- Understanding the Role

- Educational Qualifications

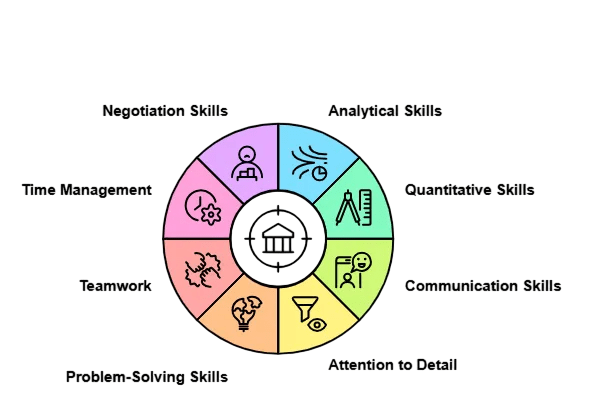

- Skills Required

- Networking and Connections

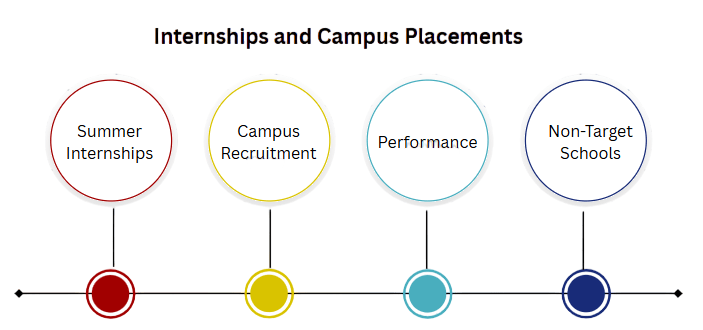

- Internships and Campus Placements

- Resume and Cover Letter Tips

- Cracking the IB Interview

- Certifications and Online Courses

- Entry-Level Positions

- Career Roadmap

- Conclusion

Understanding the Role

Investment banking is one of the most prestigious and sought-after Internships and campus placements in the finance world. Known for high compensation, challenging work, and dynamic deal-making environments, it attracts top talent globally. However, breaking into investment banking requires a strategic approach combining education, skills, networking, and preparation. In this guide, we walk through the essential steps and components to become an investment banker.An investment banker plays a crucial role in the financial industry by acting as an intermediary between companies, governments, and investors. Their primary responsibility is to help organizations raise capital by underwriting and issuing securities, such as stocks and bonds. Investment bankers also advise clients on mergers and acquisitions (M&A), corporate restructuring, and strategic financial planning. This requires a deep understanding of financial markets, valuation techniques, Cracking the IB interview and regulatory environments. Beyond capital raising, investment bankers conduct extensive market research and financial analysis to provide insights that help clients make informed decisions. They prepare detailed pitch books, financial models, and prospectuses to support their recommendations. The job demands strong analytical skills, attention to detail, and the ability to work under pressure, as deals often involve large sums and tight deadlines. Excellent communication and negotiation skills are essential, as bankers frequently interact with senior executives, investors, and legal teams. Investment banking is also known for its demanding work hours, but it offers significant financial rewards and opportunities for career growth. Overall, investment bankers are key players in facilitating business growth, enabling companies to expand, innovate, and navigate complex financial landscapes. Their expertise not only fuels economic development but also shapes the global capital markets.Before pursuing the career, it’s important to understand what investment bankers do.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Educational Qualifications

- Undergraduate Degree: Most investment banks require a bachelor’s degree. Preferred majors include finance, economics, accounting, business administration, or engineering.

- Strong Academic Record: High GPA (often 3.5+) is essential, especially from reputed institutions.

- Advanced Degrees: While not mandatory at entry level, advanced degrees such as MBA or master’s in finance increase chances of lateral entry or faster promotion.

- Alternative Paths: Some bankers come from law, mathematics, or computer science backgrounds, bringing specialized skills like legal expertise or programming.

Skills Required

- Financial Modeling & Valuation : Proficiency in building detailed financial models and conducting company valuations

- Accounting & Financial Statement Analysis : Strong understanding of income statements, balance sheets, and cash flow

- Excel & PowerPoint Expertise : Advanced skills for data analysis, presentations, and pitch books

- Market Research & Industry Analysis : Ability to research industries, companies, and market trends to inform deals

- Analytical Thinking & Problem-Solving : Critical evaluation of financial data and strategic situations

- Attention to Detail : Accuracy in preparing complex financial documents and compliance materials.

- Communication & Presentation : Clear and persuasive communication with clients, executives, and team members.

- Negotiation Skills : Ability to navigate deal terms and advocate for client interests.

- Time Management & Work Ethic : Capability to work long hours under pressure and meet tight deadlines.

- Interpersonal Skills & Teamwork : Collaborating effectively in high-stakes, fast-paced environments.

- Summer Internships: Typically 8-12 weeks, these offer hands-on exposure and a chance to prove skills.

- Campus Recruitment: Many banks recruit from target colleges via placement drives.

- Performance: Interns who perform well often receive full-time offers.

- Non-Target Schools: Candidates from less-known schools should seek off-cycle or boutique firm internships.

- Internship Roles: Analysts support deal teams, prepare models, conduct research, and assist in presentations.

- Clear, concise, and tailored to investment banking.

- Highlight quantitative achievements (e.g., improved process efficiency by 20%).

- Emphasize internships, leadership roles, relevant coursework.

- Use bullet points and action verbs.

- Keep it to one page.

- Personalize for each firm.

- Explain your motivation for investment banking.

- Showcase knowledge of the firm and industry.

- Highlight your key skills and experience.

- Keep it professional and succinct.

- Technical Questions: Cover accounting, valuation, financial modeling, and market concepts.

- Behavioral Questions: Focus on teamwork, leadership, conflict resolution, and motivation.

- Case Studies: May involve analyzing a company and proposing investment ideas or deal structures.

- Fit Questions: Why investment banking? Why this firm? Long-term goals

- Preparation: Practice common technical questions, mock interviews, and stay updated on market news.

- CFA: Industry-recognized credential with a rigorous exam structure.

- Financial Modeling Courses: Offered by platforms like Wall Street Prep, Breaking Into Wall Street.

- Excel Certifications: Demonstrate advanced spreadsheet skills.

- Accounting and Valuation: Courses to strengthen fundamentals.

- MOOCs: Coursera, edX, and Udemy offer courses tailored to banking.

- Analyst Role: Typically a 2-3 year position involving heavy financial analysis and modeling.

- Responsibilities: Preparing pitch books, supporting senior bankers, conducting market research.

- Learning Curve: Intensive training on technical and soft skills.

- Career Progression: Promotion to associate and beyond depends on performance.

- Alternative Entry Points: Some enter as associates if they have MBAs or prior experience.

- Analyst (0-3 years): Focus on technical work and learning fundamentals.

- Associate (3-6 years): More client interaction, project management, and mentoring juniors.

- Vice President (6-9 years): Leading deals, managing teams, strategic planning.

- Director/Executive Director (9-12 years): Overseeing multiple deals and client relationships.

- Managing Director (12+ years): Firm leadership, major client acquisition, and revenue generation.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Networking and Connections

Networking and Connections play a critical role in professional growth and career development. In competitive fields like investment banking or business analytics, who you know can be just as important as what you know. Building a strong professional network opens doors to job opportunities, mentorship, industry insights, and collaborative projects. Effective networking isn’t just about collecting contacts, it’s about cultivating meaningful relationships based on trust, mutual respect, and shared interests. Attending industry events, alumni meetups, conferences, or joining professional platforms like LinkedIn allows individuals to connect with peers, industry leaders, and potential employers. Informational interviews, referrals, and recommendations often stem from these interactions and can provide a significant edge in the hiring process. In fast-paced industries, staying connected also helps professionals keep up with market trends, regulatory changes, and innovations. Additionally, networks offer support systems valuable for navigating challenges, sharing knowledge, and staying motivated. For students and early-career professionals, engaging with professors, alumni, and internship colleagues can lead to lasting career benefits. In essence, networking is not a one-time effort but a continuous investment in relationships that can accelerate personal and professional success.

Internships and Campus Placements

Internships and campus placements are the gateway to a full-time role:

Early internships help build experience, enhance resumes, and create professional networks.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Resume and Cover Letter Tips

Your application documents must stand out in a highly competitive environment:

Resume:

Cover Letter:

Attention to detail in your application reflects your professionalism.

Cracking the IB Interview

Cracking the IB interview can be rigorous and multi-staged:

Confidence, clarity, and preparation differentiate successful candidates.

Certifications and Online Courses

Certifications add credibility and supplement education:

Certifications help fill knowledge gaps and signal commitment to employers.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Entry-Level Positions

Most investment bankers start as analysts:

Entry-level roles build the foundation of a banking career.

Career Roadmap

Investment banking careers typically follow this trajectory:

Career progression is competitive but rewarding, with opportunities to move into private equity, hedge funds, or corporate finance.

Conclusion

Becoming an investment banker is a challenging yet attainable goal with the right blend of education, skills, Internships and campus placements, experience, and networking. Starting with a strong academic foundation, gaining practical exposure through internships, Cracking the IB interview and mastering technical and interpersonal skills pave the way. Strategic preparation for interviews and continuous learning through certifications further boost your profile. Whether entering as a fresh analyst or lateral hire, a clear career roadmap and perseverance lead to success in this dynamic industry.