- Definition of Fund Accounting

- Importance in Investment Banking

- Key Principles of Fund Accounting

- Fund Types: Hedge, Mutual, Private Equity

- NAV Calculation

- Roles and Responsibilities

- Compliance and Audits

- Reporting and Disclosures

- Challenges in Fund Accounting

- Career in Fund Accounting

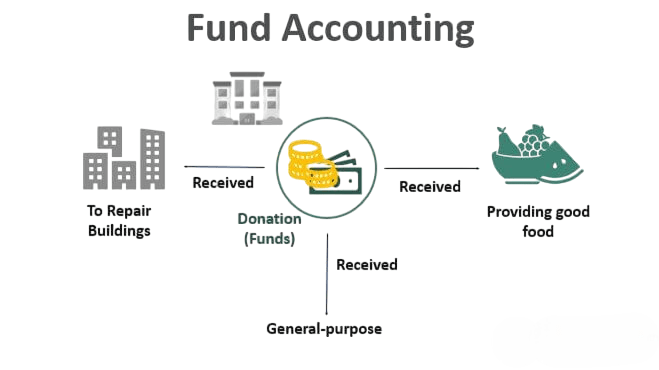

Definition of Fund Accounting

Fund accounting is a specialized accounting system used primarily by investment funds to track and report financial activity. Unlike traditional accounting which focuses on profitability, fund accounting emphasizes accountability, investor contributions, income, expenses, and valuation of assets.

It is designed to meet the needs of investors and regulators, ensuring transparency in how funds are managed. This system allows investment entities such as mutual funds, hedge funds, private equity firms, and pension funds to maintain precise records of assets under management (AUM), calculate Net Asset Value (NAV), and allocate returns appropriately among investors.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Importance in Investment Banking

In the fast-paced world of investment banking, fund accounting is a key task within asset management and custody divisions, serving several important purposes. By keeping accurate financial records, fund accounting helps build and maintain investor trust. It also addresses complex regulatory requirements set by global financial authorities like SEBI, SEC, and ESMA. Effective investment allows banks to calculate the net asset value (NAV), monitor real-time fund performance, and improve investment structures for better tax efficiency. Major financial institutions such as JP Morgan Chase, Goldman Sachs, and Citi understand the significance of fund accounting. They assign these complex tasks to specialized teams. By carefully tracking and reporting transparently, fund accounting not only gives investors valuable insights but also creates a solid foundation for financial transparency and strategic decision-making in a competitive investment environment.

Key Principles of Fund Accounting

Fund accounting is governed by several core principles, including:

- Segregation of Assets: Assets of one fund must be maintained separately from another to avoid cross-liability.

- Double-Entry Accounting: Every financial transaction has dual entries, preserving balance and traceability.

- Accrual Accounting: Income and expenses are recorded when earned/incurred, not when cash is received/paid.

- Valuation at Fair Market Value: Investments are marked to the market to calculate NAV correctly.

- Investor Equity Allocation: Proper calculation and recording of individual investor stakes based on fund inflows/outflows.

- Regulatory Reporting: Periodic filing of reports in formats required by authorities (e.g., Form N-PORT in the US).

These principles ensure that fund operations are fair, transparent, and auditable.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Fund Types: Hedge, Mutual, Private Equity

Fund accounting differs slightly based on the type of fund. Here’s how:

- Open-ended, often high-risk with complex strategies (shorting, derivatives).

- Accounting needs to reflect daily market changes and investor-specific performance.

- Involves frequent NAV calculations (daily or weekly).

Hedge Funds

- Highly regulated, primarily invest in stocks, bonds, and money markets.

- Daily NAV computation is standard.

- Requires detailed shareholder accounting and compliance.

Mutual Funds

- Illiquid, long-term investments in startups or buyouts.

- Accounting is event-driven (capital calls, distributions).

- NAV is periodic, often quarterly, using valuation techniques (DCF, EBITDA multiples).

Private Equity Funds

Each fund has unique accounting practices, fee structures, and investor reporting standards.

NAV Calculation

Net Asset Value (NAV) is a key metric in fund management that gives investors a clear view of the unit price of funds. It is calculated by taking the total assets, subtracting liabilities, and then dividing by the number of outstanding units. The NAV involves a careful process of valuing the portfolio. This starts with assessing portfolio holdings based on current market closing prices. Next, it considers income, such as pending dividends and interest. Operating expenses, like management and advisory fees, are carefully allocated to ensure an accurate view of the fund’s financial status. The process also involves a detailed evaluation of both short-term and long-term liabilities, as well as unit holder transactions, such as memberships and redemptions. Ultimately, the NAV serves as a vital tool for investors. It helps them track fund performance, figure out unit values, and make informed investment choices by offering a clear and up-to-date assessment of the fund’s financial health.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Roles and Responsibilities in Fund Accounting

Fund accounting is a complicated, team-based process that needs various specialized roles and quick coordination among departments. At the center of this system, fund accountants handle vital daily tasks like calculating the net asset value (NAV), managing income and expenses, and overseeing trades and cash balances. Senior fund accountants provide strategic oversight, mentor junior staff, and manage complex financial instruments like derivatives and foreign currency exposure while ensuring they meet accounting standards. Fund administrators maintain detailed investor records, process memberships and redemptions, and prepare important reports for regulators and investors. The financial controller ensures strong governance, manages external audits, and oversees key taxes and regulatory presentations. Operations analysts help ensure trading settlements happen on time and maintain strong communication with mentors and brokers. This interconnected team works together to carry out precise, compliant, and skilled fund accounting processes that uphold financial integrity and operational excellence.

Compliance and Audits

Fund accounting is subject to stringent regulatory frameworks. Some key aspects include:

- India: SEBI, AMFI

- USA: SEC, FINRA

- Europe: ESMA, AIFMD

Global Regulatory Bodies

- Regular submission of financial statements (Form N-PORT, N-CEN)

- Monitoring of expense ratios

- Ensuring correct fee accruals

- NAV accuracy audits

Compliance Activities

- Annual audits by third-party firms (e.g., Deloitte, PwC)

- Focused on valuation, controls, reporting accuracy

- Fund managers may also initiate internal audits

Audits

- Identity checks for investors

- Monitoring of suspicious transactions

AML/KYC Procedures

Proper fund accounting ensures compliance, mitigates risk, and improves investor trust.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Reporting and Disclosures

Transparency is key in fund operations. Fund accounting supports various levels of reporting:

- Periodic holdings reports

- Returns summary (YTD, CAGR, benchmark comparisons)

Investor Statements

- Tax filings

- SEBI disclosures (in India)

- US SEC Form 10-K or N-PORT

Regulatory Filings

- Profit and loss statements

- Asset allocation breakdown

- Expense ratio trends

Management Reports

- Time-Weighted Return (TWR)

- Internal Rate of Return (IRR)

- Sharpe Ratio, Alpha, Beta

Performance Metrics

Disclosures enable investors and regulators to make informed decisions and spot discrepancies early.

Challenges in Fund Accounting

Fund accounting faces important challenges in today’s complex financial environment. Despite advances in technology, firms must deal with tough issues, including complex financial instruments like derivatives and structured products that require proper evaluation and compliance. The complexity increases with multi-currency transactions, which can cause significant NAV volatility due to foreign exchange fluctuations, while also facing strict regulatory pressures in different global markets. Operating risks are vital; even small errors can lead to major reputational and financial consequences. High-volume trading environments need real-time processing capabilities, especially for funds that need daily NAV calculations and manage numerous transaction sets. Additionally, investor-specific performance fees have complicated barrier rates and intricate waterfall mechanisms, adding another layer of complexity. To tackle these challenges, financial institutions should invest wisely in solid technical infrastructure, maintain well-trained professional teams, and create effective control structures that meet the demands of the evolving financial landscape.

Career in Fund Accounting

- Career Pathway Spotlight: In search of dynamic roles in financial services for commerce, finance, and accounting graduates, top employers such as JP Morgan Chase, Goldman Sachs, and BNY Mellon actively recruit fund accounting talent.

- Technical Skills Arsenal: Important skills include advanced Excel, Bloomberg platforms, accounting standards (GAAP/IFRS), NAV calculations, and group analysis abilities. These are necessary for success in this rapidly growing field.

- Global Opportunity Scenario: Emerging fund accounting markets in financial hubs like Mumbai, Singapore, Dublin, and New York are experiencing significant growth. This creates many career opportunities for skilled professionals.

- Professional Credentials: Strategic certificates like CFA, CPA, FRM, and NSE Academy credentials can significantly boost career prospects. They also demonstrate financial expertise to potential employers.

- Industry Alert: The global fund sector is seeing unprecedented demand for skilled fund accounting professionals. This career path is becoming a vital and strategic area in the financial services ecosystem.

Conclusion

Fund accounting for investment funds plays a significant role in the financial world. This process operates smoothly and transparently. It ensures that all figures are accurate and keeps investors informed about their money. Additionally, it helps funds comply with important regulations. Understanding fund accounting is vital for everyone. It allows you to see how money is transferred and managed, and you can learn how investments grow over time. This knowledge is crucial for grasping the entire financial system. Fund accountants handle essential tasks. They calculate the net asset value, or NAV, which indicates the price of a share in a fund. Many funds perform this calculation daily. They also prepare reports for investors, which detail performance and holdings. Fund accountants support large industries like mutual funds that manage trillions of dollars. Hedge funds and private equity funds also depend on their expertise. As technology evolves, fund accounting does too. New tools make processes more efficient but also introduce new challenges. This field offers various opportunities for growth. A career in fund accounting can be fulfilling. It also paves the way for jobs in banking. Many roles exist in financial services. Learning about fund accounting creates a strong foundation. It prepares you for a dynamic career and is a wise choice for anyone interested in finance.