- Introduction to Global IB Landscape

- Ranking Criteria

- Goldman Sachs Overview

- JPMorgan Chase & Co.

- Morgan Stanley

- Bank of America Merrill Lynch

- Citigroup

- Barclays

- Credit Suisse

- Deutsche Bank

Introduction to Global IB Landscape

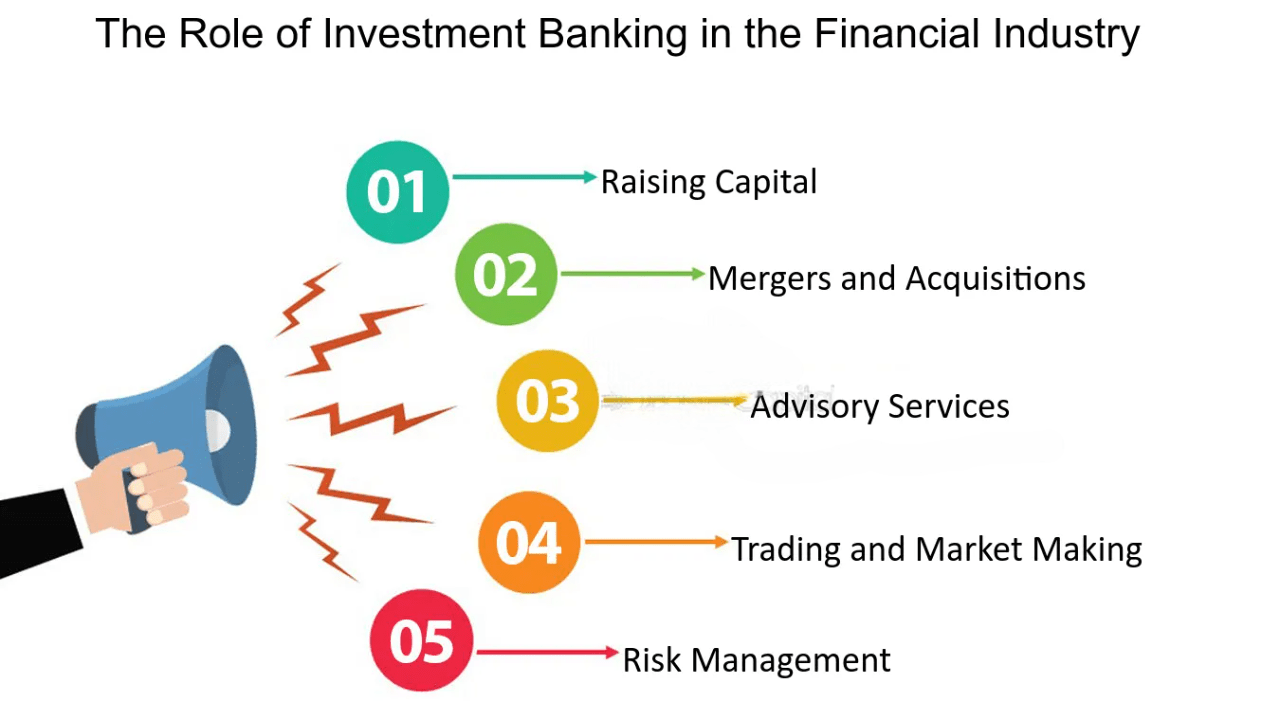

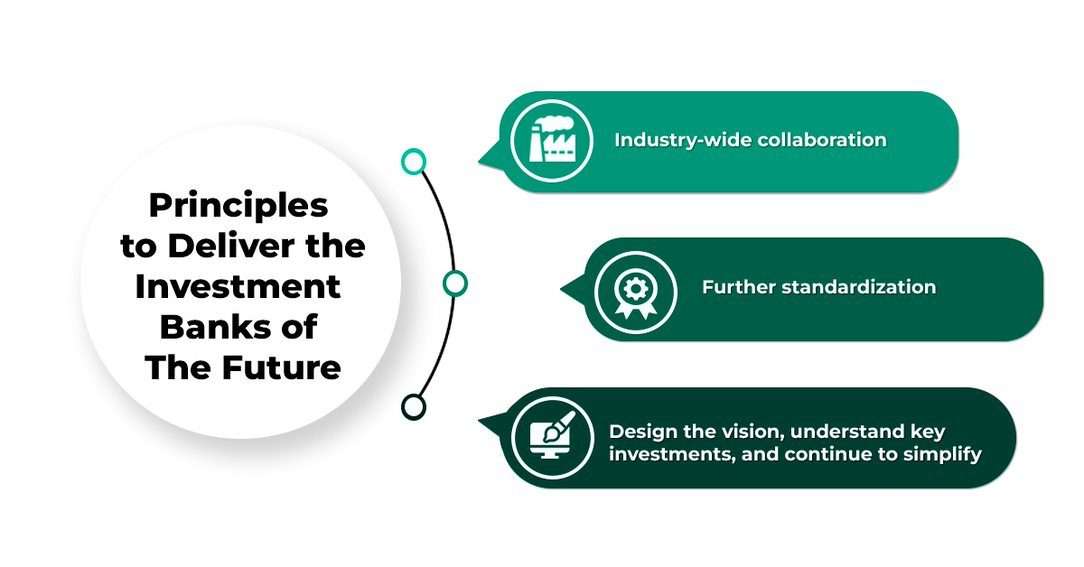

The global investment banking (IB) landscape is a dynamic and competitive space dominated by financial powerhouses that drive capital markets, advisory services, and private equity investments across the globe. At the forefront of this landscape are the Top 10 Investment Banks in the World, which include names like JPMorgan Chase, Morgan Stanley, and Goldman Sachs Private Equity, each setting benchmarks in deal-making, mergers, and acquisitions. These institutions play a crucial role in shaping economies by facilitating capital flow, underwriting securities, and managing wealth for high-net-worth clients and corporations alike. As globalization continues to fuel cross-border investments, investment banks are also expanding their footprints into emerging markets, seeking opportunities in new sectors and regions. Meanwhile, financial instruments like certificates of deposit rates influence how these banks manage liquidity and offer competitive returns to clients. With technological advancements, regulatory shifts, and evolving market demands, investment banks are constantly adapting to maintain their global edge. From traditional advisory roles to complex asset management strategies, today’s IB landscape is more multifaceted than ever, combining innovation, financial acumen, and strategic vision. Understanding this ecosystem is essential for anyone looking to enter the finance world or invest with confidence in global markets.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Ranking Criteria

- Revenue and Deal Volume: A primary measure is the total revenue generated, especially from mergers, acquisitions, underwriting, and advisory services.

- Asset Under Management (AUM): Institutions with a higher AUM, especially in long-term instruments like term deposits, are often ranked higher for their financial strength.

- Market Share in Key Sectors: A firm’s influence across various markets such as IPOs, debt issuance, and long term deposit growth adds weight to its global standing.

When evaluating and ranking institutions in the Global IB Landscape, several key criteria are considered to ensure a fair and comprehensive assessment. These factors help investors, analysts, and stakeholders understand the true performance and influence of firms like Credit Suisse Bank, PNC Investments, and others involved in major financial operations, including term deposits and long term deposit strategies. Below are six critical criteria used in ranking investment banks globally:

- Geographic Reach and Global Presence: A wide operational footprint, especially outside home markets, strengthens a bank’s role in the Global IB Landscape.

- Client Base and Services: Institutions like PNC Investments and Credit Suisse Bank that cater to diverse clients, including high-net-worth individuals, gain better ranks.

- Financial Stability and Innovation: Consistent performance, risk management, and innovation in investment products, including term deposits, are vital ranking components.

Goldman Sachs Overview

Goldman Sachs stands as one of the most influential financial institutions in the world, consistently ranking among the Top 10 Investment Banks in the World due to its global reach, innovative strategies, and robust financial performance. Founded in 1869, the firm offers a wide range of services including investment banking, securities, asset management, and wealth advisory, catering to corporations, governments, and individuals. One of its most notable divisions is Goldman Sachs Private Equity, which plays a major role in funding high-growth ventures and executing strategic buyouts across various industries. The firm is also known for its leadership in capital markets, mergers and acquisitions, and structured finance. In addition to its complex financial operations, Goldman Sachs provides competitive savings products, often benchmarked through tools like certificates of deposit rates, appealing to both retail and institutional investors. With a reputation for excellence, deep market expertise, and a global network, Goldman Sachs continues to shape the financial landscape through innovation, strategic partnerships, and unwavering client commitment. Its enduring legacy and adaptability ensure its dominance in a rapidly evolving economic world, making it a central player in both traditional and modern investment sectors.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

JPMorgan Chase & Co.

- Global Investment Banking Leadership: As a top-tier player, JPMorgan consistently ranks among the leading investment banks, advising on major mergers, acquisitions, and public offerings.

- Retail and Commercial Banking: The firm serves millions of customers worldwide, offering essential banking products such as term deposits and long term deposit options tailored for various financial goals.

- Technological Innovation: JPMorgan invests heavily in financial technology, streamlining banking operations and enhancing customer experiences across its digital platforms.

JPMorgan Chase & Co. is a leading global financial services firm that holds a prominent position in the Global IB Landscape. Known for its vast range of offerings, from retail banking to investment and asset management, the firm continues to set industry standards. As competitors like Credit Suisse Bank and PNC Investments strive to grow their market share, JPMorgan maintains its edge through strategic innovation and a robust financial structure. Here are six key highlights of JPMorgan Chase & Co.:

- Strong Asset Management Division: The bank manages trillions in client assets, placing it in direct competition with firms like PNC Investments.

- Risk Management and Stability: Its sound risk practices and diversified portfolio contribute to its resilience in changing markets.

- Global Presence: With operations in over 100 countries, JPMorgan plays a key role in shaping the modern Global IB Landscape, competing closely with giants like Credit Suisse Bank.

- Robust Investment Banking Division: BofA ML advises on major global deals, from M&A to capital raising, placing it among the top-tier global investment banks.

- Extensive Wealth Management Services: With a client-centric approach, it offers customized portfolios, including options like term deposits and long term deposit strategies.

- Strong Retail Banking Integration: Its close alignment with Bank of America’s retail banking arm allows seamless service across both personal and corporate finance.

- Global Reach and Presence: Operating in over 35 countries, BofA ML plays a vital role in shaping the international finance and investment landscape.

- Technological and Digital Innovation: The firm continues to invest in cutting-edge platforms for both advisory and portfolio management.

- Strategic Competitor Positioning: Regularly competing with firms like Credit Suisse Bank and PNC Investments, BofA ML remains a dominant force in the evolving Global IB Landscape.

Morgan Stanley

Morgan Stanley is a global financial powerhouse, widely recognized as one of the Top 10 Investment Banks in the World for its expertise in investment banking, wealth management, and institutional securities. Founded in 1935, the firm has built a strong reputation for delivering cutting-edge financial solutions to corporations, governments, and individuals across the globe. Morgan Stanley’s influence spans key sectors, including mergers and acquisitions, capital raising, and advisory services, often competing head-to-head with rivals like Goldman Sachs Private Equity in the private investment space. Known for its strategic innovation, the firm also offers tailored financial products and investment vehicles, including savings options that align with market-driven certificates of deposit rates, providing clients with diverse, risk-balanced portfolios. Morgan Stanley’s wealth management division is especially notable for serving high-net-worth individuals with precision, leveraging global insights and personalized strategies. Its role in shaping capital markets and guiding large-scale financial transactions reinforces its position at the top of the global banking hierarchy. With a blend of traditional banking strength and forward-thinking innovation, Morgan Stanley continues to drive progress in global finance, making it a cornerstone of the modern financial system and a key influencer in the evolving investment banking landscape.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Bank of America Merrill Lynch

Bank of America Merrill Lynch (BofA ML) is a major player in the Global IB Landscape, offering a wide range of financial services that span investment banking, wealth management, and corporate finance. As part of Bank of America, the firm leverages its vast resources to provide innovative solutions to institutions, governments, and individuals. Competing with notable firms like Credit Suisse Bank and PNC Investments, BofA ML has earned a strong global reputation. Here are six key points that define its standing:

Citigroup

Citigroup, commonly known as Citi, is a globally recognized financial institution that consistently ranks among the Top 10 Investment Banks in the World. With a presence in over 160 countries, Citi offers a broad spectrum of financial services, including investment banking, retail banking, asset management, and wealth advisory. The firm plays a critical role in facilitating global capital flows, supporting major mergers, acquisitions, and public offerings. Its investment banking arm competes with giants like Goldman Sachs Private Equity, delivering strategic financing and advisory services to corporations, governments, and institutional investors. Citigroup also provides attractive savings and investment options, often guided by prevailing certificates of deposit rates, which appeal to both individual savers and corporate clients seeking secure and steady returns. Known for its commitment to digital innovation and inclusive financial services, Citi has developed cutting-edge platforms that enhance user experience and financial access globally. The bank’s resilient infrastructure and strategic global positioning make it a pillar in the world of finance. With its diverse service offerings and forward-looking vision, Citigroup continues to shape the future of banking and remain a key force in the evolving landscape of global investment banking.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Barclays

Barclays is a prominent global financial institution that has earned its place among the Top 10 Investment Banks in the World through its comprehensive range of services and deep-rooted presence in international markets. Headquartered in London, Barclays offers investment banking, retail banking, and wealth management solutions to clients across more than 40 countries. The bank is especially known for its strong performance in fixed income, currencies, and commodities (FICC), as well as its robust advisory and capital markets services. Competing with major players like Goldman Sachs Private Equity, Barclays has steadily expanded its footprint in the private investment and asset management space. For individuals and businesses seeking stable returns, the bank also provides competitive savings options, often benchmarked against prevailing certificates of deposit rates, making it a trusted choice for conservative and long-term investors alike. Barclays continues to invest in digital transformation and sustainability initiatives, ensuring its relevance in an evolving financial ecosystem. With a focus on innovation, client satisfaction, and global reach, Barclays remains a critical player in shaping the modern financial world, securing its legacy and future as one of the most influential names in global investment banking.

Credit Suisse

Credit Suisse Bank has long been a respected name in the Global IB Landscape, known for its expertise in wealth management, investment banking, and asset management. Headquartered in Switzerland, the bank has built a strong reputation for delivering tailored financial solutions to clients ranging from high-net-worth individuals to global corporations. As part of its offerings, Credit Suisse Bank provides competitive savings products, including term deposits and long term deposit options that appeal to conservative investors seeking steady returns. The bank’s investment banking division has played a key role in advising on major M&A deals, capital raising, and strategic financial planning across Europe, Asia, and the Americas. Though it operates in a competitive space alongside institutions like PNC Investments, Credit Suisse distinguishes itself through its global reach, Swiss banking heritage, and personalized client service. In recent years, the bank has undergone strategic restructuring to strengthen its core business areas and increase stability amid shifting global economic conditions. Despite market challenges, Credit Suisse continues to play a significant role in the evolving financial landscape, leveraging its expertise and global network to support institutional and private clients. Its ability to offer both traditional banking products and sophisticated financial solutions keeps it relevant in today’s complex investment world.

Deutsche Bank

Deutsche Bank is a major force in the Global IB Landscape, offering a comprehensive suite of financial services including investment banking, corporate banking, asset management, and retail banking. Headquartered in Frankfurt, Germany, Deutsche Bank has a strong international presence and is known for its expertise in global capital markets, advisory services, and risk management solutions. The bank competes closely with global peers such as Credit Suisse Bank and PNC Investments, continuously enhancing its offerings to meet the demands of an evolving financial environment. In the retail segment, Deutsche Bank provides a variety of savings and investment options, including term deposits and long term deposit products that cater to clients seeking security and steady returns. Its investment banking division plays a critical role in facilitating complex transactions, advising on cross-border mergers and acquisitions, and offering strategic guidance to multinational corporations. Deutsche Bank’s resilience, commitment to innovation, and global client base make it a key player in international finance. Despite facing regulatory and market challenges in the past, the bank has focused on strengthening its core business areas and risk management frameworks, allowing it to maintain relevance and influence in the competitive world of global banking.