- Introduction to Investment Strategies

- Understanding the Top-Down Approach

- Understanding Bottom-Up Approach

- Analyzing Macroeconomic Factors (Top-Down)

- Focus on Company Fundamentals (Bottom-Up)

- Advantages of Top-Down Investing

- Advantages of Bottom-Up Investing

- Limitations of Both Approaches

Introduction to Investment Strategies

Investment strategies are essential tools for individuals and institutions aiming to grow wealth and manage financial risks effectively. A solid introduction to investment strategies begins with understanding the foundational approaches investors use to analyze and choose assets. Two widely adopted methods are the Top-Down vs Bottom-Up Approach. The top-down approach starts with macroeconomic factors such as market trends, economic indicators, and industry performance before narrowing down to specific companies. In contrast, the bottom-up approach focuses on analyzing individual companies regardless of broader market conditions, emphasizing fundamentals like revenue, earnings, and management quality. These methods also tie into bottom up top down management, where decision-making can flow either from higher-level strategic goals to operational execution (top-down), or from insights at the ground level influencing higher strategy (bottom-up). Understanding the top down and bottom up approach in management is crucial, as it reflects how investment decisions align with organizational strategies and goals. A well-informed investor often blends both techniques to balance macroeconomic context with micro-level insights, creating a more adaptive and informed strategy. Ultimately, choosing the right investment approach depends on one’s goals, risk tolerance, and market outlook, making strategic understanding vital for long-term financial success.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Understanding the Top-Down Approach

- Focus on Macroeconomic Trends: Top-Down Investing starts with analyzing economic indicators like GDP growth, inflation, interest rates, and global events to assess the overall market outlook.

- Evaluate Global and National Markets: Investors then identify the most promising regions or countries based on economic stability, growth prospects, and political conditions.

- Identify Promising Sectors: Based on macro trends, investors pinpoint which industries or sectors are likely to perform well under current economic conditions.

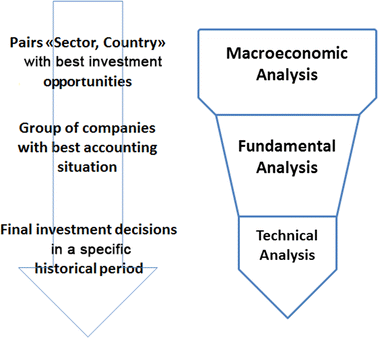

The Top-Down Approach is a strategic investment method that begins with analyzing the broader economy before narrowing down to sectors, industries, and finally individual stocks. This method is often contrasted with the Bottomup approach, where the focus is on evaluating individual companies first. Investors using Top-Down Investing aim to capitalize on macroeconomic trends and align their portfolio with larger market movements. Here’s a clearer breakdown to help understand this approach better:

- Select Leading Companies: After identifying strong sectors, individual companies with solid fundamentals and competitive advantages are selected within those sectors.

- Compare with Bottom-Up Investing: Unlike Top-Down, Bottom-Up Investing emphasizes company-level analysis, ignoring broader market factors, allowing investors to find hidden gems even in underperforming sectors.

- Integration with Management Strategies: The concept of top down button or control reflects how decisions flow from higher-level strategies to lower-level actions mirroring how Top-Down Approach functions in both investing and management.

Understanding Bottom-Up Approach

The Bottom-Up Approach is an investment and management strategy that begins by analyzing individual elements such as companies or team-level operations before considering broader market or organizational trends. In investing, this method focuses on thoroughly researching specific companies, evaluating their financial health, management quality, product offerings, and growth potential, regardless of industry or macroeconomic conditions. This contrasts with the Top-Down vs Bottom-Up Approach, where the top-down method starts from the macro level and filters down to individual stocks. The bottom-up strategy is especially useful for identifying undervalued assets or businesses that may outperform their sectors. This approach also ties into organizational strategy, aligning with bottom up top down management, where ideas and decisions flow from both grassroots employees and senior leadership. This dual-directional flow enhances flexibility, innovation, and responsiveness within companies. The top down and bottom up approach in management is often used together, balancing structured guidance with employee-driven insights. In both investing and management, the Bottom-Up Approach empowers deeper analysis and more personalized decision-making, making it a valuable framework for those seeking to build robust portfolios or dynamic organizational systems. Its emphasis on the micro level ensures a solid foundation before considering the impact of broader influences.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Analyzing Macroeconomic Factors (Top-Down)

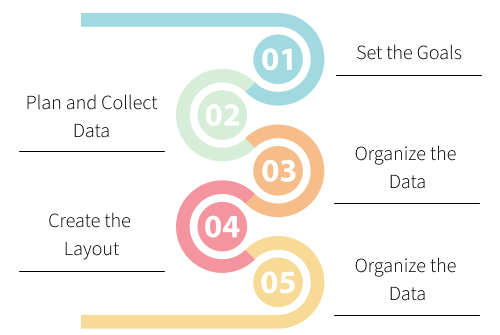

- GDP Growth Trends: Gross Domestic Product (GDP) is a primary indicator of a country’s economic health. In Top-Down Investing, strong GDP growth signals potential investment opportunities in expanding markets.

- Inflation and Interest Rates: High inflation or rising interest rates can affect consumer spending and borrowing, guiding investors toward sectors that perform better in such conditions.

- Unemployment Rates: Employment data provides insight into consumer demand and economic strength, influencing sector preferences within the Top-Down Approach.

The Top-Down Approach in investing starts with analyzing macroeconomic factors to guide investment decisions. This strategy, known as Top-Down Investing, focuses on the big picture economy-wide indicators before narrowing down to specific sectors or stocks. It contrasts with the Bottomup approach, which prioritizes individual company fundamentals first. Understanding these macro factors is essential for strategic decision-making and effective portfolio positioning. Here are six key macroeconomic elements considered in a top-down analysis:

- Government Policies and Regulations: Fiscal and monetary policies can create favorable or unfavorable environments for industries, making policy analysis crucial.

- Global Market Trends: Economic shifts in major markets like the U.S. or China often influence global investments, especially for international portfolios.

- Comparison with Bottom-Up Investing: While Bottom-Up Investing drills into company-specific metrics, a top down button perspective gives investors a broad foundation, which can be complemented by the Bottomup approach for a balanced view.

- Macro Trend Alignment: Investors can capitalize on large-scale economic movements, such as inflation shifts or policy changes, making the most of national or global growth patterns.

- Efficient Sector Selection: The strategy helps quickly identify high-performing or resilient sectors, improving allocation efficiency without deep-diving into every individual company.

- Time-Saving Analysis: By filtering sectors and industries first, investors can eliminate weak areas early on, streamlining research and decision-making processes.

- Risk Management: Staying aligned with macroeconomic indicators allows investors to avoid sectors vulnerable to downturns, offering a layer of risk control.

- Global Investment Opportunities: Top-Down Investing encourages looking beyond domestic markets, helping diversify across international economies.

- Integration with Management Styles: The concept of the top down button applies in business too, where strategic decisions are passed from the top, complementing or blending with Bottom-Up Investing and the Bottomup approach for a holistic investment and top down and bottom up approach in management strategy.

Focus on Company Fundamentals (Bottom-Up)

The Bottom-Up Approach in investing emphasizes a deep analysis of individual companies rather than starting from macroeconomic or industry-wide trends. This method is grounded in evaluating company fundamentals such as revenue growth, earnings, debt levels, competitive advantage, and management quality. Unlike the Top-Down vs Bottom-Up Approach, where the top-down strategy begins with a broad market view, the bottom-up approach allows investors to uncover high-potential opportunities even in underperforming sectors. It’s a particularly valuable method in volatile markets where strong companies can still deliver solid returns regardless of external conditions. This philosophy also mirrors decision-making in organizations, where bottom up top down management is increasingly adopted. In this system, insights from employees at every level help shape strategic decisions, ensuring that leadership remains connected to operational realities. The top down and bottom up approach in management offers a balanced structure, where both executive vision and grassroots input are valued. Similarly, bottom-up investors build their portfolio from the ground up trusting in the strength of individual assets rather than broad trends. This makes the Bottom-Up Approach ideal for long-term investors focused on value and company-specific performance as opposed to temporary market conditions.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Advantages of Top-Down Investing

Top-Down Investing is a strategic method where investors begin with a broad view of the economy, then narrow down to industries, sectors, and finally specific stocks. This approach allows investors to align their portfolio with major economic trends and global developments. Compared to the Bottomup approach, which focuses on individual companies first, the Top-Down Approach helps in identifying opportunities shaped by macro-level shifts. Here are six key advantages of Top-Down Investing:

Advantages of Bottom-Up Investing

Bottom-Up Investing offers a powerful strategy for investors who prioritize the strength and potential of individual companies over broader economic or market trends. Unlike the macro-driven nature of the top-down method, the bottom-up approach focuses on company fundamentals such as earnings, leadership quality, product innovation, and competitive positioning. This detailed analysis allows investors to identify undervalued or high-growth opportunities regardless of sector or market conditions. In the context of Top-Down vs Bottom-Up Approach, bottom-up is especially beneficial during market volatility, as strong companies often outperform despite unfavorable macroeconomic environments. This investing style also mirrors organizational strategies like bottom up top down management, where decision-making is influenced by insights from both ground-level employees and executive leadership. In this structure, feedback from the operational level helps inform higher-level strategic planning, enhancing agility and innovation. Adopting the top down and bottom up approach in management ensures that leadership remains connected to real-world performance, similar to how bottom-up investors remain closely tied to company-level realities. Ultimately, Bottom-Up Investing empowers investors to make informed, independent decisions, building resilient portfolios based on in-depth research and long-term value rather than broad economic forecasts.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Limitations of Both Approaches

While both the Top-Down Approach and Bottomup approach offer unique advantages, each comes with limitations that investors must consider when building a balanced strategy. Top-Down Investing, which starts with analyzing macroeconomic indicators, may overlook strong-performing companies in weaker sectors, potentially missing out on profitable opportunities. It also heavily relies on accurate economic forecasting, which can be unpredictable. On the other hand, Bottom-Up Investing focuses intensively on company-specific factors, but may ignore larger market or economic shifts that can impact overall performance. This tunnel vision can be risky during periods of economic downturns or industry-wide disruptions. Moreover, the top down button concept, which symbolizes centralized decision-making, may limit responsiveness and flexibility in both investment and management strategies. In contrast, relying solely on the Bottomup approach might lead to a fragmented portfolio without alignment to broader trends. In organizational terms, the absence of balance between the Top-Down Approach and Bottom-Up Investing can mirror inefficiencies found in businesses that lack a unified direction. Therefore, while each method offers value, combining elements of both can help mitigate these limitations. A blended strategy, much like a hybrid model in management, allows for adaptability, better risk control, and more informed investment decisions grounded in both macro and micro perspectives.