- Role and Responsibilities

- Typical Workday

- Analyst Hierarchy and Team Structure

- Core Financial Modeling Tasks

- Pitch Books and Deal Execution

- Industry Coverage Groups

- Capital Markets Exposure

- Training Programs

- Conclusion

Role and Responsibilities

Investment banking analysts are typically the entry-level professionals hired by investment banks. They play an essential role in supporting deal teams with financial modeling, valuation, market research, and preparation of client materials. Analysts are usually recent graduates from business schools or related disciplines.Investment banking analysts are the backbone of any investment bank’s deal execution and client advisory teams. They perform critical financial analysis, prepare client presentations, and support senior bankers throughout the transaction lifecycle. This article explores the role of an investment banking analyst, their typical workday, Core financial modeling tasks, challenges, Capital markets exposure and career development opportunities.

Key Responsibilities

- Financial Modeling: Building and maintaining complex Excel models such as discounted cash flow (DCF), leveraged buyout (LBO), comparable company analysis, and precedent transactions.

- Valuation: Conducting valuations using multiple methodologies to determine the fair value of companies or assets.

- Industry and Company Research: Gathering data on companies, industries, competitors, and market trends to support pitch books and deal execution.

- Pitch Book Preparation: detailed presentation decks for client meetings to propose potential transactions.

- Due Diligence Support: Assisting senior bankers in analyzing data rooms and compiling relevant financial and operational information.

- Transaction Execution: Coordinating with legal, compliance, and accounting teams to ensure smooth deal execution.

- Administrative Tasks: Scheduling meetings, managing documents, and liaising between different teams.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Typical Workday

Start of the Day: Most analysts start early, often arriving by 7-8 AM to review emails, prioritize tasks, and prepare for meetings. They check for updates from clients, senior bankers, or other teams.

Morning Activities

- Finalizing financial models based on new data.

- Preparing pitch books for upcoming client meetings.

- Participating in morning team calls to discuss ongoing projects and deadlines.

Midday

- Attending internal meetings or client calls.

- Performing research on target companies or industries.

- Revising presentations after receiving feedback from associates or vice presidents.

Evening and Night

- Analysts frequently work late nights, sometimes past midnight, especially during live deals or pitches.

- Finalizing deliverables such as valuation reports, financial models, and client presentations.

- Coordinating with global teams across time zones.

Analyst Hierarchy and Team Structure

In Investment Banking Analyst, the analyst role is the entry-level position within a well-defined hierarchy that structures the workflow and responsibilities of the team. Analysts typically form the foundation of the deal execution process, responsible for financial modeling,Core financial modeling tasks preparing pitch books, conducting market research, and supporting associates and senior bankers. The typical hierarchy starts with Analysts, who usually work for two to three years before advancing to Associate roles. Above associates are Vice Presidents, followed by Directors or Executive Directors, and finally Managing Directors who lead client relationships and strategic decision-making. Teams are often organized by product groups (like M&A or capital markets) or industry groups (such as healthcare or technology), allowing analysts to develop specialized knowledge. Within this structure, analysts work closely with associates and vice presidents, receiving guidance while contributing to detailed analysis and presentation materials. The hierarchy ensures clear communication, efficient deal execution, and professional development, preparing analysts to advance their careers while supporting complex transactions in a fast-paced environment.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Core Financial Modeling Tasks

Model Building

-

Analysts build detailed financial models including:

- Discounted Cash Flow (DCF): Forecasting free cash flows and discounting to present value.

- Comparable Company Analysis: Valuing a company relative to peers.

- Precedent Transaction Analysis: Benchmarking based on historical deal multiples.

- Leveraged Buyout (LBO) Models: Modeling acquisitions financed with significant debt.

- Model Maintenance: Updating models with new assumptions, financial data, or market conditions.

- Scenario Analysis: Creating multiple cases (base, best, worst) to test the impact of different assumptions.

- Output: Providing valuation outputs, key financial metrics, and charts for inclusion in client presentations.

Pitch Books and Deal Execution

Pitch books: Are comprehensive presentation documents created by investment bankers to showcase their firm’s expertise, market insights, and strategic recommendations to potential clients. These books typically include company overviews, industry analysis, financial models,Capital Markets valuation scenarios, and proposed deal structures. They serve as a critical tool during client meetings and help bankers win mandates for mergers and acquisitions, capital raising, or advisory services. Once a deal is secured.

Deal execution: Begins, which involves detailed due diligence, negotiation support, preparing legal documentation, coordinating with various stakeholders, and managing the transaction timeline. Investment banking teams work collaboratively throughout this phase to ensure smooth progress, accurate financial analyst , and compliance with regulatory requirements. Pitch books and deal execution together form the backbone of investment banking work, combining strategic thinking and operational precision to deliver successful outcomes for clients.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Industry Coverage Groups

Investment banks are divided into industry coverage groups specializing in sectors such as:

- Technology, Media, and Telecommunications (TMT)

- Healthcare and Pharmaceuticals

- Financial Institutions

- Consumer and Retail

- Energy and Natural Resources

- Industrials

Analysts typically join an industry group where they develop sector-specific expertise, allowing deeper understanding of company fundamentals and Capital markets exposure

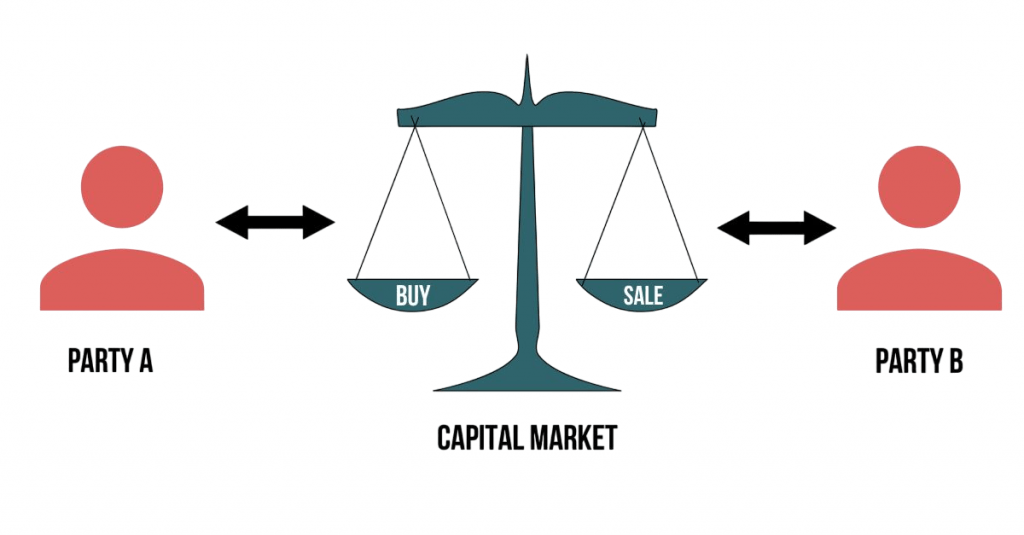

Capital Markets Exposure

- Definition: Experience working with equity and debt markets, including IPOs, bond issuances, and secondary offerings.

- Skills Developed: Financial modeling, valuation, market analysis, and understanding investor behavior.

- Types of Transactions: Initial Public Offerings (IPOs), Follow-on Equity Offerings, Debt Issuances, Convertible Securities.

- Role in Investment Banking: Supports companies in raising capital to fund growth, acquisitions, or refinance debt.

- Cross-Functional Collaboration: Works closely with sales, trading, research teams, legal advisors, and regulators.

- Market Timing & Pricing: Understanding optimal timing and pricing strategies to maximize capital raised.

- Regulatory Knowledge: Compliance with securities laws, disclosures, and market regulations.

- Career Benefit: Builds expertise valuable for roles in corporate finance, equity research, and portfolio management.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Training Programs

Onboarding and Technical Training

Most banks have structured training programs covering:,

- Financial statement analysis

- Excel modeling techniques

- Industry fundamentals

- Pitch book creation

- Ongoing Learning: Regular workshops and seminars on valuation updates, regulatory changes, and market trends.Mentorship programs pairing junior analysts with senior bankers.

- Certification Support: Some banks support analysts pursuing professional certifications like CFA or CPA.

Conclusion

In conclusion, understanding the various types of investment banks and their core services from bulge bracket to boutique firms, and from M&A to capital markets and restructuring is essential for anyone aspiring to build a successful career in investment banking. Each segment offers unique opportunities, challenges, Capital markets exposure and skill requirements, making it important to align your career goals with the right environment and specialization. Whether you are starting as an analyst or aiming for leadership roles, Core financial modeling tasks gaining exposure to deal execution, financial modeling, and client relationships will be critical. Additionally, building strong networks and continuously developing your expertise through certifications and practical experience will set you apart in this competitive field. With dedication and the right knowledge, you can navigate the complex landscape of investment banking and contribute meaningfully to the financial world.