- Concept of Profit Maximization

- Objectives and Importance

- Short-Term vs Long-Term Focus

- Methods to Maximize Profit

- Role in Business Strategy

- Risk Consideration

- Cost Control and Revenue Growth

- Conclusion

Concept of Profit Maximization

Profit maximization is a fundamental concept in economics and business management that focuses on determining the optimal level of output and pricing to achieve the highest possible profit. It is considered the primary objective for most businesses, especially in capitalist economies, where financial success often measures organizational performance. When a company maximizes its profit, it strengthens its ability to survive in competitive markets, provides returns to its shareholders, and generates capital for reinvestment in innovation, infrastructure, and growth initiatives. The concept of profit maximization is based on the principle of marginal analysis, a technique used to evaluate the additional cost and revenue of producing one more unit of output. According to this approach, a firm should continue increasing production as long as the marginal revenue, or the revenue gained from selling an additional unit, is greater than the marginal cost, which is the cost incurred to produce that unit. The point at which marginal cost equals marginal revenue is considered the profit-maximizing output level. Producing beyond this point results in decreasing profits, as the cost of making extra units would exceed the income generated from selling them. Although profit maximization is a key goal, it must often be balanced with other business responsibilities, such as ethical operations, legal compliance, environmental sustainability, and employee welfare. In today’s business environment, many companies aim to create long-term value by addressing the needs of multiple stakeholders in addition to seeking financial gain. However, a solid understanding of maximize profit remains essential for effective pricing strategies and overall financial planning.

Objectives and Importance

The main objective of profit maximization is to achieve the highest possible return from business operations. This fundamental goal serves as a driving force behind many corporate decisions and supports various aspects of organizational success. Profit is not just a measure of financial performance but a key element that enables a company to sustain itself, compete effectively, and invest in future opportunities. One of the primary purposes of profit maximization is survival and growth. In highly competitive markets, only firms that generate sufficient profits can survive over the long term. Profits provide the necessary capital for research and development, expansion into new markets, and technological innovation, all of which are vital for business growth. Another important goal is to enhance shareholder wealth. For publicly traded companies, profit maximization generally leads to higher dividends and rising stock prices. This increases the value of investments for shareholders and builds investor confidence in the company’s future performance. Profit maximization in financial management also promotes efficient resource allocation. Firms that focus on profitability tend to use their resources wisely, minimizing waste and directing inputs to their most productive uses. This efficiency not only benefits the company but also contributes to the overall health of the economy. A strong market reputation often follows high profitability. Companies that consistently perform well financially are more likely to attract investors, retain customers, and appeal to talented professionals seeking stable and rewarding employment. Finally, profit maximization acts as an incentive mechanism. It encourages entrepreneurs and managers to reduce costs, improve productivity, and seek innovative solutions that enhance business performance.

Short-Term vs Long-Term Focus

Profit maximization can have different implications in the short term versus the long term. In the short term, a company may engage in cost-cutting, price adjustments, or aggressive marketing to increase profits quickly. However, these actions might not be sustainable or could damage the company’s reputation. In contrast, long-term profit maximization considers the broader impact of business decisions, such as customer loyalty, brand value, employee satisfaction, and sustainability. Long-term strategies may involve investments that do not yield immediate returns but are crucial for future profitability.

Methods to Maximize Profit

Several methods are employed by businesses to maximize profits:

- Cost Reduction: Streamlining operations, automating processes, and reducing waste to lower operational costs.

- Revenue Enhancement: Expanding product lines, entering new markets, improving sales techniques, and enhancing customer experience.

- Pricing Strategies: Using pricing models such as penetration pricing, skimming, and value-based pricing to attract or retain customers.

- Product Differentiation: Offering unique features, quality improvements, or branding that allows for premium pricing.

- Operational Efficiency: Improving productivity through better management practices, employee training, and technology.

- Financial Management: Controlling expenditures, managing debts, and optimizing capital structure.

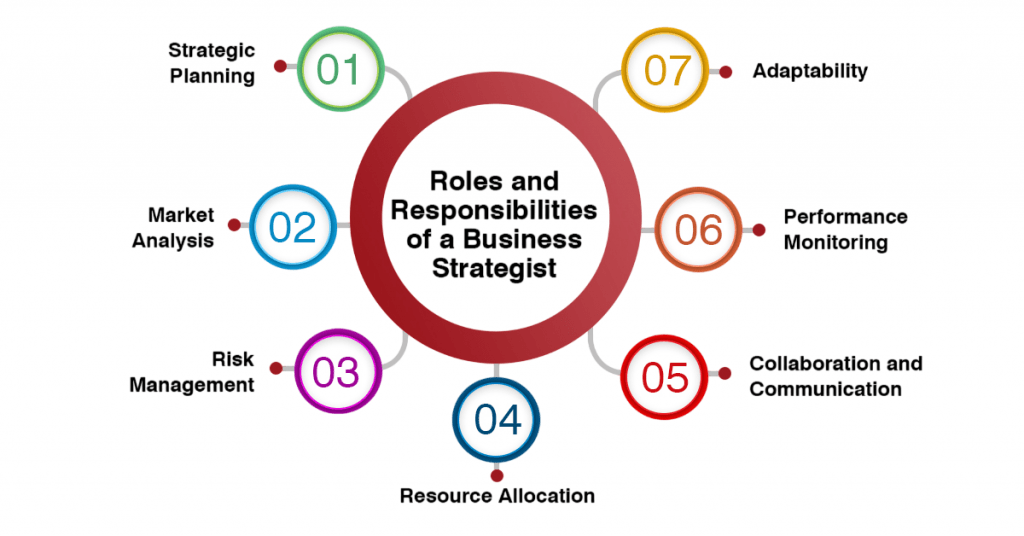

Role in Business Strategy

Role in Business Strategy Profit maximization lies at the core of strategic planning and serves as a primary objective that guides decision-making across all areas of a business. Whether in marketing, employee training, operations, finance, or product development, strategic actions are typically assessed based on their potential to increase profitability.

Organizations that prioritize profit maximization aim to make informed decisions that not only address immediate needs but also build a sustainable path toward long-term financial success. In marketing, strategies are designed to increase sales, build brand awareness, and enhance customer loyalty—all of which contribute to higher revenues. Operations strategies may focus on improving supply chain efficiency, reducing waste, or implementing automation to lower production costs. Financial strategies often involve budgeting, investment planning, and cost control, with the goal of improving the company’s overall financial health. Each of these functions, though different in execution, ultimately supports the goal of maximizing profit. Strategic decisions such as entering new markets, launching new products, or pursuing mergers and acquisitions are carefully evaluated for their expected impact on the bottom line. A well-crafted strategy balances short-term profitability with long-term growth. For example, a company might invest heavily in a new technology platform that increases costs in the short term but enhances efficiency, customer experience, and market share in the long term. Ultimately, integrating profit maximization into strategic planning ensures that resources are allocated effectively and that every major initiative contributes to the company’s financial goals. This alignment helps drive sustainable success, allowing businesses to remain competitive and resilient in changing market conditions.

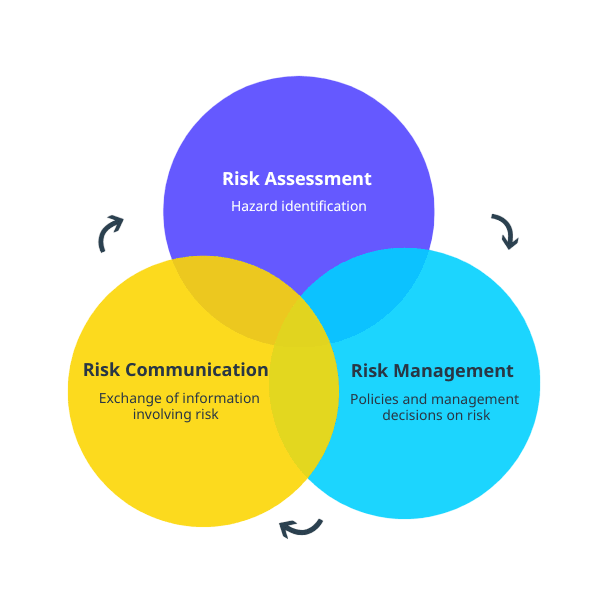

Risk Consideration

Profit maximization does not come without risks. Focusing too narrowly on profits can lead to:

- Overlooking Stakeholders: Ignoring the needs of employees, customers, or the community can lead to backlash and reduced goodwill.

- Regulatory Issues: Engaging in unethical or borderline legal practices for the sake of profit can attract regulatory scrutiny.

- Market Volatility: Strategies that work in a stable environment may fail under market uncertainties or economic downturns.

- Operational Risk: Cost-cutting may compromise product quality or employee morale, leading to operational inefficiencies.

- Cost control involves managing expenses through strategic budgeting, regular cost audits, efficient vendor negotiations, and the application of lean management practices. Companies must understand the distinction between fixed and variable costs and find ways to reduce unnecessary expenditures without compromising the quality of products or services. Efficient cost management not only improves the bottom line but also frees up resources that can be reinvested in growth initiatives. Organizations often implement automation, streamline operations, and renegotiate supplier contracts as part of their cost-control efforts.

- Revenue growth on the other hand, focuses on increasing the top line through multiple strategies. These include expanding into new markets, launching innovative products, enhancing customer retention, employee training and implementing upselling and cross-selling techniques. Businesses also leverage tools such as digital marketing, data analytics, and customer relationship management systems to better understand customer behavior and increase sales. A strong emphasis on delivering value to customers often leads to higher loyalty and repeat business, which are critical for sustained revenue growth. Balancing cost control with revenue enhancement is essential for consistent profit maximization. Overemphasis on one at the expense of the other can limit growth or compromise efficiency. When managed effectively together, these levers form the foundation of a profitable and resilient business model.

Therefore, a balanced approach that considers potential risks is essential in the pursuit of profit maximization.

Cost Control and Revenue Growth

Effective profit maximization depends on two fundamental levers: cost control and revenue growth. These elements must work in harmony to ensure a strong and sustainable profit base. Businesses that successfully manage both areas are better positioned to achieve long-term financial success, withstand economic fluctuations, and maintain a competitive edge.

Conclusion

Profit maximization remains a vital element of business success, serving as a key indicator of operational efficiency and financial health. It enables companies to generate returns for shareholders, reinvest in innovation, expand market presence, employee training and build long-term competitiveness. However, in today’s rapidly evolving and socially conscious business environment, the pursuit of profit should not exist in isolation. Organizations must recognize that long-term success is achieved not only through financial performance but also by aligning profit strategies with broader values and responsibilities. A modern and effective approach to profit maximization considers sustainability, ethical practices, stakeholder interests, and market dynamics. This means companies need to operate transparently, treat employees fairly, minimize environmental impact, and build trust with customers and partners. Ignoring these elements may yield short-term financial gains, but can lead to reputational damage, employee dissatisfaction, and regulatory challenges over time. Strategic planning should balance short-term profitability with a long-term vision. For instance, investing in sustainable technologies or employee development may increase costs initially, but such investments often lead to enhanced efficiency, stronger brand loyalty, and greater resilience. Additionally, companies that adopt responsible business practices tend to attract socially conscious investors and customers, creating new growth opportunities. As global markets become more complex and stakeholder expectations continue to rise, businesses that integrate profit motives with responsibility, innovation, and adaptability are more likely to achieve sustained growth. This balanced approach not only drives profitability but also creates enduring value for all stakeholders involved.