- Understanding ROI

- ROI Calculation and Formula

- ROI in Business Decision-Making

- ROI vs Internal Rate of Return (IRR)

- ROI in Marketing and Projects

- ROI in Real Estate and Startups

- Time-adjusted ROI

- ROI Limitations

- Conclusion

Understanding ROI

Return on Investment (ROI) is one of the most widely used financial metrics, measuring the gain or loss generated relative to the amount of money invested. ROI helps businesses, investors, Tracking and analysts assess the efficiency or profitability of an investment and compare it with alternatives. best return on Investment (ROI) is a widely used financial metric that helps individuals and businesses assess the profitability of an investment. It measures the return earned on an investment relative to its cost, offering a simple way to evaluate how effectively money is being used. The basic formula is: ROI = (Net Profit / Cost of Investment) × 100 For example, if you invest $1,000 in a marketing campaign and it generates $1,500 in profit, your ROI would be 50%. This means you earned 50 cents in profit for every dollar spent. ROI is valuable because it allows comparisons across different investments or projects. Businesses use it to analyze everything from product launches to advertising campaigns, while investors rely on it to evaluate stocks, real estate, and other assets. A higher ROI generally indicates a more profitable investment. However, ROI has limitations. It doesn’t account for the time period over which the return is earned or the risks involved. Two best return on investmentmight show the same ROI, but one could take twice as long or be far riskier. Therefore, ROI should be used alongside other metrics like payback period, internal rate of return (IRR), or risk assessment for well-rounded decision-making.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

ROI Calculation and Formula

- Definition: ROI (Return on Investment) measures the profitability of an investment relative to its cost.

- Basic Formula: ROI = (Net Profit / Cost of Investment) × 100

- Net Profit:Total returns or gains from the investment minus the initial cost

Example:

- Investment cost: $1,000

- Return: $1,500

- Net Profit = $1,500 – $1,000 = $500

- ROI = ($500 / $1,000) × 100 = 50%

- Interpretation: A 50% ROI means you earned 50 cents in profit for every dollar invested.

- Use Cases: Business projects and marketing campaigns Stock and real estate investment Comparing the efficiency of multiple opportunities

- Limitations: Doesn’t account for time duration or riskMay not reflect long-term performance

ROI in Business Decision-Making

Return on Investment (ROI) plays a crucial role in business decision-making by helping companies evaluate the potential profitability of various initiatives. Whether it’s launching a new product, investing in technology, or running a marketing campaign, ROI provides a clear, quantitative way to compare the benefits of an action against its cost. Decision-makers use ROI to prioritize projects that promise higher returns, Internal Rate ensuring optimal use of limited resources. For example, if two marketing strategies are being considered, calculating the expected ROI for each helps identify which one is more financially effective. Beyond just comparing options, ROI also aids in performance evaluation tracking whether past best return on investment met their profitability goals. However, relying solely on ROI can be misleading, as it doesn’t consider factors like time duration, risk, or strategic value. A project with a slightly lower ROI might be more beneficial in the long run due to brand building or customer retention. Therefore, while ROI is an essential tool in guiding business strategy, it should be used alongside other financial and qualitative metrics to make well-informed, balanced decisions.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

ROI vs Internal Rate of Return (IRR)

| Metric | ROI | IRR |

|---|---|---|

| Basis | Simple percentage | Time-adjusted annual rate |

| Use | Snapshot evaluation | Multi-period cash flow analysis |

| Limitation | Ignores time value | Requires complex calculation |

ROI in Marketing and Projects

- Performance Measurement: ROI helps evaluate the effectiveness of marketing campaigns and project investments.

- Formula Use:

- Spend: $5,000 on ads

- Revenue generated: $7,500

- Net profit: $2,500

- ROI = (2,500 / 5,000) × 100 = 50%

- Decision-Making Tool: Helps prioritize marketing strategies or project proposals with higher potential returns.

- Budget Justification: ROI supports funding requests by showing projected financial impact.

- Performance Tracking: Used to track whether a completed project or campaign met its profitability goals.

- Limitations: Doesn’t account for long-term value, brand growth, or non-monetary benefits.

- Definition: Time-adjusted ROI accounts for the duration of an investment, providing a more accurate measure of efficiency over time.

- Why It Matters: Two investments may have the same ROI, but the one that achieves it faster is generally more desirable.

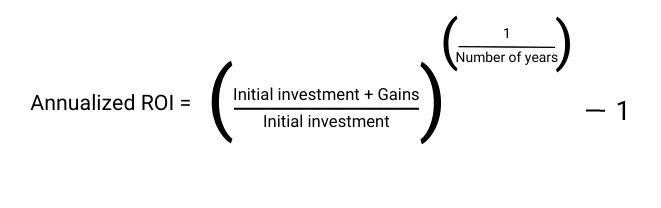

- Common Metric: Annualized ROI – expresses ROI on a per-year basis to compare investments of different durations.

- Formula for Annualized ROI:

- Used In: Long-term projects.Real estate and startup investments.Financial products like bonds or mutual funds

- Benefits: Enables fair comparison between short- and long-term investment.Improves strategic decision-making

- Limitations: Doesn’t account for risk or cash flow timing unless used with other metrics (e.g., IRR, NPV)

- Ignores Time Value: ₹10,000 over 1 year ≠ ₹10,000 over 10 years

- Overlooks Risk: High ROI doesn’t mean low risk

- Doesn’t Reflect Cash Flow Timing: A large gain in Year 1 vs Year 5 has different present value

- Susceptible to Manipulation: Costs and benefits can be creatively defined

- Single Metric Fallacy: Doesn’t provide a full financial picture

Marketing ROI Example:

ROI in Real Estate and Startups

Return on Investment (ROI) is a critical metric in both real estate and startups, helping investors assess potential profitability. In real estate, ROI measures how much profit a property generates relative to its purchase and maintenance costs. Investors use it to compare rental properties, renovation projects, or flips, often factoring in mortgage payments, taxes, tracking and property appreciation. A strong ROI indicates a high-performing asset, making it easier to attract financing or justify further best return on investment. In Business Decision-Making, ROI helps evaluate early-stage funding, marketing efforts, and product development. Founders and investors use ROI to determine whether spending on growth initiatives like hiring, advertising, or new features yields proportional returns in revenue or user acquisition. However, ROI in startups can be harder to calculate due to delayed profits, uncertain markets, and intangible gains like brand awareness or intellectual property. In both sectors, ROI supports smarter decision-making but should be balanced with other factors such as risk, time horizon, and long-term value creation.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Time-Adjusted ROI

IPO vs Private Placement

While ROI is powerful, it has pitfalls:

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

ROI is a foundational concept in finance, business, marketing, and personal investment. While it offers simplicity and clarity, its value increases when combined with time-sensitive and risk-aware metrics like IRR or PI.Return on Investment (ROI) is a fundamental financial metric that plays a crucial role in evaluating the profitability and efficiency of various decisions across industries. Whether applied in marketing, Business Decision-Making, projects, real estate, Internal Rate Tracking or startups, ROI helps businesses and investors compare opportunities, justify budgets, and measure success. Time-adjusted ROI adds further value by factoring in the duration of returns, offering a more accurate basis for long-term planning. While ROI is a powerful tool, it should not be the sole factor in decision-making. It’s most effective when used alongside other financial indicators like risk assessment, cash flow analysis, and strategic goals. By understanding and properly applying ROI, organizations and individuals can make smarter, more informed investment choices that drive sustainable growth.