- Introduction to Loan Syndication

- Parties Involved

- Syndication Process

- Role of Lead Bank

- Benefits for Borrowers

- Risk Sharing Among Lenders

- Syndicated Loans in India

- Regulatory Considerations

- Documentation and Agreements

- Fees and Revenue Structure

- Real-life Examples

- Summary

Introduction to Loan Syndication

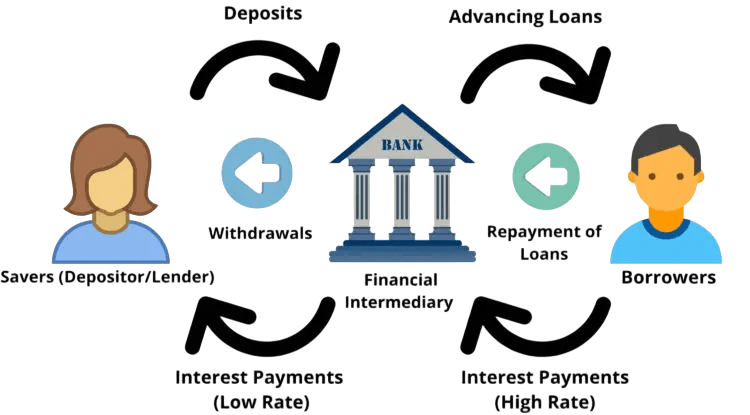

Loan syndication is a vital financing mechanism in the banking and corporate world, enabling large borrowers to access substantial amounts of capital that exceed the lending capacity or risk appetite of a single lender. It involves multiple lenders coming together to provide portions of a large loan to a borrower under a shared agreement. This approach distributes risk among the lenders while meeting the borrower’s funding needs efficiently. Loan syndication plays an increasingly important role in infrastructure, project finance, corporate acquisitions, and other large-scale funding requirements worldwide. This essay explores the concept, process, parties involved, benefits, risks, regulatory framework, and practical aspects of loan syndication, with a focus on India.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Parties Involved in Loan Syndication

Loan syndication is a complex financial process that involves many important stakeholders working together to make large-scale lending possible. At the heart of this arrangement is the borrower, which is usually a corporation, infrastructure company, government entity, or project developer in need of major financial resources. The lead bank, also called the Mandated Lead Arranger (MLA), has a key role in structuring the loan, negotiating terms, and coordinating the entire syndication process. It often commits the largest financial share and acts as the main representative. To reduce risk and spread out the funding responsibility, the lead bank invites other lenders and financial institutions to provide smaller amounts of the total loan. Legal advisors offer crucial support by drafting and reviewing syndication documents to ensure they follow regulations. A designated trustee or agent bank manages the loan agreement, oversees repayments, and represents the group’s interests in case of default. This teamwork makes it possible to carry out complex financial transactions that individual institutions might find difficult to handle alone.

Syndication Process

The loan syndication process involves several key steps:

- Origination and Mandate: The borrower approaches a lead bank or vice versa. The lead bank assesses creditworthiness, loan requirements, and decides to take on the mandate.

- Structuring the Loan: The lead bank structures the loan terms: amount, tenure, interest rate, covenants, repayment schedule, and security requirements.

- Preparation of Information Memorandum: A detailed Information Memorandum (IM) or Offering Memorandum is prepared to present the borrower’s financials, project details, risks, and loan terms. This document is shared with prospective participant banks.

- Syndication / Marketing: The lead bank invites other lenders to join the syndicate by providing their commitment amounts based on the IM. This can be done through one of two methods.

- Allocation and Commitment: Participant lenders submit their commitments. The lead bank allocates the loan portions and finalizes the syndicate composition.

- Documentation and Signing: Legal documentation including the Loan Agreement, Security Agreements, and Intercreditor Agreements are prepared and signed.

- Disbursement and Administration: Funds are disbursed, and the lead bank manages the loan servicing, repayments, and compliance monitoring on behalf of the syndicate.

- Arranging and Structuring: Designs the loan structure, pricing, and terms.

- Due Diligence: Conducts credit assessment and risk analysis.

- Marketing: Invites other lenders and markets the loan.

- Documentation: Coordinates legal documentation and agreements.

- Administration: Acts as agent for the syndicate in monitoring, repayments, and communication with the borrower.

- Risk Bearing: Often takes the largest exposure and may underwrite the loan to ensure funding.

- Regulatory Oversight: The Reserve Bank of India (RBI) provides guidelines for loan syndication to ensure transparency and protect lenders.

- Infrastructure Financing: Large infrastructure projects in sectors such as power, roads, and ports frequently utilize syndicated loans.

- Bank Collaboration: Indian banks collaborate extensively for syndicated lending both domestically and internationally.

- Diverse Participation: There is increasing involvement from Non-Banking Financial Companies (NBFCs), mutual funds, and foreign banks.

- Access to Foreign Capital: Syndication enables Indian borrowers to tap foreign capital via syndicated loans from international banks.

- RBI Guidelines: Define exposure limits, due diligence requirements, and reporting standards. Recent updates emphasize structured oversight for large syndicated loans and improved inter-bank information sharing.

- Know Your Customer (KYC): Banks must conduct thorough KYC on borrowers, including declarations of existing credit facilities and quarterly account conduct reports.

- Foreign Exchange Management Act (FEMA): Applies if loans involve foreign currency or overseas lenders. Borrowing must comply with ECB regulations and approved channels for foreign exchange transactions.

- SEBI Regulations: Relevant if the borrower is a listed company or issuing debt instruments. SEBI mandates disclosure, investor protection, and compliance with listing norms for securitized debt instruments.

- Basel Norms: Influence banks’ capital requirements based on syndicated loan exposures. Basel III implementation affects leverage, liquidity, and provisioning standards for Indian banks.

- Loan Agreement: Defines terms and conditions, repayment schedules, interest rates, covenants, and events of default.

- Intercreditor Agreement: Governs rights and obligations among lenders, decision-making processes, and priority in recovery.

- Security Agreements: Outline collateral and pledge arrangements.

- Agent Bank Agreement: Defines the lead bank’s role and fee structure.

- Side Letters: Additional agreements with individual lenders if applicable.

- Reliance Infrastructure Syndicated Loan (2018): Reliance Infrastructure secured a syndicated loan exceeding ₹3,000 crore for power and infrastructure projects. The consortium was led by a major Indian bank, enabling timely execution and effective distribution of credit risk among participating lenders.

- Tata Steel International Syndicated Loan: Tata Steel raised approximately $1.9 billion through a multi-currency syndicated loan involving around 20 global banks, including JP Morgan, Citigroup, and Bank of America. The funds supported overseas acquisitions and working capital, helping diversify funding sources and reduce borrowing costs.

- Indian Railways Infrastructure Finance Company (IRFC): IRFC routinely mobilizes funds via syndicated loans from domestic and international banks to finance railway infrastructure. It has funded over ₹5 trillion worth of assets, including locomotives, coaches, and freight wagons, and recently expanded into metro and renewable energy-linked infrastructure financing.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Role of Lead Bank

The lead bank is the central figure in loan syndication and assumes several responsibilities:

The lead bank earns fees for these services, including arranging fees, underwriting fees, and administrative fees.

Benefits for Borrowers

Loan syndication offers a smart financing option that gives borrowers several advantages in today’s complicated financial environment. It allows access to capital that goes beyond what a single lender can provide, giving organizations more flexibility and financial strength. This method helps borrowers diversify their funding sources, which lessens reliance on individual banks and lowers potential lending risks. Syndicated loans can be adjusted to fit specific needs, including customized repayment periods, interest rates, and contract conditions. One major benefit is the simplified process of negotiating a single loan agreement, which cuts down on administrative challenges and lowers transaction costs. Additionally, syndication provides borrowers with greater confidentiality since detailed financial data is shared only with a select group of trustworthy lenders. This approach not only supports larger financial deals but also boosts a borrower’s reputation in the market by involving respected banking institutions in the funding process.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Risk Sharing Among Lenders

Loan syndication serves as a smart way to reduce risk for lending institutions. By spreading large loan amounts among multiple banks, this process changes how banks manage risk. The syndication process directly tackles important risk areas.

It handles credit risk by sharing the chances of borrower defaults. It also addresses concentration risk by ensuring no single bank takes on too much exposure. Additionally, it helps manage operational risk through shared administrative tasks. Market risks, like interest rate and currency changes, are also shared, leading to a stronger lending environment. This teamwork not only helps banks meet rules on how much they can lend to one borrower but also encourages a safer and more balanced risk management approach. This improves the stability of the financial system and increases the ability of institutions to handle risks.

Syndicated Loans in India

In India, loan syndication has gained prominence due to the growing scale of infrastructure and corporate financing. Key points:

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Regulatory Considerations

Regulatory compliance is crucial in syndicated lending:

Legal and compliance frameworks ensure syndicated loans maintain high standards of transparency, risk management, and governance.

Documentation and Agreements

Syndicated loans involve detailed legal documentation and agreements including:

Documentation complexity depends on the loan size, number of lenders, and risk profile.

Fees and Revenue Structure

In the complex world of loan syndication, the revenue model is set up to pay financial institutions for their important roles and risks. Lead banks earn an arranging fee for putting together and marketing the loan. Underwriting fees compensate them for guaranteeing funding in underwritten deals. Lenders also receive commitment fees on loan amounts that are not drawn, agency fees for administrative and monitoring tasks, and sometimes participation fees. Furthermore, exit or prepayment fees act as financial protections if borrowers decide to pay off loans early. This varied fee structure encourages active participation from lead banks and lenders. It also supports a steady and profitable financial system that balances risk management with financial intermediation.

Real-life Examples

Illustrative examples of syndicated loans in India:

Summary

Loan syndication is a sophisticated financial mechanism that enables large borrowers to access substantial capital efficiently while distributing credit risk among multiple lenders. The process involves a lead bank arranging and structuring the loan, inviting participants, and administering the syndicate. For borrowers, syndicated loans offer access to large sums, flexible terms, and enhanced credibility. For lenders, they provide diversification, risk sharing, and regulatory compliance benefits. In India, syndicated lending has become integral to infrastructure and corporate finance, governed by regulatory frameworks to ensure transparency and stability. With ongoing economic development and large-scale projects, loan syndication will continue to play a pivotal role in meeting India’s financing needs.