- Definition of Interest Rate Risk

- Impact on Fixed-Income Securities

- Duration and Convexity Concepts

- Yield Curve Analysis

- Types of Interest Rate Risk

- Risk Management Strategies

- Hedging with Derivatives

- Role of Central Banks

- Impact on Portfolios

- Conclusion

Definition of Interest Rate Risk

Interest rate risk is the risk that changes in interest rates will negatively impact the value of an investment. This is especially pertinent for fixed-income securities where prices and yields move inversely. When interest rates rise, bond prices typically fall, and vice versa.Interest rate risk refers to the potential for investment losses that result from a change in interest rates. This type of risk management strategies primarily affects fixed-income securities such as bonds, loans, and other debt instruments. As interest rates fluctuate due to economic or policy-driven factors, the value of investments, especially those with fixed cash flows can rise or fall, impacting portfolio performance.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Impact on Fixed-Income Securities

Fixed-income securities are particularly sensitive to interest rate movements because they offer fixed periodic payments and a maturity value. Key impacts include:

- Price Volatility: As rates rise, new issues yield more, making existing bonds less attractive and reducing their price.

- Reinvestment Risk: When rates fall, investors reinvest at lower yields.

- Call Risk: Bonds might be called early by the issuer during periods of falling interest rates.

- Yield to Maturity (YTM): Directly influenced by the prevailing interest rates.

The longer the duration and the lower the coupon, the more sensitive the security is to interest rate changes.

Duration and Convexity Concepts

Duration is a measure of a bond’s sensitivity to interest rate changes. It reflects the weighted average time to receive all cash flows from the bond.Duration and convexity are key concepts in cost estimation and risk management, particularly when evaluating fixed-income investments such as bonds. In a cost estimation context, duration measures the sensitivity of the price of a bond (or bond-like cash flow) to changes in interest rates. It provides an estimate of how much the value of an investment will change in response to a 1% change in interest rates. A longer duration implies greater interest rate risk, which is important when estimating the future cost of financing or discounting future cash flows. Convexity, on the other hand, accounts for the curvature in the relationship between bond prices and interest rates. While derivatives gives a linear approximation, convexity provides a more accurate estimate by adjusting for the fact that bond price changes are not perfectly linear in response to interest rate changes. In cost estimation, using both duration and convexity helps improve the precision of financial forecasts, especially when projecting long-term liabilities or evaluating the cost impact of interest rate fluctuations on investment portfolios.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

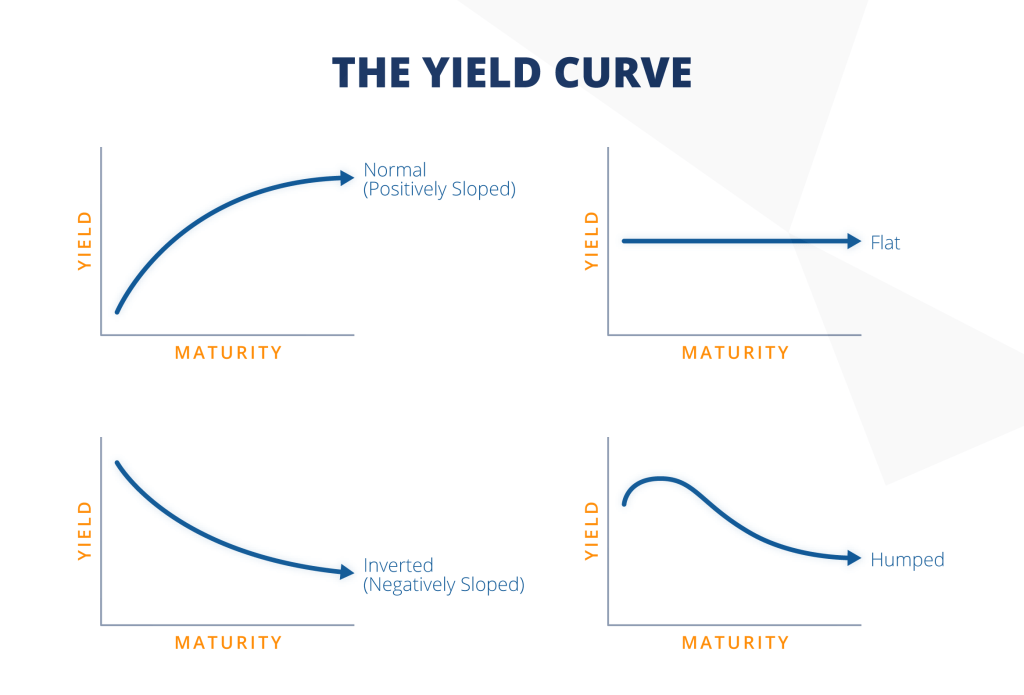

Yield Curve Analysis

TheYield Curve Analysis plots yields of bonds with different maturities, usually government securities

- Normal Yield Curve: Upward sloping; longer-term rates are higher.

- Inverted Yield Curve: Downward sloping; often signals a recession.

- Flat Yield Curve: Indicates economic transition or uncertainty.

Types of Interest Rate Risk

Interest rate risk can manifest in several forms:

- Market Risk: Price volatility due to rate changes.

- Reinvestment Risk: Risk of lower returns when reinvesting proceeds.

- Basis Risk: Arises from imperfect correlation between two instruments.

- Yield Curve Risk: Due to non-parallel shifts in the yield curve.

- Call and Prepayment Risk: Issuers may call or prepay debt when rates fall.

Each type requires specific management strategies depending on portfolio composition.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Risk Management Strategies

Risk management strategies are critical frameworks and actions employed by individuals, businesses, and organizations to systematically identify, assess, and mitigate potential risks that could adversely impact their objectives. These strategies typically begin with risk identification, where possible threats are recognized, followed by risk assessment, which evaluates the likelihood and potential impact of these risks. Among the most common approaches is risk avoidance, which involves steering clear of activities or decisions that carry excessive risk. When avoidance is not feasible, risk reduction techniques are applied to minimize either the probability of the risk occurring or its consequences, through measures such as safety protocols, diversification, or enhanced controls. Another important strategy is risk transfer, where risk is shifted to a third party commonly through insurance policies, warranties, or outsourcing agreements thereby limiting the original party’s exposure. Sometimes, organizations adopt risk acceptance, consciously deciding to bear certain risks when the cost of prevention or transfer outweighs the expected loss or when the risk is deemed low-impact. Effective risk management is a dynamic process, requiring continuous monitoring, evaluation, and adjustment as new risks emerge or circumstances evolve. This proactive approach not only helps protect assets and reputation but also ensures resilience, Yield curve analysis, regulatory compliance, and the ability to capitalize on opportunities despite uncertainty.

Hedging with Derivatives

Derivatives are vital tools for hedging interest rate exposure:

- Interest Rate Swaps: Exchange fixed-rate payments for floating-rate ones.

- Futures Contracts: Lock in bond prices or yields.

- Options (Caps, Floors, Swaptions): Provide protection against rate movements.

- Forward Rate Agreements (FRAs): Contractual agreement to borrow or lend at a future date at a predetermined rate.

Hedging strategies can be dynamic or static and require continuous monitoring.

Role of Central Banks

Central banks, like the Federal Reserve or Reserve Bank of India, influence interest rates via monetary policy tools:

- Policy Rates (e.g., Fed Funds Rate): Directly set the benchmark rates.

- Open Market Operations: Buying/selling government securities to influence liquidity.

- Reserve Requirements: Impact bank lending capacity.

- Forward Guidance: Signals future policy directions.

Changes in these tools affect the broader economy and shape market expectations.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Impact on Portfolios

Interest rate changes affect the value and return profile of investment portfolios:

- Bond Portfolios: Higher duration leads to more sensitivity.

- Equity Portfolios: Interest rate increases can reduce corporate earnings and valuations.

- Real Estate Funds: Sensitive to borrowing costs and cap rates.

- Balanced Funds: Must dynamically adjust asset allocation.

Asset allocation strategies must consider interest rate outlook and investor risk tolerance.

Conclusion

Interest rate risk is a critical consideration for investors,Derivatives policymakers, and financial institutions. Managing this risk involves understanding its various forms, quantifying exposure through duration and convexity, Yield curve analysis and using hedging techniques like swaps and futures. With central banks playing a pivotal role in rate determination, market participants must stay informed on policy changes. A well-diversified portfolio, aligned with interest rate expectations and protected through strategic hedging, ensures resilience against unpredictable market conditions. Mastery of interest rate Risk Management Strategies is thus essential for financial success in a dynamic economic environment.