- Definition and Concept

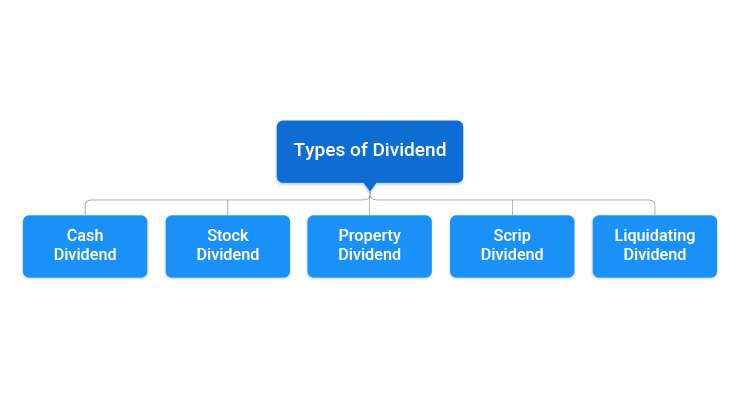

- Types of Dividends

- Dividend Declaration Process

- Dividend Yield and Payout Ratio

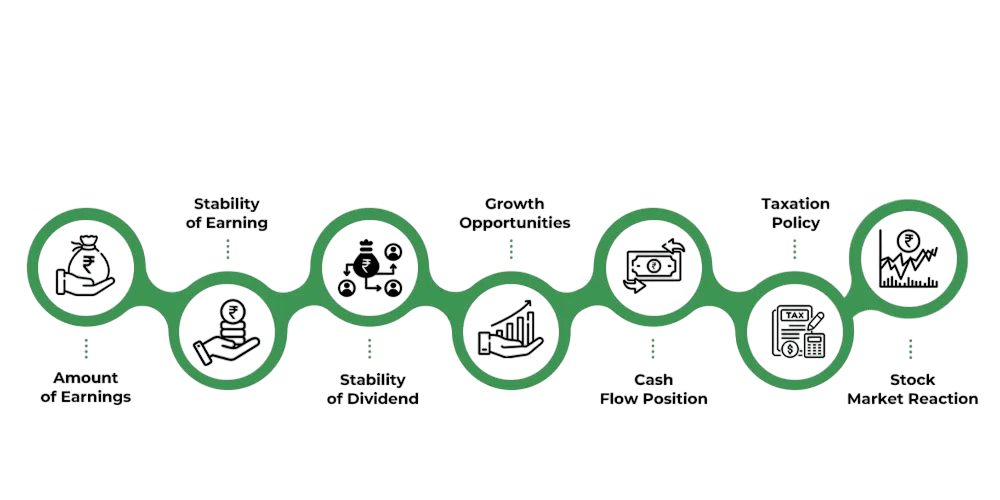

- Factors Affecting Dividend Policy

- Reinvestment vs Cash Payout

- Impact on Stock Prices

- Dividend Taxation

- Summary

Definition and Concept

A dividend is a distribution of a portion of a company’s earnings to its shareholders, typically in the form of cash or additional shares. Dividends serve as a return on investment to shareholders, reflecting the company’s profitability and management’s confidence in sustained earnings.While many companies reinvest their earnings into growth, mature and stable companies often pay dividends regularly, making them attractive for income-focused investors. Dividends in the Stock Market provide a tangible return apart from capital gains and help establish investor trust.Dividends represent one of the most visible ways companies reward their shareholders. They are a vital aspect of investment income for many investors and a key consideration in corporate finance decisions. This article explores dividends from basic definitions to complex strategic implications, Impact on Stock Prices helping investors and students of finance gain a clear understanding of this essential financial concept.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Types of Dividends

Dividends come in various forms, each with specific characteristics and implications for investors:

Cash Dividends

- The most common form.

- Paid in cash per share to shareholders.

- Directly credited to shareholders’ accounts or sent via cheque.

- Immediate income for investors.

Stock Dividends

- Paid in additional shares instead of cash.

- Increases the number of shares outstanding.

- No immediate cash outflow for the company.

- Useful when the company wants to reward shareholders but conserve cash.

Property Dividends

- Distribution of non-cash assets such as physical assets, investments, or subsidiaries.

- Rare and usually require valuation.

- Complicated to administer and less common.

Special Dividends

- One-time payments when a company has excess cash beyond normal operations.

- Often larger than regular dividends.

- Usually not recurring.

Interim Dividends

- Paid before the annual general meeting and final accounts.

- Declared between two annual dividends.

- Reflects the company’s strong cash position mid-year.

Dividend Declaration Process

The Dividends in the Stock Market declaration process is a formal procedure through which a company decides to distribute a portion of its earnings to shareholders. It begins with the board of directors, who assess the company’s financial health, profit levels, and future capital needs. If the company has sufficient retained earnings and cash flow, the board may propose a dividend.Once approved internally, the company issues a dividend declaration, stating the amount per share, the record date, and the payment date. The record date determines which shareholders are eligible to receive the dividend. To qualify, an investor must own the shares before the ex-dividend date, which is typically one business day prior to the record date.After the declaration, the company informs shareholders and regulatory authorities, and the Stock Prices begins trading types of dividends meaning new buyers will not receive the upcoming dividend. On the payment date, the dividend is distributed to eligible shareholders via bank transfer or check.This process ensures transparency, Impact on Stock Prices proper allocation of profits, and investor confidence. Regular and well-managed dividend declarations are often seen as a sign of financial stability and effective corporate governance.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Dividend Yield and Payout Ratio

Two important metrics help investors evaluate dividends:

Dividend Yield

- Dividend Yield=Annual Dividend per ShareMarket Price per Share×100\text{Dividend Yield} = \frac{\text{Annual Dividend per Share}}{\text{Market Price per Share}} \times 100

- Indicates the return on investment from dividends alone.

- Useful for income-focused investors.

- A high dividend yield may indicate undervaluation or risk.

Dividend Payout Ratio

- Payout Ratio=Dividends per ShareEarnings per Share×100\text{Payout Ratio} = \frac{\text{Dividends per Share}}{\text{Earnings per Share}} \times 100 Shows the proportion of earnings paid out as dividends.

- Helps assess dividend sustainability.

- A very high payout ratio may signal limited reinvestment in growth.

Factors Affecting Dividend Policy

- Profitability: Companies with stable and strong profits are more likely to pay regular dividends.

- Cash Flow Position: Availability of sufficient cash is essential for dividend payouts, regardless of profitability.

- Growth Opportunities: Firms with high growth prospects may retain earnings to reinvest, leading to lower dividends.

- Stability of Earnings: Consistent earnings encourage regular dividend distribution; volatile profits may lead to irregular policies.

- Debt Obligations: Companies with high debt levels may prioritize loan repayments over dividends.

- Tax Considerations: Tax treatment of dividends vs. capital gains can influence how and when dividends are paid.

- Legal Restrictions: Some jurisdictions restrict dividend payments from capital or borrowed funds.

- Access to Capital Markets: Companies that can easily raise funds externally may be more willing to pay dividends.

- Shareholder Expectations: A company may adjust its policy based on whether its investors prefer regular income or capital appreciation.

- Industry Norms: Dividend practices often vary by industry; mature industries may offer higher dividends compared to tech or high-growth sectors.

- Inflation and Economic Conditions: Inflation, interest rates, and overall economic health can impact a firm’s ability and willingness to pay dividends.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Reinvestment vs Cash Payout

A key corporate finance dilemma is whether to distribute earnings as dividends or reinvest them back into the company.

Reinvestment (Retained Earnings)

- Funds are used for R&D, acquisitions, expansion, or debt reduction.

- Can lead to higher future capital gains.

- Preferred by growth-oriented companies and investors.

Cash Payout

- Provides immediate income to shareholders.

- Preferred by income-focused investors or those valuing dividend stability.

- Signals confidence in cash flow generation.

Balancing reinvestment and payouts depends on the company’s lifecycle stage and shareholder base.

Impact on Stock Prices

Dividends can significantly influence stock prices, both in the short and long term. When a company announces a dividend, especially an increase, it often signals financial strength and confidence in future earnings, which can boost investor sentiment and drive the stock price up. Conversely, a dividend cut or suspension may indicate financial trouble, leading to a decline in stock value. However, on the ex-dividend date the day the stock starts trading without the dividend the share price typically drops by roughly the amount of the dividend. This reflects the payout that is no longer available to new buyers. While dividends provide income and stability, especially for long-term investors, their impact on price is also shaped by market expectations, types of dividends company performance, and overall economic conditions.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Dividend Taxation

Taxation on dividends varies across jurisdictions but impacts investor returns and corporate policies:

Individual Taxation

- Dividends may be taxed at different rates compared to salary or capital gains.

- Some countries offer dividend tax credits or exemptions to avoid double taxation.

Corporate Taxation

- Dividend payments are not tax-deductible for companies.

- Double taxation occurs when companies pay corporate tax on profits, and shareholders pay tax on dividends.

Tax Planning Impact

- Tax rates influence dividend policies, with companies sometimes preferring share buybacks to dividends.

Summary

Dividends represent a fundamental component of shareholder returns and corporate financial policy. Understanding their types, Impact on Stock Prices, declaration process, and key metrics like dividend yield and payout ratio helps investors make informed decisions.Dividend policies depend on various factors such as profitability, growth prospects, taxation, types of dividends, Stock Prices and investor expectations. Companies weigh reinvestment against cash payouts to optimize value creation.For investors, dividend investing offers steady income , Dividends in the Stock Market and potential capital appreciation, especially when focusing on blue-chip stocks with proven dividend records.Despite some taxation complexities and market impacts, dividends remain an essential part of the investment landscape, bridging corporate finance strategies and investor income goals.