- What is FDI?

- Types of FDI (Horizontal, Vertical, Conglomerate)

- Benefits to Host Country

- Role in Economic Development

- Sectoral Trends in FDI

- Regulatory Bodies (FEMA, RBI, DPIIT)

- FDI vs FPI

- Routes of FDI (Automatic vs Government Route)

- Conclusion

What is FDI?

Foreign Direct Investment (FDI) occurs when a company or individual from one country invests in a lasting interest in a business situated in another country. This typically means acquiring at least 10% of equity, implying a degree of managerial influence or control .Foreign Direct Investment (FDI) refers to an foreign investment made by a company or individual from one country into a business or role in economic, Enhances Global Integration development asset located in another country. Unlike portfolio investments (such as buying stocks or bonds),Sectoral Trends types of fdi involve direct ownership or significant control in the foreign enterprise.

FDI encompasses:

- Greenfield investments (setting up new enterprises abroad).

- Mergers and acquisitions (M&A).

- Reinvested earnings and intra-company loan.

It differs from Foreign Portfolio Investment (FPI), which involves passive holdings in foreign assets without control.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

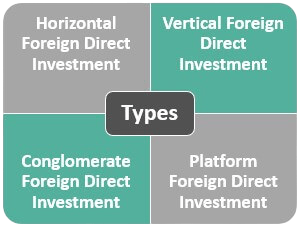

Types of FDI

Classification broadly includes

- Horizontal FDI: A firm duplicates its home-country operation abroad (e.g., a carmaker opening factories overseas).

- Vertical FDI: The firm invests in a different supply-chain stage either backward (sourcing inputs) or forward (distribution)

- Conglomerate FDI: Involves entering completely unrelated industries, a rare and typically risky venture.

- Platform FDI: Investment in a country intended for exporting products or services to third countries

Benefits to Host Country

FDI offers several advantages:

- Capital Inflow: Brings foreign capital that supports domestic investment and infrastructure.

- Employment Generation: Creates new job opportunities and reduces unemployment.

- Technology Transfer: Introduces advanced technology, know-how, and innovation.

- Skill Development: Enhances workforce skills through training and exposure to international standards.

- Improved Infrastructure: Encourages development in transport, energy, and communication sectors.

- Boosts Exports: Increases production capacity, enabling more goods to be exported.

- Enhances Global Integration: Helps the country become part of global supply chains and trade networks.

- Tax Revenue for Government: Increases tax collection from businesses and employees.

- Improves Balance of Payments: By reducing import dependency and promoting exports, FDI can help stabilize external accounts.

- Stimulates Economic Growth: Overall boost in productivity, income levels, and GDP.

A recent academic study of 109 EU regions (2012–2023) found FDI significantly enhances regional job creation,Enhances Global Integration though effects are nonlinear and Sectoral Trends-dependent

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Role in Economic Development

Foreign Direct Investment (FDI) plays a vital role in the economic development of a country by bringing in much-needed capital, technology, and expertise. It helps expand industrial capacity, creates employment opportunities, and enhances productivity across various sectors. Foreign Direct Investment (FDI) also encourages the transfer of managerial and technical skills, which can improve the overall efficiency and competitiveness of domestic industries. Furthermore, Host country it supports infrastructure development and deepens integration into global trade networks, contributing to long-term economic growth. By fostering innovation and increasing export potential, role in economic development FDI,Enhances Global Integration becomes a key driver in raising income levels and reducing poverty in developing economies.

- Enhancing productivity via technological and managerial transfer.

- Driving infrastructure development through capital-intensive projects.

- Encouraging export diversification and competitiveness.

- Catalyzing local firm upgrades through spillover effects.

- Strengthening balance of payments by bringing stable foreign capital.

However, impact depends on factors like regulatory quality, human capital, and absorptive capacity.

Sectoral Trends in FDI

- Manufacturing Sector: Traditionally a major recipient of FDI, Host country especially in automotive, electronics, and pharmaceuticals.Driven by lower production costs and skilled labor in emerging economies.

- Services Sector : FDI in services (finance, IT, telecommunications, retail) has grown significantly.Rise of digitalization and global outsourcing fuels investment in IT and business process services.

- Infrastructure and Construction :Increasing FDI in transport, energy, and urban development projects.Public-private partnerships attract long-term foreign capital.

- Renewable Energy: Surge in FDI towards green energy (solar, wind, hydro) due to global sustainability goals.Emerging as a fast-growing sector for foreign investment.

- Healthcare and Biotechnology: Growth in FDI due to global health demands, innovation, and COVID-19’s long-term impact.Includes pharmaceuticals, medical devices, and research facilities.

- Agriculture and Agro-processing: Attracts FDI in regions with arable land and export potential.Focus on food security, value chains, and rural development.

- E-commerce and Digital Platforms: Rapid digital transformation fuels FDI in online retail, logistics, fintech, and digital infrastructure.Especially strong in Asia and Africa.

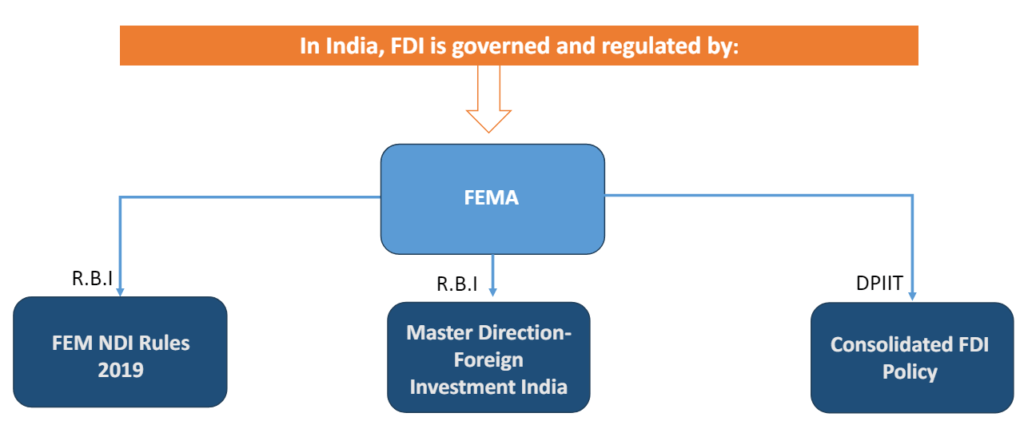

- FEMA (Foreign Exchange Management Act): Defines permissible inflows and routes.

- RBI: Oversees external investments, net FDI, and mandates approvals for restricted sectors.

- DPIIT (formerly DIPP): Under the Commerce Ministry, sets policy, sectoral caps, and routes (automatic vs government Approval route).

- Definition: Under this route, foreign investors do not require prior approval from the government or any regulatory body.

- Sectors: Applies to most sectors such as manufacturing, services, e-commerce (with conditions), portfolio and select infrastructure areas.

- Process: Only post-investment filing with the Reserve Bank or other authorities is required.Faster and more investor-friendly.

- Definition: In this route, prior approval from the concerned ministry or department is mandatory before investment.

- Sectors: Applies to sensitive or strategic sectors such as:

- Defense

- Print media

- Satellites

- Gambling and betting

- Process: Application submitted via a government portal (e.g., FIFP in India – Foreign Investment Facilitation Portal).Involves time for review and approval.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Regulatory Bodies (FEMA, RBI, DPIIT)

In India, FDI is regulated by:

Recent RBI data shows a sharp contraction in net FDI for FY25 (-96.5%), highlighting a surge in exits and outward investment amid robust IPO activity.

FDI vs FPI

| Aspect | FDI | FPI |

|---|---|---|

| Control | Active (≧ 10% equity) | Passive (< 10%) |

| Objective | Long-term control & operation | Short-term returns |

| Portfolio Nature | Greenfield, mergers, reinvestment | Shares, bonds, derivatives |

| Impact | Technology, employment, spillovers | Market liquidity, volatility |

FDI plays a more transformative role in development than FPI, which is more liquidity-driven.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Routes of FDI (Automatic vs Government)

Automatic

Government

Investments from certain countries (e.g., bordering nations, subject to scrutiny)

Conclusion

In conclusion, the routes of FDI Automatic and Government play a crucial role in economic development in regulating foreign investment while balancing ease of business with national interest. The Automatic Route offers a streamlined and investor-friendly process, encouraging foreign capital in most sectors without prior approval. On the other hand, the Government Route ensures proper oversight in sensitive and strategic areas, Enhances Global Integration, Host country Sectoral trends safeguarding national security and policy priorities. Understanding these routes is essential for investors,portfolio , types of fdi , policymakers, and businesses aiming to navigate the FDI landscape effectively and responsibly.