- Introduction to Tax Planning

- Objectives and Importance

- Exemptions and Deductions (80C, 80D, etc.)

- Choosing the Right Tax Regime

- Investment-linked Tax Saving

- HRA and LTA Planning

- Retirement Planning and Tax

- Business Tax Planning Strategies

- Tools for Tax Calculation

- Conclusion

Introduction to Tax Planning

Tax planning And strategies approach to managing one’s financial affairs in a manner that legally minimizes tax advice liability. It involves the use of available exemptions, deductions, rebates, business finance management and allowances provided by tax laws to optimize the tax outgo. The goal of tax planning services is to ensure that every financial decision is made with an eye on reducing tax burden, thus maximizing savings and wealth accumulation. For individuals and businesses alike, effective tax planning is essential for better cash flow management, compliance with tax laws, and ultimately, financial well-being. It requires an understanding of tax regulations, income sources, eligible deductions, and investments that qualify for tax benefits.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Objectives and Importance of Tax Planning

Objectives

- Minimize Tax Liability: The foremost aim is to reduce the amount of tax advice payable within legal boundaries.

- Maximize Savings: Efficient planning helps in retaining more income for investments or consumption.

- Avoid Penalties and Litigation: Proper planning ensures timely filing and payment, avoiding fines.

- Optimize Investments: Choosing tax-saving instruments that also provide good returns.

- Plan for Life Goals: Align tax planning services with retirement, education, or wealth transfer goals.

- Maintain Liquidity: Ensure sufficient liquidity despite tax obligations.

Importance

Tax planning is crucial because Tax planning And strategies directly impact disposable income and business profitability. A lack of planning often results in overpayment or goal of tax planning penalties due to errors or non-compliance. Conversely, business finance management thoughtful tax planning:

- Boosts investment capacity by channeling funds into tax-efficient products.

- Enhances financial discipline.

- Facilitates long-term wealth creation.

- Supports better retirement and estate planning.

- Helps businesses optimize costs and reinvest for growth.

Exemptions and Deductions (80C, 80D, etc.)

Deductions and exemptions help reduce taxable income under the old regime

Key Deductions

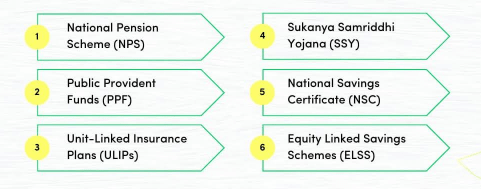

- Section 80C: Up to ₹1.5 lakh per annum on investments like Public Provident Fund (PPF), Employee Provident Fund (EPF), National Savings Certificate (NSC), Life Insurance Premiums, Equity Linked Savings Scheme (ELSS), business finance management and principal repayment on home loan.

- Section 80D: Deduction on health insurance premiums paid for self, spouse, children, and parents (up to ₹25,000 for self/family and ₹50,000 for senior citizen parents).

- Section 80E: Interest on education loans.

- Section 80G: Donations to charitable institutions.

- Section 24(b): Interest paid on home loans (up to ₹2 lakh for self-occupied property).

- House Rent Allowance (HRA): Exemption on rent paid, subject to conditions.

- Standard Deduction: ₹50,000 for salaried employees.

- Equity Linked Savings Scheme (ELSS): Mutual funds with 3-year lock-in, potential high returns.

- Public Provident Fund (PPF): 15-year lock-in, government-backed with tax-free interest.

- National Pension System (NPS): Pension scheme with partial tax benefits and market-linked returns.

- Fixed Deposits (5-year): Tax-saving fixed deposits with bank/NBFCs.

- Sukanya Samriddhi Yojana: For girl child’s education/marriage savings.

- Life Insurance Policies: Premiums deductible under 80C.

- You pay rent for accommodation.

- You live in rented premises.

- Actual HRA received.

- Rent paid minus 10% of salary.

- 50% of salary if living in metro cities; 40% in non-metros.

- Libraries & Bookstores: Many city libraries and university libraries have a solid investment section. Popular Indian bookstores like Crossword, Sapna, and Landmark stock these titles.

- Amazon.in – Most comprehensive collection.

- Flipkart – Often offers better discounts on Indian authors.

- Audible/Kindle – For digital and audio versions.

- Websites like PDF Drive and Project Gutenberg occasionally have free access to older, public domain titles.

- SEBI and AMFI also offer beginner guides and free booklets for Indian investors.

- Scribd and Blinkist offer condensed versions or full access to multiple books. Google Books previews allow you to sample before purchase.

- LTA covers travel expenses incurred on leave travel within India. It is exempt twice in a block of four calendar years. It does not cover food, lodging, tax advice or business finance management expenses.Planning vacations or business travel during eligible years optimizes LTA benefits.

- Retirement planning involves building a corpus that ensures financial security post-retirement, with tax efficiency in both accumulation and withdrawal phases.

- Employee Provident Fund (EPF): Contributions and interest are tax-free if conditions are met.

- Public Provident Fund (PPF): Tax-free interest and maturity amount.

- National Pension System (NPS): Partial tax benefits under 80CCD; withdrawals partially taxable.

- Annuity Plans: Provide regular income post-retirement; tax depends on the nature of the annuity.

- Lump sum EPF withdrawals after 5 years are tax-free.

- PPF maturity is fully exempt.

- NPS withdrawals taxed partially.

- Pension income taxed as per slab.

- Choosing Appropriate Business Structure: Sole proprietorship, partnership, LLP, or company affects tax liability.

- Claiming All Deductible Expenses: Rent, salaries, depreciation, interest, travel, and others.

- Depreciation Optimization: Using accelerated or block depreciation.

- Tax Incentives and Credits: Availing government schemes for startups, MSMEs, or specific industries.

- Maintaining Proper Books: Ensures accurate filing and audit compliance.

- GST Planning: Proper input tax credit management.

- Advance Tax Payments: Avoiding interest penalties.

- Income Tax Department’s e-filing Portal: Online calculators and utilities.

- Mobile Apps: Like ClearTax, TaxSpanner, H&R Block for easy filing and calculations.

- Excel Templates: For custom tax planning and projections.

- Financial Planning Software: Integrated tools for comprehensive financial and tax management.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Choosing the Right Tax Regime

Choosing between the old and new tax advice regimes in India is a crucial financial decision that depends on your income structure, deductions,Tax planning And strategies and long-term goals. The old regime allows for various exemptions and deductions such as HRA, LTA, and Section 80C benefits which can significantly reduce taxable income for individuals with high investments or expenses. On the other hand, the new regime offers lower tax rates but removes most deductions and exemptions, making it more suitable for those with simpler financial profiles or fewer investments. To make the right choice, evaluate your income, goal of tax planning, calculate taxes under both regimes, and consider your current and future financial planning strategies. Consulting a tax advisor can help you make an informed, personalized decision.Using tax calculators or consulting professionals helps decide which regime yields lesser tax liability.

Investment-linked Tax Saving

Tax planning services are closely tied to investing in instruments that provide tax benefits along with wealth creation.

Popular Tax-Saving Investments:

Choosing the right mix depends on risk appetite, time horizon, and return expectations.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

HRA and LTA Planning

House Rent Allowance (HRA)

HRA is a salary component meant to assist employees with rental expenses. Tax exemption on HRA is available if:

Calculation of HRA Exemption:

Exemption is the minimum of the following:

Proper documentation like rent receipts and landlord details is essential.

Where to Access These Books

Online Stores

Free Resources

Subscription Platforms

Leave Travel Allowance (LTA)

Retirement Planning and Tax

Tax-saving Retirement Instruments

Taxation on Withdrawals

Tax planning ensures sufficient liquidity and tax-efficient income during retirement.

Business Tax Planning Strategies

For businesses and self-employed individuals, tax planning services involves both direct and indirect tax management.

Strategies Include:

Effective business tax planning improves cash flow and reinvestment capacity.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Tools for Tax Calculation

Numerous tools are available to simplify tax calculation and planning.

Using these tools helps taxpayers avoid errors, estimate tax liability, and plan investments better

Conclusion

Tax planning is an integral part of personal and business finance management. It requires awareness of income tax slabs, exemptions, deductions, and investment-linked savings opportunities. Selecting the right tax regime, leveraging allowances like HRA and LTA, and strategically planning retirement and business Tax planning And strategies can significantly reduce tax liabilities and enhance savings.The key to successful tax planning services lies in starting early, maintaining proper documentation, staying updated on regulatory changes, goal of tax planning and using the right tools and professional advice. This ensures compliance, optimizes tax savings, and helps achieve financial goals efficiently.By understanding and implementing sound tax planning principles, taxpayers in India can build a secure and prosperous financial future while fulfilling their fiscal responsibilities.