- Overview of Capital Markets

- Components: Equity and Debt

- Functions of Capital Markets

- Primary and Secondary Markets

- Instruments Traded

- Role in Economic Growth

- Market Participants

- SEBI and Regulatory Role

- Conclusion

Overview of Capital Markets

Capital markets are essential pillars of the modern financial system. These markets facilitate the raising of long-term funds by channeling surplus savings from individuals and institutions into productive investments. In essence, capital markets serve as the bridge between savers and entrepreneurs, enabling businesses, governments, and other organizations to access the capital necessary for expansion, innovation, and infrastructure development.The term “capital market” encompasses all venues where buying and selling of equity (stocks) and debt (bonds) instruments take place. These markets play a vital role in mobilizing savings, ensuring efficient allocation of resources, and maintaining economic stability. Unlike money markets, Equity and Debt which deal with short-term instruments (typically less than a year), capital markets are concerned with long-term securities that have a maturity of more than one year. These markets are crucial for fostering entrepreneurship, driving economic growth, and encouraging public participation in the nation’s financial progress.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Components: Equity and Debt

Capital markets are broadly divided into two components: Equity and Debt markets and debt markets.

- These are platforms where ownership in companies is bought and sold. Companies raise funds by issuing shares to investors, who in return become part-owners. The equity market offers investors the potential for capital appreciation and dividends. Common instruments in equity markets include common shares, preferred shares, rights issues, and warrants. Equity markets are further divided into the primary market, where new shares are issued, and the secondary market, where existing shares are traded among investors.

Equity Markets:

- Debt markets involve the trading of fixed-income securities like bonds, debentures, and government securities. In these markets, the investor lends money to the issuer (a corporation, government, or financial institution) in exchange for periodic interest payments and repayment of the principal at maturity. Debt instruments are typically considered lower-risk compared to equities but offer lower returns. Government bonds, corporate bonds, municipal bonds, and convertible debentures are examples of instruments traded in the debt market.

Debt Markets:

Together, these two components make up the capital market ecosystem, each catering to different investment needs and risk appetites.

Functions of Capital Markets

Functions of Capital Markets perform a wide array of functions that contribute significantly to the health of an economy. The core functions include:

- Mobilization of Savings: Capital markets provide a platform for individuals and institutions to invest their surplus funds in productive ventures. This mobilization of savings leads to a higher capital formation rate in the economy.

- Capital Allocation: Efficient allocation of capital is one of the primary functions of capital markets. These markets allocate resources to sectors and companies that show the greatest potential for growth and returns.

- Liquidity Provision: Capital markets offer liquidity to investors by allowing them to buy and sell securities. This encourages investors to commit their capital to longer-term investments with the assurance that they can exit when needed.

- Price Discovery: Through the interaction of demand and supply in the securities market, capital markets determine the fair price of securities. This helps investors make informed decisions.

- Risk Management: Capital markets enable investors to diversify their investment portfolios across various sectors and instruments, thereby reducing overall risk exposure.

- Encouragement of Corporate Governance: Listed companies are subject to regulatory oversight and disclosure requirements. This fosters transparency, accountability, and better corporate governance.

- Economic Indicator: The performance of capital markets reflects the general economic conditions of a country. Bullish markets often signal a healthy, growing economy, while bearish markets may indicate recessionary trends.

- Initial Public Offering (IPO): A private company offers its shares to the public for the first time.

- Follow-on Public Offering (FPO): Already listed companies issue additional shares.

- Private Placement: Securities are sold to a select group of investors rather than the public.

- Rights Issue: Existing shareholders are offered additional shares at a discounted rate.

- Equity Shares: Represent ownership in a company and entitle shareholders to a share in the profits and assets.

- Preference Shares: These shares have preferential rights over equity shares regarding dividend distribution and repayment during liquidation.

- Debentures: Unsecured debt instruments that companies issue to borrow money from the public with a promise of fixed interest.

- Bonds: Debt instruments issued by governments, corporations, or municipalities. Bonds carry fixed interest payments and are considered low-risk investments.

- Convertible Securities: Instruments like convertible debentures or preference shares that can be converted into equity shares at a later date.

- Derivatives: Although not long-term capital instruments per se, derivatives like futures and options are also traded in capital markets to hedge risks.

- Mutual Funds: Pooled investment vehicles managed by fund managers that invest in a diversified portfolio of securities.

- Facilitating Capital Formation: By mobilizing long-term funds, capital markets enable the expansion of businesses and infrastructure, thereby enhancing capital stock in the economy.

- Promoting Innovation and Entrepreneurship: Access to capital encourages innovation and entrepreneurship, which leads to job creation, technological progress, and increased productivity.

- Efficient Resource Utilization: Capital markets ensure that scarce financial resources are allocated to the most productive sectors and enterprises, promoting optimal use of capital.

- Improving Corporate Governance: Publicly traded companies are required to adhere to stringent reporting and governance norms, enhancing transparency and efficiency in the corporate sector.

- Reducing Cost of Capital: The competition in capital markets leads to lower borrowing costs for companies, facilitating investment and expansion.

- Integration with Global Markets: A robust capital market attracts foreign direct investment (FDI) and foreign portfolio investment (FPI), increasing foreign exchange reserves and strengthening the domestic economy.

- Investors: Individuals, institutions (mutual funds, pension funds, insurance companies), foreign portfolio investors (FPIs), and high-net-worth individuals (HNIs) who provide capital in exchange for returns.

- Issuers: Corporations, government bodies, and public sector undertakings that issue securities to raise funds.

- Intermediaries: Include stockbrokers, merchant bankers, underwriters, registrars, and transfer agents who facilitate the issuance and trading of securities.

- Stock Exchanges: Platforms like NSE and BSE where secondary market trading takes place, providing liquidity and transparency.

- Clearing Corporations and Depositories: Entities like NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited) manage the dematerialization and settlement of securities.

- Credit Rating Agencies: Organizations such as CRISIL, ICRA, and CARE evaluate the creditworthiness of debt instruments.

- Registration and Regulation of intermediaries like stockbrokers, mutual funds, and merchant bankers.

- Investor Protection through grievance redressal mechanisms, investor education programs, and surveillance of market malpractices.

- Disclosure Requirements that mandate companies to provide timely and accurate financial information to stakeholders.

- Prevention of Insider Trading and other unfair practices by enforcing strict penalties and surveillance systems.

- Regulation of Corporate Governance in listed companies to enhance accountability and transparency.

- Approval of Public Issues by scrutinizing prospectuses and ensuring companies meet listing criteria.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

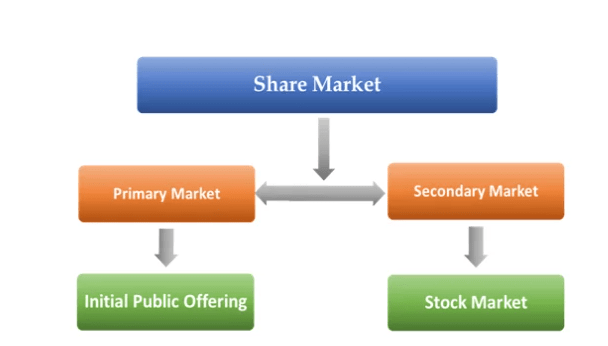

Primary and Secondary Markets

The capital market operates through two interconnected but distinct segments primary and secondary markets.

Primary Market

Also known as the new issue market, the primary market is where companies issue new securities to raise capital. These securities are sold for the first time to investors. The primary market plays a crucial role in helping companies and governments raise funds for business expansion, new projects, or infrastructure development.

Some of the key methods of raising capital in the primary market include:

Secondary Market

Once securities are issued in the primary market, they are traded in the secondary market. This market provides investors with the ability to buy and sell previously issued securities. Stock exchanges such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in India are prime examples of secondary markets. The secondary market enhances liquidity and price discovery and ensures efficient functioning of the capital market ecosystem. It also gives confidence to investors, knowing they can exit their investments when desired.

Instruments Traded

A wide range of financial instruments is traded in capital markets, each designed to cater to different financing and investment needs. These include:

Each of these instruments has unique features, risks, and return profiles, enabling investors to align their portfolios with financial goals and risk tolerance.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Role in Economic Growth

Capital markets play a pivotal role in the overall development and Role in economic growth of an economy. Their contribution is multi-faceted and deeply interconnected with various economic parameters:

In summary, a well-developed equity market infrastructure is integral to sustaining economic growth and achieving long-term development goals.

Market Participants

The capital market ecosystem consists of various participants who play distinct yet interrelated roles:

Each participant plays a critical role in ensuring the smooth functioning, integrity, and stability of the capital market.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

SEBI and Regulatory Role

In India, the Securities and Exchange Board of India (SEBI) serves as the chief regulatory authority for capital markets. Established in 1988 and granted statutory powers in 1992, SEBI’s mandate is to protect investor interests, promote the development of capital markets, and regulate the functioning of intermediaries.

Key regulatory functions of SEBI include:

SEBI also plays an active role in policy formulation, technological upgradation, and integration of Indian capital markets with global standards. Its proactive and investor-centric regulatory framework has made Indian markets more robust, transparent, Role in economic growth and attractive to both domestic and international investors.

Conclusion

Capital markets are a cornerstone of modern economies, serving as platforms for mobilizing long-term funds, enabling investment, and fostering financial inclusion. Comprising equity and debt markets, Role in economic growth these financial systems perform critical functions such as Functions of Capital Markets allocation, risk management, Economic Growth and price discovery. The primary and secondary markets ensure continuous capital flow, while diverse instruments offer investment opportunities tailored to varied risk-return preferences.Participants ranging from individual investors to institutional powerhouses interact within this ecosystem under the supervision of regulatory authorities like SEBI. The regulator plays a pivotal role in ensuring transparency, protecting investor interests, and maintaining market integrity.Ultimately, the significance of capital markets extends far beyond financial transactions; they are engines of economic transformation. By enabling entrepreneurship, supporting corporate growth, and facilitating infrastructure development, capital markets contribute meaningfully to a nation’s prosperity. A strong and transparent capital market is, therefore, not just a financial imperative but a developmental necessity.