- What is an IPO?

- Reasons for Going Public

- Preparing a Company for IPO

- Role of Investment Banks and Underwriters

- Regulatory Requirements and Filings

- Due Diligence Process

- Pricing and Valuation Techniques

- Marketing and Roadshows

What is an IPO?

An IPO, or Initial Public Offering, is the process by which a private company offers its shares to the public for the first time, allowing it to raise capital from a broader investor base. This transition from a private to a public entity involves a detailed and regulated procedure that ensures transparency and investor protection. The IPO preparation process begins with selecting underwriters, conducting due diligence, and filing necessary documents with regulatory bodies like the SEBI or SEC. This stage is crucial as it sets the foundation for the offering’s success. A well-structured IPO process flow chart is often used by companies and advisors to visualize each step, from initial planning and regulatory filing to roadshows and final pricing. For investors, understanding the IPO process for investors is essential as it involves evaluating the company’s fundamentals, reviewing the prospectus, and participating through brokerage platforms. IPOs offer potential for significant returns, but they also come with risks due to limited historical data. Thus, thorough research and understanding of the IPO process are key for both companies and investors looking to participate in the public market for the first time.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Reasons for Going Public

- Access to Capital: An IPO enables companies to raise substantial funds from public investors, which can be used for expansion, R&D, or reducing debt.

- Enhanced Credibility and Visibility: Public companies often gain stronger brand recognition and credibility with stakeholders, aiding in customer trust and future partnerships.

- Liquidity for Existing Shareholders: Going public provides a structured exit route or liquidity for founders, early investors, and employees holding stock options.

Going public is a significant milestone for any company, often driven by strategic goals like raising capital, enhancing brand visibility, or enabling growth through acquisitions. The decision to go public involves careful planning, including IPO selection, assessing market conditions, and aligning with long-term business objectives. Below are key reasons why companies choose to go public, incorporating critical aspects such as IPO execution, due diligence process, and more:

- Acquisition Opportunities: Public companies can use their shares as currency for mergers and acquisitions, facilitating faster growth through strategic deals.

- Improved Governance and Transparency: Through a rigorous due diligence process, including tax due diligence and other types of due diligence, public companies are held to higher standards, building investor confidence.

- Attracting and Retaining Talent: A public listing makes it easier to offer stock-based compensation, attracting top talent and incentivizing long-term employee commitment.

Preparing a Company for IPO

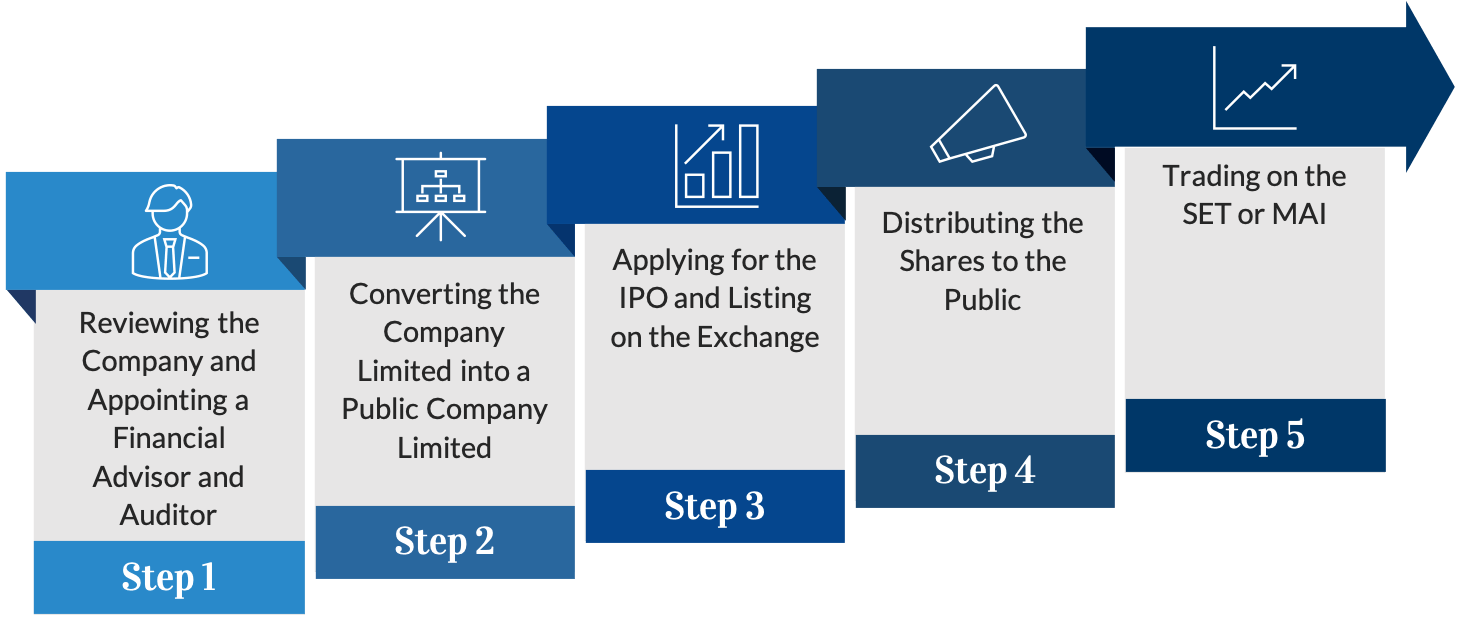

Preparing a company for an IPO is a complex and strategic journey that requires meticulous planning, financial restructuring, and regulatory compliance. The IPO preparation process begins long before a company files its intent to go public. It involves strengthening corporate governance, auditing financial records, ensuring legal compliance, and selecting the right underwriters and advisors. A comprehensive IPO process flow chart is often created to guide each stage, from initial assessments and internal readiness checks to drafting the red herring prospectus and meeting regulatory requirements. This visual tool helps stakeholders stay aligned and ensures no critical step is missed. Companies must also prepare to operate under increased public scrutiny, which means adopting transparent financial reporting practices and setting clear investor communication strategies. Equally important is understanding the IPO process for investors, as companies must present a compelling value proposition through roadshows and investor meetings, addressing potential risks and growth strategies transparently. Successful IPO readiness also includes identifying and mitigating operational, financial, and legal risks that could affect valuation or investor trust. Overall, thorough preparation not only boosts the chances of a successful listing but also sets the foundation for long-term growth as a public company.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

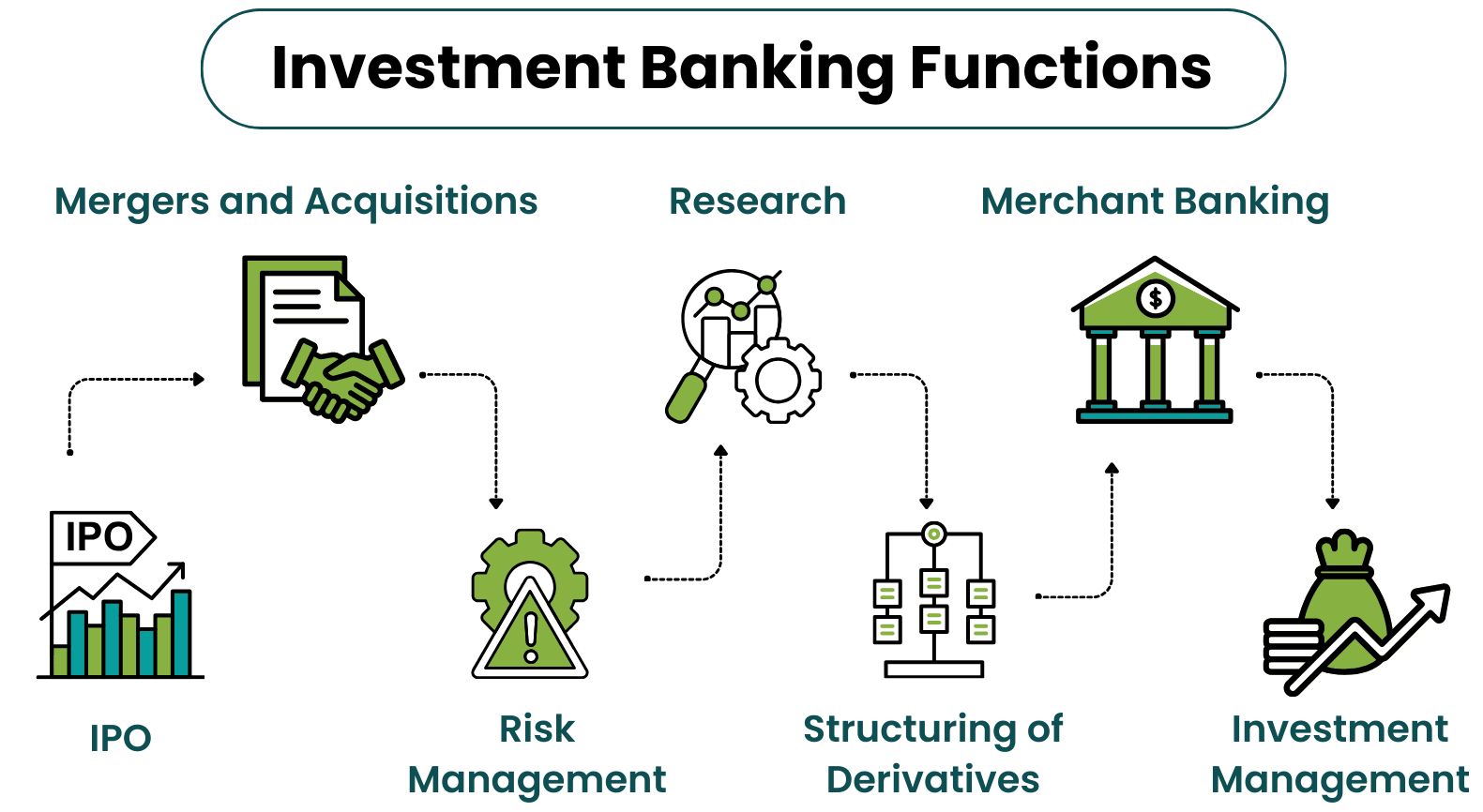

Role of Investment Banks and Underwriters

- Advising on IPO Selection: Investment banks assist companies in deciding whether an IPO is the right strategic move, evaluating timing, market conditions, and business readiness.

- Structuring and Pricing the Offering: They help determine the offering structure, number of shares, and pricing strategy to maximize value while ensuring investor appeal.

- Leading the Due Diligence Process: Banks coordinate the due diligence process to verify the company’s financial, legal, and operational integrity before going public.

Investment banks and underwriters play a pivotal role in guiding companies through the IPO journey, from initial planning to public listing. Their expertise helps ensure that the offering complies with regulations, is attractive to investors, and supports the company’s long-term goals. Their involvement spans from IPO selection to IPO execution, involving financial advisory, pricing, marketing, and risk management. Here are six key responsibilities they handle, with a focus on due diligence and other essential aspects:

- Conducting Multiple Types of Due Diligence: This includes financial, legal, commercial, and tax due diligence, ensuring the company is free from liabilities that could impact the IPO.

- Managing IPO Execution: Underwriters oversee the entire IPO execution, from drafting prospectuses to coordinating with regulators and exchanges.

- Marketing and Book Building: They conduct roadshows and gather investor interest, building the order book to ensure a successful launch and sustained trading.

- Financial Due Diligence: This involves a deep review of financial statements, revenue streams, liabilities, and historical performance to verify accuracy and consistency.

- Legal Due Diligence: Legal experts evaluate contracts, intellectual property, corporate structure, and any pending litigation to ensure legal soundness before listing.

- Tax Due Diligence: A focused review of the company’s tax records ensures compliance with tax laws and uncovers any hidden tax liabilities that could impact investor confidence.

- Operational Due Diligence: Analysts assess internal systems, processes, and supply chains to confirm that day-to-day operations support long-term business goals.

- Regulatory Compliance Review: This checks adherence to industry regulations and ensures all necessary licenses and approvals are in place for public listing.

- Market and Competitive Analysis: As part of the broader types of due diligence, this examines the company’s position in the market, growth potential, and competitive advantages to attract investor interest.

Regulatory Requirements and Filings

Navigating the regulatory requirements and filings is a critical phase in a company’s IPO journey, ensuring transparency, investor protection, and legal compliance. Once the IPO selection decision is made, companies must initiate a structured due diligence process that validates their financials, legal standing, operations, and risk exposure. This includes various types of due diligence, such as legal, financial, operational, and tax due diligence, to identify any red flags that might hinder the offering. Accurate and complete documentation is key companies are required to file a draft red herring prospectus (DRHP) with the regulatory body, like the SEC in the U.S. or SEBI in India, disclosing vital information about business operations, management, financial statements, and risk factors. These filings undergo detailed scrutiny before approval. During the IPO execution phase, the company must also comply with listing requirements set by stock exchanges, meet corporate governance standards, and adhere to financial reporting norms. Ongoing communication with regulatory authorities, underwriters, and legal advisors ensures that the process stays on track and aligned with compliance expectations. Fulfilling all regulatory obligations not only safeguards investor interests but also builds credibility and paves the way for a successful and sustainable entry into the public markets.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Due Diligence Process

The Due Diligence Process is a crucial component of any IPO, ensuring that a company is fully prepared, compliant, and transparent before it goes public. This process is initiated soon after the IPO selection is finalized and continues throughout the IPO execution phase. Investment banks, legal teams, and auditors work together to examine every aspect of the company’s operations to identify risks, liabilities, and opportunities. Below are six essential elements of a comprehensive due diligence process:

Pricing and Valuation Techniques

Pricing and valuation techniques play a central role in determining the success of an IPO, directly influencing investor demand and the company’s market debut. As part of the IPO preparation process, investment banks and financial advisors conduct a thorough valuation of the company using techniques such as discounted cash flow (DCF), comparable company analysis, and precedent transactions. These methods help establish a fair market value based on the company’s earnings potential, industry performance, and growth prospects. The insights gained from this analysis are then used to determine the initial share price. A detailed IPO process flow chart is often used to align the valuation with key stages of the IPO, such as regulatory approvals, investor roadshows, and final pricing decisions. The chosen price must strike a balance it should be attractive enough to generate investor interest but also reflect the company’s intrinsic value and future prospects. For investors, understanding the IPO process for investors involves assessing whether the valuation justifies the investment, especially in comparison to industry peers. Transparent pricing and accurate valuation not only build investor confidence but also set the tone for post-listing performance, making this phase one of the most critical in the entire IPO journey.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Marketing and Roadshows

Marketing and roadshows are essential components of a successful IPO strategy, aimed at generating investor interest and building confidence in the company’s value proposition. After IPO selection and during the IPO execution phase, companies, along with their underwriters, organize roadshows live or virtual presentations to institutional investors, analysts, and media to showcase the company’s business model, growth plans, and financial strength. These events allow company executives to answer critical questions, clarify concerns, and present a compelling investment case. Prior to these engagements, the company undergoes a thorough Due Diligence Process, covering all aspects of operations, finances, and compliance to ensure accurate and transparent communication during marketing. Different types of due diligence, including legal, operational, and tax due diligence, play a key role in preparing materials and addressing potential investor inquiries. The credibility built during roadshows is vital to book-building, pricing, and eventual demand during the IPO. A well-executed marketing strategy not only helps in securing anchor investors but also lays the groundwork for a strong debut in the secondary market. Overall, marketing and roadshows are where preparation meets perception, and they significantly influence how the public and institutional investors respond to a new public offering.