- Definition and Structure

- Types of Mutual Funds

- NAV and Units Explained

- How Mutual Funds Work

- Active vs Passive Funds

- Open-End vs Closed-End Funds

- Fund Manager Roles

- Expense Ratio and Loads

- Conclusion

Definition and Structure

A mutual fund is a professionally managed investment vehicle that pools money from multiple investors to purchase securities like stocks, bonds, money market instruments, + [8i0[ and other assets. Types of mutual funds are operated by asset management companies (AMCs), and each mutual fund scheme has a specific investment objective and strategy.A mutual fund is a pooled investment vehicle that collects money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or other assets. It is managed by professional fund managers who make investment decisions based on the fund’s objectives. Each investor in a mutual fund owns units that represent a portion of the holdings in the fund. The structure typically includes a sponsor (who sets up the fund), an asset management company (AMC) (which manages the investments), trustees (to oversee the fund’s compliance and operations), and custodians (who hold the fund’s securities). This organized setup ensures transparency, professional management, and regulatory oversight, making mutual funds a popular choice for both new and experienced investors.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

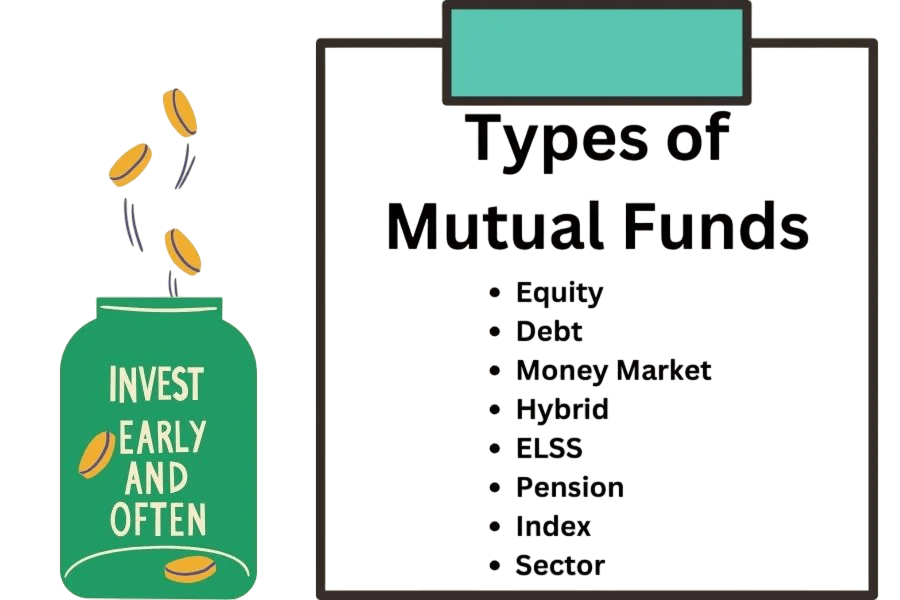

Types of Mutual Funds

Types of mutual funds come in various types based on investment objectives, structure, Money market and asset class:

- Equity Funds: Invest in stocks; high risk, high return potential.

- Debt Funds: Invest in fixed-income securities; lower risk, moderate returns.

- Hybrid Funds: Mix of equity and debt instruments.

- Money Market Funds: Invest in short-term instruments; very low risk.

- Index Funds: Track a specific index like Nifty 50 or S&P 500.

- Sectoral/Thematic Funds: Focus on specific sectors like technology or pharma.

- ELSS (Equity-Linked Saving Schemes): Offer tax benefits under Section 80C in India.

NAV and Units Explained

The Net Asset Value (NAV) represents the per-unit value of a mutual fund. It is calculated as:

NAV = (Total Assets – Total Liabilities) / Number of Units Outstanding

In mutual funds, NAV (Net Asset Value) represents the per-unit value of the fund’s assets after deducting liabilities. It is calculated by dividing the total market value of all the fund’s assets minus its liabilities by the number of outstanding units. NAV is updated daily and reflects the current value of one unit of the mutual fund. For example, if a fund’s total assets are ₹100 crore and it has 10 crore units, the NAV would be ₹10 per unit. Units, on the other hand, represent an investor’s share in the mutual fund. When you invest in a mutual fund, your money buys a certain number of units based on the prevailing NAV. If the NAV increases over time, the value of your investment grows accordingly. Mutual fund returns are typically measured by the change in NAV over a period, along with any dividends or distributions made by the fund. Investors purchase units based on the prevailing NAV. The number of units allotted depends on the amount invested and the NAV on the date of purchase. NAV fluctuates daily based on the market value of the underlying assets.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

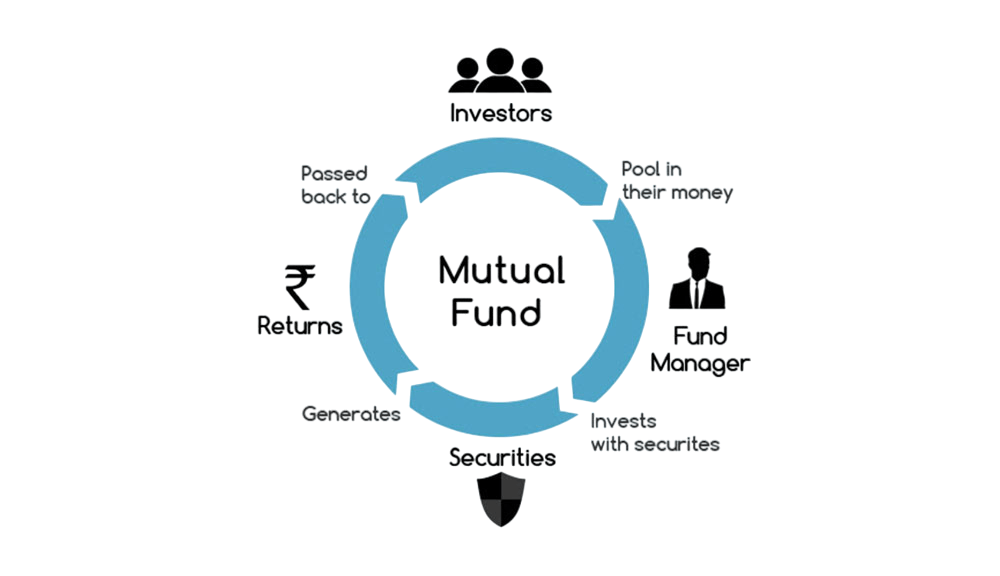

How Mutual Funds Work

Mutual funds work by pooling money from multiple investors to create a large fund, which is then managed by professional fund managers. These managers invest the pooled capital in a diversified portfolio of assets such as stocks, bonds, or other securities, depending on the fund’s objective. Each investor owns units in the mutual fund, and the value of these units is based on the Net Asset Value (NAV), which is calculated daily by dividing the total value of the fund’s assets (minus liabilities) by the number of outstanding units. When investors put money into a mutual fund, they buy units at the current NAV. The fund manager actively or passively makes investment decisions to grow the value of the fund while adhering to its investment strategy. Investors earn returns through capital gains, interest, or dividends generated by the underlying assets. These returns can be reinvested or paid out, depending on the fund’s distribution plan. Mutual funds are regulated to ensure transparency and investor protection, making them a convenient and accessible investment option.

Here’s how a mutual fund functions:

- Investors pool money into a fund

- The AMC appoints a fund manager

- The fund manager invests in line with the scheme’s objectives

- Fund’s returns depend on the performance of these investments

- NAV is declared daily

- Investors can redeem units at the prevailing NAV

This structure allows small investors to benefit from diversification, professional management, Fund manager roles and liquidity.

Active vs Passive Funds

- Active Funds: Active funds are managed by professional fund managers who actively make investment decisions with the goal of outperforming a specific benchmark or index (like the S&P 500 or Nifty 50). These managers research companies, analyze market trends, and frequently buy and sell securities based on their judgments. Because of this hands-on approach, active funds typically have higher management fees and expense ratios. They aim for higher returns, but performance can vary and may not always beat the market.

- Passive Funds: on the other hand, aim to replicate the performance of a specific index by investing in the same securities in the same proportions. Examples include index funds and ETFs (Exchange-Traded Funds). Since passive funds don’t require frequent trading or active management, they usually have lower fees and are more cost-effective over the long term. While they don’t try to beat the market, they closely match its performance.

Passive funds like index funds and ETFs are gaining popularity due to their cost-efficiency and consistency in tracking benchmark performance.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Fund Manager Roles

Fund managers roles a critical role in mutual fund performance. Their responsibilities include:

- Conducting research and analysis

- Selecting assets in line with the fund’s mandate

- Monitoring performance and rebalancing the portfolio

- Managing liquidity

- Adhering to compliance and regulatory guidelines

A Money market track record is often closely tied to the expertise and consistency of its fund manager.

Expense Ratio and Loads

The expense ratio is the annual fee expressed as a percentage of the fund’s average assets under management (AUM). It includes management fees, administrative costs, and other operating expenses.- Entry Load: Fee charged when buying units (mostly abolished in many jurisdictions)

- Exit Load: Fee charged when redeeming units before a specified time Lower expense ratios are preferable as they leave more returns in the investor’s hands.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Conclusion

Mutual funds are a versatile investment tool that offers something for every investor. From high-growth equity funds to stable debt instruments and hybrid options, mutual fund managers provide diversification, liquidity, and professional management. By understanding their structure, types, Passive funds, risk metrics, and tax implications, Money market investors can choose the right Fund manager roles to meet their financial goals. Whether starting with a small SIP or a large lump sum, Closed-End Funds, types of mutual funds offer a path to long-term wealth creation.