- Overview of Investment Process

- Setting Financial Objectives

- Risk Tolerance Assessment

- Asset Allocation Strategies

- Security Selection Techniques

- Portfolio Construction

- Performance Monitoring

- Rebalancing Strategy

- Behavioral Factors in Investment

- Conclusion

Overview of Investment Process

The investment process is a structured sequence of steps that investors follow to achieve their financial goals. It combines financial planning, analysis, execution, and performance monitoring. A sound investment process is crucial for minimizing risks, optimizing returns, and achieving long-term financial success. The investment process typically includes, Effective investment management needs a clear approach. It starts with setting specific financial goals and evaluating individual risk tolerance. By creating a strategic asset allocation plan, investors can choose securities that fit their financial objectives. The portfolio construction process involves carefully picking investments that balance potential returns and acceptable risk levels. Ongoing management and performance monitoring are also essential. Regularly rebalancing the portfolio helps keep the investment strategy in tune with shifting market conditions and personal financial situations. This ultimately boosts the chances for long-term financial success and stability. By following a disciplined process, investors can make informed and rational decisions aligned with their goals and constraints.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Setting Financial Objectives

The first step is to establish clear, measurable, and time-bound financial goals. These goals could include, Financial planning involves a clear method to reach important life goals and ensure lasting financial security. By focusing on key objectives like saving for retirement, funding children’s education, and owning a home, people can develop a clear plan for their financial future. Setting up an emergency fund offers vital financial strength, while looking for ways to earn passive income can improve overall financial flexibility. These related goals need careful investing, disciplined saving, and active financial management to turn hopes into real successes. This process helps build a strong and lasting financial base that supports individual and family well-being. Financial objectives can be short-term (within 1-3 years), medium-term (3-7 years), or long-term (over 7 years). Proper goal-setting helps determine the appropriate investment strategy and time horizon. SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound) are often used to frame financial objectives. For example, “accumulate Rs. 20 lakhs in 10 years for a child’s education” is a SMART goal.

Risk Tolerance Assessment

Risk tolerance refers to an investor’s ability and willingness to endure market volatility and potential losses. It is influenced by:

- Age

- Income and wealth

- Investment horizon

- Financial obligations

- Personality and psychological comfort

Risk assessment can be conducted through questionnaires and interviews. Investors are typically categorized into:

- Conservative (low risk tolerance)

- Moderate (balanced risk)

- Aggressive (high risk tolerance)

- Equities (stocks)

- Fixed income (bonds)

- Cash and cash equivalents

- Real estate

- Commodities

- Alternative investments (hedge funds, private equity)

- Strategic Allocation: Long-term portfolio structure based on investor objectives, risk tolerance, and time horizon.

- Tactical Allocation: Short-term shifts made to capitalize on market opportunities or anomalies.

- Dynamic Allocation: Ongoing rebalancing and adjustments aligned with changing market conditions and risk assessments.

- Total Return: Sum of capital gains and income (dividends or interest) over a period.

- Annualized Return: Compounded annual growth rate (CAGR), representing geometric average growth per year.

- Sharpe Ratio: Risk-adjusted return metric comparing portfolio excess return to its standard deviation.

- Alpha: Measure of active return above a benchmark; reflects manager’s skill.

- Beta: Measure of portfolio volatility relative to the benchmark; indicates market risk sensitivity.

- Calendar-Based Rebalancing: Adjusting portfolio allocations at predetermined intervals (e.g., annually or semi-annually), regardless of market conditions.

- Threshold-Based Rebalancing: Realigning assets when individual holdings deviate from their target weights by a specified percentage (e.g., ±5%).

- Overconfidence: Excessive belief in one’s own ability to outperform the market, often leading to higher risk-taking and underestimation of uncertainty.

- Herd Behavior: Imitating the actions of the majority without independent analysis, potentially resulting in irrational market movements or bubbles.

- Loss Aversion: Preference to avoid losses over acquiring equivalent gains, which may cause investors to hold losing positions too long or sell winning ones prematurely.

- Anchoring: Fixating on an initial piece of information (e.g., entry price or forecast) and failing to adjust to new data or changing market conditions.

Matching investments to risk tolerance ensures that investors do not react emotionally during market fluctuations.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

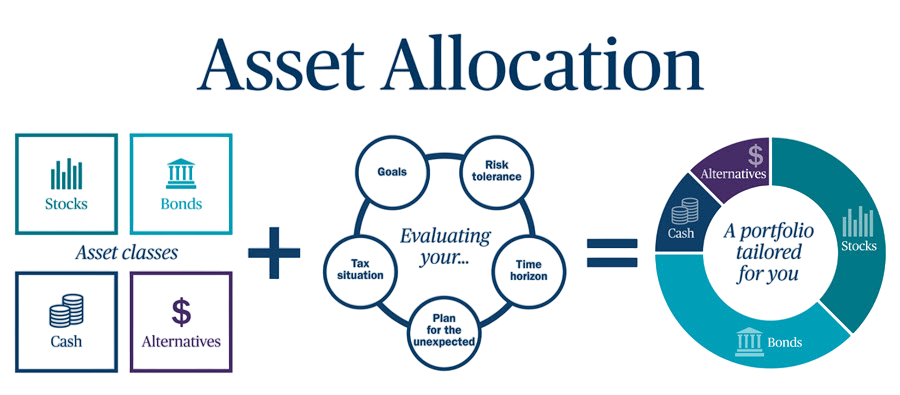

Asset Allocation Strategies

asset allocation strategies involves dividing the investment portfolio among different asset classes such as:

Types of asset allocation strategies:

Asset allocation is the primary determinant of portfolio performance and risk.

Security Selection Techniques

Security selection is a detailed investment strategy that involves choosing specific investments within asset classes through careful analysis. Investors usually use two main methods: fundamental and technical analysis. Fundamental analysis looks closely at financial statements, examining key metrics like the P/E ratio, return on equity, debt-to-equity, and profit margins. This method is especially appealing to long-term investors who want stable investments. On the other hand, technical analysis concentrates on price patterns and market indicators such as moving averages, the relative strength index (RSI), and MACD. This approach tends to attract short-term traders who want to take advantage of market trends. Strategic investors can further improve their methods using two supporting frameworks: the top-down method begins with macroeconomic trends and narrows down to specific sectors and companies. The bottom-up approach focuses on individual company fundamentals, regardless of the wider economic context. By combining these analytical techniques, investors can create a more detailed and effective investment selection process that balances risk and potential returns.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Portfolio Construction

Portfolio construction is a process of combining securities to find the best balance between risk and return, following the ideas of Modern Portfolio Theory (MPT). By diversifying investments across different asset classes, sectors, and regions, investors can reduce risks while increasing potential returns. The main strategy focuses on choosing assets that have low or negative correlations, which helps build a stronger investment portfolio. Using the concept of the Efficient Frontier, investors can find and create portfolios that provide the highest return for a specific level of risk. This ensures that each investment choice aligns with personal financial goals and risk tolerance. In the end, a well-designed portfolio reflects the investor’s unique situation, investment timeline, and financial aspirations, turning complicated investment ideas into a tailored plan for managing wealth.

Performance Monitoring

Monitoring ensures that the portfolio remains aligned with goals and risk tolerance. Key metrics include:

Regular performance reviews (quarterly or annually) help in assessing whether strategic adjustments are needed.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

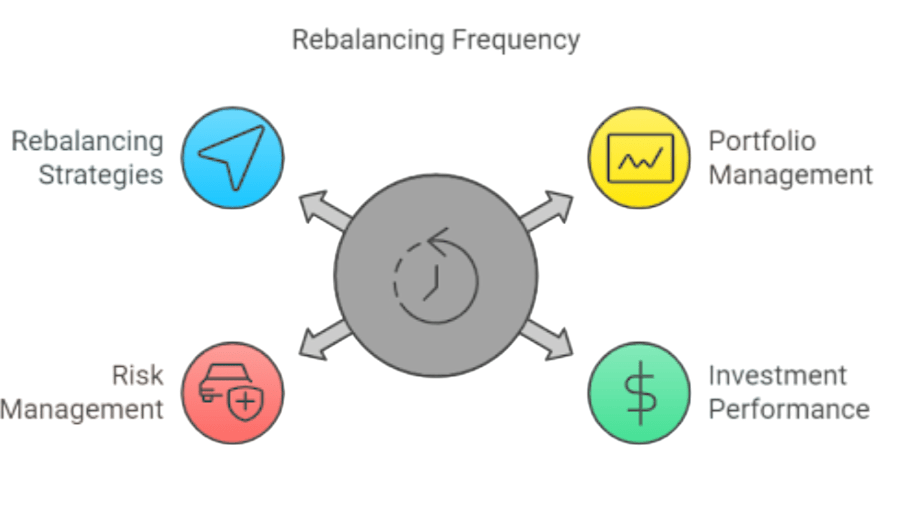

Rebalancing Strategy

Rebalancing restores the original asset allocation by adjusting the weights of investments. It is essential because market movements can skew the intended risk profile.

Rebalancing helps lock in profits, control risk, and maintain discipline.

Behavioral Factors in Investment

Behavioral finance explores how psychological biases affect investment decisions. Common biases include:

Being aware of biases helps investors make more rational decisions and stick to their investment plan.

Conclusion

The investment process is a comprehensive journey that blends planning, analysis, execution, and monitoring. From setting goals and assessing risk to selecting securities and rebalancing, each step plays a pivotal role in long-term financial success. Understanding behavioral factors, following ethical standards, and learning from real-world examples equip investors to navigate markets confidently. Whether for individuals or institutions, a disciplined and informed investment process is the foundation of long-term wealth creation. Behavioral factors are important too. Emotions can cloud judgment. Fear can lead to poor choices. Greed can create issues. Staying disciplined is crucial. Learning to manage emotions is beneficial. Ethical standards guide actions. Transparency and honesty are vital. Following rules protects everyone involved. Studying real-world examples offers valuable long-term financial success insight. You can learn from successful investors. You can also learn from their mistakes. Case studies provide important lessons. These examples help you navigate markets. They boost investor confidence. This knowledge is empowering. This thorough approach benefits everyone. It applies to individuals saving for retirement. It also applies to large institutions that manage huge funds. A disciplined process is necessary. It is the foundation of building wealth over time. Consistent effort produces results. This organized approach supports long-term financial success.