- Introduction to Financial Markets

- Types (Capital Market, Money Market, etc.)

- Role in Economic Development

- Participants in Financial Markets

- Primary vs Secondary Markets

- Financial Instruments

- Regulatory Framework (SEBI, RBI)

- Market Efficiency

- Global vs Domestic Markets

- Technology and Innovations

- Market Risks

- Conclusion

Introduction to Financial Markets: An In-Depth Overview

Financial markets form the backbone of a modern economy by facilitating the flow of funds between savers and borrowers, enabling investment, risk management, and wealth creation. These markets allow businesses, governments, and individuals to access capital, trade securities, and manage financial risks efficiently. This comprehensive article explores the structure, types, functions, participants, regulatory frameworks, and evolving dynamics of financial markets, with a special focus on the Indian context while also touching upon global developments.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

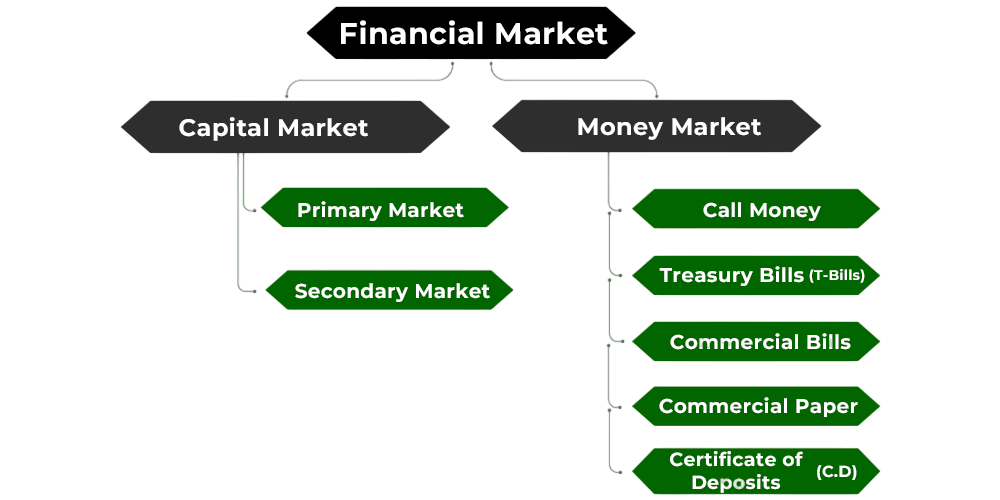

Types (Capital Market, Money Market, etc.)

Financial markets are platforms or systems that facilitate the buying and selling of financial instruments like stocks, bonds, currencies, and derivatives. They connect investors who want to invest surplus funds with entities that require capital for business expansion, infrastructure development, or consumption. These markets enhance liquidity, enable price discovery, reduce transaction costs, and contribute significantly to economic growth by efficiently allocating resources. Financial markets include a variety of trading platforms, each serving specific economic functions and addressing different investment needs. Capital markets focus on long-term funding through equity shares and bonds.

They help businesses and governments raise capital in primary markets, where new securities like IPOs are issued, and in secondary markets, where existing securities are traded on exchanges. Money markets play a supporting role by enabling short-term borrowing and lending with maturities under one year. They provide important liquidity management for banks and businesses through tools like Treasury bills and commercial paper. Derivatives markets add complexity by trading contracts that derive their values from underlying assets. These markets offer advanced options for managing risk and speculative opportunities. The global financial framework is also enhanced by foreign exchange markets, which facilitate international trade by supporting currency transactions, and commodity markets that allow for the trading of physical goods and related contracts. Other specialized markets, such as insurance, mortgage, private equity, and venture capital markets, complete this complex financial ecosystem. Each market plays a key role in economic dynamics and investment strategies.

Role of Financial Markets in Economic Development

Financial markets play a pivotal role in fostering economic development by:

- Efficient Capital Allocation: By channeling funds from savers to productive uses, markets ensure that capital is deployed where it generates the highest returns.

- Liquidity Provision: Markets provide liquidity, allowing investors to convert assets into cash easily, increasing the attractiveness of investment.

- Price Discovery: Through the forces of supply and demand, financial markets determine the fair prices of securities, reflecting all available information.

- Risk Management: Derivatives and insurance markets enable individuals and firms to hedge against various risks.

- Promoting Savings and Investment: Attractive financial markets incentivize savings and investment, vital for long-term economic growth.

- Facilitating Corporate Governance: Listed companies in stock exchanges are subject to regulatory oversight, promoting transparency and accountability.

- Retail Investors: Individual investors who buy and sell securities for personal accounts.

- Institutional Investors: Entities like mutual funds, pension funds, insurance companies, hedge funds managing large pools of capital.

- Corporations: Issue securities to raise capital; also invest surplus funds.

- Governments: Raise funds for public spending and development projects by issuing bonds.

- Regulators: Oversee market functioning, protect investors, and ensure transparency.

- Exchanges: Provide organized platforms for trading securities.

- Equity Instruments (Stocks): Represent ownership in a company. Provide dividends and capital appreciation.

- Debt Instruments (Bonds, Debentures): Represent borrowed funds to be repaid with interest. Include government bonds, corporate bonds, municipal bonds.

- Derivatives: Contracts like futures, options, swaps. Used to hedge or speculate on price movements.

- Money Market Instruments: Short-term debt like Treasury bills, commercial paper.

- Mutual Funds and ETFs: Pooled investment vehicles that provide diversification.

- Foreign Exchange: Currencies traded globally.

- Securities and Exchange Board of India (SEBI): Functions include regulating stock exchanges, protecting investor interests, and promoting transparency.

- Reserve Bank of India (RBI): Regulates the money market, banking sector, and foreign exchange markets. Manages liquidity, interest rates, and currency stability.

- Ministry of Finance: Frames policies affecting financial markets and taxation.

- Stock Exchanges: National Stock Exchange (NSE), Bombay Stock Exchange (BSE) provide trading platforms. Ensure fair and transparent trading.

- Other Regulators: Insurance Regulatory and Development Authority (IRDA), Pension Fund Regulatory and Development Authority (PFRDA).

- Weak Form: Prices reflect all past trading information.

- Semi-Strong Form: Prices reflect all publicly available information.

- Strong Form: Prices reflect all information, public and private.

- Electronic Trading Platforms: Replace traditional open outcry systems.

- Algorithmic Trading: Automated strategies executed at high speeds.

- Blockchain and Cryptocurrencies: Decentralized finance and digital assets.

- Robo-Advisors: Automated portfolio management.

- Artificial Intelligence: Enhances risk assessment and trading models.

- Mobile Trading Apps: Enable retail investor participation globally.

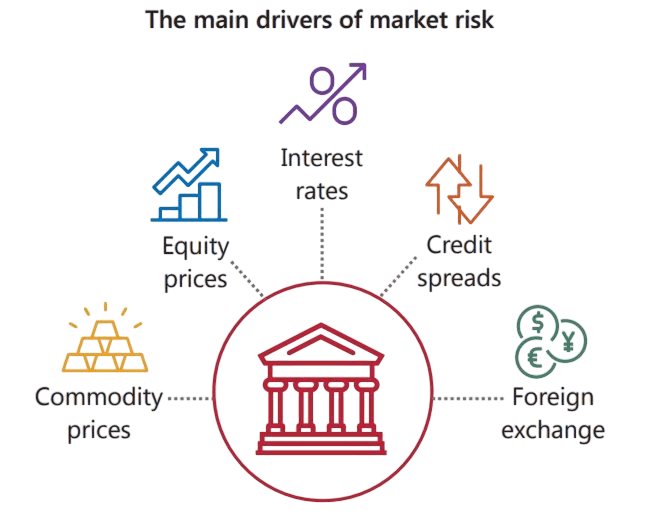

- Market Risk: Risk of losses due to price fluctuations. Includes equity risk, interest rate risk, currency risk.

- Credit Risk: Risk of default by issuers on debt obligations.

- Liquidity Risk: Risk of being unable to buy or sell assets quickly without loss.

- Operational Risk: Failures in systems, processes, or controls.

- Regulatory Risk: Changes in laws or policies affecting markets.

- Systemic Risk: Risk of collapse of the entire financial system or markets.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Participants in Financial Markets

Financial markets involve diverse participants, each playing specific roles:

Primary vs Secondary Markets

In the ever-changing world of financial markets, it is vital for investors and companies to understand the distinct roles of primary and secondary markets. The primary market is where new securities are created and sold directly to investors. This allows companies to raise capital through stock or bond offerings, with the important backing of investment bank underwriting. On the other hand, the secondary market is a lively space where existing securities are traded among investors. This market provides necessary liquidity and helps discover prices through the interactions of supply and demand. Major stock exchanges like NSE and BSE illustrate how the secondary market functions, with securities constantly changing hands. This creates a flexible and transparent environment, making it easy for investors to buy and sell financial instruments. The connection between the primary and secondary markets supports effective capital allocation, which drives economic growth and investment opportunities.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Financial Instruments

Financial markets trade a wide array of instruments, each serving different purposes:

Regulatory Framework in India

India’s financial markets are governed by robust regulatory bodies that ensure market integrity, investor protection, and orderly growth.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Market Efficiency

Market efficiency relates to how well market prices reflect all available information.

Forms of Market Efficiency:

Efficient markets facilitate accurate pricing, reduce arbitrage opportunities, and enable investors to make informed decisions.

Global vs Domestic Markets

Financial markets are active systems that function in both domestic and global settings. Each setting has unique traits and interrelated features. Domestic markets operate within a single country’s borders. They are regulated by national authorities and reflect the specific economic conditions, policies, and characteristics of local investors. On the other hand, global markets extend beyond national boundaries. They enable the flow of capital across borders through international stock exchanges, bond markets, and foreign exchange platforms. Global markets broaden access to capital and investment options. However, they also add layers of complexity due to fluctuating currencies and varied regulatory systems. As globalization continues, these markets become more interconnected, forming a complex network that presents new opportunities but also exposes participants to greater risks. This interrelatedness means that economic events in one area can quickly affect financial markets around the world. It highlights the need to understand both local and global market systems.

Technology and Innovations in Financial Markets

Technological advancements have revolutionized financial markets, making them more accessible, efficient, and secure.

Technology has reduced transaction costs, increased transparency, and opened markets to new participants.

Market Risks

Investing in financial markets involves various risks, which must be understood and managed:

Risk management through diversification, hedging, and regulatory oversight is essential for market stability.

Conclusion

Financial markets are integral to economic growth and wealth creation. They enable efficient capital allocation, liquidity provision, and risk management, serving as the nexus between savers and users of funds. Understanding the types of markets, instruments, participants, and regulatory frameworks empowers investors and policymakers to navigate and harness these markets effectively. In an increasingly interconnected and technologically advanced world, financial markets continue to evolve, presenting new opportunities and challenges. Robust regulation, investor education, and innovation will remain key to fostering healthy, transparent, and inclusive financial markets that support sustainable economic development.