- Introduction to DCF

- Time Value of Money

- Calculating Free Cash Flows

- Terminal Value Estimation

- WACC and Discount Rate

- Step-by-Step DCF Model

- Sensitivity Analysis

- DCF in Equity Valuation

Introduction to DCF

The Discounted Cash Flow Method is a fundamental valuation approach used to estimate the intrinsic value of a business, investment, or project by forecasting its future cash flows and discounting them to their present value. This technique rests on the principle that a rupee today is worth more than a rupee tomorrow due to its potential earning capacity. In the discounted cash flow valuation process, analysts project the expected future free cash flows of a company and then apply a discount rate usually the company’s weighted average cost of capital (WACC) to bring those future earnings to present-day terms. This method helps investors assess whether an asset is undervalued or overvalued in the market. When conducting a DCF valuation of a company, it is critical to consider factors such as revenue growth, profit margins, capital expenditures, and working capital needs, as these directly influence the cash flow forecasts. The Discounted Cash Flow Method is widely used in corporate finance, investment banking, and equity research due to its logical framework and adaptability across industries. While powerful, it requires accurate assumptions and thorough analysis, as small changes in inputs can significantly affect the outcome. Overall, the DCF approach remains a cornerstone of modern financial valuation strategies.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Time Value of Money

- Core of DCF Models: TVM is at the heart of any free DCF model, as future Free Cash Flows are projected and then discounted back to their present value to determine the worth of an investment today.

- Informs Decision-Making: By applying TVM in building a DCF model, analysts can better assess whether a project or company is likely to deliver returns exceeding its cost of capital.

The Time Value of Money (TVM) is a foundational concept in finance that states a sum of money today is worth more than the same amount in the future due to its earning potential. Understanding this principle is essential when evaluating investments using cash flow methods such as the Discounted Cash Flow (DCF) calculation. Here’s how TVM plays a critical role in valuation:

- Accurate Valuation: Without accounting for the time value, financial models would misrepresent the true value of future cash inflows or outflows.

- Cash Flow Timing Matters: TVM highlights that receiving ₹10,00,000 today is more valuable than getting it five years from now because it can be reinvested to generate additional income.

- Enables Investment Comparison: It allows investors to compare different opportunities with varying cash flow timelines using consistent financial metrics.

Overall, understanding TVM is vital for effectively using cash flow methods and conducting precise DCF calculations for investment decisions.

Calculating Free Cash Flows

Calculating Free Cash Flows (FCF) is a crucial step in applying various cash flow methods for valuing businesses and investments. FCF represents the cash a company generates after accounting for capital expenditures needed to maintain or expand its asset base, and it’s a key input in any free DCF model. To calculate it, one typically starts with earnings before interest and taxes (EBIT), adjusts for taxes, adds back non-cash expenses like depreciation and amortization, and subtracts changes in working capital and capital expenditures. This figure reflects the actual cash available to investors or creditors, making it vital for accurate DCF calculation. In the process of building a DCF model, Free Cash Flows are projected over a forecast period often 5 to 10 years and then discounted back to the present using a suitable discount rate, usually the weighted average cost of capital (WACC). Properly calculating Free Cash Flows ensures that the valuation reflects the company’s true earning power rather than just its accounting profits. Whether assessing a startup, mature company, or capital project, understanding and calculating FCF correctly is essential for credible and meaningful financial analysis through discounted cash flow methods.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Terminal Value Estimation

- Two Common Approaches: Terminal value is typically estimated using the Gordon Growth Model (perpetuity growth method) or the Exit Multiple Method, depending on the nature of the business.

- Gordon Growth Assumption: This method assumes that the company’s cash flows will grow at a constant rate forever, which is then used in a perpetuity formula to determine the value.

- Exit Multiple Method: Analysts apply an industry-specific multiple (like EV/EBITDA) to a financial metric at the end of the forecast period to estimate value.

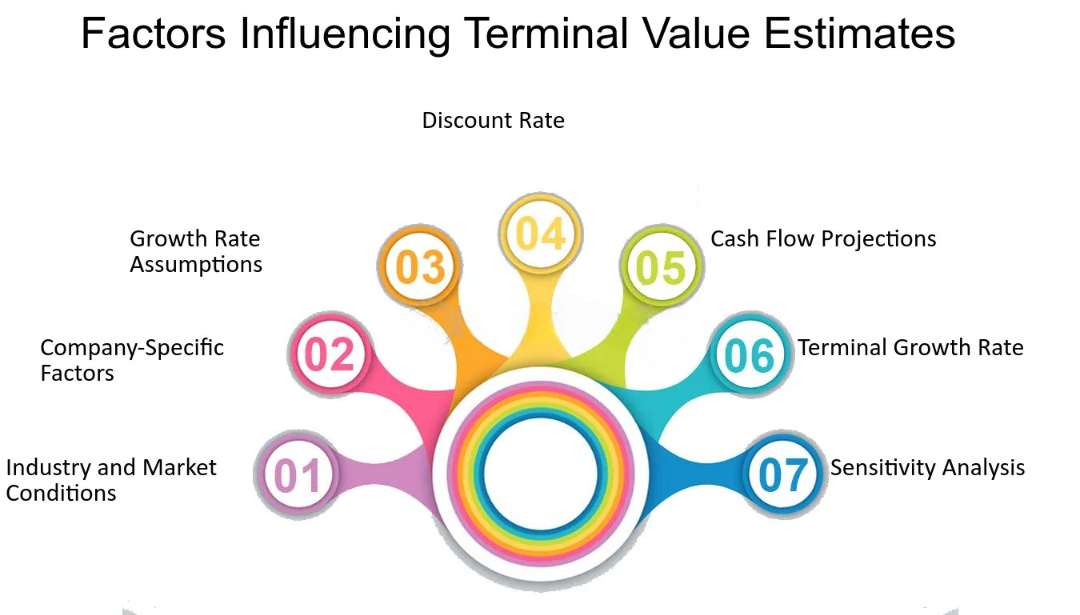

Terminal Value Estimation is a key component of the Discounted Cash Flow Method used to capture the value of a business beyond the forecast period, often accounting for a large portion of the total valuation. Since it’s impractical to forecast detailed Free Cash Flows indefinitely, analysts use terminal value to estimate a company’s worth at the end of the projection period. In any discounted cash flow valuation, calculating terminal value accurately is essential for arriving at a realistic and defendable result. Here are six important points regarding terminal value:

- Discounting Terminal Value: Once estimated, the terminal value is discounted back to present using the company’s WACC, aligning with the Discounted Cash Flow Method.

- Significant Value Driver: Terminal value often makes up more than 50% of the total DCF valuation of a company, highlighting its importance.

- Risk of Overestimation: Overly aggressive growth rates or unrealistic multiples can distort the entire discounted cash flow valuation, so assumptions must be reasonable and well-supported.

WACC and Discount Rate

WACC (Weighted Average Cost of Capital) and the discount rate are fundamental components in the Discounted Cash Flow Method, playing a crucial role in assessing the present value of future cash flows. WACC represents a company’s average cost of capital from all sources equity, debt, and preferred stock weighted by their respective proportions in the company’s capital structure. It reflects the minimum return that investors expect for providing capital to the business, and thus it is widely used as the discount rate in discounted cash flow valuation. When conducting a DCF valuation of a company, using an accurate WACC ensures that the projected Free Cash Flows are discounted appropriately, aligning with the company’s risk profile and market conditions. A higher WACC reduces the present value of future cash flows, indicating higher risk or cost of capital, while a lower WACC increases valuation by implying lower risk. Calculating WACC involves assessing the cost of equity, often through the Capital Asset Pricing Model (CAPM), and the after-tax cost of debt. Precision in determining WACC is critical, as small errors can significantly skew results in a discounted cash flow valuation, leading to incorrect investment decisions. Therefore, WACC serves as the backbone of the DCF valuation of a company, anchoring its valuation to market realities.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Step-by-Step DCF Model

Creating a Step-by-Step DCF Model involves a structured approach to evaluating the intrinsic value of a business using forward-looking cash flow methods. The process begins with projecting a company’s Free Cash Flows over a forecast period, typically 5 to 10 years, based on realistic assumptions about revenue growth, operating margins, capital expenditures, and changes in working capital. These projected cash flows form the backbone of the free DCF model. The next step is calculating the terminal value, which estimates the business’s value beyond the forecast period using either a perpetuity growth method or exit multiples. Once both the forecasted Free Cash Flows and terminal value are determined, they are discounted back to their present value using an appropriate discount rate usually the Weighted Average Cost of Capital (WACC). This DCF calculation provides a present-value estimate of all future benefits generated by the business. When building a DCF model, it is essential to carefully justify every assumption, stress-test different scenarios, and maintain consistency in inputs. A well-constructed DCF not only provides a snapshot of intrinsic value but also helps identify key value drivers and risks. Ultimately, this method offers a detailed, methodical approach for assessing investments using proven cash flow methods.

Sensitivity Analysis

Sensitivity Analysis is a vital tool used alongside the Discounted Cash Flow Method to evaluate how changes in key assumptions impact the overall valuation outcome. Since the discounted cash flow valuation heavily relies on projected inputs such as revenue growth rates, profit margins, capital expenditures, terminal value, and the discount rate, even minor adjustments can significantly influence the estimated intrinsic value. By performing a sensitivity analysis, analysts can systematically test how variations in these assumptions affect the final output of the DCF valuation of a company. For example, increasing the discount rate or decreasing the terminal growth rate can lead to a notably lower valuation, while more optimistic assumptions can inflate it. This analysis typically involves creating data tables or charts that show a range of possible values under different scenarios, helping investors and decision-makers understand the potential risks and upside. It also improves transparency and strengthens the credibility of the valuation model by highlighting which variables have the greatest impact. In essence, sensitivity analysis enhances the robustness of the Discounted Cash Flow Method, making it an indispensable step in any thorough discounted cash flow valuation and a crucial part of evaluating the financial feasibility of an investment or acquisition.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

DCF in Equity Valuation

DCF in Equity Valuation is a powerful technique used to determine the intrinsic value of a company’s stock by forecasting its future financial performance and discounting it back to present value. This approach falls under advanced cash flow methods, where analysts rely on projected Free Cash Flows available to equity holders after meeting all operating and capital requirements. The process begins by building a DCF model that includes detailed forecasts of revenue, operating expenses, taxes, capital expenditures, and working capital changes. These projections help calculate the Free Cash Flows, which are then used in the free DCF model to determine equity value. The DCF calculation involves discounting these future cash flows using the cost of equity as the discount rate, reflecting the risk-return expectations of shareholders. Terminal value is added to capture the business’s worth beyond the projection horizon. Once the present value of all expected Free Cash Flows is determined, the sum represents the total equity value, which can then be divided by the number of outstanding shares to estimate the fair value per share. By incorporating company-specific assumptions and market data, DCF in Equity Valuation offers a comprehensive and methodical way to assess whether a stock is undervalued or overvalued.