- What is a Cash Flow Statement?

- Purpose and Importance of the Cash Flow Statement

- Why is the Cash Flow Statement Important?

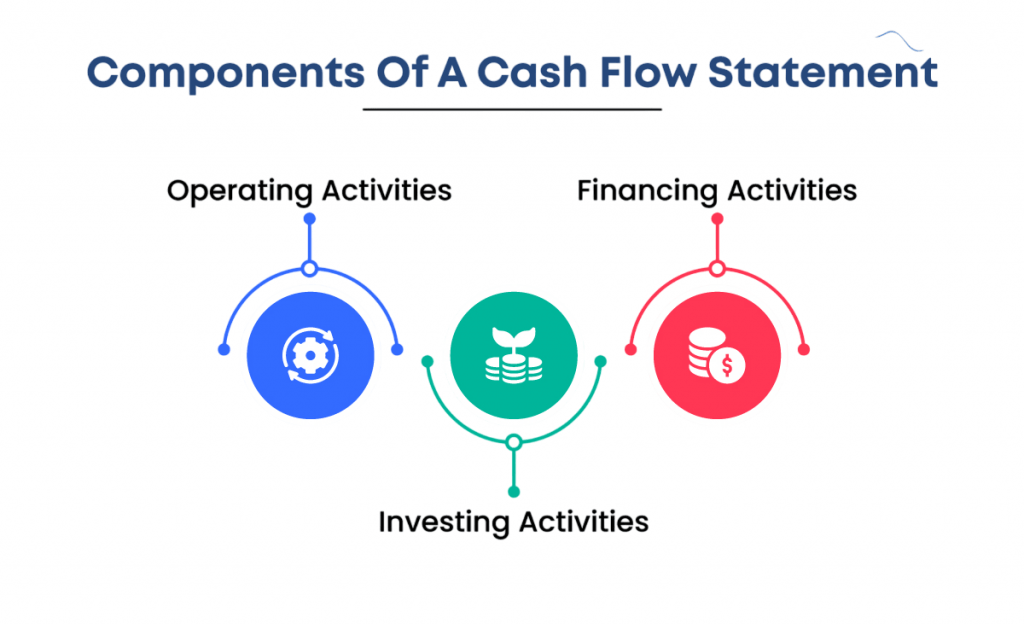

- Components of the Cash Flow Statements

- Direct vs Indirect Method of Preparing the Cash Flow Statement

- Analyzing Free Cash Flow

- Link to Income Statement and Balance Sheet

- Real-Life Examples

- Conclusion

What is a Cash Flow Statement?

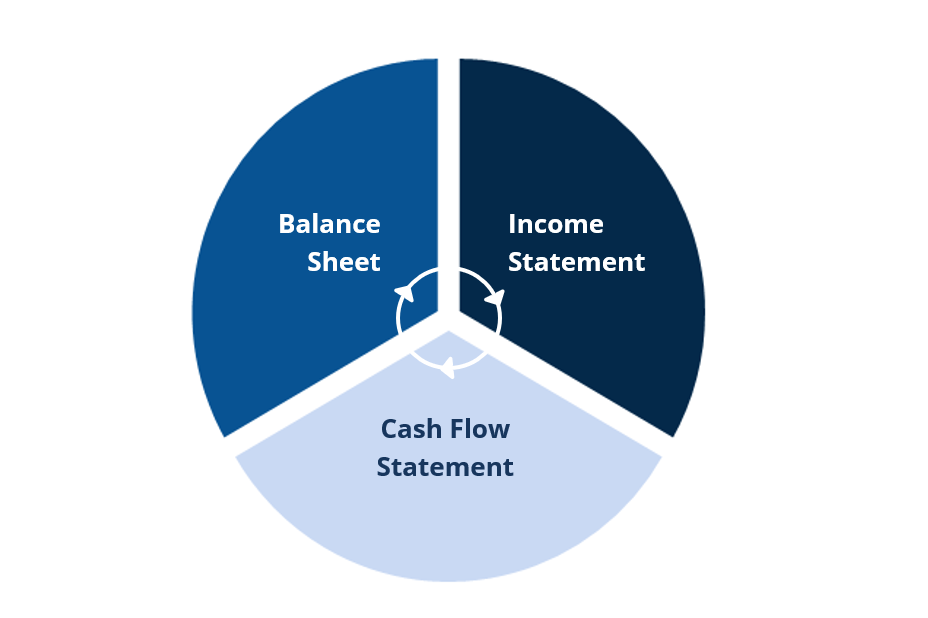

A Cash Flow Statement (CFS) is a fundamental financial document that provides a detailed summary of the cash inflows and outflows of a business over a specific period, typically quarterly or annually. Unlike the Income Statement, which shows profitability, or the Balance Sheet, which displays a snapshot of financial position at a point in time, the Cash Flow Statement focuses exclusively on cash movements, giving insight into how a company generates and uses its cash. The CFS is one of the three essential financial statements used by investors, creditors, and management to evaluate a company’s liquidity, solvency, and overall financial health. It helps stakeholders understand whether a company has enough cash to meet its obligations, invest in growth, Components of the Cash Flow Statement or return value to shareholders.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Purpose and Importance of the Cash Flow Statement

The cash flow statement is a key financial report that shows how cash is generated and used by a business over a specific period. Unlike the income statement, which records revenues and expenses on an accrual basis, the cash flow statement focuses purely on actual cash movements providing a clearer picture of a company’s liquidity and financial health. The primary purpose of the cash flow statement is to help stakeholders understand how a company manages its cash in three main areas: operating activities, investing activities, and financing activities. This breakdown allows investors, creditors, and management to assess whether the company can generate sufficient cash to meet its obligations, invest in growth, and return value to shareholders.

Its importance lies in revealing the company’s ability to:

- Sustain operations and profitability

- Pay off debts and obligations

- Make strategic investments

- Manage working capital efficiently

- Avoid liquidity issues even when net income appears strong

By providing insights that are not always evident from the balance sheet or income statement alone, the Importance of the Cash Flow Statement plays a vital role in financial decision-making and long-term planning

Why is the Cash Flow Statement Important?

- Liquidity Assessment: It shows whether the company can cover short-term liabilities without raising external funds.

- Profitability vs. Cash Generation: Companies can show profits but still face cash shortages; the CFS reveals the real cash situation.

- Investment Decisions: Investors use it to assess a company’s ability to generate cash to fund growth and dividends.

- Creditworthiness: Lenders analyze cash flow to evaluate a borrower’s ability to repay debt.

- Internal Management: Management uses it to plan cash needs, optimize operations, and allocate resources effectively.

- Detecting Earnings Manipulation: Cash flow figures are harder to manipulate than accounting profits, offering a reality check on earnings quality.

- Operating Activities: Operating activities refer to the core business functions that generate a company’s primary revenue. These activities include the day-to-day processes such as producing goods, providing services, managing inventory, collecting payments from customers, and paying wages or suppliers. In financial accounting, operating activities are reported in the cash flow statement and are crucial indicators of a company’s operational efficiency and financial health.

- Investing Activities: Investing activities refer to the cash flows related to the acquisition and disposal of long-term assets and investments that are not part of a company’s core operations. These activities are reported in the cash flow statement and help assess how a company is allocating its capital to grow or maintain its business. Cash outflows from investing often indicate expansion or modernization efforts, while inflows might come from asset sales or divestitures.

- Financing Activities: Financing activities involve the inflow and outflow of cash related to a company’s capital structure and how it raises funds and returns value to its investors. These activities are reported in the cash flow statement and reflect how a business finances its operations through debt, equity, or distributions.

- Lists specific cash inflows and outflows from operating activities such as cash received from customers and cash paid to suppliers.

- Presents cash receipts and payments line by line.

- Offers clearer insight into cash sources and uses.

- Less commonly used because it requires detailed cash transaction data, which is often harder to compile.

- Starts with net income from the Income Statement.

- Adjusts for non-cash items such as depreciation, amortization, and changes in working capital.

- Converts accrual accounting figures to cash basis.

- More widely used due to easier preparation and compliance with accounting standards.

- Indicates financial flexibility and health.

- Positive FCF suggests the company can pursue new opportunities without raising additional capital.

- Negative FCF may mean the company is investing heavily in growth or facing liquidity issues.

- Used by investors to assess value beyond accounting profits.

- Income Statement: Net income from the income statement is the starting point for the indirect method of the cash flow from operations. Adjustments are made for non-cash expenses (like depreciation) and working capital changes.

- Balance Sheet: Changes in balance sheet accounts such as accounts receivable, accounts payable, inventory, and other current assets and liabilities affect cash flows. For example, an increase in accounts receivable means cash has not yet been collected, reducing cash flow.

- Operating Activities: Strong positive cash inflow driven by iPhone sales and services.

- Investing Activities: Significant cash outflows due to capital expenditures on new stores and equipment.

- Financing Activities: Cash outflows for share repurchases and dividends, reflecting return of capital to shareholders.

- Heavy investing outflows linked to factory expansions.

- Operating cash flows turning positive due to increased vehicle deliveries.

- Financing inflows from debt issuances to support growth.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

Components of the Cash Flow Statement: Operating, Investing, and Financing Activities

The Cash Flow Statement is divided into three sections that classify cash transactions based on their nature:

Direct vs Indirect Method of Preparing the Cash FlowStatement

There are two accepted methods for preparing the operating activities section of the Cash Flow Statement:

Direct Method

Indirect Method

Both methods yield the same net cash flow from operating activities but differ in presentation style.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Analyzing Free Cash Flow

Free Cash Flow (FCF) represents the cash a company generates after accounting for capital expenditures needed to maintain or expand its asset base. It indicates the Components of the Cash Flow Statement available to pay debt holders, importance of the Cash Flow Statement, dividends, buy back shares, or reinvest in growth.

Formula for Free Cash Flow:

Free Cash Flow=Operating Cash Flow−Capital Expenditures (CapEx)\text{Free Cash Flow} = \text{Operating Cash Flow} – \text{Capital Expenditures (CapEx)}

Importance of Free Cash Flow:

Link Between Cash Flow Statement

The Cash Flow Statement is closely interconnected with the other two financial statements:

These linkages ensure that the financial statements collectively present a comprehensive picture of a company’s financial health.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Real-Life Examples of Cash Flow Statements

Example 1: Apple Inc. (Fiscal Year 2023)

Apple’s cash flow statement shows:

Apple’s positive free cash flow underlines its robust ability to fund growth and reward investors.

Example 2: Tesla Inc. (Fiscal Year 2023)

Tesla’s cash flow reveals:

Investors closely monitor Tesla’s cash flows to assess sustainability during rapid expansion.

Conclusion

The Cash Flow Statement is an indispensable tool for understanding the true liquidity and financial health of a company. By dissecting cash flows into operating, investing, and financing activities, it provides transparency that complements the Income Statement and Balance Sheet. Whether you are an investor, creditor, Components of the Cash Flow Statement or business manager, analyzing the importance of the Cash Flow Statement helps make informed decisions about a company’s ability to generate cash, manage debts, fund operations, and invest in growth. Mastering its components, preparation methods, shareholders and analysis techniques is crucial for sound financial analysis and business strategy.