- What is Capital Raising?

- Equity vs Debt Financing

- Seed and Angel Funding

- Venture Capital and Private Equity

- Initial Public Offerings (IPO)

- Rights Issue and Follow-on Offer

- Convertible Securities

- Crowdfunding Platforms

- Corporate Bonds and Debentures

- Role of Investment Banks

- Regulatory Framework for Capital Raising

- Conclusion

What is Capital Raising?

Capital raising is a critical function for businesses aiming to fund growth, manage operations, invest in new projects, or restructure finances. It involves securing funds from various sources, each with distinct advantages, risks, and implications for the company’s future. This article explores the fundamentals of capital raising, different methods companies use to raise funds, the roles played by financial intermediaries, and the regulatory environment governing these processes. Capital raising is the process through which companies obtain funds to finance their activities, such as expanding operations, investing in research and development, acquiring assets, or meeting working capital requirements. It is essential for startups, growing companies, and established enterprises alike.

Key Points:

Businesses seek financial resources to fuel growth and expansion through capital raising, a critical strategic process. Companies can pursue this objective through various methods, including equity financing, where they sell ownership shares, or debt financing, where they borrow funds from external sources. The primary aim is to secure adequate funding at an optimal cost while carefully balancing organizational control and financial risk. Depending on factors such as company size, industry, and current market conditions, organizations may tap into diverse funding channels, ranging from private investors and financial institutions to public markets and alternative funding sources. This nuanced approach to capital raising directly impacts a company’s capital structure, liquidity, and long-term growth prospects, making it a pivotal decision in corporate financial strategy.

Do You Want to Learn More About Database? Get Info From Our Database Online Training Today!

Equity vs Debt Financing

Capital raising requires businesses to make important strategic decisions. They primarily choose between two basic methods: equity and debt financing. Investors, such as venture capitalists, buy company shares through equity financing. This method provides flexible capital without the need for repayment. It also shares financial risks among shareholders. While this option dilutes existing ownership, it gives investors rights to participate and potential returns through dividends. This makes it especially appealing for startups and growth-focused companies. On the other hand, in debt financing, companies borrow money through loans or bonds. This approach requires them to make regular principal and interest repayments, no matter how profitable they are. Debt financing helps maintain the current ownership structure and offers tax benefits through deductible interest payments. Therefore, it is often more attractive for established companies with steady cash flows. The best financing method depends on several factors, including the company’s financial health, risk tolerance, control preferences, and long-term goals. Businesses must carefully assess these financing options to ensure their capital acquisition supports their growth plans and financial management objectives.

Seed and Angel Funding

Seed funding is the initial capital raised to start a business, usually before a product or service is fully developed.

Seed Funding:

- Typically comes from founders, friends, family, or early investors.

- Used for market research, product development, and early-stage operations.

- Involves high risk due to business uncertainties.

Angel Funding:

- Provided by affluent individuals known as angel investors.

- Angels invest their own money in startups with high growth potential.

- Often offer mentorship and strategic guidance alongside capital.

- Usually occurs after seed funding, before venture capital.

Angel investors bridge the gap between personal funds and institutional investment, supporting early-stage ventures that are too risky for banks or large investors.

Would You Like to Know More About Database? Sign Up For Our Database Online Training Now!

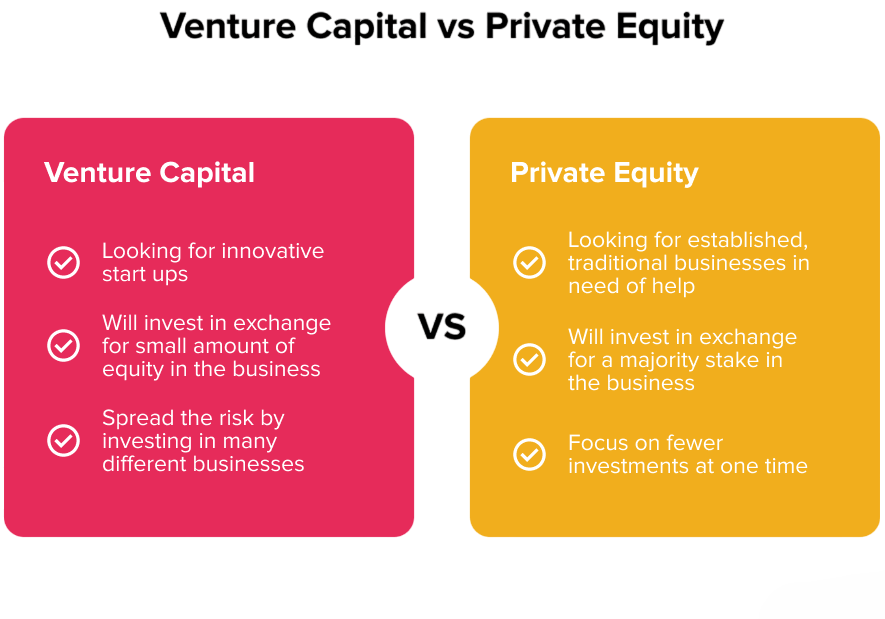

Venture Capital and Private Equity

Venture capital (VC) and private equity (PE) are institutional forms of equity financing aimed at different stages of business development.

Venture Capital:

- VC firms invest in early to mid-stage startups with high growth potential.

- Provide capital, expertise, and networking opportunities.

- Investments are typically in exchange for significant equity stakes.

- VC funds are usually structured as limited partnerships.

- Expected high returns through eventual exits like IPOs or acquisitions.

Private Equity:

- PE firms invest in more mature companies, often acquiring controlling stakes.

- Focus on improving operational efficiency, restructuring, and growth.

- Investment horizon ranges from 4 to 7 years, culminating in sale or IPO.

- Use leverage (debt) to finance acquisitions (leveraged buyouts).

- Target stable returns through active management.

Both VC and PE are critical in fostering innovation and restructuring industries by allocating capital to high-potential companies.

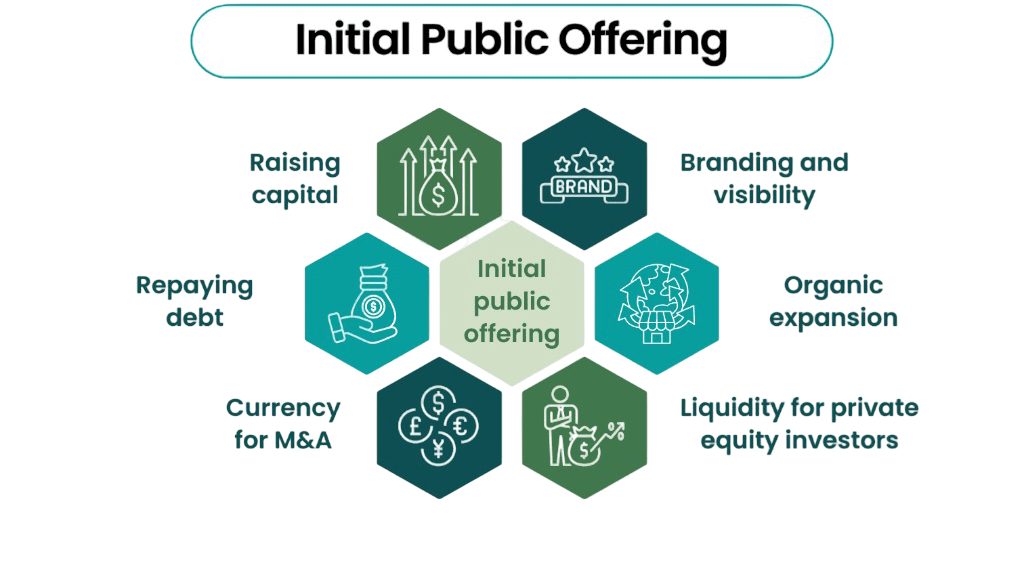

Initial Public Offerings (IPO)

An Initial Public Offering (IPO) is an important step for private companies as they move into the public market by listing their shares on a stock exchange. This process allows organizations to raise significant capital from public investors while increasing their visibility and credibility. By going public, companies offer early investors and founders cash, which opens up chances for major financial growth. Investment banks help companies through the tough IPO process. They ensure compliance with strict regulations and disclosure requirements, while also managing crucial details like pricing, marketing, and share distribution. Companies use IPO proceeds for various goals, such as expanding their business, paying off debt, or making strategic acquisitions. The IPO process includes several stages, from filing the initial prospectus and holding investor roadshows to setting the price and allocating shares. This journey marks a significant moment in a company’s financial development.

Rights Issue and Follow-on Offer

In the fast-changing world of corporate finance, companies use methods like rights issues and follow-on public offerings (FPOs) to raise more capital after their initial public offering. A rights issue gives existing shareholders the chance to buy more shares at a lower price. This protects their investment from dilution and provides a quick, low-cost way to generate capital. Similarly, FPOs allow listed companies to raise new funds or let promoters sell parts of their holdings by offering shares to new investors and the general public. Both of these financial tools depend on market conditions and regulatory approvals. They are effective ways for organizations to manage their equity structure and financial flexibility. By using these methods, companies can meet their capital needs, keep investor confidence, and support their growth goals in a competitive business environment.

To Earn Your Database Certification, Gain Insights From Leading Blockchain Experts And Advance Your Career With ACTE’s Database Online Training Today!

Convertible Securities

Convertible securities are hybrid instruments that start as debt or preferred stock and can be converted into common equity at a later date.

Types:

- Convertible Bonds: Debt instruments convertible into equity shares.

- Convertible Preferred Stock: Preferred shares with an option to convert into common shares.

Advantages:

- Offer investors downside protection with fixed income and upside potential through conversion.

- Lower interest costs for issuers due to conversion option.

- Help companies raise capital without immediate dilution.

Convertible securities are popular in raising capital when investors seek balance between income and equity participation.

Crowdfunding Platforms

An Initial Public Offering (IPO) is a crucial step for private companies as they move into the public market by listing their shares on a stock exchange. This process allows businesses to raise significant funding from public investors while also increasing their visibility and credibility. When companies go public, they give early investors and founders a chance to cash in, creating opportunities for notable financial growth. Investment banks help companies through the demanding IPO process. They guide them in following strict rules and regulations while managing important aspects like pricing, marketing, and share distribution. Companies use the money from IPOs for various purposes, such as expanding their business, paying off debt, or making strategic acquisitions. The IPO process involves several stages, from filing the initial prospectus and holding investor roadshows to setting the price and distributing shares. This process marks a key moment in a company’s financial development.

Preparing for a Database Job? Have a Look at Our Blog on Database Interview Questions and Answers To Ace Your Interview!

Corporate Bonds and Debentures

Corporate bonds and debentures are debt instruments companies use to borrow money from investors.

Corporate Bonds:

- Fixed-income securities with defined interest payments and maturity.

- Can be secured or unsecured.

- Traded in secondary markets.

Debentures:

- A type of unsecured bond backed by the issuer’s creditworthiness.

- Often convertible or non-convertible.

Features:

- Provide predictable cash flows for investors.

- Offer companies an alternative to bank loans.

- Subject to credit rating by agencies.

Corporate bonds and debentures help companies raise large sums while spreading risk across investors.

Role of Investment Banks

Investment banks are key intermediaries in capital raising, providing advisory, underwriting, and distribution services.

Functions:

- Advisory: Assisting companies on capital structure, valuation, and market timing.

- Underwriting: Buying securities from issuers and selling them to investors.

- Due Diligence: Assessing financial and legal aspects.

- Marketing: Roadshows and investor presentations.

- Distribution: Allocating shares to institutional and retail investors.

Investment banks ensure efficient capital raising and help manage risks and regulatory compliance.

Regulatory Framework for Capital Raising

Capital raising activities are heavily regulated to protect investors and ensure market integrity.

Key Regulators:

- Securities and Exchange Board of India (SEBI): Regulates IPOs, FPOs, and listed companies.

- Reserve Bank of India (RBI): Oversees foreign exchange and debt financing.

- Companies Act: Governs corporate governance and disclosures.

Regulations Include:

- Mandatory disclosures in prospectuses.

- Limits on public offerings and shareholder rights.

- Insider trading and market manipulation rules.

- Compliance with accounting and audit standards.

Adherence to regulations builds investor confidence and ensures fair practices.

Conclusion

Capital raising is an essential function that fuels business growth and economic development. Companies must carefully choose appropriate methods based on their stage, industry, and strategic objectives. From seed funding to IPOs, and from debt issuance to crowdfunding, a wide array of options exists, each with unique benefits and challenges. Investment banks, regulatory frameworks, and capital structure considerations play critical roles in shaping capital raising strategies. Understanding these components equips entrepreneurs, managers, and investors to navigate complex financial markets and secure the funds needed for success