- Definition of Trade Life Cycle

- Trade Initiation

- Trade Validation

- Trade Execution

- Trade Matching and Confirmation

- Trade Settlement

- Trade Reconciliation

- Post-Trade Reporting

- Regulations and Compliance

- Technology in Trade Life Cycle

- Conclusion

Definition of Trade Life Cycle

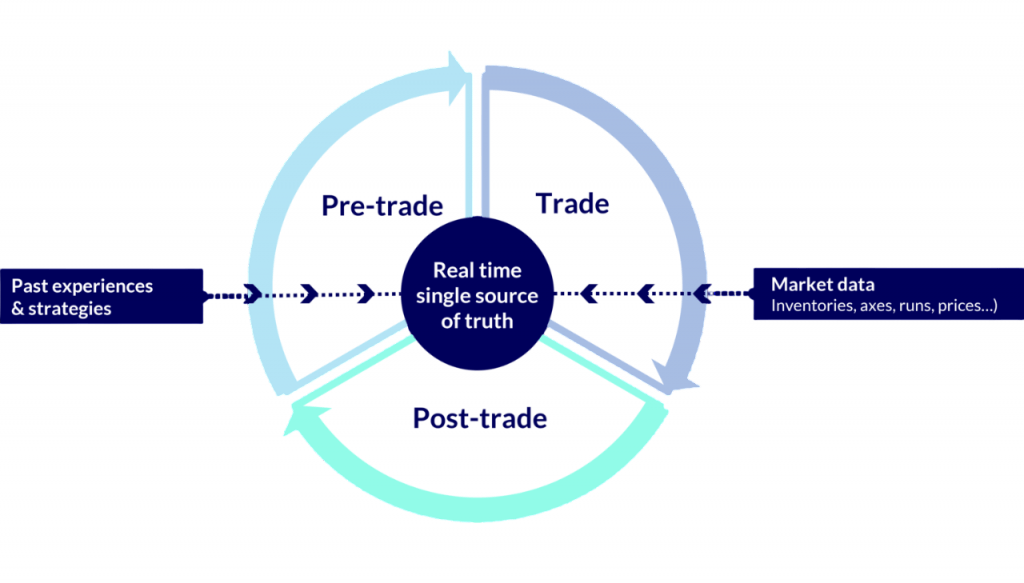

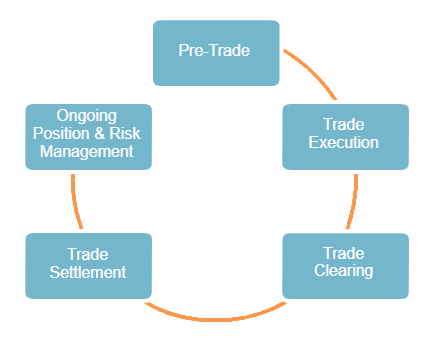

The Trade Life Cycle refers to the end-to-end process that a financial trade undergoes, from initiation to settlement and post-trade reporting. It encompasses all stages involved in completing a trade in financial securities such as stocks, bonds, derivatives, or currencies. In capital markets, the trade life cycle is vital for smooth financial transactions. It includes pre-trade, trade, and post-trade phases and involves several participants, such as traders, brokers, custodians, clearing houses, and regulatory bodies. By carefully managing each stage, the cycle offers important benefits like accurate record-keeping, timely settlement, strong regulatory compliance, and effective risk management. This organized approach helps financial institutions maintain smooth operations, reduce potential errors, and create a clear environment that supports efficient market functioning. Through coordinated interactions among various participants, the trade life cycle acts as a key system that ensures the reliability and effectiveness of capital market operations, ultimately promoting trust and stability in complex financial environments.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Trade Initiation

Trade initiation is the important first step in financial transactions. Here, traders decide whether to buy or sell financial instruments. These decisions come from several factors, such as market research, rebalancing portfolios, managing risks, and specific client requests in institutional settings. Traders and portfolio managers carry out this phase by placing orders carefully. They choose suitable trading venues like stock exchanges or over-the-counter markets and specify key trade details such as asset type, quantity, price, and execution time. Modern technology, including order management systems and algorithmic trading tools, greatly improves traders’ abilities during this process. This technology helps them make more efficient, data-driven decisions that lead to better investment results.

Trade Validation

Once a trade is initiated, it undergoes validation checks to ensure accuracy and compliance before proceeding. Trade validation typically includes:

- Compliance Checks: Verifying regulatory restrictions or internal risk limits.

- Pre-Trade Risk Assessment: Ensuring sufficient margin or credit availability.

- Counterparty Validation: Confirming the identity and status of the opposite party.

- Instrument Verification: Ensuring the instrument exists and is tradable.

This phase is critical to prevent incorrect or unauthorized trades and is often automated in modern trading systems.

Trade Execution

Trade execution refers to the actual process of fulfilling a buy or sell order. This may occur on:

- Exchanges: Centralized venues like NYSE, BSE, or NASDAQ, where buyers and sellers meet via standardized platforms.

- ECNs (Electronic Communication Networks): Digital systems that match buy and sell orders automatically, often used in equities and forex trading.

- OTC Markets (Over-the-Counter): Decentralized markets where trades are negotiated directly between parties, common for derivatives, bonds, and exotic instruments.

Types of execution:

- Manual Execution: Trades conducted via phone calls or verbal agreements. Rare in modern systems due to slower speed, higher error risk, and lack of audit trail.

- Electronic Execution: Orders submitted through online trading platforms or automated algorithms. Offers speed, transparency, and efficiency for both retail and institutional participants.

- DMA (Direct Market Access): Institutional clients use broker infrastructure to send orders directly to the market, bypassing intermediaries. Enables high-speed execution and greater control over order flow.

Execution speed, cost (spread), and quality are critical performance metrics here.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Trade Matching and Confirmation

In the crucial post-trade execution phase, trade details are carefully shared and verified between counterparties through a thorough matching process. This vital step ensures both parties agree on key transaction details, including trade date, security specifics (like ISIN and ticker), price, quantity, counterparty identifiers, and settlement instructions. Financial institutions use automated trade matching technologies to compare and validate transaction details. They follow this with formal electronic confirmations, usually sent via FIX (Financial Information eXchange) messaging platforms. The accuracy and timing of this process are essential. Any delays or errors can lead to settlement failures or complex disputes between parties. This highlights the need for solid technology-driven reconciliation methods in today’s financial transactions.

Trade Settlement

Settlement is the final and important stage of financial transactions. During this stage, cash and securities are exchanged through clearing houses or central counterparties (CCPs). This process relies on Delivery versus Payment (DvP), which makes sure that securities and funds are transferred at the same time. It also includes risk management through obligation netting. Custodians are essential for keeping and facilitating secure asset transfers during different settlement periods. Market practices differ. Equity markets usually follow a T+2 timeline, which means transactions settle two days after the trade. Some specialized markets allow for quicker T+1 or same-day settlements. By keeping accurate settlement processes, financial institutions maintain market liquidity, build trust in transactions, and help support the overall stability of the system, which is crucial for the smooth operation of global financial markets.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Trade Reconciliation

Trade reconciliation is a critical risk management process that systematically compares and validates financial transaction records across multiple systems to ensure complete accuracy and detect potential discrepancies.

- Types: Two primary reconciliation types exist: internal (comparing records between different organizational departments) and external (matching internal records with external counterparties like brokers and custodians), each serving unique verification purposes.

- Challenges: Common reconciliation challenges include identifying mismatched trade amounts, detecting incorrect pricing, and resolving missing trade confirmations, which can potentially lead to significant financial and compliance risks.

- Importance: Consistent and timely reconciliation practices are essential for maintaining robust data integrity, preventing financial losses, and supporting regulatory compliance requirements in complex trading environments.

- Requirements: Effective reconciliation processes require sophisticated technological systems and meticulous attention to detail, enabling organizations to proactively manage transactional discrepancies and maintain high standards of financial reporting and operational excellence.

Post-Trade Reporting

Regulatory bodies require firms to report trade activity for transparency and oversight.

- Post-Trade Reporting: Includes transaction reporting, trade repository submissions, and client reporting.

- Transaction Reporting: Reporting trade details to regulatory authorities.

- Trade Repository Submissions: Required under EMIR (Europe) or Dodd-Frank (U.S.).

- Client Reporting: Statements and trade confirmations to clients.

- Jurisdictional Differences: Regulatory requirements vary by region, such as MiFID II in the EU, FINRA rules in the U.S., and SEBI regulations in India.

- Consequences: Failure to report timely and accurately may result in penalties and reputational damage.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Regulations and Compliance

In today’s financial ecosystem, regulation is deeply embedded in the trade life cycle. Regulatory compliance ensures transparency, protects investors, and prevents systemic risks.

- MiFID II (EU): Requires transaction reporting, best execution, and transparency.

- Dodd-Frank Act (U.S.): Governs derivatives trading and promotes clearing.

- EMIR (EU): Requires derivatives trade reporting and clearing through CCPs.

- SEBI Guidelines (India): Regulates trade execution, settlement, and investor protection.

Firms must implement surveillance tools, audit trails, and robust governance frameworks to stay compliant.

Technology in Trade Life Cycle

Strategic technology ecosystems in modern trading rely on interconnected systems like OMS, EMS, and Trade Lifecycle Management Platforms to streamline order processing, execution, and settlement across multiple financial platforms.

- Advanced Integration Capabilities: APIs and FIX Protocols enable seamless communication between trading systems and counterparties, facilitating real-time data exchange and enhanced operational efficiency.

- Emerging Technology Innovations: Blockchain and Distributed Ledger Technology (DLT) are revolutionizing post-trade operations by promising faster, more transparent settlement processes, as demonstrated by initiatives like DTCC’s Project Ion.

- Intelligent Automation Solutions: AI-powered technologies are transforming operational workflows by automating critical functions such as exception handling, reconciliation, and sophisticated fraud detection mechanisms.

- Operational Performance Optimization: Cutting-edge technological implementations systematically reduce manual errors, accelerate settlement cycles, and significantly improve overall data accuracy in trading environments.

Conclusion: The Importance of the Trade Life Cycle

A well-functioning trade life cycle is the lifeblood of capital markets. It ensures that trades are executed, settled, and reported accurately and efficiently. For financial institutions, mastering the trade life cycle is crucial for profitability, compliance, and reputation. With evolving regulations and technological innovations, the trade life cycle is becoming faster, more complex, and increasingly automated. Professionals working in this domain need a strong understanding of each stage, along with continuous learning to adapt to changes in technology and regulation. Whether you’re a student, a financial professional, or an aspiring investment banker, understanding the trade life cycle provides foundational knowledge crucial to operating in today’s capital markets.