- What is Financial Modeling?

- Types of Financial Models

- Excel Skills for Modeling

- Forecasting Techniques

- Revenue and Expense Modeling

- Cash Flow Projections

- Valuation Models (DCF, LBO, Comparable)

- Scenario and Sensitivity Analysis

- Error Checking and Audit

- Best Practices in Financial Modeling

- Tools and Certifications for Modelers

What Is Financial Modeling?

Financial modeling is the creation of a quantitative representation of a company’s financial performance, designed to forecast future outcomes under different scenarios. It’s a backbone tool used by professionals in investment banking, corporate finance, equity research, private equity, and more.

Core Objectives of a Financial Model:

Organizations use financial models as important tools to predict financial statements and perform detailed valuations through various analytical methods. Financial professionals combine historical data with future assumptions to make accurate projections of key performance indicators such as revenue growth, margins, and free cash flow. They use these models to carry out thorough scenario and sensitivity analyses, which offer valuable insights for assessing potential deal structures and fundraising opportunities. The team carefully prepares detailed outputs for essential business documents like pitch decks, board presentations, and investor materials. This process ultimately provides decision-makers with solid financial information and strategic insight.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Types of Financial Models

Types of Financial Models, each aimed at meeting specific business needs and analytical requirements. Professionals use the Three-Statement Model to predict income, cash flow, and balance sheet changes. They apply the Discounted Cash Flow (DCF) method to get accurate valuations. Private equity professionals rely on Leveraged Buyout (LBO) models to examine deals. M&A experts use merger models to offer insights into possible accretion and dilution scenarios. Retailers use merchandising models for unit-level profit analysis. Organizations track internal forecasting and variance with budget models. Finance teams use consolidation models to handle complex group reporting. Project finance specialists use project finance models to aid in capital investment decisions. Smaller businesses employ three-way cash flow models for better liquidity insights. Analysts create each model as a detailed analytical tool, turning raw financial data into useful information that supports informed decision-making in various business situations.

Excel Skills for Modeling

Excel is the foundational environment for financial modeling. Key skills include:

- Efficient Formula Use: VLOOKUP, INDEX/MATCH, IFERROR, SUMIF(S), and dynamic arrays

- Named Ranges Tables: For clarity and scalability

- Cell Referencing: Use absolute vs relative referencing intentionally

- Formatting Structure: Color-coded inputs, calculation structure, key outputs

- Error Control: IFERROR, ISERROR, FORMULATEXT

- Navigation Shortcuts: Ctrl+Arrow keys, F2, Alt+Enter, Ctrl+Click

- Chart Creation: Line, bar, waterfall, KPI dashboards

- Excel Advanced Tools: Data Tables, Solver, scenario manager

Modelers spend as much time mastering Excel as they do learning finance.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

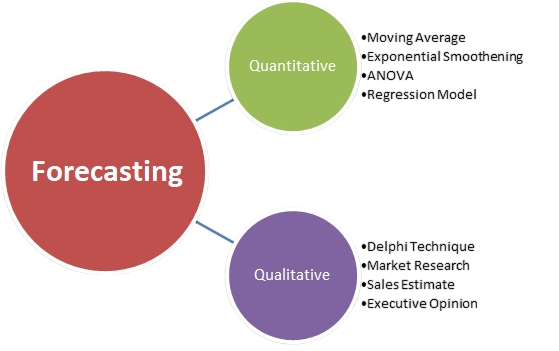

Forecasting Techniques

Forecasting project financials requires structured assumptions tied to core business drivers. Key approaches include:

- Historical Trend Analysis: Sales growth, margin trends, expense ratios

- Driver-Based Modeling: Revenue built from units × price, or headcount × salary

- Regression or Statistical Models: Predictive modeling via linear regressions

- Scenario Analysis: Best-case, Base-case, Worst-case outlooks

- Bottom-Up vs Top-Down: Build from first principles or scale historical aggregates

Models often embed multiple forecast sheets covering drivers, revenue, COGS, operating expenses, and working capital.

Revenue and Expense Modeling

In Revenue and Expense Modeling, professionals build model credibility and support decision-making through accuracy. Financial analysts use methods like volume times price calculations and customer cohort analysis to monitor SaaS churn and annual recurring revenue (ARR) metrics. They create detailed assumptions tables that improve precision by outlining growth rates across various regions and product lines. Expense modeling requires that professionals directly link expenses to revenue streams, such as calculating selling, general, and administrative expenses as a percentage of sales. By categorizing fixed and variable costs and adjusting for seasonality in operational expenses and working capital cycles, financial professionals create clearer and more transparent models. These careful techniques improve the detail of the model and ensure better traceability, ultimately giving leadership more dependable insights for planning and Revenue and Expense Modeling.

Cash Flow Projections

Financial analysts calculate free Cash Flow Projections (FCF) as an important financial process that shows how much cash a company has after covering its operational expenses and investments. The method focuses on key parts. Analysts start with net income, add back non-cash expenses, then subtract changes in working capital and capital expenditures. Analysts use a formula that includes earnings before interest and taxes (EBIT), tax rates, depreciation, amortization, and working capital adjustments to determine a company’s real financial flexibility. The accuracy of this calculation relies on careful handling of non-cash items, thoughtful assessment of capital expenditures, and a close look at balance sheet working capital elements. By breaking down these financial parts, organizations can understand their cash generation potential better and make smarter decisions about resource allocation and future investments in Cash Flow Projections.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Valuation Models (DCF, LBO, Comparable)

- Forecast unlevered free cash flows for 5–10 years

- Determine terminal value using perpetuity or exit multiple

- Discount cash flows with WACC

- Sum PV of FCF and TV to derive enterprise value

DCF Model:

- Use valuation metrics such as EV/EBITDA, P/E, EV/Sales

- Select appropriate peer group and normalize earnings

- Apply trading multiples to derive relative valuation

Comparable Company Valuation:

- Structure acquisition with high debt leverage

- Forecast free cash flows to repay debt over time

- Output IRR based on exit multiples and capital structure

LBO Model:

Anchoring valuation to cash flows, earnings, leverage profiles, and exit scenarios increases analytical rigor and defensibility.

Scenario and Sensitivity Analysis

Deploy analysis to model alternative future states. Core tools include:

- Scenario Tabs: Model input assumptions for base/up/dn cases

- Sensitivity Tables: Two-variable tables (e.g., revenue growth vs margin)

- Tornado Charts: Rank-order drivers by impact on output

- Monte Carlo Simulations: Risk analysis with probabilistic input distributions

Scenarios help stakeholders understand downside risks and upside opportunities.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

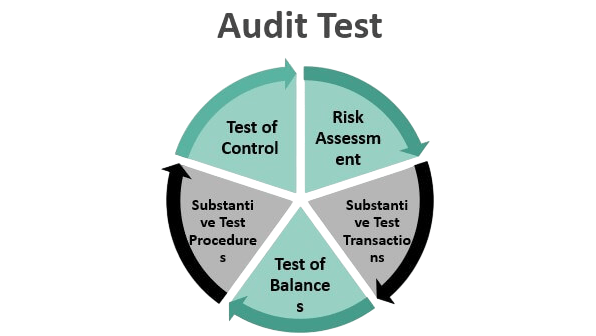

Error Checking and Audit

Financial professionals must carefully prepare models to ensure they are reliable and accurate. Analysts start their testing process with basic balance sheet checks. They confirm that assets equal liabilities plus equity. Modelers perform circularity checks to find and manage potential loops that could harm model integrity. Analysts stress-test models by pushing inputs with unrealistic assumptions to evaluate their resilience.

Professionals validate benchmarks by comparing key financial ratios with those of industry peers and sector standards. They use formula auditing techniques, such as Excel’s trace precedents and dependents features, to find possible calculation errors. Financial experts create thorough model documentation, including version control and detailed descriptions of assumptions, to improve transparency and credibility. By carrying out these careful checks, financial professionals can raise model integrity and build greater client trust in their analytical work.

Best Practices in Financial Modeling

Top-tier modelers adhere to discipline in design and structure. Key conventions include:

- Inputs/Outputs Separation: Color-coded and on dedicated sheets

- Modular Design: Independent assumptions, calculations, and outputs

- Documentation: Use comments, assumptions table, and a model overview page

- Flexibility: Allow easy changes to growth/cost assumptions

- Transparency & Simplicity: Keep formulas readable; avoid hidden links

- Versioning & Protection: Track versions; protect key cells

- User-Focused Design: Support non-technical users; consider navigation and currencies

Following these conventions saves time, lowers errors, and improves usability.

Tools and Certifications for Modelers

Beyond Excel, modelers use:

- VBA/Macros: Automate repetitive tasks

- Power Query / Power Pivot: Data integration and large dataset analysis

- Financial Databases: Bloomberg, Capital IQ, FactSet, PitchBook

- Modeling Software: Quantrix, Anaplan, Adaptive Planning

Prominent certifications:

- Certified Financial Modeling: Valuation Analyst (FMVA) by CFI

- Chartered Financial Analyst (CFA)

- CPA with financial modeling CMAs

- CFI’s Capital Markets Modeling (CMM)

Wrap-Up Application

Financial modeling is both craft and science blending Excel mastery, financial theory, business insight, and structural clarity. Whether you’re valuing an acquisition, pitching to investors, building budgets, or stress-testing plans, these 12 pillars form your toolkit.