- Definition and Functions

- Revenue Models

- Customer Base

- Services Offered

- Risk Exposure

- Regulatory Oversight

- Profitability Metrics

- Organizational Structure

- Conclusion

Definition and Functions

Commercial banking refers to the segment of the banking industry that deals directly with individuals and small to medium-sized businesses. Its primary function is to accept deposits from customers and provide loans for personal, commercial, or business purposes. Commercial banking vs investment banking offer a wide range of financial services including savings and checking accounts, personal and home loans, credit cards, mergers and acquisitions and business financing. Their key role in the economy is to facilitate the flow of money by acting as intermediaries between savers and borrowers, ensuring liquidity and credit availability in the market. Investment banking, on the other hand, focuses on helping large corporations, governments, and institutional investors raise capital and execute complex financial transactions. Unlike commercial banks, investment banks do not accept deposits from the public. Their core functions include underwriting new debt and equity securities, facilitating mergers and acquisitions (M&A), providing advisory services, and engaging in proprietary trading and asset management. Investment banks are crucial players in the capital markets, connecting entities that need capital with investors willing to provide it, thus enabling economic growth and corporate development.While both types of banks play vital roles in the financial system, they operate under different business models and cater to distinct client needs: commercial banks serving everyday financial activities, and investment banks handling high-level financial strategies and capital market transactions.

Revenue Models

Commercial Banks earn revenue through:

- Net interest income (interest from loans minus interest paid on deposits)

- Fees for services like ATM usage, account maintenance, and wire transfers

- Credit card interest and fees

Investment Banks earn revenue through:

- Advisory fees for M&A and restructuring deals

- Underwriting fees when helping companies issue securities

- Trading profits from buying and selling stocks, bonds, and derivatives

- Asset management fees based on assets under management (AUM)

The commercial banking model is more volume-driven, while investment banking relies on high-value transactions and deals.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Customer Base

The customer base of commercial banking model primarily consists of individual consumers, small to medium-sized enterprises (SMEs), and large businesses seeking day-to-day banking services. These customers rely on commercial banks for basic financial needs such as deposit accounts, personal loans, business loans,deposits , credit facilities, and payment solutions. Commercial banks serve the general public and play a crucial role in retail banking, offering accessible services through branches, ATMs, and digital platforms. Their widespread customer base makes them essential for promoting financial inclusion and supporting local economic activity. In contrast, investment banks cater to a more specialized and institutional clientele. Their typical customers include large corporations, institutional investors (such as mutual funds and pension funds), government agencies, hedge funds, and high-net-worth individuals. These clients seek sophisticated financial services like capital raising through Debt and equity issuance, mergers and acquisitions advisory, and complex risk management solutions. Unlike commercial banking model, investment banks focus on large-scale transactions and strategic financial services that require deep market expertise and tailored solutions. While commercial banks serve the financial needs of the broader population, investment banks target a niche segment involved in high-value, strategic financial operations.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

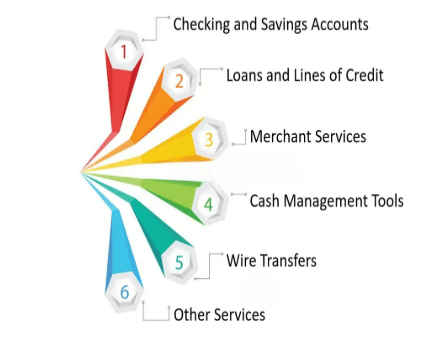

Services Offered

Commercial Banking Services:

- Checking and savings accounts

- Mortgages and personal loans

- Credit cards

- Auto and student loans

- Mobile and online banking

- Wealth management for individuals

Investment Banking Services:

- IPO underwriting and securities issuance

- Mergers & acquisitions (M&A) advisory

- Debt and equity capital raising

- Proprietary trading and market making

- Institutional sales and trading

- Risk and financial advisory

Each bank type provides services tailored to its customer base and regulatory boundaries.

Risk Exposure

Commercial banks are primarily exposed to credit risk, which arises when borrowers fail to repay their loans, leading to potential losses. They also face interest rate risk, as fluctuations in interest rates can impact the bank’s net interest margin , the difference between the interest earned on loans and the interest paid on deposits. Another significant concern is liquidity risk, where the bank may not have enough liquid assets to meet sudden withdrawal demands from depositors. Given their role in safeguarding public funds, Debt and equity commercial banking model are typically more risk-averse and operate under strict regulatory guidelines to manage and mitigate these risks. On the other hand, investment banks encounter a different and often higher level of risk due to their exposure to the capital markets. They are particularly vulnerable to market risk, which refers to potential losses from fluctuations in stock prices, interest rates, or commodity prices. Operational risk arising from system failures,deposits , human error, or fraud is also a critical concern due to the complexity and speed of trading operations. Additionally, investment banks face counterparty risk, where the other party in a financial transaction may default on their obligation, and regulatory risk,commercial banking model vs investment banking as non-compliance with evolving financial laws can lead to substantial penalties and reputational damage.While both types of banks operate in highly regulated environments, investment banks typically engage in more volatile and complex financial activities, making their risk profile significantly higher than that of commercial banks.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Regulatory Oversight

Commercial Banks are heavily regulated due to their custody of public deposits. Regulatory bodies enforce strict standards to ensure liquidity, solvency, and consumer protection.

In India:

- Regulated by the Reserve Bank of India (RBI)

- Subject to CRR, SLR, Basel norms, and priority sector lending requirements

- Regulated by bodies like the FDIC, Federal Reserve, or ECB

Globally:

Investment Banks are also regulated, especially post the 2008 financial crisis. While their activities differ, they are still monitored to prevent systemic risks.

Regulators include:

- Securities and Exchange Board of India (SEBI) in India

- U.S. Securities and Exchange Commission (SEC)

- Financial Industry Regulatory Authority (FINRA)

The degree and nature of regulation differ, with commercial banks under tighter consumer-protection scrutiny and investment banks under market conduct oversight.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Profitability Metrics

The profitability of commercial banks is primarily driven by their ability to manage the spread between the interest they earn on loans and the interest they pay on deposits. This is measured by the Net Interest Margin (NIM), a key metric that reflects how efficiently a bank earns from its lending activities. Other important metrics include the Return on Assets (ROA), which shows how effectively the bank uses its assets to generate profit, Commercial banking vs investment banking and the Cost-to-Income Ratio, which measures operational efficiency by comparing operating costs to income. Additionally, the Loan-to-Deposit Ratio helps assess how much of the bank’s deposits are being used for lending, indicating the bank’s asset utilization and liquidity position.In contrast, investment banks reply on more volatile and transaction-based sources of income. Their profitability is influenced by fee-based revenue from services such as underwriting, mergers and acquisitions advisory, and asset management. Key metrics include Return on Equity (ROE), which evaluates profitability relative to shareholder investment, and Assets Under Management (AUM), which reflects the scale and revenue potential of their investment management business. Trading revenue is also a critical metric for investment banks engaged in proprietary trading and market-making activities. Unlike commercial banks, investment banking profitability is often cyclical and closely tied to market conditions and deal flow. Overall, while commercial banks tend to have more stable and predictable income streams, investment banks operate with higher profit potential but face greater fluctuations in earnings.

Organizational Structure

Commercial Banks tend to have a retail-oriented structure:

- Branch networks

- Relationship manager

- Retail and corporate banking divisions

- Risk, compliance, and operations departments

Investment Banks are usually structured into specialized divisions:

- Front Office (trading, sales, investment banking)

- Middle Office (risk management, compliance)

- Back Office (settlements, IT, finance)

- Boutique or full-service models

Some global giants (e.g., JPMorgan Chase, Citigroup) operate universal banking models, combining both commercial and investment banking arms.

Conclusion

Both commercial banking and investment banking play crucial yet distinct roles in the financial system. Commercial banking vs investment banking serve as the backbone of everyday financial transactions by offering savings, loans, and other essential services to individuals and businesses. They focus on stability, consistent income through interest margins, Debt and equity and broad customer reach. In contrast, investment banks operate in a more specialized and high-stakes environment, facilitating capital raising, advisory services, and market-based activities for large corporations and institutions. Their revenue models are deal-driven and subject to market volatility, but they offer potentially higher returns.Understanding the differences in functions, customer base, revenue sources, risk exposure, and regulatory frameworks is essential for anyone exploring careers in finance, mergers and acquisitions investing, or analyzing the banking sector. While the two types of institutions often work together especially within universal banks their strategies, operations, and risk appetites differ significantly. Ultimately, both are indispensable pillars of modern finance, each contributing uniquely to economic growth and financial market efficiency.