- Introduction to Financial Risk

- Types of Financial Risks: Market, Credit, Operational

- Measuring Risk: Metrics and Models

- Market Risk and Its Management

- Credit Risk and Evaluation Techniques

- Liquidity and Operational Risks

- Risk Mitigation Strategies

- Derivatives and Hedging

Introduction to Financial Risk

Financial risk refers to the possibility of losing money due to various uncertainties in financial markets, and understanding it is essential for businesses, investors, and policymakers. In the complex world of finance, risks arise from numerous sources including fluctuating interest rates, changing exchange rates, defaults on loans, and operational failures. Among these, market risk management plays a crucial role, focusing on strategies to mitigate losses from volatile market movements. Risk management in financial institutions has become increasingly sophisticated, with banks, investment firms, and insurance companies employing advanced tools and regulatory frameworks to identify, assess, and control potential threats. These institutions rely heavily on quantitative finance risk management techniques such as value-at-risk models, stress testing, and scenario analysis to make data-driven decisions that balance risk and return. A solid introduction to financial risk also includes an understanding of how economic cycles, geopolitical events, and global financial systems impact risk exposure. Effective risk management not only protects assets but also enhances long-term performance and sustainability. As global markets grow more interconnected and complex, mastering financial risk fundamentals becomes critical for anyone involved in finance, from analysts to executives.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

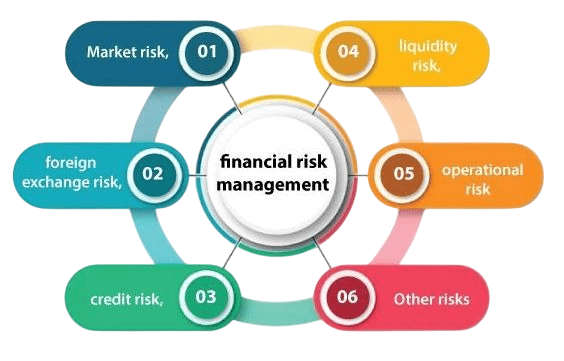

Types of Financial Risks: Market, Credit, Operational

- Market Risk: This arises from fluctuations in market prices such as stocks, interest rates, or foreign exchange. A subset of this is money market risk, where short-term instruments are exposed to sudden liquidity or rate changes.

- Credit Risk: The possibility that a borrower will default on repayment. This is a critical focus area for risk management in financial institutions, often modeled using credit scoring and stress testing.

- Operational Risk: Linked to failures in internal processes, systems, or human errors. Cybersecurity breaches and compliance failures fall under this category.

Financial risk comes in many forms, each impacting institutions and investors in different ways. Understanding these risks is crucial for sound decision-making, particularly in a highly regulated and interconnected financial ecosystem. Key frameworks such as the FRM Handbook help professionals navigate these risks effectively, while tools like Provenir Fintech offer advanced risk analytics and automation. Here are the major types of financial risks:

- Systemic Risk: The risk that the failure of one financial entity could trigger a broader collapse of the entire financial system, as seen in global crises.

- Liquidity Risk: Occurs when assets cannot be quickly converted to cash without significant loss, affecting both banks and markets.

- Legal and Regulatory Risk: Stems from changes in laws or enforcement practices. Professionals pursuing FRM eligibility must deeply understand this evolving risk landscape.

Measuring Risk: Metrics and Models

Measuring financial risk is a critical component of sound decision-making in today’s complex and fast-paced financial environment. It involves the use of various metrics and models to quantify potential losses and understand the impact of uncertainty on assets, portfolios, or institutions. In the realm of market risk management, tools such as Value at Risk (VaR), Conditional Value at Risk (CVaR), and stress testing are commonly used to assess exposure to fluctuations in market variables like interest rates, stock prices, and exchange rates. For risk management in financial institutions, accurate measurement helps in maintaining capital adequacy, complying with regulatory frameworks, and ensuring operational resilience. Models such as credit scoring, Monte Carlo simulations, and historical scenario analysis play a significant role in forecasting and mitigating credit, liquidity, and operational risks. The field of quantitative finance risk management blends statistical techniques, mathematical modeling, and financial theory to enhance precision in risk assessment. These models not only help identify vulnerabilities but also guide strategic planning and resource allocation. As financial products grow more complex, the demand for robust risk measurement tools becomes even more vital to protect investments, meet compliance standards, and support long-term stability in global financial markets.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

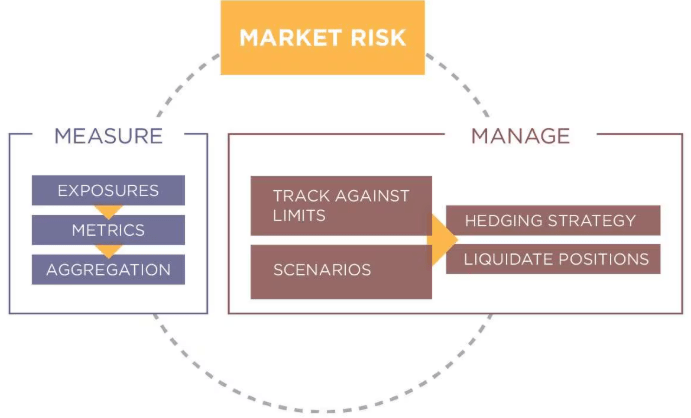

Market Risk and Its Management

- Types of Market Risk: Includes interest rate risk, equity risk, currency risk, and commodity risk all of which can impact investment value.

- Value at Risk (VaR): A core metric in market risk management, VaR estimates the maximum expected loss over a given period at a certain confidence level.

- Stress Testing: Simulates extreme market conditions to evaluate the firm’s ability to withstand shocks, crucial in risk management in financial institutions.

Market risk refers to the potential for financial losses due to movements in market variables such as interest rates, stock prices, commodities, and foreign exchange rates. Effective market risk management is essential for maintaining stability and profitability, especially in volatile financial environments. Within risk management in financial institutions, managing market risk involves identifying exposures, applying suitable models, and implementing controls to minimize potential losses. Leveraging quantitative finance risk management techniques helps firms make data-driven decisions and build resilience. Here are six key aspects of market risk and its management:

- Hedging Strategies: Techniques like derivatives trading, options, and futures are used to offset potential losses from adverse market movements.

- Scenario Analysis: An essential quantitative finance risk management approach that evaluates risk under multiple hypothetical situations.

- Regulatory Compliance: Adhering to frameworks like Basel III ensures that institutions hold sufficient capital to absorb market losses and maintain financial stability.

- Liquidity Risk Types: Includes funding liquidity risk and market liquidity risk especially relevant in money market risk where short-term instruments are affected.

- Operational Risk Sources: Arise from internal process failures, human errors, system breakdowns, or external shocks like fraud and cyberattacks.

- Systemic Risk Connection: Both liquidity and operational risks can contribute to systemic risk, especially when they cascade across interconnected institutions.

- Monitoring and Reporting: Real-time analytics from tools like Provenir Fintech help in detecting early warning signals and responding proactively.

- Risk Frameworks: The FRM Handbook outlines structured approaches to assess and mitigate these risks using global best practices.

- Professional Competency: Mastery of liquidity and operational risk concepts is essential for professionals seeking FRM eligibility, ensuring they are equipped to handle real-world risk challenges.

Credit Risk and Evaluation Techniques

Credit risk refers to the possibility that a borrower or counterparty may fail to meet their financial obligations, leading to a loss for the lender or investor. It is one of the most significant forms of financial risk and is closely monitored in all sectors of the financial industry. Effective risk management in financial institutions involves evaluating creditworthiness through rigorous analysis of the borrower’s financial history, credit score, repayment capacity, and economic environment. Techniques such as credit scoring models, internal rating systems, and credit risk exposure limits are commonly used to assess and manage this risk. Tools derived from quantitative finance risk management including probability of default (PD), loss given default (LGD), and exposure at default (EAD) help institutions to model credit risk accurately and provision for expected losses. While market risk management focuses on price movements, credit risk evaluation ensures the quality and reliability of receivables and loan portfolios. Stress testing and scenario analysis further help in understanding how credit portfolios might perform under adverse conditions. By combining traditional assessment methods with advanced statistical models, institutions can maintain healthy credit portfolios, comply with regulatory standards, and safeguard themselves against potential financial disruptions caused by borrower defaults.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Liquidity and Operational Risks

Liquidity and operational risks are critical components of a financial institution’s overall risk profile, often underestimated until they create severe disruptions. Liquidity risk arises when a firm cannot meet its short-term obligations due to an inability to convert assets into cash without significant loss. Operational risk, on the other hand, stems from failures in internal processes, systems, or external events. Tools like the FRM Handbook and platforms such as Provenir Fintech are instrumental in identifying and managing these risks effectively. Understanding and mitigating these threats is essential for those pursuing FRM eligibility and careers in modern risk management. Here are six key points:

Risk Mitigation Strategies

Risk mitigation strategies are essential tools used by businesses and financial institutions to reduce the impact of potential losses from uncertain events. These strategies involve identifying risks, assessing their potential impact, and implementing measures to minimize their effect on financial performance. In the realm of market risk management, institutions often use hedging techniques such as options, futures, and swaps to protect against price volatility in stocks, interest rates, and currencies. Risk management in financial institutions also includes diversification of assets, implementing robust credit evaluation procedures, maintaining sufficient capital buffers, and adhering to regulatory requirements. One of the most powerful enablers of effective mitigation is the use of quantitative finance risk management methods, which apply mathematical models and statistical tools to forecast potential risks and evaluate the effectiveness of control mechanisms. Techniques like scenario analysis, Value at Risk (VaR), stress testing, and Monte Carlo simulations allow institutions to prepare for both expected and extreme events. These strategies not only help in preserving financial stability but also build investor confidence and support long-term growth. By integrating proactive risk mitigation into their core operations, organizations can better navigate uncertainties and maintain resilience in dynamic financial markets.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Derivatives and Hedging

Derivatives and hedging play a vital role in modern financial risk management, offering tools to protect against unpredictable market movements and potential losses. Derivatives such as futures, options, forwards, and swaps derive their value from underlying assets like stocks, interest rates, or currencies, and are commonly used to hedge against price volatility and money market risk. By strategically using derivatives, institutions can lock in prices, reduce uncertainty, and stabilize cash flows. Effective hedging is especially crucial in managing systemic risk, as it helps prevent the cascading effects of market disruptions across interconnected entities. Platforms like Provenir Fintech provide real-time analytics and automation to enhance the execution and monitoring of derivative strategies, making them more precise and responsive. The FRM Handbook offers in-depth guidance on derivative instruments and their application in controlling market exposures, making it a key resource for finance professionals. Those pursuing FRM eligibility must demonstrate a deep understanding of derivatives, hedging techniques, and their role in mitigating financial risk under different market conditions. When used wisely, derivatives not only safeguard against losses but also provide strategic opportunities for portfolio optimization, contributing to the overall resilience and efficiency of financial systems and institutions.