- What is Book Building?

- Process of Book Building in IPOs

- Role of Investment Bankers

- Price Band and Floor Price

- Bidding Process Explained

- Allotment and Oversubscription

- Benefits of Book Building

- Institutional vs Retail Participation

- Risks and Criticisms

- Global Practices in Book Building

- Conclusion

What is Book Building?

Book building is a price discovery mechanism used during the issuance of securities, particularly in Initial Public Offerings (IPOs). It allows investors to bid for shares at a price within a specified range, helping the issuer determine the best price to sell its shares. Unlike the fixed price method where the price is predetermined, book building involves market participants in the pricing process. This method has become the preferred mechanism for pricing shares in IPOs across the globe due to its efficiency, transparency, and market-driven approach.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

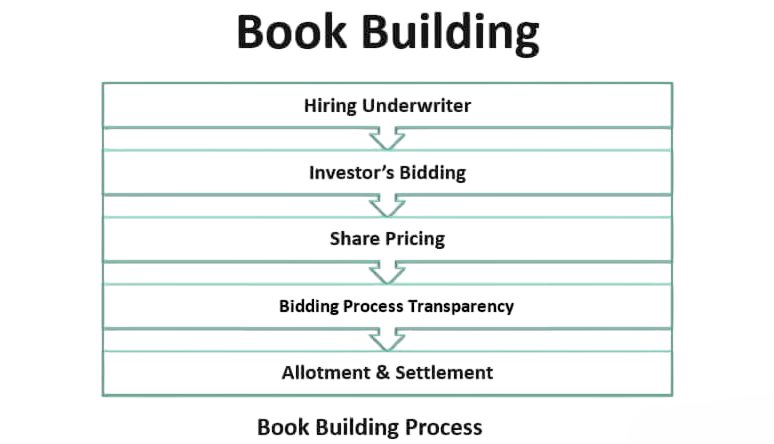

Process of Book Building in IPOs

In the complex world of initial public offerings (IPOs), investment banks start by choosing a Book Running Lead Manager (BRLM) to coordinate the book building process. The company first submits a Draft Red Herring Prospectus (DRHP). This preliminary document outlines its financial details and offering structure but does not include the final issue price.

Regulatory bodies like SEBI and SEC review this document carefully to ensure compliance and protect investors. The issuer and appointed bankers then hold roadshows, marketing the IPO to institutional and retail investors to generate interest and gauge market sentiment. They announce a price band, which sets a minimum and maximum for potential bids. This period usually lasts 3 to 5 days. Investors submit bids through online platforms and registered intermediaries, allowing broad market participation. The company and its financial advisors then set the final issue price based on investor demand and market conditions. They allocate shares to successful bidders, quickly refund excess funds, and list the company’s shares on the stock exchange. This marks the end of a carefully planned public offering journey.

Role of Investment Bankers

Investment bankers or book runners play a central role in the book building process:

- Structuring the Issue: Advising on size, pricing, and timing.

- Drafting Offer Documents: Preparing and submitting the Draft Red Herring Prospectus (DRHP).

- Marketing: Organizing roadshows and liaising with potential investors.

- Price Band Setting: Assisting in determining appropriate price range.

- Book Running: Collecting bids and managing the electronic book.

- Allotment: Coordinating the distribution of shares post-bidding.

- Regulatory Compliance: Ensuring the issue meets legal requirements.

Their expertise significantly influences the success of the offering.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Price Band and Floor Price

The band and floor price is the range within which investors can place their bids. It comprises:

Common Derivatives

- Floor Price: The minimum price at which bids can be made

- Cap Price: The maximum permissible bid price

Regulators often require the price band to be disclosed in advance, with a minimum gap between the floor and cap prices (typically 20%). This range allows issuers to gauge investor demand and finalize a price that reflects true market sentiment.

Bidding Process Explained

During the bid submission process, investors can adjust their investment strategy as needed. They can submit bids by stating the number of shares and the price they want. They can also change these bids during the bidding period.

A useful feature for retail investors is the cut-off price option, which lets them accept the final determined price without needing to specify an exact amount. Investors must follow specific bid lot sizes and use the ASBA (Applications Supported by Blocked Amount) method, which securely holds funds in the bidder’s account instead of transferring them right away. Institutional investors often use strategic anchor investor routes to get involved before the public issue opens, giving them a special opportunity to enter the investment.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Allotment and Oversubscription

In the fast-changing world of initial public offerings (IPOs), companies use the allotment process to decide how to distribute shares. Investment banks and underwriters mainly rely on the number and price of bids submitted. They use a pro-rata method to distribute shares based on bid sizes. When demand exceeds the number of available shares, it signals oversubscription. Investors often see this as a sign of strong market interest. To help small investors, companies usually set aside a specific quota in the retail category, which encourages more market participation. The Application Supported by Blocked Amount (ASBA) system allows banks to simplify the refund process for unsuccessful applicants. This ensures a quick return or unblocking of funds. This clear and organized approach promotes fairness and gives investors confidence during the IPO allocation process. It can also impact post-listing price performance and overall market sentiment.

Benefits of Book Building

- Efficient Price Discovery: Reflects real-time demand.

- Market-Driven Pricing: Reduces underpricing and overpricing risks.

- Investor Participation: Encourages wide-scale involvement.

- Transparency: Demand visible to issuer and regulators.

- Optimal Allocation: Allocates shares to genuine investors.

- Flexibility: Allows issuers to modify issue size based on response.

Due to these advantages, most major IPOs worldwide now use the book building method.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Institutional vs Retail Participation

In the ever-changing world of investment options, two main types of investors play important roles: institutional and retail investors. The institutional category usually includes mutual funds, insurance companies, and foreign investors, who often make large bids and receive significant allocations. On the other hand, retail investors, or individual market participants, make smaller bids and enjoy appealing benefits such as discounts and better pricing. While both groups are essential to the investment landscape, the active involvement of institutional investors often serves as a key indicator of confidence, showing the market’s potential and the attractiveness of specific financial opportunities. Their participation can greatly affect how the market is viewed and how other investors feel, making them important contributors to the success of investment options.

Risks and Criticisms

- Complexity: May confuse novice retail investors.

- Institutional Bias: Preference may be given to large investors.

- Price Volatility: Post-listing price swings due to speculation.

- Manipulation Risk: Potential for artificial inflation of demand.

- Transparency Concerns: Bidding data may not always be fully disclosed.

Despite these challenges, regulatory oversight and increasing investor awareness have mitigated many concerns.

Global Practices in Book Building

- USA: Investment banks use roadshows and private placements to build books.

- UK: Institutional book building dominates with limited retail involvement.

- India: Regulated by SEBI, with strong retail and institutional frameworks.

- China: Hybrid model using fixed pricing and book building.

- Europe: Common use of accelerated book building for seasoned equity offerings.

Global practices continue to evolve, with increasing emphasis on digital platforms and real-time analytics to manage the book building process more efficiently.

Conclusion

Book building has revolutionized the way securities are priced and issued in the capital markets. Its ability to incorporate market feedback into the pricing mechanism has led to more accurate valuations, better investor participation, and enhanced transparency. While not without its flaws, the advantages of book building far outweigh the disadvantages, making it the gold standard in IPO pricing worldwide. As technology and regulation evolve, the book building process is expected to become even more efficient and inclusive.