- Introduction Of Bond Price

- Face Value and Coupon Rate

- Bond Pricing Formula

- Yield to Maturity (YTM)

- Interest Rate Impact on Price

- Duration and Convexity

- Credit Rating and Risk Premium

- Callable and Convertible Bonds

- Conclusion

Introduction Of Bond Price

A bond is a fixed-income instrument that represents a loan made by an investor to a borrower, typically a corporation or government. Bonds are used by these entities to finance projects and operations. Essentially, when you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments (known as coupon payments) and the return of the bond’s face value when it matures. Bonds are popular among investors seeking predictable returns and lower risk compared to equities. They play a vital role in portfolio diversification and are integral to both personal,Risk premium and institutional investment strategies.The bond price is the amount an investor pays to purchase a bond in the market. It represents the present value of a bond’s future cash flows, which include periodic interest payments (called coupon payments) and the repayment of the face value at maturity. Bond prices are influenced by several factors, including interest rates, time to maturity, credit quality of the issuer, and market demand. When interest rates rise, bond prices typically fall, and vice versa a key concept in fixed-income investing. Understanding how bond prices are determined is essential for investors to assess the value and potential return of a bond investment.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Face Value and Coupon Rate

- Face Value (Par Value): Also known as the par value, the face value of a bond is the amount the issuer agrees to repay the bondholder at maturity. It is the principal amount printed on the bond certificate, typically in denominations like $1,000. The face value is important because it determines the amount on which interest payments are calculated and the amount returned to investors when the bond matures.

- Coupon Rate: The coupon rate is the fixed annual interest rate paid by the bond issuer to the bondholder, expressed as a percentage of the bond’s face value. For example, a bond with a face value of $1,000 and a coupon rate of 5% pays $50 in interest each year. Coupon payments are typically made semi-annually or annually, providing a steady income stream to investors.

The face value remains constant unless the bond is defaulted or restructured. Coupon rates may be fixed or variable and influence the attractiveness of a bond relative to current market interest credit rating.

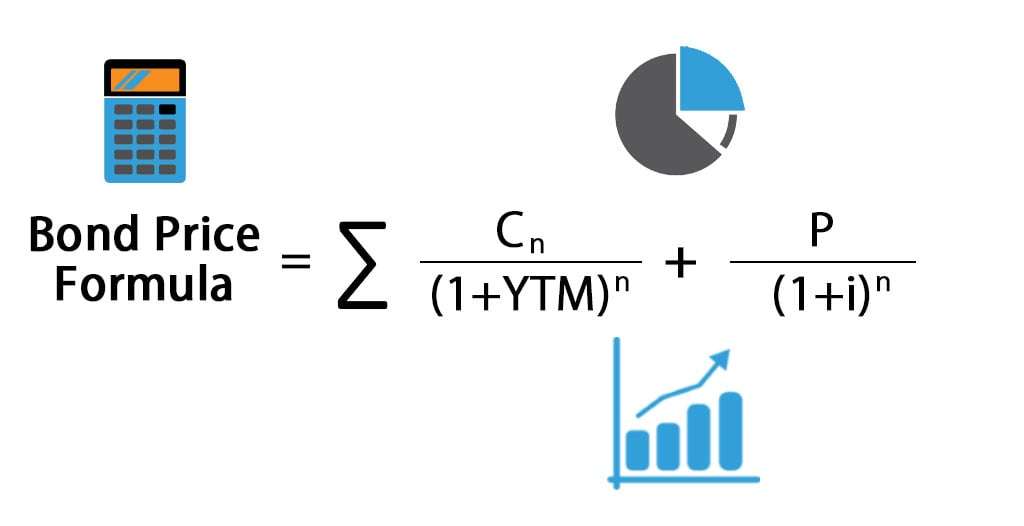

Bond Pricing Formula

The price of a bond is the present value of its future cash flows (coupon payments and face value) discounted at the market interest rate. The formula is:

Where:

- C = Coupon payment

- r = Discount rate or yield to maturity (YTM)

- t = Period when payment is made

- F = Face value

- n = Total number of periods

If the market interest rate exceeds the coupon rate, the bond will trade at a discount. If the market rate is lower, the bond trades at a premium.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Yield to Maturity (YTM)

YTM is the total return an investor can expect if the bond is held to maturity. It accounts for:

- Coupon income

- Capital gain or loss if the bond is bought at a price different from face value Time value of money

YTM is expressed as an annual rate and is a key measure for comparing Bond Pricing formula with different maturities and coupon rates.

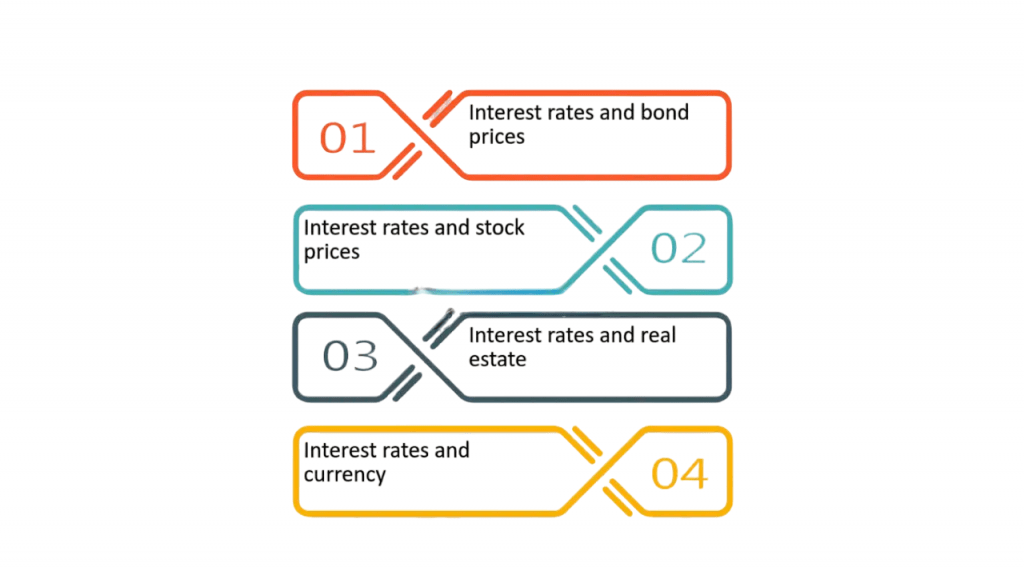

Interest Rate Impact on Price

Bond prices and Interest rate impact on price share an inverse relationship. When interest rates rise, existing bond pricing falls, and vice versa. This occurs because new bonds offer higher Yield to maturity , Interest rate impact on price making existing bonds with lower coupon payments less attractive. This sensitivity varies depending on the bond’s maturity and coupon structure. Longer-term bonds are generally more sensitive to interest rate changes than shorter-term ones.The relationship between interest rates and bond prices is inverse—when interest rates rise, bond prices fall, and when interest rates fall, bond prices rise.

This happens because newly issued bonds offer higher yields when interest rates increase, making existing bonds with lower coupon rates less attractive. As a result, the market price of existing bonds must decrease to offer a comparable yield to new issues. Conversely, when interest rates decline, existing bonds with higher coupons become more valuable, and their prices rise. This sensitivity to interest rate changes is a key consideration for bond investors and is measured using metrics like duration and convexity, which estimate how much a bond’s price will change in response to a shift in interest rates.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Duration and Convexity

- Duration: A measure of a bond’s sensitivity to interest rate changes. The higher the duration, the more the bond price will fluctuate with rate changes.

- Modified Duration: Shows the approximate percentage change in price for a 1% change in interest rates.

- Convexity: Measures the curvature in the bond price-yield relationship. Positive convexity implies that as yields fall, bond prices rise more than they fall when yields increase.

These metrics help investors assess interest rate risk and potential volatility in bond pricing.

Credit Rating and Risk Premium

Credit rating agencies (like Moody’s, S&P, and Fitch) assess the creditworthiness of bond issuers. Ratings range from AAA (highly secure) to D (default).

- Investment Grade Bonds: Rated BBB/Baa or higher.

- High-Yield (Junk) Bonds: Rated below BBB/Baa and offer higher yields to compensate for higher risk.

Risk Premium is the additional yield required by investors for taking on higher credit risk.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Callable and Convertible Bonds

- Callable Bonds: These are bonds that the issuer can redeem before their maturity date at a specified call price. Issuers usually call bonds when interest rates decline, allowing them to refinance debt at a lower cost. For investors, callable bonds carry reinvestment risk because they may have to reinvest the returned principal at lower interest rates. To compensate for this risk, callable bonds often offer higher coupon rates.

- Convertible Bonds: These bonds give investors the option to convert their bond holdings into a predetermined number of the issuer’s shares, usually at specific times during the bond’s life. Convertible bonds combine the features of debt and equity, offering fixed income through interest payments and the potential for capital appreciation if the company’s stock price rises. They typically offer lower interest rates than regular bonds due to this conversion feature.

These features affect the bond’s valuation and risk profile. Callable bonds are more sensitive to interest rate declines, while convertible bonds blend characteristics of debt and equity.

Conclusion

Understanding bond pricing is essential for building a diversified and interest rate impact on price premium portfolio. The interplay of coupon rates, Bond pricing formula ,market interest rates, maturity, credit quality,Credit Rating and market dynamics determines the fair value of bonds. Through tools like YTM, duration, and convexity, investors can measure and manage the impact of interest rate changes. Whether you are investing in sovereign debt for safety or corporate bonds for yield to maturity, a solid grasp of bond fundamentals ensures more informed and strategic decision-making in the fixed-income market.