- Introduction

- Investment Decisions

- Financing Decisions

- Dividend Decisions

- Working Capital Management

- Financial Planning

- Budgeting and Forecasting

- Risk Management

- Conclusion

Introduction and Purpose of a BRD

Scope Of Financial Management is a vital function within any organization, involving the planning, organizing, directing, and controlling of financial resources to achieve strategic objectives. It plays a critical role in ensuring that funds are allocated efficiently, financial risks are managed effectively, and both short-term needs and long-term goals are met. Regardless of the size or type of organization, sound financial management practices are essential for maintaining profitability, ensuring liquidity, and achieving sustainability. The primary aim of financial management is to maximize the value of the firm while maintaining financial stability. This includes making informed decisions in key areas such as investment, financing, and dividends. Investment decisions focus on how to allocate capital to projects or assets that will yield the best returns. Financing decisions involve determining the right mix of equity and debt to fund these investments in a cost-effective manner. Dividend decisions guide whether profits should be distributed to shareholders or retained for future growth. Another important area is working capital management, which ensures that the organization maintains adequate cash flow to meet day-to-day operational expenses. Managing inventories, accounts receivable, and accounts payable efficiently helps avoid liquidity issues and supports smooth business operations. Financial planning and analysis also form an integral part of financial management. By forecasting future performance, evaluating financial risks, and analyzing trends, managers can make data-driven decisions that align with the organization’s goals. In essence, financial management provides the framework for making strategic choices that strengthen the organization’s financial health and drive long-term success.

Investment Decisions

Investment decisions, also called capital budgeting decisions, involve allocating capital to long-term assets or projects that will impact a company’s future growth and profitability. These decisions are critical because they determine how resources are used to generate returns over time. To make sound investment choices, companies analyze potential projects using various financial metrics such as return on investment (ROI), payback period, internal rate of return (IRR), and net present value (NPV). These tools help quantify the expected benefits and costs associated with each investment. Strategic investment decisions require a comprehensive evaluation of external and internal factors. Companies must examine market trends to ensure their investments align with current and future demand. Technological advancements also play a key role, as investing in outdated technology can result in lost competitive advantage. Additionally, analyzing competitor strategies helps businesses identify opportunities and threats in the marketplace. Risk assessment is another important element of investment decisions. High-return projects may come with significant risks that could threaten the company’s financial health. Therefore, it is essential to balance potential rewards with the risks involved. Companies often use risk management techniques to mitigate uncertainties. Finally, investment decisions must align with the company’s long-term vision and goals. Factors such as the regulatory environment and availability of funds also influence these choices. By carefully evaluating all these elements, businesses can make informed investment decisions that support sustainable growth and maximize shareholder value.

Financing Decisions

Scope Of Financial Management decisions pertain to the methods by which a business raises capital to fund its operations and growth initiatives. These decisions involve determining the right mix of debt and equity financing. The goal is to minimize the cost of capital while maintaining an optimal capital structure. Equity financing includes issuing shares to raise money, which doesn’t require repayment but dilutes ownership. Debt financing, on the other hand, involves borrowing funds that must be repaid with interest, thereby imposing a fixed financial burden. Companies must carefully weigh the pros and cons of each financing method. An effective financing strategy ensures adequate liquidity and financial flexibility. It also influences the company’s credit rating and investor confidence. Additionally, financing decisions must align with the company’s risk appetite, current market conditions, and tax considerations.

Dividend Decisions

Dividend decisions revolve around the distribution of profits to shareholders. A company must decide whether to retain earnings for reinvestment or distribute them as dividends. These decisions significantly impact shareholder satisfaction and market perception. There are various dividend policies a firm can adopt, such as stable, constant, or residual dividend policies. A stable dividend policy ensures regular payments, fostering investor trust, while a residual policy distributes dividends from leftover profits after all Scope Of Financial Management needs are met. Factors influencing dividend decisions include profitability, cash flow position, growth opportunities, tax policies, and shareholder preferences. A well-thought-out dividend policy maintains a balance between rewarding shareholders and supporting future expansion.

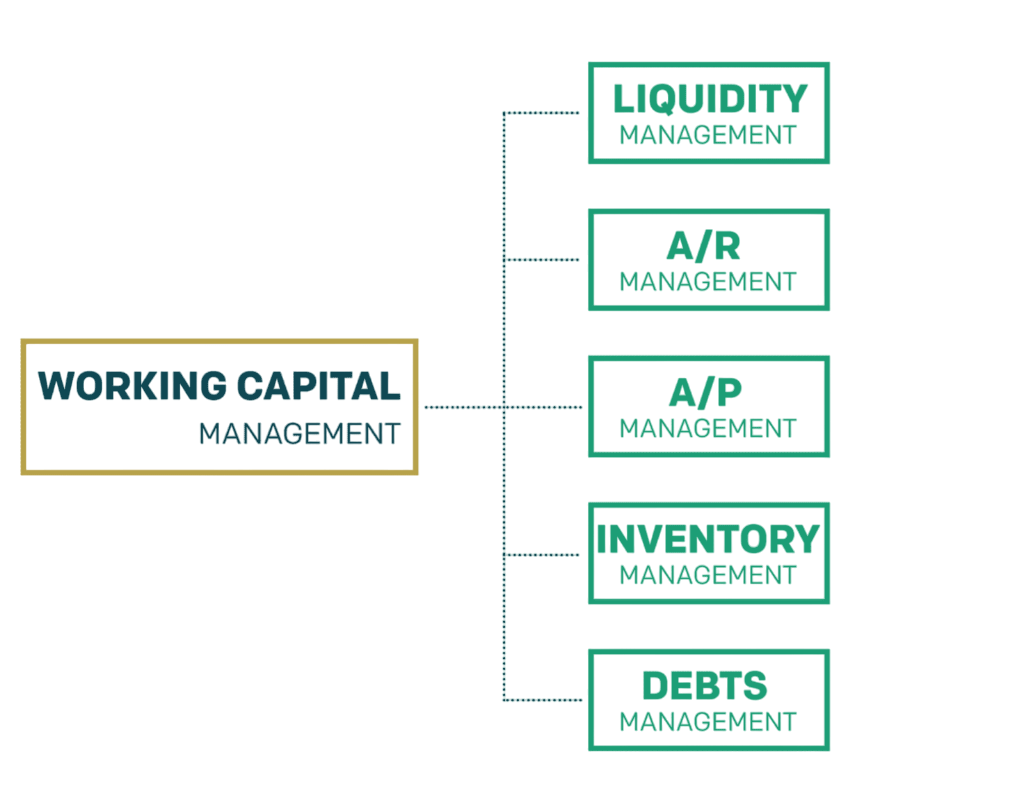

Working Capital Management

- Working capital management focuses on managing a company’s short-term assets and liabilities to maintain sufficient liquidity for daily operations. It is a vital aspect of financial management because it ensures that a business can meet its immediate financial obligations while maintaining smooth operations.

- Effective working capital management helps improve operational efficiency, reduce costs, and strengthen the company’s financial position.

- The key components of working capital include inventory, accounts receivable, accounts payable, and cash reserves.

- Managing inventory involves maintaining the right balance to avoid stockouts or excess holding costs. Accounts receivable management ensures that customers pay their invoices on time, which is crucial for maintaining cash flow. On the other hand, managing accounts payable involves negotiating favorable payment terms with suppliers to optimize cash outflows. Cash reserves must be sufficient to cover unexpected expenses and support daily activities.

- Achieving the right level of working capital is essential. Too little working capital can lead to liquidity problems, making it difficult for the company to pay bills or invest in opportunities. Too much working capital, however, may signal inefficiency, as excess funds could be better used elsewhere for growth or investment.

- Several techniques aid in managing working capital effectively. Just-in-time inventory systems reduce holding costs by receiving goods only when needed. Credit management policies help ensure timely collection of receivables. Cash flow forecasting allows businesses to predict cash needs and avoid shortages or surpluses.

- Ultimately, efficient working capital management ensures the company operates smoothly without financial disruptions, contributing to overall business success.

Financial Planning

Financial planning is the process of estimating the capital required and determining its allocation. It ensures that the organization has adequate funds to meet its objectives and operate efficiently. Financial planning involves budgeting, forecasting, and long-term planning. It aligns financial resources with business goals, facilitates investment and financing decisions, and aids in risk management. Effective financial planning also ensures better coordination among departments and helps in performance evaluation. A good financial plan includes revenue projections, expense estimates, capital expenditure plans, and funding strategies. It should be flexible enough to accommodate changes in business conditions and market dynamics.

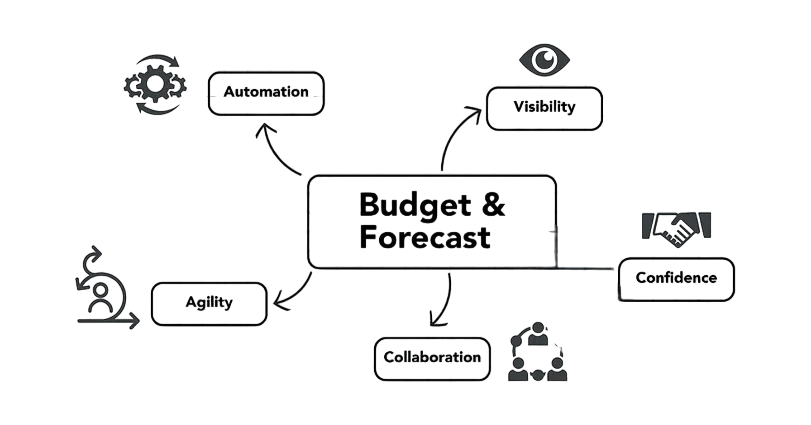

Budgeting and Forecasting

Budgeting and forecasting are essential parts of financial planning that help organizations manage their resources and plan for the future effectively. Budgeting is the process of setting financial targets and allocating resources to meet those goals.

It acts as a financial roadmap, guiding spending and investment decisions throughout a given period. By establishing budgets, companies can monitor their performance, control costs, and ensure that funds are used efficiently to support business objectives. Forecasting, on the other hand, involves predicting future financial outcomes based on historical data, market trends, and economic conditions. It provides insights into expected sales, cash flows, expenses, and other key financial metrics. This forward-looking approach allows businesses to anticipate changes in the market, prepare for potential challenges, and seize opportunities ahead of time. For budgeting and forecasting to be effective, collaboration across departments is crucial. Different teams contribute valuable information, ensuring that budgets and forecasts are realistic and aligned with overall business goals. Using reliable data is equally important, as inaccurate or outdated information can lead to poor financial decisions. Modern financial software tools enhance the budgeting and forecasting process by automating calculations, enabling scenario analysis, and improving accuracy. Additionally, regular variance analysis comparing actual results with budgets or forecasts helps identify discrepancies early. This allows management to take corrective actions promptly, such as adjusting spending or revising strategies, to keep the organization on track. In summary, budgeting and forecasting provide a structured framework for financial control and strategic planning, enabling businesses to navigate uncertainty and achieve their financial objectives.

Risk Management

Risk management is a vital component of financial management that focuses on identifying, analyzing, and addressing potential financial risks that could impact an organization’s ability to achieve its goals. These risks can take various forms, including market risk, which arises from fluctuations in market prices or interest rates; credit risk, related to the possibility of a counterparty defaulting on obligations; liquidity risk, which concerns the firm’s ability to meet short-term financial demands; and operational risk, funding strategies, stemming from internal processes, systems, or human error. To effectively manage these risks, organizations develop a comprehensive risk management framework. This framework begins with risk assessment, where potential risks are identified and evaluated based on their likelihood and potential impact. Following this, policies are formulated to guide risk mitigation efforts. These policies are then put into action through various control measures, such as establishing limits on exposures, implementing internal controls, and ensuring compliance with regulations. Continuous monitoring and review are essential to adapt to changing conditions and to ensure that controls remain effective. Common techniques used to reduce financial risks include hedging, which uses financial instruments like derivatives to offset potential losses; purchasing insurance to transfer certain risks; and diversification, which spreads risk across different assets or business areas to reduce exposure to any single risk. Financial managers must remain vigilant by monitoring macroeconomic trends, regulatory changes, and internal financial indicators. Integrating risk management with strategic planning allows organizations to anticipate potential challenges, make informed decisions, and build resilience. This proactive approach ultimately supports sustainable growth and protects shareholder value over the long term.

Conclusion

Financial management has numerous applications and is critical to business success. It encompasses strategic decisions on everyday financial activity, risk, dividends, financing, and investment. Companies can facilitate long-term growth, ensure financial stability, and improve profitability by effectively managing these aspects.