- Why Learn Investment Banking?

- Course Objectives

- Core Modules

- Financial Modeling

- Valuation Techniques

- Mergers and Acquisitions

- IPO Process

- Risk Management

- Practical Projects

- Certifications and Exams

- Career Support

- Top Institutes Offering Courses

- Conclusion

Why Learn Investment Banking?

Investment banking is one of the most prestigious and lucrative fields in the finance industry. It offers exciting career opportunities for individuals with a keen interest in financial markets, corporate finance, mergers, acquisitions, and capital raising. Courses on investment banking are designed to provide aspiring professionals with a comprehensive understanding of the industry, its tools, and practices. Learning investment banking equips individuals with skills that are highly valued in the finance and business world. It prepares students for roles that require strong analytical, quantitative, and communication skills. Whether you’re a finance graduate, MBA student, or a working professional looking to switch careers, investment banking courses can open doors to high-paying roles in top-tier firms. These courses not only enhance your understanding of financial instruments and markets but also build strategic thinking and deal-making capabilities.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Course Objectives

The primary objectives of investment banking courses are to develop a deep understanding of the financial services industry and ensure learners are equipped with real-world skills.

- Corporate Finance Tools: Equip learners with essential tools used in corporate finance, such as financial modeling and valuation.

- Industry Knowledge: Provide insights into mergers and acquisitions, IPO processes, and capital markets.

- Analytical Skills: Enable students to interpret financial statements and market trends.

- Career Preparation: Prepare participants for interviews and certifications required in investment banking roles.

Core Modules

Most investment banking courses cover a range of core modules designed to provide both theoretical insight and practical proficiency.

- Introduction to Investment Banking: Overview of industry functions and roles.

- Financial Statement Analysis: Techniques to evaluate a company’s financial health.

- Excel for Finance Professionals: Mastery of spreadsheet tools essential for modeling.

- Corporate Finance Fundamentals: Understanding capital structure, budgeting, and decision-making.

- Equity and Debt Capital Markets: Insights into fundraising and market instruments.

- Mergers and Acquisitions: Strategies and processes behind corporate restructuring.

- Initial Public Offerings (IPO): Step-by-step exploration of going public.

- Risk Management: Identifying and mitigating financial risks.

- Financial Modeling and Valuation: Building models to forecast and value companies.

- Pitch Book Creation and Deal Structuring: Crafting persuasive client presentations and structuring transactions.

These modules ensure a well-rounded understanding of both theoretical and practical aspects of investment banking.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Financial Modeling

Financial modeling is a critical skill in investment banking. It involves building models in Excel to represent a company’s financial performance. These models help in decision-making regarding investments, budgeting, and forecasting. Students learn to construct income statements, balance sheets, and cash flow statements. They also gain experience in scenario and sensitivity analysis. Accurate financial models are essential for valuing companies and making investment decisions, which is why this module is a core part of any investment banking course.

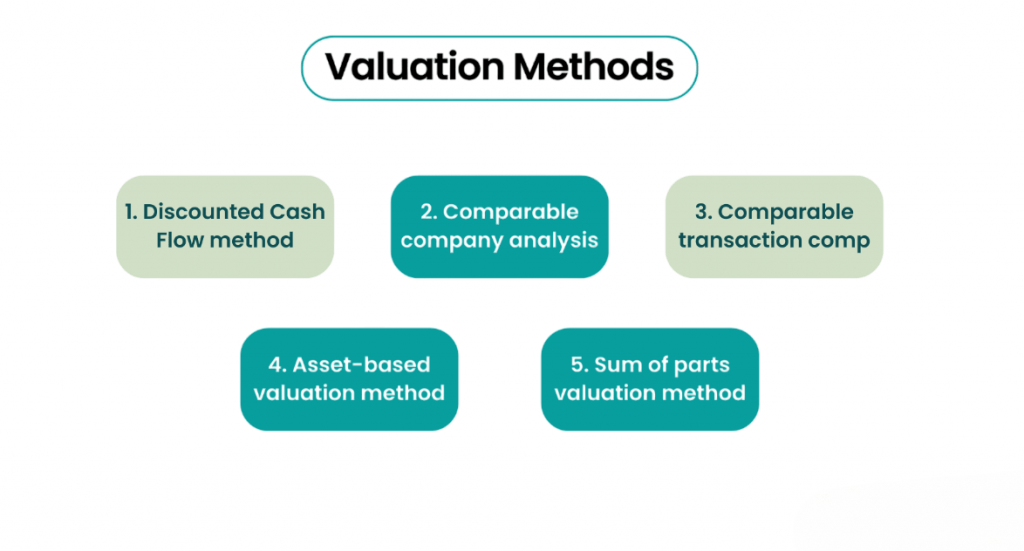

Valuation Techniques

Valuation is the process of estimating the present value of a company or asset, and is a cornerstone of investment banking education.

- Discounted Cash Flow (DCF) Analysis: Calculates intrinsic value based on future projected cash flows discounted to today’s value.

- Comparable Company Analysis (Comps): Uses ratios and metrics from similar publicly traded companies to estimate value.

- Precedent Transactions Analysis: Examines historical M&A deals to derive valuation benchmarks in comparable circumstances.

Each method provides a different perspective and is used depending on the deal type or industry. Students learn to apply these techniques using case studies and real-world scenarios, giving them a strong foundation in assessing company value.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Mergers and Acquisitions (M&A)

M&A is a major part of investment banking activities. This module covers the entire lifecycle of a merger or acquisition deal. Students learn about deal structuring, due diligence, financing options, negotiation tactics, and regulatory considerations. Real-life case studies help learners understand the strategic importance and complexity of M&A transactions. They also explore the impact of such deals on stakeholders and company valuation.

IPO Process

Initial Public Offerings (IPOs) are critical for companies looking to raise capital by going public. The IPO module teaches the process of preparing a company for a public offering, including regulatory filings, roadshows, pricing, and underwriting. Students understand the role of investment banks in guiding companies through the IPO journey. The course also highlights recent IPO trends and success factors that influence investor interest.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

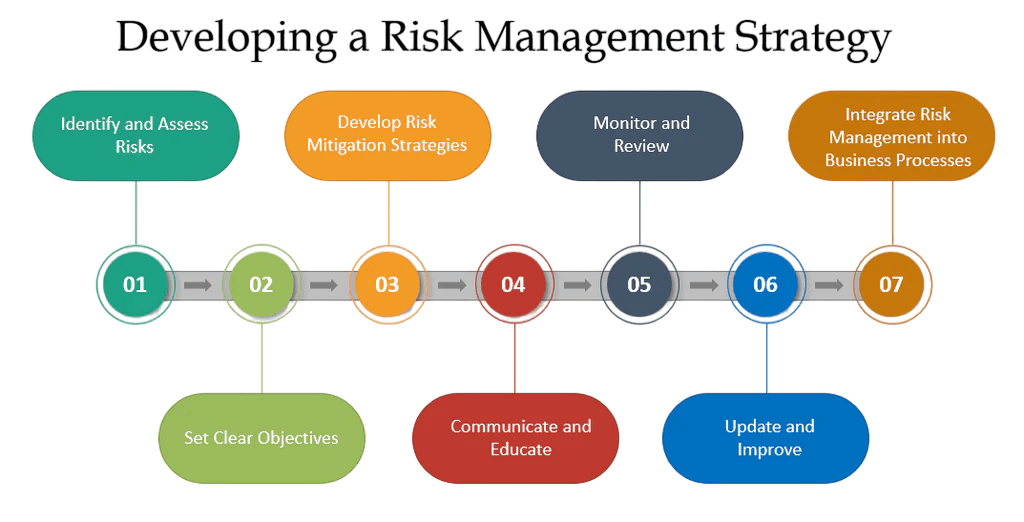

Risk Management

Managing risk is essential in investment banking due to the high stakes involved in financial transactions. This module covers the identification, analysis, and mitigation of various risks such as credit risk, market risk, and operational risk. Learners study techniques like Value at Risk (VaR), stress testing, and hedging strategies. Understanding risk helps investment bankers make better decisions and safeguard client interests.

Practical Projects

Hands-on learning is a key part of investment banking education. Most courses include practical projects where students apply concepts learned in class to real-world scenarios. These projects may involve creating a financial model for a company, preparing a pitch book for an M&A deal, or conducting a valuation of a startup. Such exercises help in building confidence and portfolio-ready work that can be showcased to potential employers.

Certifications and Exams

To validate their expertise and increase career prospects, students often pursue certifications after completing an investment banking course.

- CFA (Chartered Financial Analyst): A globally recognized credential focusing on investment management, ethics, and financial analysis.

- CFI’s Investment Banking Certification: Provides practical knowledge in deal structuring, valuation, and financial modeling tailored for aspiring bankers.

- FINRA Series 79 (U.S.): Required for professionals involved in investment banking activities, including M&A and capital raising within U.S. markets.

These credentials are highly valued by employers and enhance job prospects. Courses often prepare students for these exams through mock tests and exam-oriented modules.

Career Support

Investment banking courses often come with career support services such as resume building, mock interviews, and networking opportunities. Institutions may connect students with industry professionals, provide access to job boards, or facilitate internship opportunities. This support is crucial for breaking into a competitive field like investment banking.

Top Institutes Offering Courses

Several prestigious institutions and online platforms offer high-quality investment banking courses. Some top options include:

- Wall Street Prep: Offers self-paced online training and instructor-led bootcamps used by top investment banks and universities. Courses include financial modeling, valuation, and deal structuring.

- Corporate Finance Institute (CFI): Provides globally recognized certifications like the FMVA and Investment Banking & Private Equity Modeling Specialization. Courses are hands-on and tailored for real-world finance roles.

- New York Institute of Finance (NYIF): Delivers expert-led programs including the Investment Banking Certificate (IBC), covering M&A, capital markets, and valuation. Available online and in-person.

- Coursera & edX: Host university-backed courses from institutions like Wharton, Columbia, and Yale. Topics range from financial markets to IPOs and M&A strategies, often with certificates upon completion.

- IMS Proschool & NSE Academy (India): Offer classroom and online programs such as the Securities Market & Investment Banking Operations (SMIBO) and CIIB. These are tailored to Indian markets and include placement support and certifications from NSE and NSDC.

These institutes combine academic rigor with industry relevance, making their courses ideal for aspiring investment bankers.

Conclusion

Investment banking courses are an important starting point. They help individuals build successful careers in finance. These programs combine essential technical knowledge with practical skills. Additionally, they provide valuable career guidance. Mastering the training takes dedication. It opens doors to top investment banks. Roles also become available in private equity firms. Corporate finance departments look for skilled professionals. Whether you are new to the field or want to improve your skills, these courses give you the expertise you need. They prepare you for the challenging finance sector. Success in this fast-paced environment is possible. These programs create a strong foundation. They teach the skills that employers want. Graduates gain confidence. They understand complex financial tools. They learn to analyze markets and develop financial modeling skills. This learning journey is rewarding. It leads to entry into a profitable industry. The financial world changes quickly. Keeping up requires ongoing learning. Investment banking courses provide that advantage. They simplify complicated financial concepts. Students study mergers and acquisitions, capital markets, and valuation methods. These areas are essential in finance. Gaining proficiency in them is crucial. It leads to roles like analyst or associate, which are very competitive. A solid course prepares you well and sets you apart from the crowd. The curriculum is often demanding.