- Introduction to Foreign Investment

- Benefits to Host Country

- Types of Foreign Investors

- Sector-wise Investment Trends

- Regulatory Framework in India

- FEMA and RBI Guidelines

- Taxation for Foreign Investors

- Risk Factors in Foreign Investment

- Bilateral Investment Treaties

- Economic Impact Assessment

- Future Trends in Global Capital Flows

- Conclusion

Introduction to Foreign Investment

Foreign investment refers to the flow of capital from one country to another to establish business operations or acquire business assets in the target country. It plays a pivotal role in the economic development of nations by enhancing capital formation, boosting employment, and facilitating technology transfer. Foreign investments can be broadly classified into two categories: Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI). FDI involves long-term participation and management control in an enterprise by a foreign entity. In contrast, FPI entails investing in financial assets such as stocks and bonds without obtaining management control. Both types serve different purposes and offer distinct advantages and risks. Foreign investment is considered a barometer of investor confidence and is instrumental in fostering bilateral and multilateral economic cooperation. Nations often compete to attract foreign capital by offering favorable regulations, tax incentives, and improved ease of doing business.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Benefits to Host Country

Foreign investors boost economic development by providing various benefits to host countries. They lessen reliance on domestic savings by bringing in capital. This influx creates important job opportunities in many sectors. These investments have a lasting impact beyond immediate financial benefits. They enable technology transfer and introduce better management practices and new methods. Manufacturers especially help increase exports, allowing countries to improve their position in global trade. Foreign investors often finance vital infrastructure projects, enhancing transportation, communication, and industrial capabilities. By promoting market competition and efficiency, these investments energize the economy, particularly benefiting small and medium enterprises through joint ventures. In the end, these investments contribute to GDP growth, help reduce budget deficits, and encourage stronger international economic ties, setting host countries up for sustainable development in the long run.

Types of Foreign Investors

Foreign investors can be categorized based on their investment style and institutional structure:

- Multinational Corporations (MNCs): Invest through subsidiaries and joint ventures to expand global operations.

- Sovereign Wealth Funds (SWFs): Government-owned investment vehicles deploying capital for strategic and financial returns.

- Private Equity Firms: Invest in unlisted companies for long-term gains, often via buyouts and restructuring.

- Venture Capitalists: Fund start-ups with high growth potential and innovation-led models.

- Foreign Institutional Investors (FIIs): Participate in public markets through equity and debt instruments.

- Retail Investors: Individual foreign investors, typically accessing markets via Foreign Portfolio Investment (FPI) channels.

- Pension Funds: Large-scale institutional investors targeting stable, long-term returns across asset classes.

Each investor type brings different levels of commitment, expertise, and expectations, contributing uniquely to the host economy.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Sector-wise Investment Trends

Certain sectors tend to attract more foreign investment due to their profitability and growth potential:

- Information Technology and Services: Major FDI inflows driven by skilled talent pools and operational cost efficiencies.

- Pharmaceuticals: Strategic foreign partnerships for research, development, and large-scale production.

- Automobile Manufacturing: FDI focused on vehicle production and export-oriented manufacturing hubs.

- Infrastructure and Real Estate: Capital investment in smart cities, highways, and urban development projects.

- Financial Services: FPI directed toward banks, insurance companies, and other financial institutions.

- Retail and E-commerce: Sector growth fueled by rising consumer demand and digital marketplace expansion.

- Renewable Energy: Greenfield investments targeting solar, wind, and sustainable energy initiatives.

Government initiatives like “Make in India” and targeted sector-specific policies have played a pivotal role in shaping these investment trends.

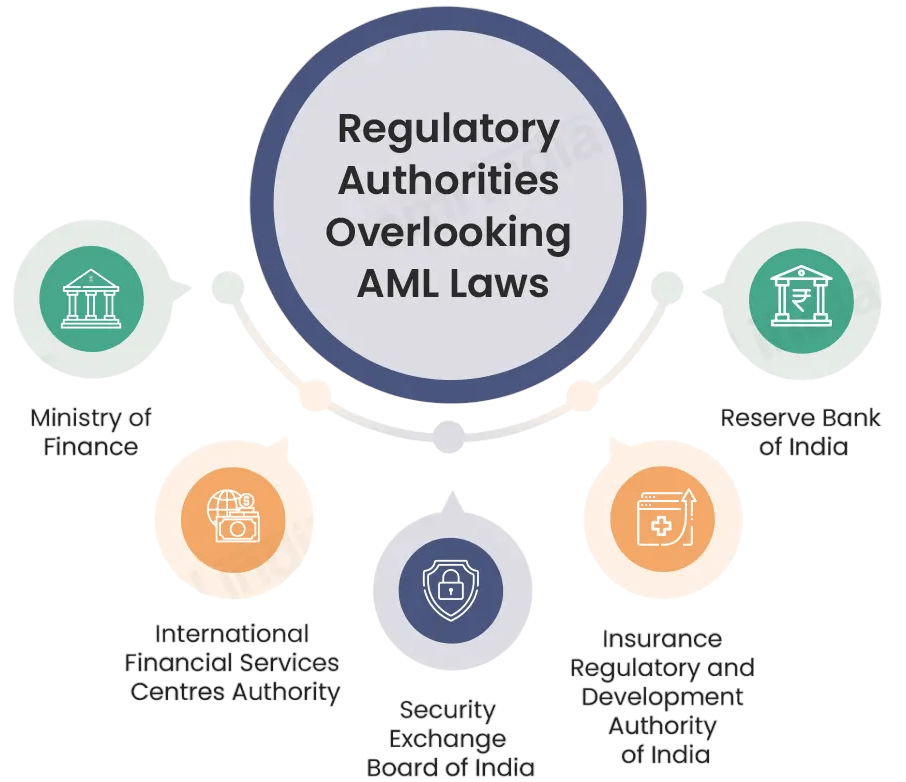

Regulatory Framework in India

The Reserve Bank of India (RBI) enforces the Foreign Exchange Management Act (FEMA) of 1999. This law provides a clear framework for foreign exchange transactions in India and outlines how to conduct financial interactions internationally. The RBI is the main body that ensures compliance in this area, carefully monitoring different aspects of the law. The Act lays out specific guidelines that define who can invest and establishes exact limits on investments through sector caps and entry routes. FEMA requires businesses to submit necessary documents, including FC-GPR and FLA forms, and it enforces strict reporting rules. The legislation also provides clear pricing guidelines for issuing and transferring shares to ensure fair valuation processes. Additionally, FEMA sets out detailed rules for repatriation, which govern how to transfer profits, dividends, and capital. This creates a stable and predictable environment for foreign investment and financial transactions in India.

FEMA and RBI Guidelines

India has a clear and organized set of rules for foreign investment, which key government bodies manage. The Department for Promotion of Industry and Internal Trade (DPIIT) is crucial in issuing guidelines and overseeing foreign direct investment (FDI) policies. The Reserve Bank of India (RBI) controls capital inflows and reporting requirements. The Securities and Exchange Board of India (SEBI) provides important supervision of foreign portfolio investments in capital markets, ensuring transparency and compliance. Investors can enter the Indian market through two main routes: the automatic route, which needs no prior government approval, and the government route, which requires explicit clearance. Sensitive sectors like defense, telecommunications, and media impose specific investment limits and strict approval processes on international investors. This reflects India’s approach to welcome foreign capital while safeguarding vital national interests.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Taxation for Foreign Investors

Tax obligations vary depending on the type of investment and applicable bilateral tax treaties:

- Capital Gains Tax: Differentiated treatment for short-term and long-term capital gains based on holding period and asset type.

- Dividend Distribution Tax: Responsibility now shifted to shareholders, with dividends subject to applicable withholding tax.

- Transfer Pricing: Mandates arm’s-length pricing in transactions between related entities to ensure fair taxation.

- Withholding Tax (TDS): Applied on income from interest, royalties, and fees for technical services, often governed by treaty rates.

- Double Tax Avoidance Agreements (DTAAs): Bilateral treaties designed to prevent income from being taxed in both jurisdictions.

India has entered into DTAAs with numerous countries, offering foreign investors reduced tax rates and simplified compliance mechanisms.

Risk Factors in Foreign Investment

Foreign investors face several risks, including:

- Currency Risk: Fluctuations in exchange rates

- Political Risk: Policy changes, nationalization, or regulatory shifts

- Market Risk: Volatility in equity and debt markets

- Liquidity Risk: Difficulty in exiting investments

- Legal Risk: Disputes due to unclear or changing laws

- Repatriation Risk: Restrictions on moving profits or capital

Risk mitigation strategies include diversification, insurance, and legal safeguards.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Bilateral Investment Treaties (BITs)

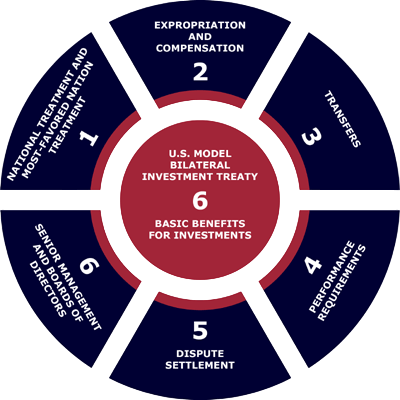

Bilateral Investment Treaties (BITs) promote and protect cross-border investments between countries through important international agreements. These frameworks provide essential protections for investors. They include fair treatment, strong safeguards against expropriation, most-favored-nation status, and clear dispute resolution processes. Countries like India have updated their BIT models to offer more balanced approaches. These changes help protect foreign investments while also preserving government regulatory rights.

Economic Impact Assessment

The economic impact assessment impact of foreign investment includes:

- GDP Growth: Boost through capital formation

- Employment: Direct and indirect job creation

- Exports and Imports: Enhanced trade volume

- Innovation: Encouragement of R&D and skill development

- Regional Development: Investments in Tier-II and Tier-III cities

However, excessive reliance on foreign capital may lead to vulnerabilities such as economic impact assessment dependence or sudden capital flight.

Future Trends in Global Capital Flows

The landscape of foreign investment is continuously evolving:

- Sustainable Investing: Emphasis on ESG (Environmental, Social, Governance) factors

- Digital Platforms: Use of AI and analytics in investment decisions

- Geopolitical Realignments: Shifting investment flows due to new alliances

- Reshoring and Friendshoring: Businesses relocating to politically stable regions

- Emerging Market Focus: Increased interest in India, Vietnam, and Africa

India is poised to benefit from these trends, provided it maintains investor-friendly policies, regulatory transparency, and robust infrastructure.

Conclusion

Foreign investment remains a cornerstone of global economic integration and national development. It bridges capital deficits, promotes innovation, and strengthens bilateral ties. With evolving regulatory norms and increasing emphasis on sustainability, both investors and host countries must adapt to the dynamic global investment environment. For India, continued reform, infrastructure development, and legal clarity are essential to attract and retain high-quality foreign investment.