- Definition of Portfolio Investment

- Portfolio Construction

- Types Risk Tolerance and Investment Goals

- Asset Allocation Strategies

- Diversification Principles

- Active vs Passive Management

- Role of Mutual Funds and ETFs

- Portfolio Performance Evaluation

- Conclusion

Definition of Portfolio Investment

Portfolio investment refers to the purchase of a variety of financial assets such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs) with the goal of earning returns through capital appreciation, dividends, global trends or interest, without exerting significant control over the entities invested in.Portfolio investment is a fundamental component of modern financial goals and personal wealth management. It involves strategically allocating assets across different securities and markets to achieve specific investment objectives. Unlike direct investment in businesses, portfolio investments are passive in nature and focus on returns through market Portfolio performance evaluation, dividends, or interest. This article explores the intricate components of portfolio investment, from construction and diversification to global trends and taxation. It also incorporates theoretical and behavioral frameworks for a holistic understanding.Typically involves minority, non-controlling stakes in financial securities.Includes short-term and long-term investments in diverse instruments.Contrast with Foreign Direct Investment (FDI), which involves active ownership and management.Portfolio investment can be domestic or international and caters to individual investors, institutions, financial goals and fund managers seeking optimized returns based on risk appetite and goals.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Portfolio Construction

Portfolio construction is the methodical process of selecting a mix of assets to build an investment portfolio aligned with the investor’s financial objectives and risk tolerance.

Steps in Portfolio Construction:

- Define Investment Objectives: Income, capital growth, preservation, or a combination.

- Assess Risk Profile: Conservative, balanced, or aggressive.

- Select Asset Classes: Equities, fixed income, real estate, commodities, alternatives.

- Choose Individual Securities: Specific stocks, bonds, mutual funds, etc.

- Determine Allocation Weights: Proportion of each asset in the portfolio.

Effective construction requires balancing risk and return expectations, often using quantitative models and qualitative judgment.Every investor has unique financial goals and risk tolerance that shape the structure of their investment portfolio.

Types Risk Tolerance and Investment Goals

- Conservative: Prefers safety over returns; leans towards fixed-income securities.

- Moderate: Willing to take some risk for higher returns; balanced asset allocation.

- Aggressive: Prioritizes high growth and can withstand market volatility.

Investment Goals:

- Short-term: Saving for a vacation, wedding, or emergency fund.

- Medium-term: Down payment for a house, children’s education.

- Long-term: Retirement, wealth accumulation.

Investment strategies must align with the time horizon, liquidity needs, and psychological comfort of the investor.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Asset Allocation Strategies

Asset Allocation Strategies is a fundamental component of portfolio investment, involving the strategic distribution of investments across various asset classes such as equities, fixed income, real estate, global trends and cash equivalents to balance risk and return based on an investor’s goals, risk tolerance, and investment horizon. There are several common asset allocation strategies, including strategic, tactical, and dynamic approaches. Strategic asset allocation focuses on maintaining a fixed ratio of assets, periodically rebalancing the portfolio to preserve the desired proportions. Tactical asset allocation allows temporary deviations from the target allocation to capitalize on short-term market opportunities. Dynamic asset allocation involves continuous adjustment of the portfolio in response to market changes or shifts in economic outlook. Another approach, core-satellite investing, combines a passive “core” investment with active “satellite” positions to enhance performance while controlling risk. Ultimately, choosing the right strategy requires a comprehensive understanding of market conditions and a clear alignment with the investor’s financial objectives.

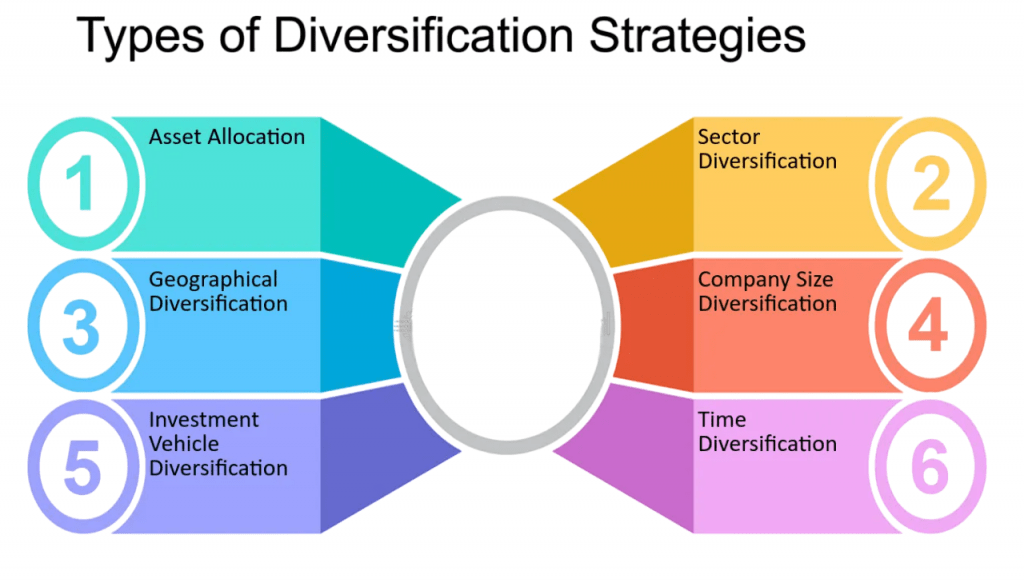

Diversification Principles

Diversification is the practice of spreading investments across different asset classes, sectors, geographies, and instruments to mitigate risk.

Benefits of Diversification:

- Reduces portfolio volatility.

- Minimizes the impact of poor-performing assets.

- Enhances the risk-return profile of the portfolio.

Types:

- Asset Class Diversification :This involves investing in different asset categories such as stocks, bonds, real estate, commodities, and cash. Each asset class reacts differently to market conditions, helping balance overall risk.

- Geographic Diversification: Investors diversify across countries or regions to reduce exposure to risks specific to a single economy or political system. This helps cushion the portfolio against localized economic downturns or geopolitical events.

- Sector or Industry Diversification:This strategy spreads investments across various sectors like technology, healthcare, finance, energy, global trends and consumer goods. It protects the portfolio from sector-specific downturns.

- Company Size Diversification (Market Capitalization): Investing in a mix of small-cap, mid-cap, and large-cap companies can balance growth potential with stability. Smaller companies often offer higher growth but come with greater risk, while larger firms are typically more stable.

- Time Diversification:Also known as dollar-cost averaging, this involves investing at regular intervals over time rather than all at once. It helps reduce the risk of entering the market at a high point.

- Investment Style Diversification: Combining different investment styles such as growth vs. value investing or active vs. passive management can help smooth out performance across market cycles.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Active vs Passive Management

Portfolio management styles are broadly categorized as active and passive.

Active Management:

- Involves selecting securities to outperform benchmarks.

- Relies on research, market timing, and judgment.

- Higher fees due to transaction costs and management expenses.

Passive Management:

- Tracks a market index (e.g., S&P 500, Nifty 50).

- Lower costs and consistent market-matching returns.

- Popular via index funds and ETFs.

While active management aims for alpha (excess returns), passive management focuses on beta (market returns) with cost efficiency.

Role of Mutual Funds and ETFs

Mutual funds and Exchange-Traded Funds (ETFs) are popular vehicles for portfolio investment, offering accessibility and diversification.

Mutual Funds:

- Actively or passively managed pools of money.

- Priced at Net Asset Value (NAV) at market close.

- Types: Equity funds, debt funds, balanced funds, sectoral funds.

ETFs:

- Traded like stocks throughout the day.

- Generally passive, tracking an index or sector.

- Lower expense ratios than mutual funds.

These instruments simplify investing for individuals by offering professional management, liquidity, and risk spreading.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Portfolio Performance Evaluation

Portfolio performance evaluation is the process of assessing how well an investment portfolio meets its objectives in terms of return, risk, and efficiency. It involves both quantitative and qualitative analysis to determine whether the portfolio manager’s decisions have added value over a given period. Key metrics used in performance evaluation include absolute return, relative return (compared to a benchmark), risk-adjusted return (such as the Sharpe ratio, Treynor ratio, or Jensen’s alpha), and volatility measures like standard deviation and beta. Evaluating performance also includes assessing consistency, adherence to the investment strategy, and the impact of market timing and security selection. A thorough performance review helps investors identify strengths and weaknesses in their portfolio management, make informed decisions about rebalancing or strategy adjustments, and ensure alignment with long-term financial goals.

Conclusion

Portfolio investment is both an art and a science. It requires a nuanced understanding ofAsset allocation Strategies, investor psychology, financial goals , risk-return trade-offs, Portfolio performance evaluation and market dynamics. Whether through individual security selection or professionally managed funds, the goal remains consistent: achieving long-term financial success aligned with the investor’s personal goals and risk profile.From modern portfolio theory to the latest global trends, an informed, disciplined approach to portfolio investment can deliver consistent value while safeguarding against market volatility.