategic Decision-Making: A well-prepared budget helps managers make data-driven decisions regarding investments, expansion, and cost-cutting initiatives, with the guidance of a Certified Management Accountant to ensure alignment with long-term goals.

- Focus on Variable Costs: The technique primarily looks at variable costs, such as direct materials, labor, and other costs that fluctuate with production. It helps businesses track how these costs influence the overall cost structure.

- Contribution Margin:By calculating the difference between sales and variable costs, businesses determine the contribution margin. This is a crucial metric for understanding how much revenue contributes to covering fixed costs and generating profit, which is valuable for those pursuing a Product Manager Career Path

- Pricing Decisions: Understanding variable costs allows managers to set competitive prices that ensure the business covers these costs while maintaining a profitable margin. It’s especially useful when facing price competition in the market.

- Break-even Analysis: This approach is essential for break-even analysis. It helps businesses calculate the sales volume needed to cover both variable costs and fixed expenses, highlighting the point at which the company neither makes a profit nor incurs a loss.

- Profitability Assessment: By isolating variable costs, businesses can determine the profitability of individual products or services, making it easier to prioritize those that yield higher margins.

- Cost Control: The method is key for effective cost control. Managers can track and minimize variable costs, improving the efficiency of the production process and contributing to overall profitability.

- Cost Variance: This measures the difference between the actual and expected costs. It can help identify areas where the company has spent more or less than anticipated, such as material costs or labor costs.

- Sales Variance: This evaluates the difference between actual sales revenue and budgeted revenue. It helps businesses understand whether they are meeting their revenue targets and whether sales strategies need to be adjusted.

- Material and Labor Variance: Variance analysis can break down the discrepancies in material and labor usage, helping managers control costs more effectively by pinpointing areas where inefficiencies occur, which aligns with the Functions of Product Management.

- Price and Quantity Variances: This involves analyzing the difference between the expected price of materials or labor and the actual price paid, as well as the quantity used. It helps in controlling unit costs.

- Management Performance Evaluation: By comparing actual performance against budgeted figures, variance analysis provides a clear picture of how well managers are performing in controlling costs and meeting financial objectives.

- Decision-Making Tool: Variance analysis helps in making key business decisions. Identifying favorable and unfavorable variances enables managers to adjust operations, optimize processes, and enhance overall financial performance.

Standard Costing

Standard cost accounting is a vital management tool used to measure and control costs within an organization. It involves setting predetermined or “standard” costs for materials, labor, and overhead, which serve as benchmarks for evaluating actual performance. These standard costs are based on historical data, industry trends, and estimated future conditions, and they are used to compare with actual costs incurred. The differences, known as variances, are analyzed to determine the reasons for discrepancies and provide insights into cost control and operational efficiency. One of the primary benefits of standard cost accounting is that it simplifies the cost analysis process by providing a clear point of comparison for management, a crucial Key Tools and Techniques in Management Accounting. By monitoring and analyzing variances, managers can take corrective actions, optimize resource allocation, and ensure that production processes remain cost-effective. Additionally, standard cost accounting helps in budgeting, forecasting, and financial planning by offering a predictable cost structure. It provides a consistent framework for measuring performance across periods and departments, contributing to improved decision-making. Overall, standard costing is an effective technique in management accounting that aids in controlling costs, improving profitability, and enhancing organizational efficiency by identifying and addressing cost-related issues promptly.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Marginal Costing

Marginal costing is a vital concept in management accounting that helps businesses understand the incremental cost of producing one additional unit. It focuses on analyzing variable costs, which change with the level of production, and excludes fixed costs from the decision-making process. This method enables managers to make informed decisions on pricing, production levels, and profitability by evaluating how each additional unit impacts the overall financials. By using this approach, organizations can efficiently allocate resources, minimize wastage, and optimize profit margins.

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

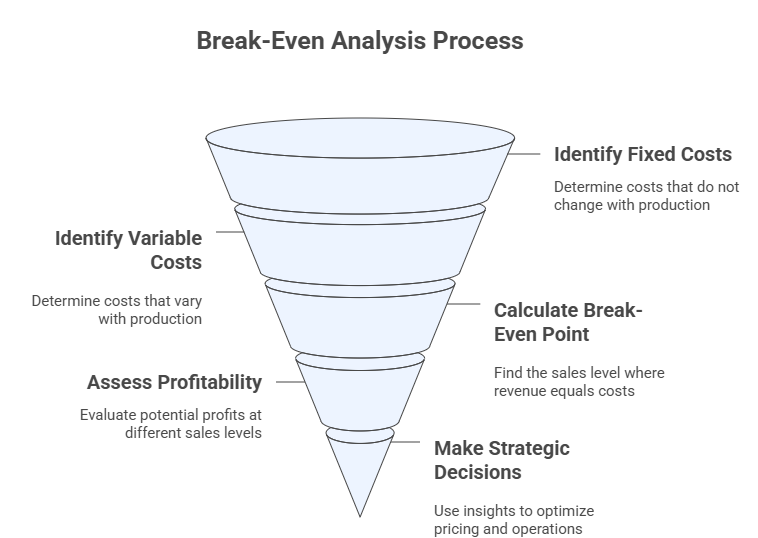

Break-Even Analysis

Break-even analysis is a fundamental tool in management accounting that helps businesses determine the level of sales needed to cover both fixed and variable costs. It provides critical insights into the point at which a company’s total revenues equal its total costs, meaning there is no profit or loss. This analysis is crucial for businesses to understand the minimum sales volume required to avoid financial loss and start generating profit. By focusing on fixed costs, variable costs, and sales price per unit, companies can calculate their break-even point and assess the risk associated with different production or sales levels. PMP Training in addition to assessing profitability, break-even analysis is a valuable tool for making strategic decisions regarding pricing, cost control, and product mix. It also helps businesses evaluate how changes in costs or sales volumes impact overall profitability. For instance, if variable costs increase, the break-even point will rise, requiring higher sales to cover the increased expenses. Understanding the break-even point enables managers to make data-driven decisions about scaling operations, launching new products, or adjusting pricing strategies. Overall, break-even analysis helps businesses minimize risk, optimize pricing strategies, and make more informed decisions to ensure long-term profitability and sustainability.

Variance Analysis

Variance analysis is an important tool in management accounting that helps businesses compare actual financial performance with budgeted or expected performance. By identifying the differences, or variances, between planned and actual results, organizations can assess their performance, understand the causes of discrepancies, and take corrective actions. Variance analysis is used for both cost control and performance evaluation, helping managers make informed decisions to improve efficiency and profitability. It is particularly useful in assessing both material costs and labor costs, providing insights into where a business is over performing or underperforming.

Ratio Analysis

Ratio analysis is a powerful tool used in management accounting to evaluate a company’s financial performance by analyzing the relationships between different financial variables. It helps businesses assess their profitability, liquidity, efficiency, and solvency by using key financial ratios derived from the company’s income statement and balance sheet. Common ratios include the current ratio, quick ratio, return on equity (ROE), and gross profit margin, each offering insights into different aspects of the company’s financial health. Ratio analysis allows management to benchmark the company against industry standards or competitors, highlighting areas of strength and weakness, which can be valuable for understanding How to Become a Project Manager. It also aids in identifying trends over time, enabling better forecasting and decision-making. For instance, a low current ratio may indicate liquidity problems, while a high return on equity (ROE) can suggest that the company is effectively using its equity to generate profits. Moreover, ratio analysis provides valuable information to investors and stakeholders, helping them make informed decisions about the company’s financial stability and growth potential. By continuously monitoring and analyzing these ratios, businesses can ensure they remain financially sound and well-positioned for future growth, making ratio analysis an essential component of strategic planning and performance evaluation.

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Cash Flow Analysis

Cash flow analysis is an essential tool in management accounting that helps businesses assess their ability to generate cash and manage cash inflows and outflows. By evaluating the cash flow statement, which categorizes cash activities into operating, investing, and financing activities, this analysis provides insights into the company’s liquidity and overall financial health. PMP Training helps identify whether a company has sufficient cash to meet its short-term obligations, invest in growth, and return value to shareholders. A positive cash flow indicates that a company is generating enough cash from its core operations, while a negative cash flow may signal potential liquidity problems or an overreliance on external financing. In addition, cash flow analysis helps in forecasting future cash needs, allowing businesses to plan for working capital requirements, debt repayments, and capital expenditures. It also aids in assessing the sustainability of the company’s earnings, distinguishing between cash profits and accounting profits. Investors and stakeholders often rely on cash flow analysis to evaluate the financial stability of a company, as it highlights its ability to maintain operations without relying heavily on credit. Overall, cash flow analysis is crucial for making informed business decisions, optimizing cash management, and ensuring long-term financial stability.