- Introduction to Investment Banking

- Core Functions of Investment Banking

- The Role of Investment Banks in the Financial Market

- Key Players in the Investment Banking Industry

- The Skills Required to Pursue a Career in Investment Banking

- The Future of Investment Banking and Industry Trends

- Conclusion

Investment banking is a specialized sector within the financial industry focused on providing services to organizations, governments, and other large institutions. It primarily involves raising capital through the issuance of stocks and bonds, advising on mergers and acquisitions (M&A), and offering strategic financial advice. Investment banks act as intermediaries between clients and investors, helping to manage complex financial transactions. Cloud Computing Course also engage in market making, trading, and. Major investment banks include firms like Goldman Sachs, JPMorgan Chase, and Morgan Stanley. Investment bankers work closely with clients to structure deals, assess risks, and secure funding. They often specialize in certain sectors like technology, healthcare, or energy. Although lucrative, the industry is highly demanding, requiring significant expertise in finance, markets, and regulation.

Advance your Cloud Computing career by joining this Cloud Computing Online Course now.

Introduction to Investment Banking

Investment banking is a specialized sector of the financial industry that focuses on helping companies, governments, and other institutions raise capital, manage financial risks, and navigate complex financial transactions. The industry plays a pivotal role in global economies by facilitating the flow of capital and enabling growth through mergers, acquisitions, and securities trading. Unlike commercial banking, which primarily deals with Azure Advisor and lending, investment banking is heavily involved in the financial markets, advising clients on major financial decisions, and providing services related to corporate finance, securities, and asset management. In this blog, we will explore the different aspects of investment banking, its core functions, the key players in the industry, and the skills required to succeed in this highly competitive field.

The Role of Investment Banks in the Financial Market

- Investment banks are integral to the smooth functioning of financial markets. They provide essential services that facilitate capital raising, improve market liquidity, and help companies navigate complex financial transactions.

- Their ability to assess market conditions, value Enhancing Data Security with AWS Macie, and structure deals ensures that both investors and companies are able to make informed financial decisions.

- By underwriting securities and facilitating M&A activity, investment banks contribute to the growth and development of businesses, helping them expand, innovate, and create jobs.

- In addition to providing advisory and transaction-related services, investment banks also influence the flow of capital in the economy.

- Through their trading and brokerage activities, they ensure that financial markets remain liquid and efficient.

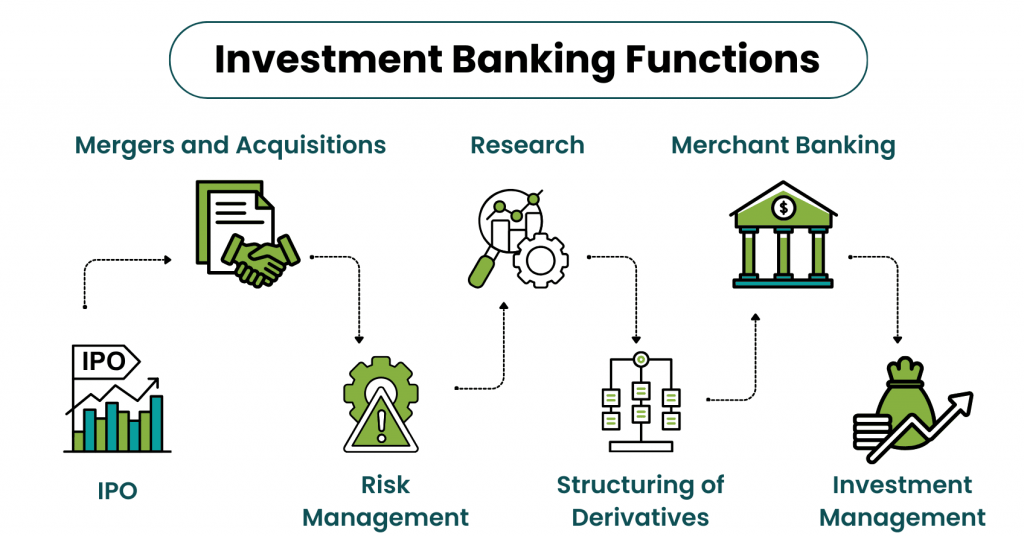

Core Functions of Investment Banking

Investment banks perform several critical functions that help businesses and governments raise money, manage investments, and develop financial strategies. These functions can be broken down into distinct areas, each playing a crucial role in ensuring the smooth operation of financial markets.

Start your journey in Cloud Computing by enrolling in this Cloud Computing Online Course .

Mergers and Acquisitions (M&A)Mergers and Acquisitions (M&A) are perhaps the most well-known activities within investment banking. Investment banks advise clients on buying or merging with other companies, helping them identify potential targets, value the transaction, and structure deals. M&A transactions are complex and involve a detailed analysis of financials, market conditions, regulatory concerns, and strategic goals. In the M&A process, investment banks often act as intermediaries between buyers and sellers, conducting due diligence, helping with negotiations, and securing financing. Load Balancing are also responsible for structuring the deal and ensuring that it is financially viable for both parties involved. Successful M&A transactions can result in significant value creation for the companies involved, making it a key function of investment banking.

Underwriting and Issuing SecuritiesOne of the primary roles of investment banks is underwriting securities. Underwriting refers to the process of helping companies issue new stocks (equity) or bonds (debt) to the public. Investment banks act as intermediaries between the company issuing the securities and the investors who will purchase them. When a company decides to go public through an Initial Public Offering (IPO), investment banks play a critical role by determining the value of the company, setting the price of the shares, and managing the sale process. The bank also helps manage the distribution of shares to institutional and retail investors. Investment banks take on significant risks during the underwriting process, as they often purchase securities from the issuer and then resell them to the market.

Investment banks also engage in the buying and selling of securities through trading and brokerage services. These transactions typically occur in the secondary market, where investors buy and sell previously issued stocks, bonds, and other financial instruments. Investment banks facilitate these trades by acting as intermediaries between buyers and sellers, often providing market liquidity and efficient pricing. In addition to traditional trading, investment banks may also engage in proprietary trading, where they use their own capital to invest in various financial assets. While this practice is less common due to regulatory changes following the 2008 financial crisis, some investment banks still engage in proprietary trading to generate profits from market fluctuations.

Asset Management and Private EquityInvestment banks often operate asset management divisions that help individuals, institutions, and pension funds manage their investments. Asset management involves selecting and Understanding Teamcity portfolios to meet the financial objectives of clients. Investment banks provide strategies that align with clients’ risk profiles and financial goals, offering everything from equity and fixed-income investments to alternative assets. Private equity is another area where investment banks play a crucial role. Private equity firms acquire companies or invest in private businesses with the goal of improving their operations, increasing profitability, and eventually selling them for a profit. Investment banks assist private equity firms by providing financing, conducting valuations, and helping with the acquisition and exit strategies.

Ready to excel in Cloud Computing? Enroll in ACTE’s Cloud Computing Master Program Training Course and begin your journey today!

Key Players in the Investment Banking Industry

The investment banking industry is made up of a mix of large, global institutions, as well as smaller boutique firms. Some of the key players in the industry include:

- Goldman Sachs: One of the most prominent names in investment banking, Goldman Sachs offers a wide range of services, including M&A advisory, trading, asset management, and securities underwriting.

- J.P. Morgan Chase: A major player in investment banking, J.P. Morgan provides services in capital markets, M&A, trading, and private equity, serving both institutional and retail clients.

- Morgan Stanley: Another global investment bank, Morgan Stanley is involved in wealth management, investment banking, and trading, with a strong presence in M&A and securities issuance.

- Barclays: A multinational bank that provides a variety of investment banking services, including corporate finance, M&A, and trading.

- Lazard: A leading boutique investment bank that specializes in M&A advisory and financial restructuring.

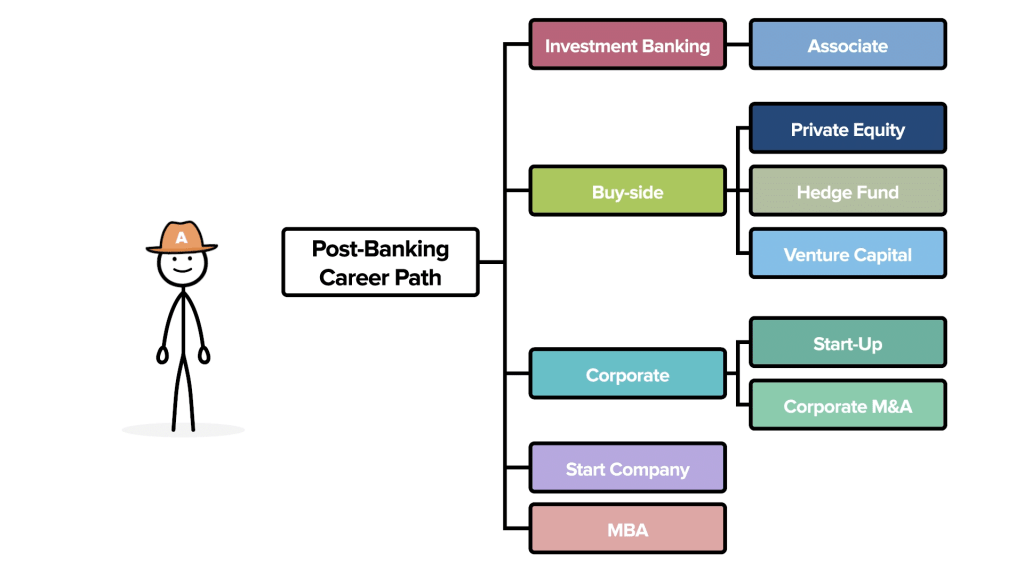

The Skills Required to Pursue a Career in Investment Banking

Investment bankers must possess a combination of analytical skills, attention to detail, and strong communication abilities to succeed in the fast-paced financial environment. Cloud Computing Course must be adept at evaluating complex financial data, understanding market trends, and analyzing company performance to make informed decisions. Precision is critical, as small mistakes can result in significant losses or missed opportunities. Additionally, they must be skilled problem-solvers, capable of thinking creatively under pressure to address financial challenges. The ability to work long hours and manage stress is also vital due to the demanding nature of the industry. A deep knowledge of financial markets and instruments enables investment bankers to offer valuable advice and navigate intricate transactions effectively.

In addition to these core skills, investment bankers need to be adaptable, as market conditions and client needs can shift rapidly. They must stay updated on global economic trends, regulatory changes, and emerging financial technologies to remain competitive. Strong teamwork is also essential, as collaboration with colleagues and clients is often required to close deals successfully. Negotiation skills play a key role in reaching favorable terms and conditions for clients, while ethical decision-making is crucial to maintaining trust and integrity in the industry. Ultimately, the ability to balance technical expertise with interpersonal skills ensures success in this high-stakes profession.

Preparing for Cloud Computing interviews? Visit our blog for the best Cloud Computing Interview Questions and Answers!

The Future of Investment Banking and Industry Trends

The investment banking industry is constantly evolving, driven by advances in technology, changing regulatory environments, and global economic trends. Some key trends shaping the future of investment banking include:

- Technological Advancements: Investment banks are increasingly adopting technology to streamline operations, automate trading, and enhance data analysis. The use of artificial intelligence (AI) and machine learning is becoming more prevalent, particularly in areas like Azure DNS Management and algorithmic trading.

- Regulatory Changes: After the 2008 financial crisis, regulatory changes such as the Dodd-Frank Act and Basel III have reshaped the investment banking landscape. These regulations are designed to reduce risk and improve transparency, but they also create new challenges for investment banks.

- Sustainability and Green Finance: As environmental concerns grow, investment banks are increasingly focusing on sustainable finance and green bonds. Clients are seeking investments that align with social responsibility and environmental goals.

- Globalization: Investment banks are expanding their reach into emerging markets, with increasing demand for services in regions like Asia, Africa, and Latin America. Globalization presents new opportunities and challenges for investment banks as they navigate diverse regulatory environments and market conditions.

- Competition from Fintech: The rise of fintech companies and digital platforms is challenging traditional investment banks. These startups offer innovative financial services, often at lower costs and with more transparency. Investment banks must adapt to this competition by embracing new technologies and business models.

Conclusion

Investment banking is a crucial component of the global financial system, helping companies raise capital, manage risk, and make strategic decisions. The industry offers a range of services, from M&A advisory to securities underwriting, asset management, and trading. Investment banks play a vital role in facilitating economic growth, driving innovation, and supporting businesses at all stages of development. As the industry continues to evolve, investment banking professionals must stay agile, adapting to new market trends, regulatory changes, and technological innovations. Cloud Computing Course interested in pursuing a career in investment banking, a combination of technical skills, strong communication abilities, and a deep understanding of financial markets will be key to success. The future of investment banking is dynamic, with exciting opportunities on the horizon for those ready to embrace the challenges and rewards of the industry.