- Definition and Purpose of FPO

- Types of FPO: Dilutive vs Non-Dilutive

- Difference Between IPO and FPO

- Reasons Companies Opt for FPOs

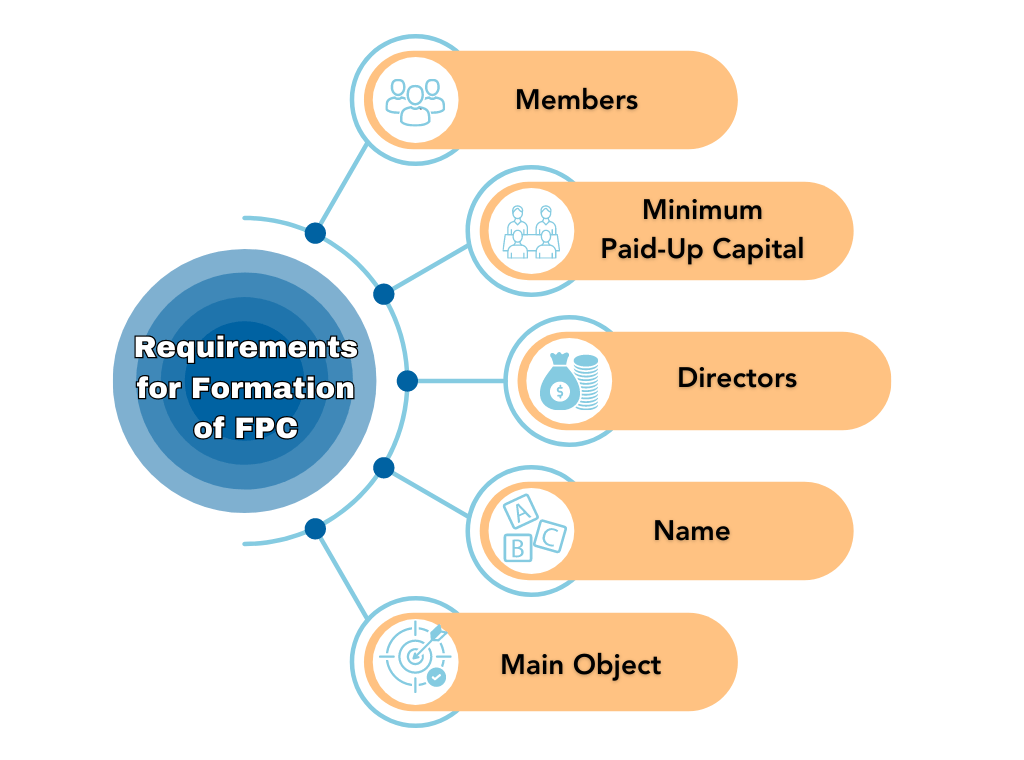

- Regulatory Framework and Requirements

- Pricing Methods in FPO

- Process and Timeline of FPO

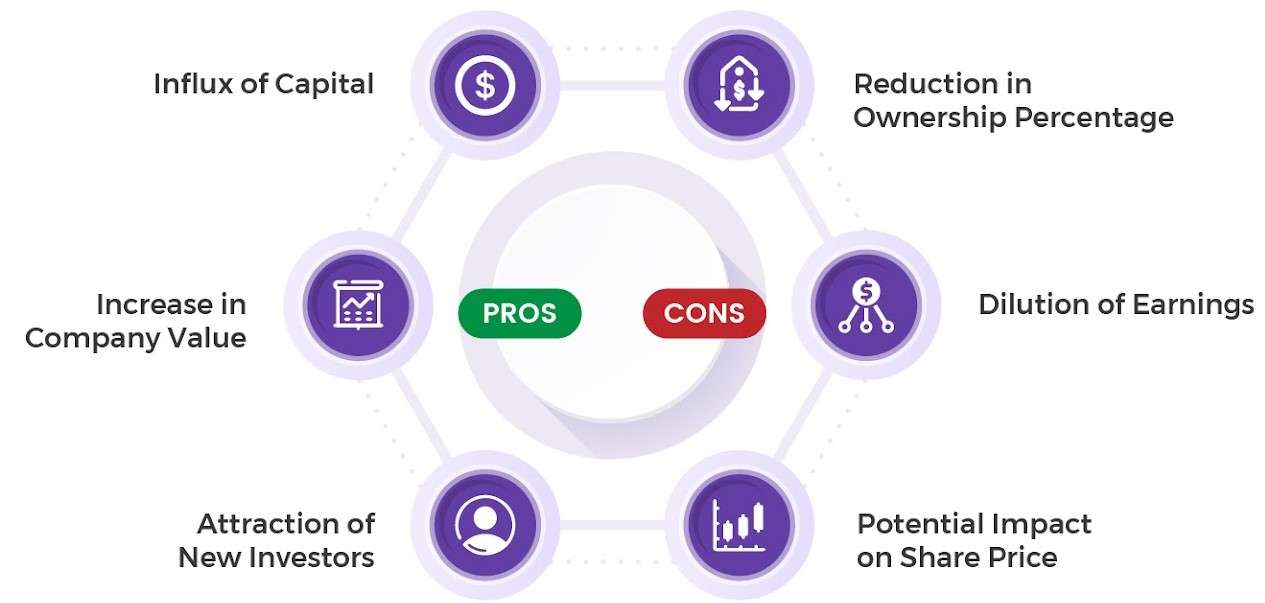

- Impact on Shareholders and Market

Definition and Purpose of FPO

A Follow-on Public Offer (FPO) is the process through which a publicly listed company issues additional shares to investors after its initial public offering (IPO). The primary purpose of an FPO is to raise additional capital for business expansion, debt repayment, or operational needs. There are two main types: dilutive and non-dilutive shares. In a dilutive FPO, the company issues new shares, increasing the total share count and slightly reducing the ownership percentage of existing shareholders. Conversely, a non-dilutive FPO involves existing shareholders selling their shares, so no new shares are created. Companies often use an FPO as a strategic financial move to strengthen their balance sheets while reinforcing investor confidence. The pricing strategy in marketing plays a critical role in the success of an FPO, as companies must strike a balance between making the offer attractive to investors and maintaining fair value for current stakeholders. Many investors refer to the follow on public offer list to evaluate recent or upcoming FPOs for potential investment opportunities. Overall, FPOs provide a vital tool for companies to fuel growth while giving the public a chance to invest further in an already listed entity.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Types of FPO: Dilutive vs Non-Dilutive

- Dilutive FPO: In this type, a company issues new shares to the public, increasing the total number of outstanding shares. This dilutes the ownership of existing shareholders but raises fresh capital for the company.

- Non-Dilutive FPO: Here, no new shares are issued. Instead, existing shareholders sell their shares to the public. It does not dilute ownership but allows early investors to liquidate their holdings.

- Capital Raising Impact: Dilutive FPOs bring direct capital to the company, often used for growth or debt reduction. Non-dilutive FPOs don’t raise new funds for the company.

A Follow-on Public Offer (FPO) can be classified into two main types Dilutive and Non-Dilutive based on how shares are issued and their impact on existing shareholders. Understanding these types helps investors assess changes in ownership structure and how companies use pricing methodologies during the offering. Companies may adopt various pricing techniques, such as cost plus pricing or the Gabor Granger method, to determine the optimal share price during an FPO. Here’s a breakdown of the two types:

- Market Perception: Investors may view dilutive FPOs as signs of company expansion. Non-dilutive offers might raise concerns about insider confidence.

- Use of Pricing Strategies: Companies use pricing tools like Gabor Granger and cost plus pricing to align FPO prices with market expectations and maximize investor interest.

- Dynamic Pricing Methods: Advanced dynamic pricing methods are increasingly used in FPOs to adjust share prices based on real-time demand and market sentiment, ensuring better price discovery.

Difference Between IPO and FPO

The key difference between an Initial Public Offering (IPO) and a Follow-on Public Offer (FPO) lies in their timing and purpose. An IPO is the first time a private company offers its shares to the public to raise capital and get listed on a stock exchange. In contrast, an FPO is issued by a company that is already listed, aiming to raise additional funds for expansion, debt repayment, or strategic growth. Investors often refer to the follow on public offer list to track upcoming FPOs and evaluate potential investment opportunities. Another major distinction lies in the share structure: FPOs can be either dilutive or non-dilutive shares. Dilutive FPOs involve issuing new shares, which increases the total share count and dilutes existing shareholders’ stakes. Non-dilutive FPOs, on the other hand, involve existing shareholders selling their stakes, with no impact on share volume. From a company’s standpoint, both IPOs and FPOs require a thoughtful pricing strategy in marketing to ensure investor appeal while maintaining the stock’s perceived value. While IPOs generate excitement as companies go public for the first time, FPOs offer a chance for additional investment in an already established entity with a proven track record in the market.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Reasons Companies Opt for FPOs

- Capital for Expansion: FPOs provide fresh capital for business growth, new product lines, or market entry strategies without relying on debt financing.

- Debt Repayment: Many companies use funds from an FPO to reduce existing liabilities, improving their balance sheets and credit profiles.

- Strengthening Public Confidence: A well-structured FPO can boost investor trust, especially when backed by transparent pricing strategies that reflect market demand.

A Follow-on Public Offer (FPO) allows publicly listed companies to raise additional funds by issuing more shares after their Initial Public Offering. FPOs are often part of a broader financial and strategic plan, supported by effective pricing methodologies to attract investors while ensuring fair value. Companies rely on various pricing techniques like Gabor Granger, cost plus pricing, and dynamic pricing methods to determine the optimal share price. Below are key reasons companies choose to go for an FPO:

- Improved Liquidity: Issuing more shares increases the number of available stocks in the market, leading to better liquidity and smoother trading.

- Exit for Existing Investors: Through non-dilutive FPOs, early investors or promoters can exit partially, monetizing their holdings without impacting the company’s capital structure.

- Market-Driven Pricing Optimization: Advanced dynamic pricing methods and models like Gabor Granger help companies align FPO pricing with investor willingness to pay, ensuring maximum participation.

Regulatory Framework and Requirements

The regulatory framework and requirements for public offerings, including Follow-on Public Offers (FPOs), are governed by market regulators like SEBI in India or the SEC in the U.S., ensuring transparency, investor protection, and fair market practices. Companies must comply with strict disclosure norms, file updated prospectuses, and obtain necessary approvals before launching an FPO. These regulations are designed to maintain market integrity and prevent manipulation or misinformation. In addition to legal compliance, companies must also adopt strategic pricing approaches to make their offerings attractive and competitive. This involves using various pricing techniques and pricing methodologies, such as cost plus pricing, where a fixed markup is added to the production cost, or the Gabor Granger method, which gauges consumer willingness to pay at different price points. Such methods help companies establish a fair and optimized price for their shares. Moreover, dynamic pricing methods are becoming increasingly relevant, allowing companies to adjust FPO prices in response to market demand, timing, and investor sentiment. This dynamic approach, supported by sound pricing models and regulatory approval, ensures a balance between company valuation and investor interest, making the FPO both compliant and commercially viable in a competitive market landscape.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Pricing Methods in FPO

Pricing methods in a Follow-on Public Offer (FPO) play a critical role in determining the success of the offering, as they directly impact investor interest and market response. Companies must carefully select a pricing strategy in marketing that balances the need to raise capital with fair valuation and shareholder expectations. In FPOs, two primary share structures dilutive vs non-dilutive shares influence pricing decisions. Dilutive FPOs involve issuing new shares, potentially reducing existing shareholder ownership, while non-dilutive FPOs involve the sale of existing shares without changing the total number of shares outstanding. To ensure market appeal, companies often rely on techniques like book building, fixed price offerings, and market-driven approaches. Strategic pricing is essential to position the offer attractively within the follow on public offer list, where investors compare FPOs based on performance, valuation, and pricing fairness. Companies may also incorporate feedback from institutional investors and use past stock performance as a benchmark. Ultimately, the goal is to set a price that reflects the company’s true value while remaining competitive and investor-friendly. An effective pricing method ensures sufficient demand, minimizes under-subscription risk, and reinforces the company’s credibility in the public markets.

Process and Timeline of FPO

The process and timeline of a Follow-on Public Offer (FPO) involve several key stages, beginning with the company’s decision to raise additional capital through share issuance. Once approved by the board, the company appoints investment bankers, legal advisors, and registrars to initiate the documentation and due diligence process. The draft offer document, containing financials, business updates, and risk factors, is then submitted to the market regulator for review and approval. During this stage, determining the right offer price becomes crucial. Companies employ various pricing methodologies and pricing techniques such as cost plus pricing, where a markup is added to costs, or Gabor Granger, which tests investor willingness to pay at different price points. Once the price range is set, often through book-building, the company announces the issue date and opens the FPO for subscription, typically for 3–5 working days. Throughout the offering, dynamic pricing methods may be used to adjust the pricing based on market demand and investor sentiment. After the closure of the issue, allotment is finalized, shares are credited to investors’ accounts, and listing on the stock exchange follows within a few days. This structured timeline ensures transparency, regulatory compliance, and market responsiveness.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Impact on Shareholders and Market

The impact of a Follow-on Public Offer (FPO) on shareholders and the broader market can be significant, depending on the type of FPO and the company’s pricing decisions. When a company opts for a dilutive FPO, it issues new shares, increasing the total share count and potentially diluting the ownership percentage of existing shareholders. This can sometimes lead to short-term pressure on the stock price as supply increases. On the other hand, non-dilutive FPOs involve the sale of existing shares by current stakeholders, which does not affect the total number of shares but may still influence market sentiment based on perceived insider intentions. The company’s pricing strategy in marketing plays a critical role in how the offer is received if priced attractively, it can enhance demand and strengthen investor confidence. Investors often analyze the follow on public offer list to compare recent or upcoming FPOs, looking at factors such as pricing, performance, and type of offer before making decisions. Overall, while FPOs may cause short-term volatility, they can positively impact long-term value if the raised capital is used strategically. Transparent communication, fair valuation, and sound pricing strategies are key to ensuring a favorable response from both shareholders and the market.