- What is FPI?

- FPI vs FDI

- Role in Emerging Markets

- Benefits of FPI

- Risks Associated with FPI

- Regulatory Framework

- SEBI Guidelines on FPI

- Tax Implications

- Conclusion

What is FPI?

Foreign Portfolio Investment (FPI) refers to the investment by foreign individuals, institutions, or governments in a country’s financial assets, global financial assets such as stocks, bonds, and other financial instruments. Unlike Foreign Direct Investment (FDI), FPI does not entail direct control over the companies in which investments are made. It is characterized by its liquidity and ease of entry and exit from financial markets. FPI is a key component of a country’s capital account and contributes significantly to the development of its financial markets. It allows foreign investors to gain exposure to a country’s equity and debt markets without taking on ownership or management responsibilities.Foreign Portfolio Investment (FPI) refers to the investment made by individuals, global financial assets institutions, or governments from one country into the financial assets of another country. These investments typically include stocks, bonds, mutual funds, and other marketable securities. Unlike Foreign Direct Investment (FDI), which involves acquiring a significant ownership stake or control in a foreign company, FPI is passive in nature. Investors do not get involved in the management or operations of the companies they invest in. FPI is usually short-term and highly liquid, making it easier for investors to enter and exit markets quickly. However, this also makes it more volatile, as it is sensitive to changes in global financial conditions, interest rates,investment goals, debt markets, global financial assets and currency fluctuations. FPI is a key component plays a significant role in global capital flows and helps developing countries access foreign capital, but it can also pose risks to financial stability if large amounts of capital are suddenly withdrawn.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

FPI vs FDI

| Feature | FPI | FDI |

|---|---|---|

| Ownership | Less than 10% | More than 10% or controlling |

| Control | No control | Active control |

| Investment Type | Securities (stocks, bonds) | Physical assets, companies |

| Risk and Return | Higher volatility | Relatively stable |

| Liquidity | Highly liquid | Illiquid |

| Investment Horizon | Short to medium term | Long term |

While FPI allows for quick market entry and exit, FPI is a key component that typically represents a more stable and long-term commitment to the host economy.

Role in Emerging Markets

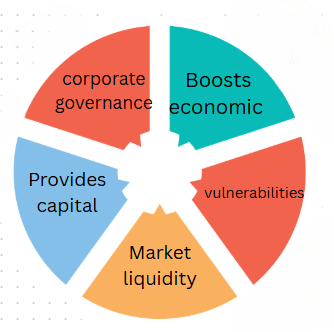

Foreign Portfolio Investment (FPI) plays a crucial role in emerging markets by:

- Provides capital: Helps fill the gap between domestic savings and investment needs.

- Improves market liquidity: Increases the volume and ease of trading in financial markets.Role in Emerging Markets

- Enhances market efficiency: Encourages better pricing of securities through increased participation.

- Promotes corporate governance: Pressures local companies to adopt global standards in transparency and accountability.

- Diversifies investor base: Reduces dependence on local investors and broadens the pool of available capital.

- Boosts economic growth: Supports infrastructure development, debt markets, industrial expansion, and financial sector growth.

- Exposes vulnerabilities: Can lead to volatility if large volumes of capital are quickly withdrawn.

- Affects currency stability: Inflows and outflows influence exchange rates and balance of payments.

- Requires strong regulation: Needs effective policy and regulatory oversight to manage risks and maintain stability.

However, reliance on FPI can make emerging markets vulnerable to sudden capital flight during periods of global uncertainty.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Benefits of FPI

- Access to foreign capital: Provides additional funding for domestic businesses and governments.

- Market liquidity: Increases trading activity, making it easier to buy and sell securities.

- Lower cost of capital: With more investment, companies may face lower borrowing costs.

- Diversification of investor base: Reduces reliance on local investors and broadens market participation.

- Improved financial infrastructure: Encourages development of capital markets and financial institutions.

- Boost to economic growth: Capital inflows can stimulate economic activity and support development.

- Better corporate governance: Foreign investors often demand transparency and accountability.

- Encouragement of reforms: To attract FPI, countries may implement economic and regulatory reforms.

- Currency support: Inflows of foreign currency can help stabilize or strengthen the local currency.

- Increased international confidence: High FPI inflows signal investor trust in a country’s economy and stability.

Risks Associated with FPI

Despite the benefits, Foreign Portfolio Investment (FPI) is subject to various risks:

- Market Volatility: Prices can fluctuate sharply.

- Currency Risk: Changes in exchange rates can impact returns.

- Political Risk: Changes in government policy or political instability can affect investor sentiment.

- Regulatory Risk: Sudden changes in rules governing foreign investments.

- Exit Barriers: In times of crisis, investors may face restrictions on repatriation of funds.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

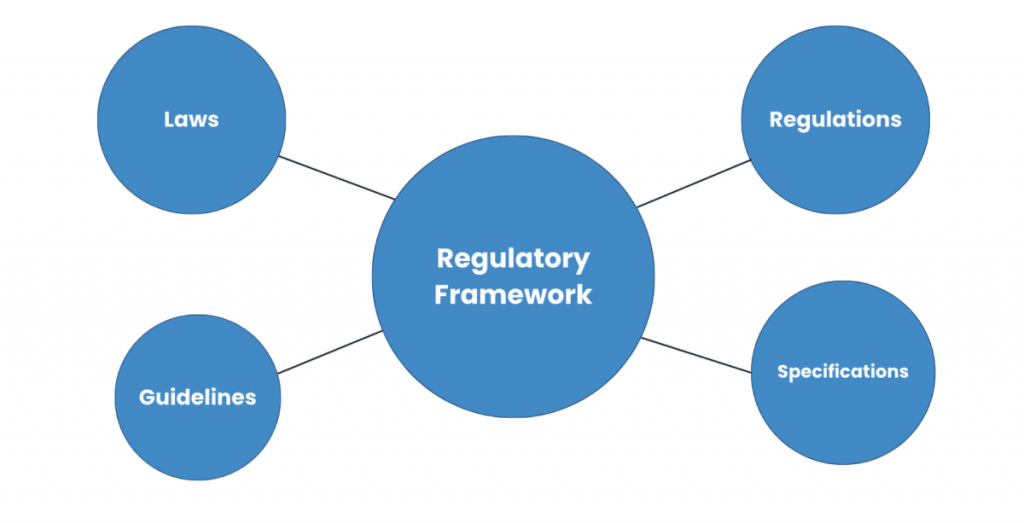

Regulatory Framework

The regulatory framework for Foreign Portfolio Investment (FPI) is designed to facilitate smooth inflows of foreign capital while protecting the domestic financial system from potential risks. It typically includes guidelines set by a country’s central bank, debt markets, securities regulator, and government authorities to govern the registration, global financial, reporting, and investment goals limits for foreign investors. These regulations ensure transparency, prevent money laundering, and promote market stability.

SEBI Guidelines on FPI

In India, the Securities and Exchange Board of India (SEBI) regulates FPI activities:

- FPI Categories: Classified into three categories based on risk profile and investor type.

- FKYC Norms: Detailed Know Your Customer compliance for all FPI participants.

- FInvestment Limits: Caps on investment goals in corporate bonds and equities.

- FReporting Requirements: Timely disclosure of holdings and transactions.

- FCustodian Appointment: Mandatory for all FPI investors.

- Capital Gains Tax: Short-term and long-term gains may be taxed at different rates.

- Withholding Tax: On interest or dividends earned.

- Double Taxation Treaties (DTTs): May reduce tax burden through bilateral agreements.

- Tax Filing: Investors are often required to file returns in the host country.

These guidelines ensure transparency and reduce systemic risk.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Tax Implications

Tax treatment varies by country and type of security:

Proper tax planning is essential to optimize net returns from FPI.

Conclusion

Foreign Portfolio investment goals serve as a powerful tool for channeling global capital into emerging and developed markets alike. It offers mutual benefits: higher returns and diversification for investors, debt markets, global financial and capital and financial markets development for host countries. However, global financial assets it brings with it a set of challenges including market volatility and regulatory complexities. Governments and regulators must craft sound policies to harness the benefits of FPI is a key component while managing associated risks. For investors, thorough due diligence, financial markets, understanding of tax implications, and alignment with long-term financial goals are critical to making the most of foreign portfolio investments.