- Introduction to APT

- Background and Origin

- Key Assumptions

- APT vs CAPM

- Mathematical Representation

- Factors in APT

- Application in Portfolio Management

- Limitations

- Empirical Testing

- Real-life Examples

- Conclusion

Introduction

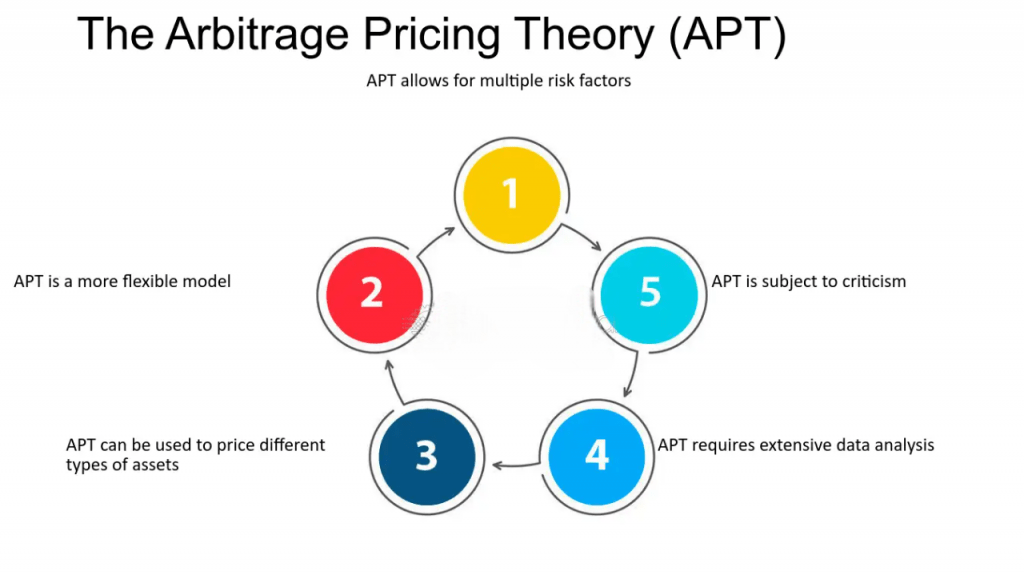

The Arbitrage Pricing Theory (APT) is a fundamental concept in modern finance that offers a way to assess the expected return of an asset based on its relationship to multiple economic factors. Developed by economist Stephen Ross in the 1970s, APT extends beyond the classical Capital Asset Pricing Model (CAPM) by suggesting that asset returns are driven not just by the overall market, but also by various macroeconomic factors. Unlike CAPM, which uses a single factor (the market portfolio), APT posits that several systematic factors contribute to asset pricing. In essence, APT provides a multi-factor model to explain asset returns by factoring in the sensitivity of the asset to various economic influences. These influences may include inflation rates, interest rates, industrial production, and other macroeconomic factors, offering a broader, more nuanced approach compared to traditional asset pricing models.

To Explore PMP in Depth, Check Out Our Comprehensive PMP Certification Training To Gain Insights From Our Experts!

Background and Origin

The concept of APT was introduced in 1976 by Stephen Ross, a financial economist. His work provided a more flexible alternative to the Capital Asset Pricing Model (CAPM), which was the prevailing asset pricing theory at the time. CAPM was based on the assumption that there is a single factor the market portfolio that drives asset returns. However, Ross believed that there are several factors influencing asset returns and that the relationship between these factors and returns could be modeled more precisely through arbitrage opportunities. APT was created as a response to the limitations of CAPM. While CAPM assumes a world of perfect competition and a single risk factor, APT acknowledges the complexity of real markets, where a variety of forces affect the prices of assets. APT is less restrictive and allows for greater flexibility in its application, making it appealing to those seeking a more comprehensive understanding of asset pricing.

Key Assumptions

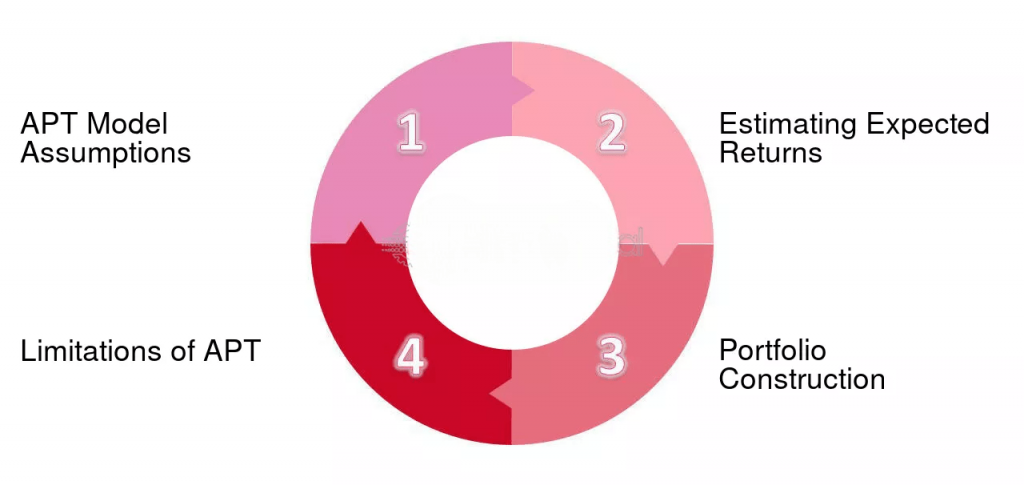

APT rests on several key assumptions that distinguish it from other asset pricing theories like CAPM. These assumptions are important for understanding how APT works and why it might be more applicable in some situations:

- Return Determinants: Asset returns are influenced by multiple factors such as interest rates, inflation, and GDP growth. These factors, or systematic risks, are not necessarily related to the market as a whole but to various aspects of the economy.

- Arbitrage: The theory assumes the existence of arbitrage opportunities. If an asset is mispriced relative to the factors that determine its price, investors can exploit price discrepancies by buying undervalued assets and selling overvalued ones, driving prices back to equilibrium.

- No Arbitrage Condition: APT assumes that there are no arbitrage opportunities in the market. If such opportunities do exist, they would quickly disappear as investors exploit them, leading to the elimination of discrepancies.

- Linear Relationship: The relationship between asset returns and the factors is assumed to be linear. That is, each factor’s effect on the asset’s return can be captured through a simple mathematical equation.

- Factor Sensitivity: The returns of an asset are sensitive to each factor, but the degree of sensitivity varies from one asset to another. This is typically represented by factor loadings (also known as betas), which measure how an asset responds to changes in each factor.

- Single Factor vs. Multi-factor Model: CAPM uses the market portfolio as the single factor that explains asset returns. In contrast, APT uses multiple factors such as inflation, interest rates, and GDP growth. APT thus provides a more nuanced and detailed approach to asset pricing by incorporating several economic influences.

- Assumptions about the Market: CAPM assumes that the market is in equilibrium and that investors are rational, whereas APT makes fewer assumptions about the market’s structure and focuses on the relationship between asset returns and multiple factors.

- Risk Considerations: In CAPM, the risk of an asset is determined by its covariance with the market portfolio. APT, however, uses factor loadings to determine how sensitive an asset is to various economic factors.

- Arbitrage: APT relies on the no arbitrage condition, meaning that any price discrepancies between assets and their theoretical prices (derived from the factors) will be exploited by investors, eliminating those discrepancies. CAPM does not incorporate the concept of arbitrage.

- Flexibility: APT is more flexible than CAPM because it allows for the inclusion of multiple factors in the pricing model. In contrast, CAPM is limited to the market as the sole source of risk.

- E(Ri)E(R_i) is the expected return of asset ii,

- RfR_f is the risk-free rate,

- β1,β2,…,βk\beta_1, \beta_2, \dots, \beta_k are the sensitivities (or factor loadings) of the asset to the various factors F1,F2,…,FkF_1, F_2, \dots, F_k.

- Risk Diversification: By using APT, portfolio managers can ensure that they are not overly exposed to any single economic factor. They can diversify risk across multiple factors, potentially reducing the overall risk of the portfolio.

- Factor Hedging: APT allows managers to hedge exposure to specific factors. For instance, if an investor is concerned about inflation, they could overweight assets that are less sensitive to inflation or that perform well when inflation rises.

- Improved Asset Allocation: APT provides valuable insights for asset allocation decisions. By understanding which factors are likely to affect asset returns, portfolio managers can make more informed decisions about which assets to include in their portfolios.

- Factor Identification: Identifying the relevant factors that drive asset returns can be difficult. It requires extensive data analysis, and even then, there is no guarantee that the chosen factors will capture all relevant sources of risk.

- Model Complexity: The more factors that are included in the model, the more complex it becomes. This can make it difficult to estimate the betas accurately and may lead to overfitting.

- No Clear Guidance on Factor Selection: Unlike CAPM, which has a clear theoretical basis for using the market as a factor, APT lacks a precise guideline for selecting factors. This is an issue for practitioners looking for simplicity and clear direction.

- Assumptions of Perfect Arbitrage: APT assumes that arbitrage opportunities will be fully exploited by the market, leading to price corrections. However, in reality, perfect arbitrage opportunities may not always exist.

- Inflation and Interest Rates: In the 1970s and 1980s, inflation and rising interest rates were key factors that influenced the returns of many asset classes, particularly bonds. APT would have allowed investors to account for these factors and adjust their portfolios accordingly.

- Technology Sector: For technology stocks, factors such as innovation, regulatory changes, and economic growth play a significant role in determining their returns. Using APT, investors could measure the exposure of these stocks to such factors.

Are You Preparing for PMP Jobs? Check Out ACTE’s Project Management Interview Questions & Answer to Boost Your Preparation!

APT vs CAPM

The Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT) are both used to explain the relationship between risk and expected return, but they differ in several significant ways.

Mathematical Representation

The mathematical representation of Arbitrage Pricing Theory is relatively straightforward. The expected return of an asset under APT can be modeled as follows:

E(Ri)=Rf+β1(F1)+β2(F2)+⋯+βk(Fk)E(R_i) = R_f + \beta_1 (F_1) + \beta_2 (F_2) + \dots + \beta_k (F_k)

Where:Factors in APT

The Arbitrage Pricing Theory (APT) asserts that macroeconomic variables negatively influence an asset’s return. These variables may be known from statistical analysis or observation of the prevailing economic conditions. Inflation is an important variable because changes in the inflation rate change the purchasing power of money, and some (or all) asset classes, like stocks, bonds, and other investments, may be impacted. One variable with a strong impact on the value of all assets, but particularly fixed-income securities, is interest rates. Other economic conditions may impact the underlying economy’s overall performance, often measured by GDP growth, and because earnings from business will directly impact prices of all other assets, we can utilize the general condition of the economy as a factor to consider. Exchange rates may also impact income and costs of businesses involved in international trade, and therefore, currency fluctuations are another key variable to consider. Similarly, changes in commodity prices, for example, oil, metals, and other inputs used to produce goods, will likely affect asset prices, especially if the commodity is a critical input.

This currency risk, or exchange rate changes, can affect income and costs for firms participating in international trades; therefore, currency change is an essential factor. Likewise, underlying changes in commodity prices, such as those generated for oil, metals, and raw materials, may also affect asset prices, especially in industries that are commodity-heavy. All together, these macroeconomic factors give the foundation for understanding how and why asset prices change under APT and provide a broader and more flexible model than any of the single-factor models.

Are You Interested in Learning More About PMP? Sign Up For Our PMP Certification Training Today!

Application in Portfolio Management

APT is widely used in portfolio management because it offers a framework to understand how various factors influence the performance of a portfolio. By identifying the relevant factors affecting asset returns and understanding the sensitivities (betas) of individual assets to those factors, portfolio managers can construct portfolios that are better aligned with market expectations.

Limitations

While APT is a powerful tool, it does have several limitations:

Are You Considering Pursuing a Master’s Degree in PMP? Enroll in the PMP Masters Program Training Course Today!

Empirical Testing

APT has been subject to empirical testing over the years, with mixed results. Some studies suggest that APT provides a better explanation of asset returns than CAPM, especially when there are multiple relevant factors affecting the market. However, other studies have shown that the factors identified by APT do not always explain asset returns as well as expected, indicating that the theory may be limited in practice.

Real-life Examples

Conclusion

In conclusion, Arbitrage Pricing Theory (APT) offers a more flexible and comprehensive approach to asset pricing than traditional models like CAPM. By considering a wide range of macroeconomic factors, APT provides portfolio managers and investors with better tools for understanding and managing risk. However, its practical application depends on correctly identifying the relevant factors and accurately measuring the sensitivities of assets to those factors. Despite its limitations, APT remains a valuable framework in modern financial theory, particularly in understanding how various economic variables influence asset returns and portfolio management.